By Shane Oliver, Chief Economist and Head of Investment Strategy at AMP.

- The RBA cut its cash rate by 0.25% taking it to 3.6%. This is the third rate cut in this easing cycle.

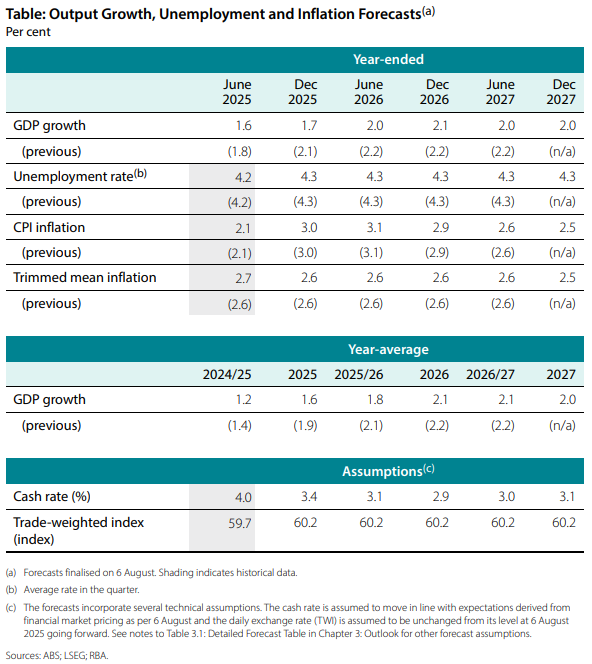

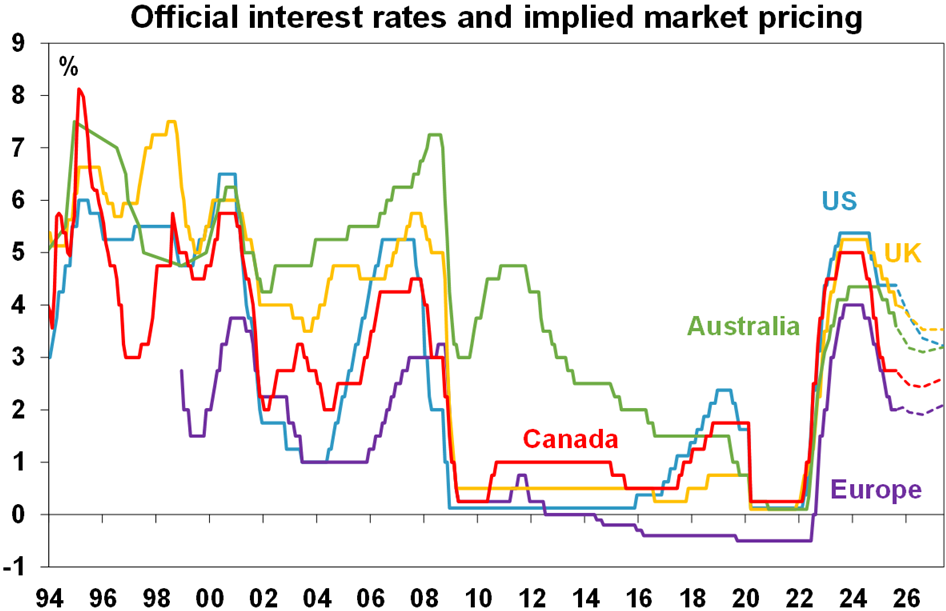

- The RBA sees inflation running around target but has revised its growth forecasts down again. Its forecasts assume that the cash rate will continue to “follow a gradual easing path”, implying that without further easing growth and inflation will be lower and unemployment higher.

- We expect the RBA to cut again in November, February and May taking the cash rate to 2.85%.

- The ongoing rate cutting cycle should help underpin a modest further pick up in Australian economic growth to around 1.8%yoy by year end, but with the tariff threat posing some downside risk.

RBA cuts to 2.6% and continues to lean to more cuts

A great day for Swifties (with a new album on the way – “The Life of a Showgirl”) and for RBA watchers (which seems to overlap here at AMP)!

After the surprise RBA decision to leave rates on hold last month, there was no such surprise this month with the RBA delivering a widely expected 0.25% rate cut taking its cash rate to 3.6%. The money market had priced in a 100% chance of a cut and all 40 economists surveyed by Reuters had expected a 0.25% move.

