Investors in ASX listed iron ore groups are cheering China’s stronger than expected rebound in steel making and Australia’s mines ability to supply record volumes when others have faltered. Iron ore prices have risen from the 23rd Mar 2020 low by 53% to US$124/t. Why then has premium Hard Coking Coal has fallen around 32% to US$108/t in the same period?

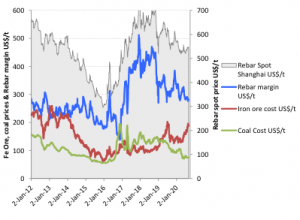

While steel orders have been better than feared a few months ago, conditions remain competitive and steel mills who need to consider the costs, including those of input ingredients. We track spot price equivalent relationships in the Chart-1 below. The blue line is the steel mill’s margin after iron ore and coal costs. As Chinese reinforcing steel bar prices (represented in grey shaded area) have risen only about 3% since late March, the surge in iron ore costs has meant Steel Mill margins have stagnated at lowish levels for this cycle since 2016.

There appears to be ample steel-make capacity to meet current demand in China while other North Asian and European steel make has fallen. Mill owners can therefore sacrifice some steel output and partly offset costs by buying lower quality/cost ingredients. One example is that steel mills increased use of lower grades of iron ore – like Fortescue’s 58% blend ore that has seen proportionately lower discounts to premium 62%-grades as a result.

However, bigger cost savings have come from lower coking coal prices. Lower demand from non-Chinese mills has combined with a post-pandemic policy effort to boost local Chinese coal production to create oversupply. Some switching to lower coal qualities has also retarded premium coking coals market position as mill owners seek to offset their rising iron ore bill.

We conclude that if steel demand continues its rebound there is likely need for added hi-quality coking coal imports, perhaps aided by the re-imposition of pollution restrictions. Post-pandemic infrastructure programs spanning China, greater Asia and Europe may bolster Australian coking coal export price prospects in 2021.

Promised additional iron ore from Brazil will eventually start deliveries. A correction in iron ore prices will enable the steel mills to consider a better-quality mix of coking coal ingredients resulting in stronger coal prices. Some of iron ore’s current feast can then fall to the cash-flow starved coking coal sector.

Chart-1: China Steel Reinforcing Bar Spot US$/t (rhs)

Delivered Spot Prices for Standard Mix of Iron Ores & Coking Coal US$/t (lhs)

Implied Steel Mill post-ingredient Margin US$/t (lhs)

Sources: Bloomberg, World Bank