For many investors, the main focus in the United States economy is whether or not the Federal Reserve will raise interest rates in coming months. On this view the outlook seems binary.

If the Fed finds more excuses not to raise rates, its happy days and Wall Street should continue to rise. But if the Fed does raise rates, the market outlook will be more challenged as rising bond yields could begin to pressure already elevated price to earnings valuations.

But to my mind, the market faces are far larger problem: America’s economic “sweet spot” is rapidly coming to an end. By sweet spot, I mean the extended period since the global financial crisis over which the US economy was able to growth at an above-potential pace – as evident from declining unemployment – without stoking under wage or price inflation, thanks to still ample spare capacity in labour and product markets.

Contrary to claims that America’s economy recovery has been “sluggish”, we should remember that that rate of decline in unemployment in recent years has been just as impressive as seen in past economic recoveries. Even the broader measure of unemployment – which allows for workers that are not yet working as many hours as they would like – is also close to lows seen prior to the financial crisis.

Business surveys are already suggesting that corporate America is facing a harder time find suitable workers. Labour tightness is also evident from the in average hourly earnings.

So while the Fed may wax and wane over whether it should raise interest rates, it can’t avoid the reality that capacity limits in the economy are already being reached. Core consumer price inflation is also close to its long-run average – headline inflation is only lower thanks to recent declines in volatile food and energy prices.

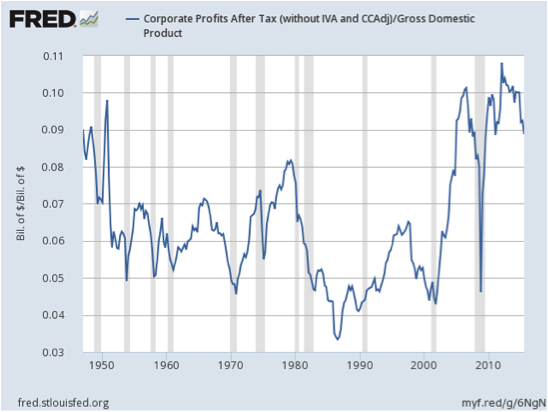

So here’s the real challenge the market faces: either the Fed raises rates in coming months, or the economy will have slowed of its own accord. If the economy does slow, it would also place further downward pressure on corporate earnings – which despite the recent better than feared earnings reporting season – are still retreating. Already stretched US corporate profit margins have already begun their retreat.

Indeed, we’re now entering into the typical “confession” season whereby CEO’s act to lower overly bullish analyst earnings expectations so that their companies can again managed to deliver “market beatings” earnings results next time around.

Why might the economy slow? Further retrenchment in the oil and gas sector seems likely. While along with a firm US dollar is also hurting the manufacturing sector.

Indeed, as the world’s new swing producer, any attempt by US oil producers to respond to high oil prices – caused by the oil production cuts – is ultimately self-defeating and this only services to push oil prices back down again. The other challenge is the simple fact that the labour market is getting tighter, which could crimp the ability of the service sector to expand. Against this the US housing sector still appears to have scope growth further, given the level of home building is still at below average levels.

Should the US economic data soften up, there’s even the risk that the Fed not only drops any threat of higher interest rates, but ever resorts to a new round of quantitative easing. That would likely see US bond yields drop even further, though whether low rates can continue to support Wall Street remains to be seen given the likely even more significant downward pressure on earnings that an economic slowdown would generate.

Of course, if the US dollar also weakens under this scenario, it would also place the onus on Europe and Japan to boost their own quantitative easing programs even further – in yet another round of the “global currency wars”.

Once again, Australia would be caught in the cross fire, and would need to respond through even lower interest rates to avoid the $A unhelpfully moving higher in a weakening global growth environment.