By Dr Shane Oliver, Chief Economist and Head of Investment Strategy at AMP.

- Australia is seeing a gradual economic recovery with growth likely to reach 2.5% next year.

- This in turn is underpinning a likely upswing in profits.

- The RBA is expected to cut again in November, February and May to 2.85%, although the risk is on the upside.

- The combination of rising profits and still falling rates is positive for shares, beyond short term correction risks.

Introduction

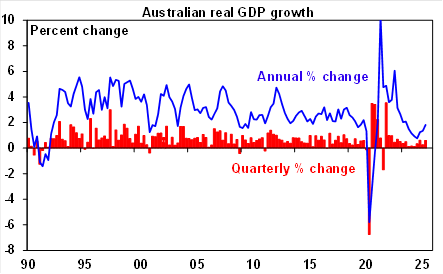

The Australian economy was stronger than expected in the June quarter, with GDP up 0.6% and by 1.8% over the previous twelve months. But will it continue? And what does it mean for profits and the RBA?

Source: ABS, AMP

The good news

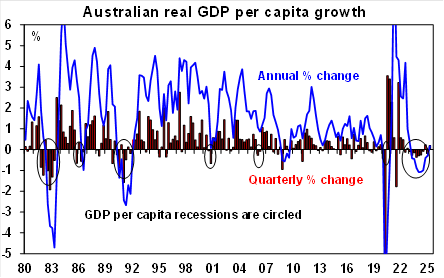

The good news is that annual growth is at its strongest in nearly two years, consumer spending finally looks to be strengthening, per capita GDP rose after declining in nine of the last 11 quarters, productivity rose, and trade added to growth. This is good news as it suggests rate cuts, last year’s tax cuts and some easing in cost-of-living pressures are enabling the economy to begin recovering from a per capita recession.

Source: ABS, AMP

…but there are some reasons for caution

- Firstly, the strong growth in consumer spending was boosted by recovery spending after Cyclone Alfred, the close proximity of the Easter and ANZAC holidays which saw many take off the three days in between, End of Financial Year Sales, medical spending relating to a strong flu season and the launch of Nintendo Switch 2. Similarly, public consumption was boosted by big defence exercises. So, both household and public consumption are likely to see softer growth this quarter after they rose 0.9%qoq and 1%qoq in the June quarter.

