By Dr Shane Oliver, Chief Economist and Head of Investment Strategy at AMP.

Key points

- 2025 was another strong year for investors with shares up strongly on the back of better than feared growth and profits and global central banks cutting rates. Balanced super funds returned around 9%. Volatility rose though mainly on the back of worries about Trump’s tariffs.

- 2026 is likely to see good returns but after the strong gains of the last three years, its likely to be more constrained. And another 15% plus correction is likely along the way again.

- We expect the RBA to leave rates on hold, the ASX to return around 8% and balanced growth super funds to return around 7%. Australian home price gains are likely to slow to around 5-7%.

- The key things to watch are: interest rates; the AI boom; US midterms; China; geopolitics; and the Australian consumer.

Introduction

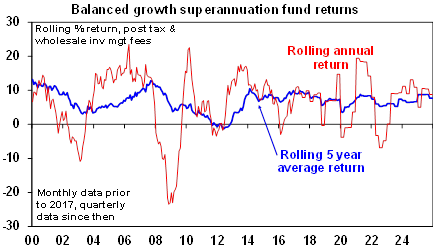

Despite uncertainty around US President Trump’s policies, geopolitics and interest rates, 2025 saw strong investment returns on the back of falling interest rates, solid economic and profit growth globally and expectations for stronger profit growth in Australia. AI enthusiasm boosted US shares although they were relative underperformers globally. This saw average superannuation funds return around 9%. This is the third year in a row of returns around 10% and over the last five years, they returned 7.7% pa.

Source: Mercer Investment Consulting, Morningstar, Chant West, AMP

Here is a simple dot point summary of key insights & views on the outlook.

Five key themes from 2025

· US tariff turmoil – Trump’s Liberation Day tariffs caused volatility, but fortunately he backed down, retaliation was limited, deals were cut, and a trade war was averted.

· AI enthusiasm – It surged along with related investment.

· Global resilience – Despite Trump’s shock and awe global growth remained just above 3% and Australian growth picked up.

· Lower interest rates – Despite sticky inflation around 3%, central banks continued to cut rates. In Australia rates were cut three times.

· Gold a “safe haven” – There was lots of geopolitical noise, but it failed to dent investment markets significantly, but it did help gold prices!

Five lessons for investors from 2025

1. Government intervention in markets is still rising. It was evident under Biden with increasing subsidies, and it’s ramped up dramatically under Trump with tariffs a key example along with the US Government buying shares in companies like Intel and charging Nvidia a fee for selling chips to China. “Socialism with American characteristics” is becoming more apt. In Australia it’s also evident in government moves to prop up failing steel works and aluminium smelters. Ultimately, it will mean a high cost to taxpayers and consumers.

2. Trump’s bite is often worse than his bark. Variations are “take Trump seriously but not literally” or “Trump always chickens out” (TACO). Trump often puts something out there (like Liberation Day tariffs around 30%) then backs down as markets rebel or deals are cut.

3. Timing markets is hard. It was tempting to switch out of shares in response to the plunge around Trump’s silly Liberation Day tariffs and on the back of concerns around stretched valuations or an AI bubble. But the trend remained up. As Keynes once said, “markets can remain irrational for longer than you can remain solvent.”

4. Geopolitical risk remains high in an age of populists and nationalism, and this can create periodic setbacks in markets.

5. By the same token, geopolitical events are hard to predict & then can be less impactful than feared. There was much fear that a US strike on Iran would lead to a flare up and surge in oil prices, but it was all a bit of a non-event from a market perspective and quickly forgotten about.

Seven big worries for 2026

· Share valuations – these remain stretched relative to history with US shares offering little risk premium over bonds and Australian shares not much better. Fortunately, Eurozone and Asian shares are cheaper.

· The surge in AI shares shows some signs of being a bubble – including surging data centre capex increasingly being funded by debt.

· Some central banks are at or close to the bottom on rates – this includes the ECB, Bank of Canada and the RBA. In Australia, higher inflation since 2025 could see the RBA hike prematurely.

· Trump’s policies – there is much uncertainty about the impact of his policies in relation to tariffs, immigration, university research, the rule of law and his attacks on Fed independence which are hotting up ahead of Chair Powell’s term expiring in May. And now his crazy grab for Greenland to get its minerals and threat of tariffs on Europe if they don’t let him have it. All of which threaten “US exceptionalism.”

· Risks for China’s economy remain – as its property slump continues.

· High public debt in the US, France the UK and Japan is a problem – it runs the risk that governments will try and inflate their way out of it.

