Liontown Resources – (ASX: LTR, Share Price: $0.036, Market Cap: $54m – coverage initiated @ $0.025 in February 2019 – current gain of 44%)

Key Catalyst

Multiple thick, high-grade intercepts recorded outside the current conceptual open-pit, including best-ever intersection – 52m @ 1.4% Li2O, highlighting potential for significant resource upgrades.

Despite being caught within a trading range between $0.02 and $0.03 since September 2018, the quality of the exploration results from LTR’s dual drilling programs at its Kathleen Valley and Buldania lithium projects in Western Australia, cannot be questioned. LTR’s management approach has typically been low-key, preferring substance over hype, which adds further credibility to its exploration successes and resource growth. A positive Scoping Study released during January 2019 highlighted the potential for a viable stand-alone lithium mining and processing operation at Kathleen Valley, with a full DFS set for release during early 2020. Encouragingly, the latest drilling results have highlighted thick zones of high-grade lithium mineralisation up to 300m along strike and 150m down-dip of the current conceptual open-pit, suggesting the potential for a more-than-doubling of the current lithium resource base.

Latest Activity

Kathleen Valley Project Update

LTR has over recent months released a series encouraging assay results from ongoing resource expansion drilling activity at its 100%-owned Kathleen Valley Lithium Project in WA. The results have delivered thick, high-grade mineralised intercepts well beyond the current resource boundaries.

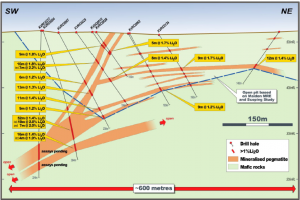

LTR today provided the market with further heartening news, advising that the shallow-dipping Kathleen’s Corner pegmatites are merging with the Mt Mann pegmatites at depth, forming a thick (>30m), moderately dipping (~400) pegmatite body. Some of the latest and best intercepts include 30m @ 1.6% Li2O from 139m (including 13m @ 2.1% Li2O from 143m) in hole KVRC0199; and 52m @ 1.4% Li2O from 199m (including 10m @ 2.0% Li2O from 202m and 7m @ 2.0% Li2O from 227m) in hole KVRC0204.

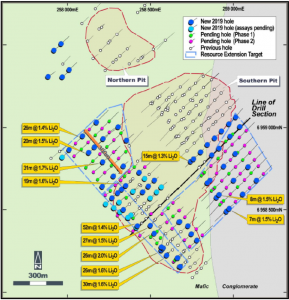

Figure 1: Kathleen Valley – Drill hole plan showing better lithium intersections from 2019 drilling program.

Technical Significance

The significance of the latest results is that they are located outside of the current conceptual Kathleen Valley open-pit, which is based on the maiden Mineral Resource Estimate released during September 2018 and the Scoping Study released during January 2019.

What the results reveal are thick zones of high-grade lithium mineralisation that have been intersected up to 300m along strike and 150m down-dip of the conceptual open-pit, with the mineralised trend remaining open – both along strike and at depth. Essentially, the latest drilling shows that the Kathleen’s Corner and Mt Mann pegmatites are coalescing at depth to form a thick pegmatite body.

Figure 2: Kathleen Valley – Drill section showing mineralised pegmatites and better lithium intersection.

There’s a major positive implication from a resource perspective. In our prior coverage earlier this month we highlighted LTR’s enhanced Kathleen Valley Exploration Target, comprising an additional 15 – 22.5Mt @ 1.2 – 1.5% Li2O. The significance of the latest drilling is that it has resulted in LTR ratcheting up its Exploration Target to 19 – 31Mt @ 1.2 – 1.5% Li2O, which is in addition to the current MRE of 21.2Mt @ 1.4% Li2O.

The bottom-line is that if the Exploration Target is successfully converted to JORC-compliant Mineral Resources, it will likely substantially boost the potential mine life of Kathleen Valley, with a Resource somewhere between 40mt and 50Mt – a more-than-doubling of the current resource estimate.

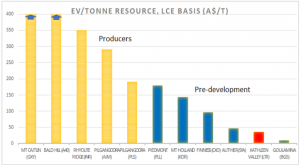

Figure 3: LTR Peer Comparison Study

Summary

LTR has undertaken a wealth of meaningful exploration and appraisal activity at Kathleen Valley since 2018 and the positive results it has generated have led to a clear commitment to progress the project as quickly as possible. It is now pursuing a full Definitive Feasibility Study (DFS) by early 2020, prior to moving into the financing and construction phases.

The resource expansion drilling program at Kathleen Valley is exceeding expectations in most areas, demonstrating the robust nature, high-grade and strong growth potential of the deposit. All eyes will now be on the balance of the drilling program, with the results to feed into an updated Mineral Resource.

It’s extremely encouraging that the high-grade nature of the mineralisation is being maintained and has been extended up to 300m along strike and 150m down-dip of the conceptual open-pit. The drilling appears to show the Kathleen’s Corner and Mt Mann pegmatites coalescing at depth to form a thick pegmatite body.

LTR has risen from $0.025 at the date of our coverage initiation in February 2019 and from $0.022 at the date of our most recent coverage on 13th April – to its current price of $0.036.