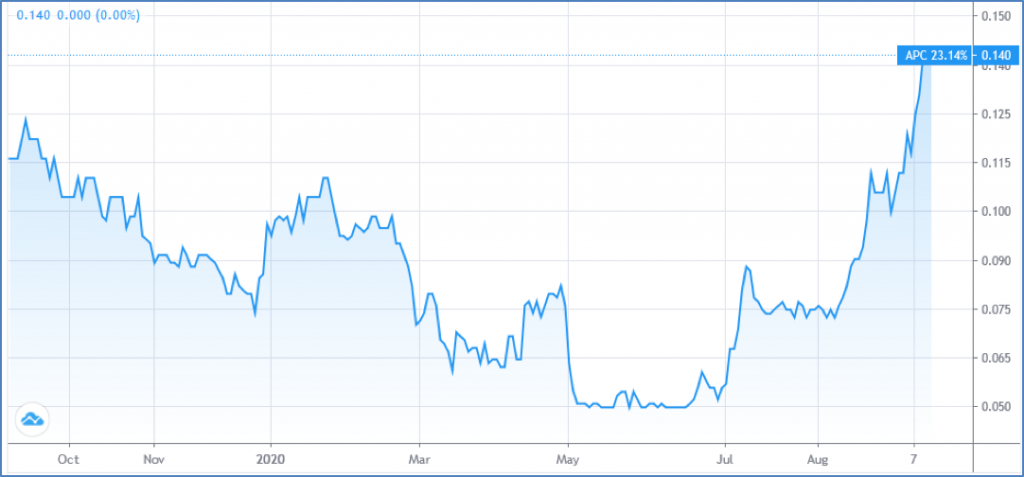

Australian Potash – (ASX: APC, Share Price: $0.14, Market Cap: $68m, coverage initiated @ $0.098 in Feb 2018 – current gain of 43%)

Key Catalyst

Signing of the fourth binding off-take term-sheet with Tier 1 partner HELM AG for the supply of 30,000 tonnes per annum of premium K-BriteTM sulphate of potash from the Lake Wells Project.

We introduced Australian Potash to our coverage universe during February 2018, based on the potential of its advanced Lake Wells Sulphate of Potash (SOP) Project in Western Australia. A Scoping Study on the Lake Wells Potash Project was completed and released during March 2017, exceeding expectations and confirming the project’s economic and technical credentials. This was further reaffirmed with the release during H2 2019 of a Definitive Feasibility Study (DFS), which underlined its potential to become a significant long-life, low capital and high-margin SOP producer for both domestic and export markets. In terms of other achievements, APC has also produced Australia’s first field-evaporated SOP at its Canning Vale pilot processing facility in Western Australia, a major milestone that’s exceeded expectations in terms of product purity. APC has also recently released an enhanced resource estimate for Lake Wells.

Latest Activity

Lake Wells Project Update

APC has provided an important update with respect to the off-take situation at its Lake Wells project in Western Australia, having signed up yet another off-take customer in the form of HELM AG.

Overview

APC has signed a fourth binding term-sheet in the company’s Offtake Program with Tier 1 partner HELM AG, for the supply of 30,000 tonnes per annum of premium K-BriteTM sulphate of potash from its Lake Wells Sulphate of Potash Project (LSOP).

Details

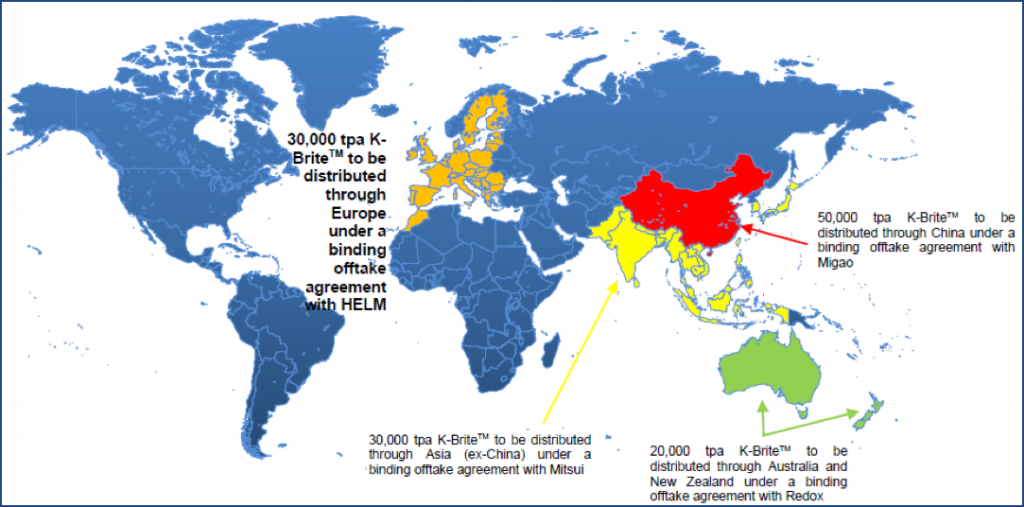

The deal involves a binding ten-year agreement for HELM to take 30,000 tpa of K-BriteTM. Pricing will be on a Net Realised Price basis, which will incentivise HELM to achieve the highest sales price in the market jurisdictions covered by the Agreement. HELM will have the geographic rights for distribution sales and distribution rights on an exclusive basis to European jurisdictions. The arrangement is conditional upon the finalisation of long-form documentation by 15 September 2020, and the board of APC making a final investment decision by 31 March 2021.