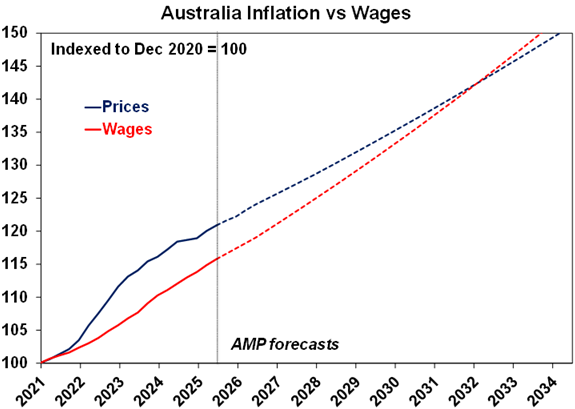

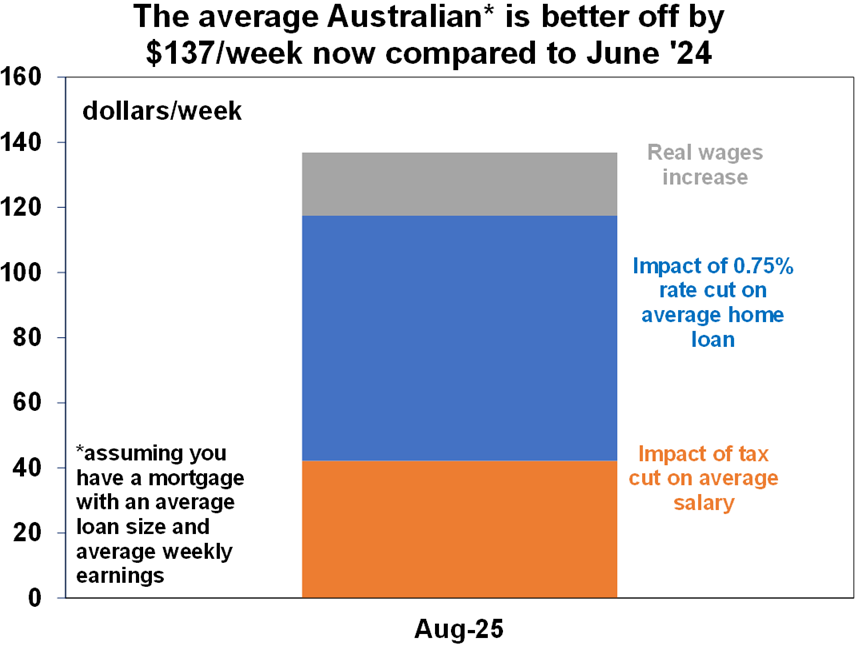

- Secondly, households still remain under pressure. Rate cuts so far have only reversed three of the 13 rate hikes between May 2022 and November 2023, or 0.75% of the total 4.25% cash rate hike. And while wages are now rising faster than inflation real wages are down around 5% compared to five years ago and at the current rate of real wage growth won’t return to the 2020 levels until around 2032.

Source: ABS, AMP

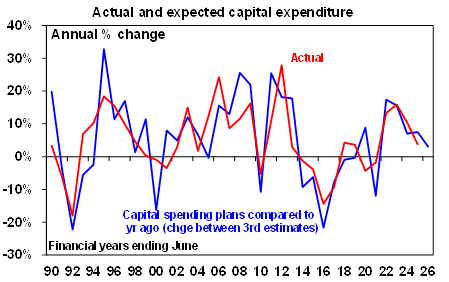

- Thirdly, business investment was weak with a 0.1% fall in the quarter and over the year with business investment plans for this financial year looking pretty subdued, being up just 3.1% on a year ago.

Source: ABS, AMP

- Fourthly, while investment markets are no longer as concerned about President Trump’s tariffs as they have settled below levels announced around the so-called Liberation Day, they are 6 or 7 times greater than last year’s average posing a threat to US, global and hence Australian growth. Their negative impact appears to be starting to become evident in the weakening US jobs market.

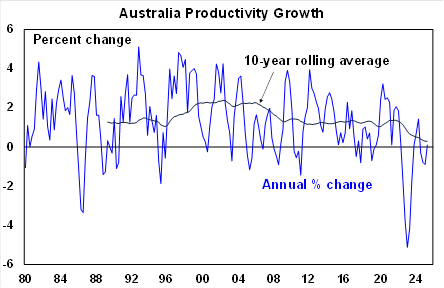

- Finally, while both productivity (i.e. growth in GDP per hour worked) and per capita GDP (or GDP per person) rose it may just be another brief bounce, with the trend in productivity remaining very weak.

Source: ABS, AMP

Overall, while growth was stronger than expected in the June quarter (the surprise on the day was just 0.1%), it’s likely that growth will be a bit weaker in the current quarter and the recovery will remain subdued.

Five reasons for optimism

However, despite all this, recovery is likely to continue to gather pace into next year.

Firstly, while real wages will take a long while to catch up with where they were in 2020, they are rising again (with wages growth at 3.4%yoy in the June quarter versus inflation of 2.1%yoy) and this is likely to continue, albeit with some narrowing of the gap.

Secondly, the lagged impact of rate cuts and some more to come will provide a boost to spending. Sure, evidence suggests that most mortgage holders have been maintaining their payments so far. But this always occurs initially, and it reflects the tendency of mortgage holders to take a while to respond to the impact of rate cuts in boosting their finances. After a while, they then start to spend some of the savings.

The combination of the three mortgage rate cuts so far, last year’s July tax cuts, and wages growth running above inflation is providing roughly a $137 a week boost to someone on average earnings with a mortgage.

Source: RBA, ABS, AMP

Thirdly, the rising trend in shares, strong super returns and the renewed upswing in property prices is driving a positive wealth effect.

