by Marco Correia – Deputy Portfolio Manager, Perennial Value Smaller Companies Trust

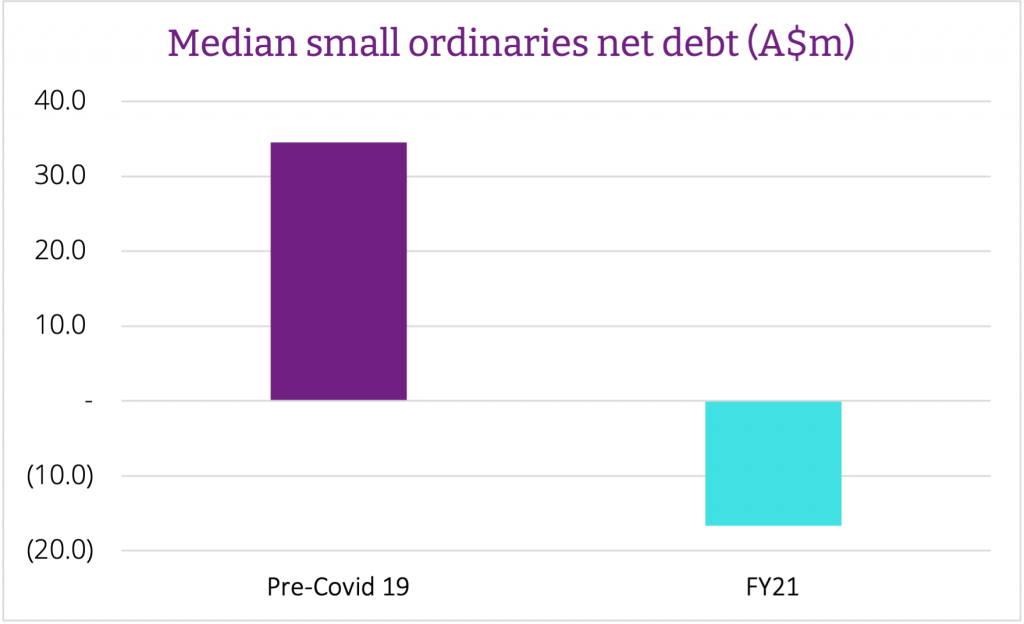

One of the key takeaways from the recent 2021 financial year (“FY21”) reporting season was the vastly improved balance sheets of smaller companies trading on the ASX. A combination of government stimulus and generally positive trading conditions resulted in a large de-leveraging across the market. If we exclude real estate investment trusts who have a unique operating model, the median small capitalisation company net debt (i.e., senior debt less cash) fell from roughly A$35m prior to Covid-19 pandemic to an almost A$17m net cash position by the end of FY211. The question then becomes: What to do with all that cash?

What we are talking about here is essentially capital management and companies have a couple of options. They could commence or increase a dividend; however, this may not be appropriate for smaller companies who typically have superior growth opportunities. Another option could be a share buyback which is more flexible than a dividend, albeit with the small ordinaries index reaching decade highs we are not anticipating too many buyback programs. We expect smaller companies will be more focused on investing in the following areas: working capital and supply chain, mitigating inflationary pressures and growth via mergers & acquisitions (“M&A”) or organic initiatives.

We have seen companies invest in improving the resilience of their supply chain, leading to higher working capital balances. With container freight rates at record highs, patchy global manufacturing due to rolling lockdowns and heightened demand, and stockouts of raw materials it’s not surprising to see companies holding more inventory which requires additional investment.

Inflation has also started to pick up in certain pockets of the economy and while the debate remains ongoing as to whether this will be transitory or structural, we have seen companies respond by investing to mitigate rising costs. Examples here include increased digitalisation of systems and processes; investments in more efficient plant and equipment; and acquisitions of technology, products, or vertical integration with the aim of increasing profitability within the businesses’ value chain.

Finally, we turn our attention to M&A, which is likely to be the most impactful yet carries the largest risk. Across the market we are seeing ever increasing levels of activity, with companies looking to use their clean balance sheet to bolster future growth. In our experience, we prefer smaller bolt-on acquisitions to the larger more transformational kind. These smaller acquisitions supplement, not replace, management’s current growth strategy; are naturally lower risk given their size; and can be more readily funded using internal sources rather than raising debt or equity. In essence, we prefer management not to bet the farm. An exemplary example here is EBOS group, a retailer, wholesaler and distributor of health care, animal care and medical and pharmaceutical products. Management has a longstanding track record of buying smaller companies, integrating them within EBOS’ superior distribution network and growing sales nicely post acquisition.

While having extra balance sheet capacity is typically positive and a source of earnings upside, the quality of management’s capital management decisions will ultimately drive the share price higher or lower. While the global pandemic has been a challenging time for most of us, the silver lining for some smaller companies has been a better balance sheet. How management spend this extra cash remains a key focus of ours here at Perennial Partners. As Winston Churchill famously said, “Never let a good crisis go to waste”, and we like to remind our portfolio of companies: “Never let a good balance sheet go to waste”.

The Perennial Value Smaller Companies Trust invests in a diversified portfolio of Australian small cap shares predominantly outside the S&P/ASX 100 Index. The Trust aims to provide a total return (after fees) that exceeds the Benchmark measured on a rolling three-year basis.