Technical Significance

This is the fourth agreement executed in the company’s off-take program and ensures that more than 85% of the DFS projected output is now under contracted sale. The agreement with HELM covers the distribution of K-BriteTM into the lucrative and expanding European fertiliser market through HELM’s dominant brand and market leading position.

HELM is a Hamburg, Germany, based family-owned company established in 1900 and is one of the world’s largest chemicals marketing companies. The company secures access to the world’s key markets through its specific regional knowledge as well as its subsidiaries, sales offices and participations in more than 30 countries. As a multifunctional marketing organization HELM is active in the chemicals industry, crop protection, pharmaceuticals and the fertilizer industry.

APC now has agreements in place for 130,000tpa of off-take across Australia, New Zealand, Europe, China and Asia, out of its total expected production of 150,000tpa – with partners comprising Redoxi, Migaoii, Mitsui and HELM. APC is now working to finalise the last part of its Offtake Program, with discussions reportedly well advanced with further Tier 1 off-take partners covering markets in the Americas.

Project Overview

APC holds a 100% interest in the Lake Wells potash project, located approximately 500km northeast of Kalgoorlie in Western Australia’s Eastern Goldfields. The project covers an area of 2,100 sq km and comprises three granted Mining Leases and 17 exploration licences on the edge of the Great Victorian Desert. The project is being explored for the premium fertiliser mineral Sulphate of Potash (SOP), contained within the lake brines.

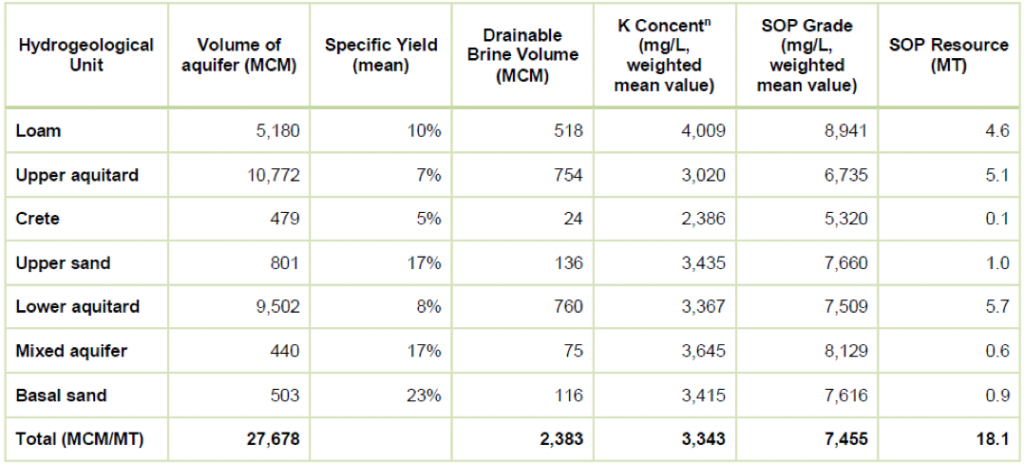

APC recently released an upgraded JORC 2012-Compliant Mineral Resource Estimate of 18.1 million tonnes (Mt) for its Lake Wells SOP Project, which was incorporated into the recently-completed project DFS. The resource upgrade is based on data from more than 60,000 metres of drilling, 300,000 metres of seismic surveys and 1,329 exploration holes that has been completed by APC and others at Lake Wells.

Table 1: Measured JORC Mineral Resource Estimate for Lake Wells Sulphate of Potash Project based on modelled aquifer volume, specific yield and weighted mean K concentrations (derived from modelling)

K-BriteTM is a registered trademark brand of APC), representing the premium Sulphate of Potash (SOP) to be produced from its flagship Lake Wells Sulphate of Potash Project (LSOP). With combined resources of 18.1Mt SOP, APC has delineated a substantial resource upon which to base its planned 150,000 tpa SOP operation for a 30-year period – and 130,000 tpa is now under off-take.

APC’s aim is to develop Lake Wells at a cost that promotes SOP use over MOP to both domestic markets and markets in southeast Asia. Lake Wells has a logistical advantage over other projects due to its rail and port access, local government support and low-risk brine abstraction model, which should positively impact on operating costs. The project also benefits from the strong potassium (K) grades returned so far.

Summary

The signing of a fourth major off-take partner is another important step in progressing the Lake Wells project towards commerciality, with 85% of its planned output now under off-take. We also expect to hear more over the coming months in terms of additional off-take partners.

APC’s premium high-grade SOP project will be a hallmark operation in commencing a new export industry for the Eastern Goldfields region of Western Australia. The company plans to reserve a significant portion of output for the Australian market.

Lake Wells will utilise a bore-field to abstract brine, mitigating the geotechnical challenges and decline in grade and production over time that are evident in trenching-type systems. The project also has an extremely competitive capital intensity, low forecast first-quartile operating costs and exceptional returns. The DFS enhances APC’s ability to finalise binding off-take agreements, optimise and secure the finance debt package, finalise the approvals process and FEED activities.