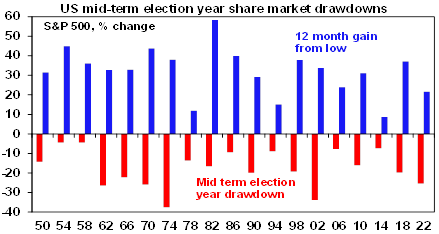

· Geopolitical risk remains high – the Ukraine war is yet to be resolved, problems with Iran could flare up again with a possible US military strike, US tensions with China could escalate again, political uncertainty will likely be high in Europe with the rise of the far right, the US intervention in Venezuela could turn bad for the US (and may be interpreted as a “green light” for China and Russia to act in their own spheres of influence). Trump’s grab for Greenland threatens the NATO appliance. And the midterm elections in the US are often associated with share market volatility with an average 17% drawdown in US shares in midterm election years since 1950. This is arguably evident in Trump’s increasingly erratic and populist policies.

Source: Bloomberg, AMP

These considerations point to another year of high volatility.

Five reasons for optimism

1. First, while AI may be in the process of becoming a bubble it could still be early days. Compared to the late 1990s tech bubble: valuations are cheaper; Nasdaq is up less; tech sector profits are very strong; bond yields are lower; and its early days in the associated capex build up around data centres.

2. Second, while central banks are likely close to the bottom on interest rates, rate hikes are likely a way off (probably a 2027 story). For the Fed, another rate cut is likely in 2026, and a Trump appointee will likely be given some leeway before Fed independence worries really kick in. In Australia we expect some fall back in underlying inflation to allow the RBA to avoid rate hikes, but it’s a close call.

3. Third, despite lots of noise Trump is pivoting to more consumer-friendly policies ahead of the midterms which will boost demand, and ultimately, he wants shares to rise ahead of the midterms and not fall. There is a chance he could now pivot further towards the populist left. But mostly his shift will likely be more market friendly and given the elections he has an interest in keeping geopolitical flareups low. Pressure to reduce the cost of living suggest the threatened tariffs on Europe over Greenland are a bluff and won’t stick.

4. Fourth, global growth is likely to stay just above 3% as the lagged impact of rate cuts feed through along with some policy stimulus in the US and China. Australian growth is likely to edge up to 2.2%.

5. Finally, okay economic growth likely means solid profit growth globally & about 10% profit growth in Australia (after 3 years of falls).

Key views on markets for 2026

· After three years of strong returns, global and Australian share returns are expected to slow in the year ahead to around 8%. Stretched valuations in the key direction setting US share market, political uncertainty associated with the midterm elections and AI bubble worries are the main drags, but returns should still be positive thanks to Fed rate cuts, Trump’s consumer friendly pivot and solid profit growth. A return to profit growth should also support gains in Australian shares. Another 15% or so correction in share markets is likely along the way though.

· Bonds are likely to provide returns around running yield.

· Unlisted commercial property returns are likely to stay solid helped by strong demand for industrial property for data centres.

· Australian home price growth is likely to slow to around 5-7% in 2026 after 8.5% in 2025 due to poor affordability, rates on hold with talk of rate hikes & APRA’s ramping up of macro prudential controls.

· Cash & bank deposits are expected to provide returns around 3.6%.

· The $A is likely to rise as the rate gap in favour of Australia widens as the Fed cuts & the RBA holds or hikes. Fair value is about $US0.73.

· Precious metals like gold are likely to remain strong as a hedge against Trump related inflation risks and geopolitics.

· Balanced super fund returns are likely to be around 7%.

Six things to watch

1. Interest rates – if underlying inflation fails to fall, central banks including the RBA could start hiking rates.

2. The US midterm elections – historically these drive more volatility in markets & uncertainty is high this time around given Trump’s erratic approach.

3. The AI boom – watch for signs that it may be becoming more bubble like with investor euphoria and excessive debt driven capex.

4. The Chinese economy – China’s property sector is continuing to struggle, and more measures are needed to support consumers.

5. Geopolitics – risks remain high on several fronts including the US/China détente, Iran, Ukraine and now Greenland.

6. The Australian consumer – consumer spending has seen a decent pick up but may be vulnerable if rates start to rise.

Nine things investors should always remember (yeah, I know I say this every year, but they are important!)

1. Make the most of compound interest to grow wealth. Saving in growth assets can grow wealth significantly over long periods. Using the “rule of 72”, it will take 16 years to double an asset’s value if it returns 4.5% pa (ie, 72/4.5) but only 9 yrs if the asset returns 8% pa.

2. Don’t get thrown off by the cycle. Falls in asset markets can throw investors off a well-considered strategy, destroying potential wealth.

3. Invest for the long-term. Given the difficulty in timing market moves, for most it’s best to get a long-term plan that suits your wealth, age and risk tolerance and stick to it.

4. Diversify. Don’t put all your eggs in one basket.

5. Turn down the noise. We are increasingly hit by irrelevant, low quality & conflicting information which boosts uncertainty. The key is to avoid the click bait, turn down the noise and stick to a long-term strategy.

6. Buy low, sell high. The cheaper you buy an asset, the higher its prospective return will likely be and vice versa.

7. Avoid the crowd at extremes. Don’t get sucked into euphoria or doom and gloom around an asset.

8. There is no free lunch! If an investment looks dodgy, hard to understand or has to be justified by odd valuations, then stay away.

9. Seek advice. Investing can get complicated.