By Dr Shane Oliver, Chief Economist and Head of Investment Strategy at AMP.

Key points

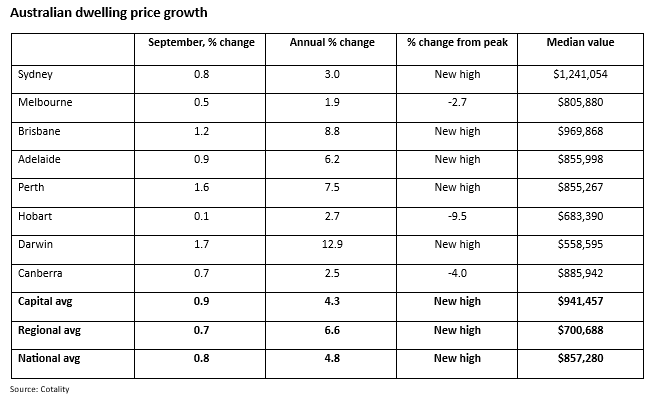

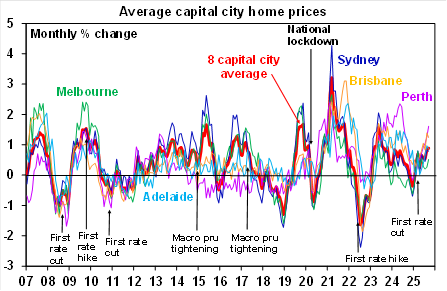

- Cotality data shows national average home prices rose again in September, their eighth monthly rise in a row, with the pace of increase remaining solid at 0.8%mom, but with capital cities seeing an acceleration to 0.9%mom growth, which is their fastest since October 2023.

- The upswing got underway in February when the RBA first started cutting rates, with subsequent cuts in May and August and expectations of more cuts to come providing further support along with improving real wages and consumer sentiment and the ongoing property shortage.

- The upswing in property prices is a clear indication RBA rate cuts are getting traction and as such are likely contributing to a rethink by the RBA in terms of how much rates need to fall.

- A renewed fall in vacancy rates is contributing to a pickup in rental growth with average monthly growth of 0.5%mom.

- Some further gradual RBA rate cuts, real wages growth, the ongoing housing shortage and more support for first home buyers from this month are expected to drive further gains in average prices. However, uncertainty about the timing and extent of further rate cuts following higher inflation data and the latest RBA meeting, rates remaining relatively high compared to the 2021 low, poor affordability and slowing population growth will act as constraints.

- In fact, the monthly pace of home price gains may slow a bit in the near term on the back of uncertainty about the outlook for further rate cuts.

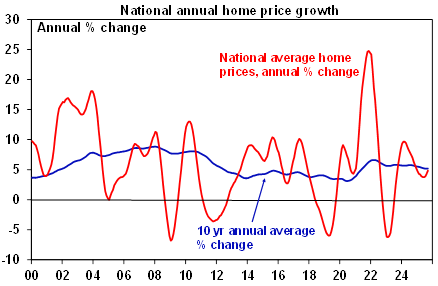

We expect home prices to rise around 7% this year, but likely pick up to around 8-10% next year.

All capital cities saw home prices rise in September

Cotality data shows that national average property prices rose again in September, with the August rate cut providing a further boost to buyer confidence.

All cities saw price gains, with Brisbane and Perth remaining very strong and Melbourne and Hobart remaining laggards. Darwin has been rapidly accelerating.

Source: Cotality, AMP

The acceleration in monthly price gains points to a continuing acceleration in annual price growth.

Source: Cotality, AMP

Expect further price gains

Further gains in home prices are likely as we still expect interest rates to fall a bit further, real wages are continuing to rise, consumer sentiment has picked up, the property shortage remains and Government support for first home buyers ramps up again from this month.

