By Dr Shane Oliver, Chief Economist and Head of Investment Strategy at AMP.

- The RBA left its cash rate on hold at 3.6% as widely expected.

- Its commentary was more hawkish noting “the decline in underlying inflation has slowed” and “private demand is recovering a little more rapidly than expected” and saying it was “appropriate to remain cautious”. Governor Bullock indicated only a very mild easing bias and emphasised that it will have to be data dependent.

- We see September quarter trimmed mean inflation being close enough to RBA forecasts to allow another rate cut in November but concede it’s a very close call. Beyond that we are forecasting one more rate cut in February taking the cash rate to a bottom of 3.1%. The risks are high that further rate cuts are delayed into next year or we get even less cuts than expected.

RBA holds with somewhat hawkish commentary, and a very watered-down easing bias

Consistent with its “gradual” approach to lowering interest rates the RBA left rates on hold this month at 3.6% as widely expected. The money market had priced in just a 4% chance of a cut and all 33 economists surveyed by Bloomberg expected no change a 0.25% move.

But following recent economic data that has been in line with or slightly stronger than expected the RBA and Governor Bullock adopt a somewhat more hawkish tone. In particular, following recent higher than expected monthly inflation data the RBA noted that September quarter inflation may be higher than expected in the August Statement of Monetary Policy and that “private demand is recovering a little more rapidly than expected”. It also notes a pickup in consumption and the housing market and that credit is readily available. While the RBA noted a slowing in employment growth and wages growth from its peak it continues to see the labour market as “a little tight” and productivity growth as weak.

So against this backdrop its no surprise that the RBA Board unanimously decided to leave rates on hold and “remain cautious” dependent on how the data evolves. As occurred following its July meeting ahead of the August meeting, RBA Governor Bullock noted that by the November meeting it will have the September quarter inflation data, another round of jobs data and business liaison and revised economic forecasts to consider.

In terms of forward guidance, the RBA has clearly eased back from dovish guidance seen up to August. Governor Bullock declined to reiterate her comment from July that “its about the timing, not the direction” of cuts to the cash rate, but she did say that monetary policy is still judged to be “a little bit restrictive” and that the RBA will need to wait for more data in the November meeting to decide whether “it’s a hold or down again” on rates. All of which implies that while the RBA is now more hawkish it retains an easing bias but it’s been substantially watered down.

Seven reasons to expect more RBA rate cuts

While recent stronger than expected economic data and higher than expected inflation data for July and August along with the RBA’s cautious commentary has increased the level of uncertainty about the interest rate outlook we continue to see further rate cuts as growth remains subpar, the risks to unemployment are on the upside, underlying inflation is likely to remain around the 2.5% target and monetary policy remains tight.

- Only three of the 13 rate hikes between May 2022 and November 2023 which totalled 4.25% have been reversed. For an average $660,000 new mortgage its saved around $3780 in annual interest payments, which only reverses 23% of the increase in payments between May 2022 and November 2023. So interest payments as a share of household income remain high.

- Partly reflecting this, the outlook for consumer spending is likely to remain subdued and this will in turn continue to constrain business investment which will keep the economic upswing relatively subdued.

- While unemployment at 4.2% remains historically low, there has been recent signs of softer jobs growth – it averaged less than 8000 a month over the last three months compared to around 37,000 a month in the prior three months – suggesting some upside risks for unemployment. In particular, there is significant uncertainty as to whether the private sector will take over from the public sector in driving employment growth.

- While monthly inflation surprised on the upside in July and August, it has been quite volatile and goes through hot and cold patches. What’s more the trimmed mean in the monthly CPI has averaged 2.6%yoy since the start of the year which is effectively at target.

- The cash rate is still above most of the RBA’s estimates of the neutral rate which averaged around 2.8% as at May when the RBA last published it. This means there is still scope for further rate cuts to get monetary policy back to neutral.

- If the Fed continues to cut in line with market expectations and the RBA holds it will see the Fed Funds rate fall well below the RBA’s cash rate possibly putting substantial upwards pressure on the $A which will bear down on Australian growth and inflation putting more pressure on the RBA to cut.

