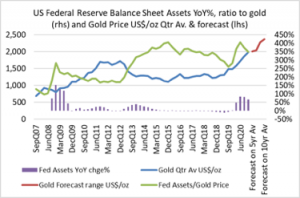

Gold prices often benefit from sizable increases in the US Federal Reserve’s asset holdings that inject liquidity into the economy. When the real economy’s money demand remains tepid, more of that money stays within financial markets and perhaps to gold. The 80%+ rise YoY in the Fed’s balance sheet has arguably aided Gold’s stellar rise.

Can gold’s bull run continue? Gold prices are driven by many factors, however, Gold could rise over the coming quarter or so, given cautious statements by the US Federal Reserve. This seems to indicate The Fed’s asset base will either be maintained or increase. We have charted below in green the ratio of US Fed’s total assets to the gold price. If the Fed’s assets were to remain stable and the ratio reverts to the 5-yr and 10-year average – then the gold price outcome would be: in the range of US$2,002 to US$2,368/oz. Keep watching the Fed’s balance sheet!

Sources: US Fed Reserve, RBA, Bloomberg

NOTICE: This communication explicitly does not constitute a recommendation to trade any security. Investors should seek appropriate professional advice prior to trading any listed or unlisted security or asset. See further disclaimers below.