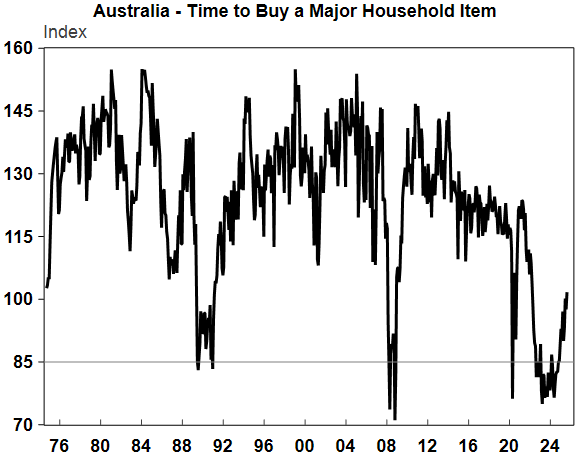

Fourthly, while consumer confidence fell in September, the trend is up. In particular, households are noting some improvement in their finances, and more are seeing now as a good time to buy major household items.

Source: Westpac/Melbourne Institute, Macrobond, AMP

Finally, lower interest rates are helping to drive a rising trend in building approvals which points to a further rise in dwelling investment.

Overall, we see economic growth improving to around 2.5%yoy next year.

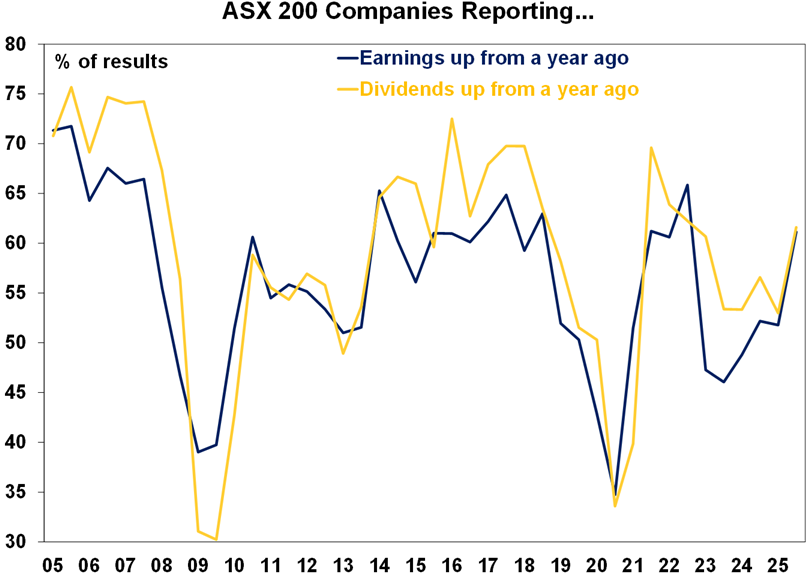

The pickup in growth is positive for profits

Australian listed companies’ earnings per share fell 3.1% in 2024-25, resulting in a third consecutive year of falls. However, the weakness was driven largely by resources companies with most other sectors seeing rising profits. Momentum for the average company looks to be improving. In particular, 61% of companies reported earnings being up on a year ago and 62% raised their dividends on a year ago, both of which are significantly improved consistent with profits returning to growth this financial year. The results reflect consumers starting to respond to improving conditions consistent with the pickup in economic growth.

Source: Bloomberg, AMP.

The RBA is still expected to cut rates further

I agree with RBA Governor Bullock’s comment in reaction to the GDP and consumer spending beat that “if it keeps going, then there may not be many interest rate declines yet to come”. But as she also said, “it all depends”, it’s likely that consumer spending growth won’t keep going at this pace but will settle back a notch leaving a subdued recovery in place. So while a September rate cut is unlikely – not that we were expecting one anyway – we continue see the RBA cutting rates at a quarterly pace with the next cut coming in November and being supported by monetary policy remaining restrictive, growth likely to remain subdued and inflation likely to run around the RBA’s target.

Concluding comment

The gradual pick up in Australian economic growth is a positive sign that profits will continue to improve, while at the same time the RBA is still likely cut rates a few more times. All of which should be positive for share market returns, notwithstanding the risk of a short-term correction flowing mainly from US uncertainties around tariffs and jobs.

Ends