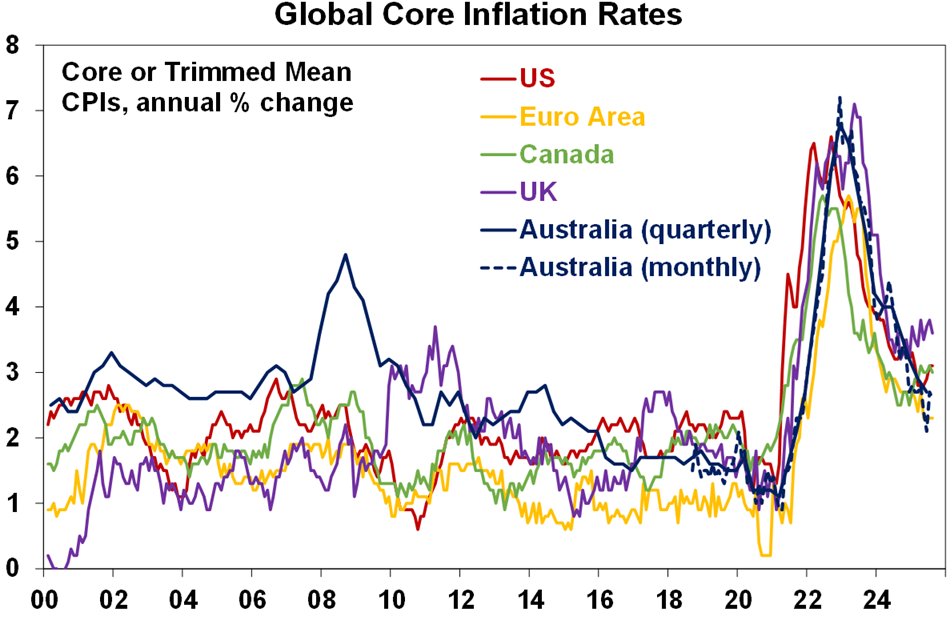

- Finally, the experience of Australia in getting inflation back down is not that different to other countries that have seen the decline in inflation stall at various points leading to a pause in rate cuts followed by a resumption. In fact, underlying inflation in Australia compares reasonably well with other major countries adding to confidence that we will see a resumption of rate cuts here too.

Source: Bloomberg, AMP

The bottom line

So, on balance we continue to expect the RBA to cut rates further but after last week’s higher than expected inflation data we have wound back our expectation to two cuts from three. We see September quarter trimmed mean inflation being close enough to RBA forecasts at 2.6-2.7%yoy to allow another rate cut in November but concede it’s a very close call. Beyond that we are forecasting one more rate cut in February taking the cash rate to a bottom of 3.1%. The risks are that they are delayed, or we get even less cuts.

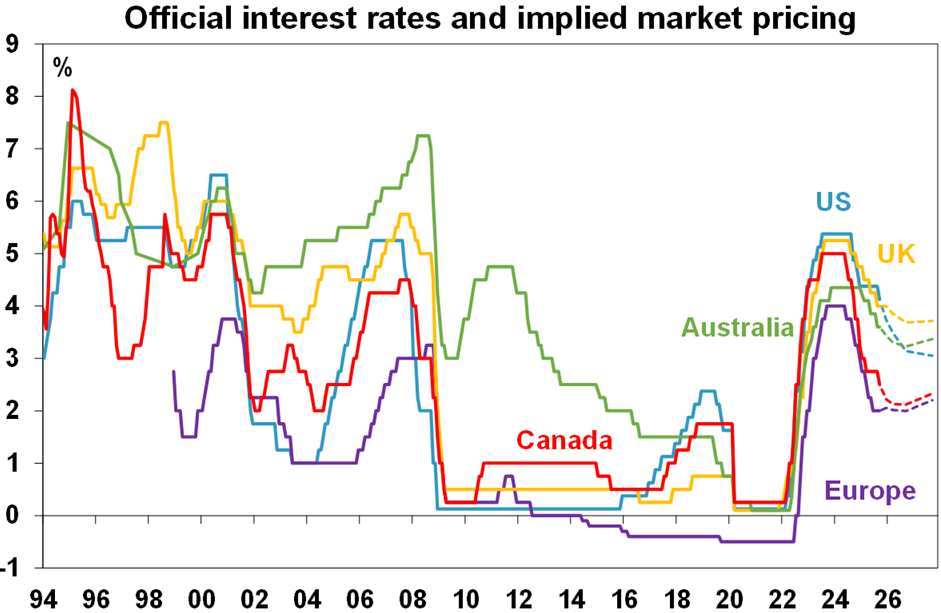

The money market is allowing for another one and a half more 0.25% cuts with around a 54% probability of a cut by year end.

Source: Bloomberg, AMP

Finally, Governor Bullock reiterated that while there will be a full monthly CPI from the November release for October, given monthly volatility, the different monthly trimmed mean and getting a handle on seasonality the RBA’s focus will remain on the quarterly trimmed mean which the ABS will provide for 18 months.

Ends