- Our base case is for further RBA rate cuts in each of November and February taking the cash rate to 3.1%. This is supported by our expectation that underlying inflation is likely to stabilise around the midpoint of the RBA’s target range, the cash rate still being relatively restrictive at current levels and still subdued consumer spending and business investment. Rate cuts boost how much buyers can borrow and hence pay for a property. Roughly speaking, each 0.25% cut in variable mortgage rates adds around $11,000 to how much a buyer on average earnings can borrow.

- While falling population growth and improving housing completions are bringing the property market into better balance on annual basis, there is still an accumulated housing shortfall that has built up over the last few years of under building. We estimate this to be around 200,000 to 300,000 dwellings.

- With the Government expanding the low deposit guarantee allowing most FHBs to get in with a 5% deposit from this month, support for first home buyers is ramping up again which will likely bring forward demand and so add to near term upwards pressure on prices. The Government’s Help to Buy Scheme with 10,000 places a year which will see the Government take a 30 to 40% equity stake is also expected to start soon.

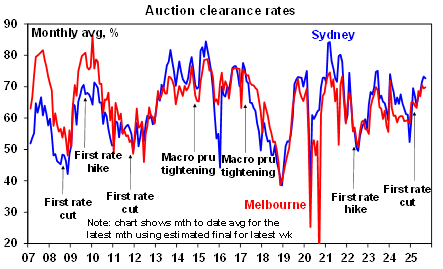

The upswing in property prices in Sydney and Melbourne is consistent with auction clearance rates in both cities running above average levels for this time of year. This is also being helped by low levels of listings compared to a year ago as vendors hold back for higher prices and as lower interest rates are relieving the pressure to sell for some distressed mortgage holders.

However, limited rate cuts & poor affordability is likely to act as a constraint

However, the upswing is likely to be constrained because of interest rates likely to remain well above their 2021 record lows, poor affordability and slowing population growth.

- Recent higher than expected inflation data along with somewhat stronger than expected economic growth as reinforced by RBA commentary and guidance have added significant uncertainty to the extent and timing of further rate cuts which may dampen buyer confidence. So, while we still expect two more rate cuts the risk is high that they are delayed or we only get one more on none. Either way this will still leave mortgage rates well above their record lows seen in 2021 of around 2 to 3%. As such, the buying capacity of home buyers is expected to remain below the levels seen in 2021-22. This will limit the upside in property prices and may see the monthly pace of gains slow a bit in the months ahead.

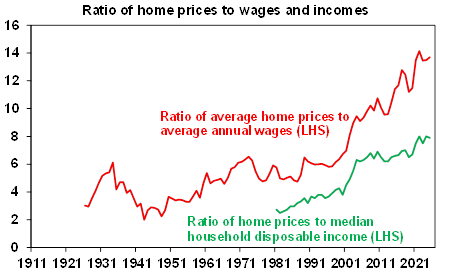

- Housing affordability remains very poor. This is evident in the ratio of home prices to wages & incomes being around record levels.

Source: Cotality, ABS, AMP

- Slower population growth, reflecting a crackdown on student visas and a return to the normal pattern of students leaving after they complete their degrees (after disruption from the pandemic), may take some pressure off the home buyer market. Population growth has already slowed from a peak of 662,000 over the year to September 2023 to 423,000 over the year to March with the Government’s immigration forecasts implying a fall to around 365,000 in 2025-26.

Overall, we expect rate cuts and the housing shortage to dominate but with annual gains in national average home prices constrained to around 7% this year. The lagged impact of rate cuts and a surge in first home buyer demand on the back of the bring forward of the broader low deposit scheme and the startup of the Help to Buy scheme are likely to see the pace of gains pick up to around 8-10% next year.

What to watch?

The key things to watch will be interest rates, unemployment and population growth. For example, a return to rate hikes, a sharply rising trend in unemployment and a sharp slowing in net migration could result in a resumption of property price falls. On the flipside a faster fall in rates and faster than expected population growth could drive a stronger upswing in property prices.

Ends