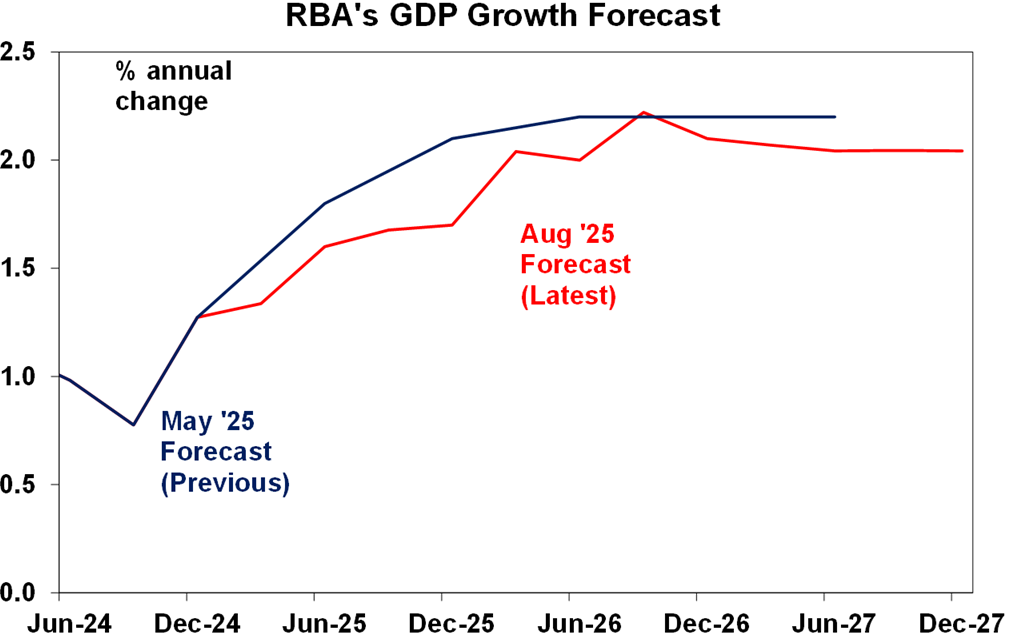

Basically, the RBA got the confirmation it was waiting for with June quarter inflation data showing a further leg down in underlying (or trimmed mean) inflation to 2.67%yoy which was basically in line with RBA inflation forecasts for a 2.6%yoy rise. In particular, the RBA noted that underlying inflation has fallen broadly as expected providing more confidence that inflation will be sustained around the midpoint of its 2-3% target range. It also notes that labour market conditions have eased further, wages growth has eased from its peak, businesses in some sectors have been finding it more difficult to pass on cost increases, there is a risk that consumption growth is a little weaker and US tariffs are still expected to adversely affect global activity. Against this the RBA continues to note that the labour market remains tight and productivity growth has not improved, with the RBA revising down its long run productivity assumption to 0.7%pa from 1%pa.

Consistent with its decision to ease again the RBA made no change to its inflation forecasts – continuing to see underlying inflation around 2.6%yoy. And while it revised down slightly its growth forecasts it continues to see a gradual economic recovery with unemployment remaining low but above its cyclical low.

The RBA now sees growth recovering more slowly. But with growth forecast to run below potential – judged to be around 2%pa – until mid next year the risk is that this results in a rising trend in the unemployment rate in the near term, rather than a flat trend as the RBA is forecasting.

Source: RBA, AMP

The unchanged RBA underlying inflation forecasts mean that it continues to see it basically remaining around the midpoint of the target range right through its forecasting period.

Source: RBA, AMP

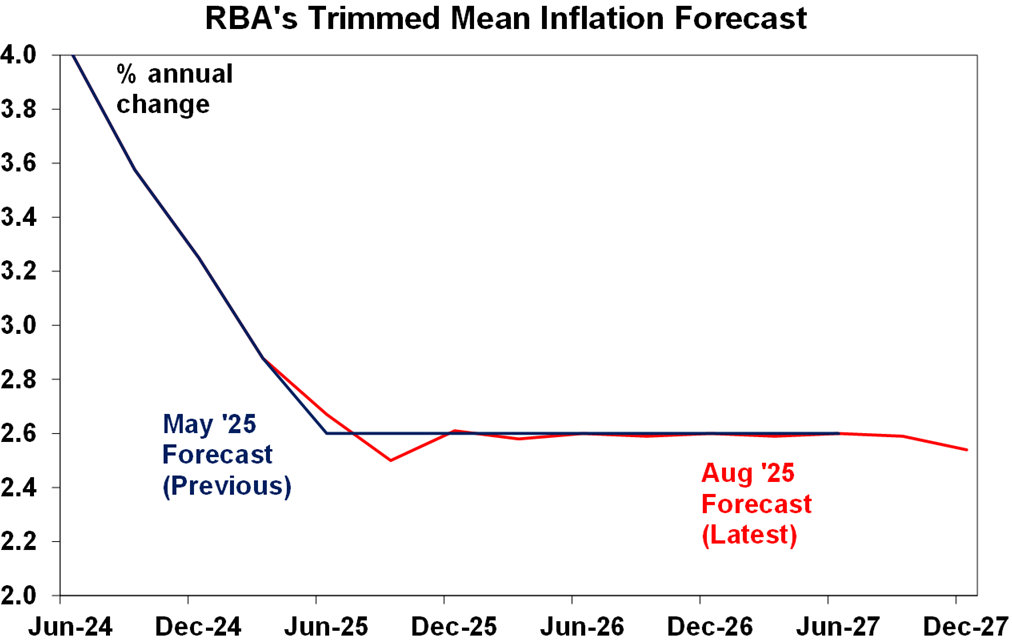

The RBA now sees the risks around the outlook and inflation as “broadly balanced”. Nevertheless, it remains cautious about the outlook and its forecast assume a further “gradual easing” in the cash rate to 2.9% next year. In other words were it not for the assumption of further easing it would be forecasting weaker growth, rising unemployment and inflation below the midpoint of the 2-3% target range. At the same time the still tight labour market and poor productivity provide room for the RBA to remain gradual in easing.

Overall, we interpret this as consistent with an ongoing quarterly pace of rate cuts for now.

Source: Bloomberg, AMP

The RBA’s downgrade to its productivity assessment is of more relevance to the medium term because in the near term poor productivity has not prevented inflation from falling despite strong growth in unit labour costs. What it does tell us is that the speed limit for Australian economic growth, wages growth and growth in living standards in Australia is likely now a lot lower than it used to be. It highlights why it’s so important the Government’s upcoming Economic Reform Roundtable sets of a process to boost productivity. If not, our living standards will be a lot lower than we have come to expect.

Seven reasons to expect more RBA rate cuts

We continue to see further rate cuts as growth remains sub par, the risks to unemployment are on the upside, underlying inflation is likely to remain around the 2.5% target and monetary policy remains tight.

- The latest rate cut means that just three of the 13 rate hikes between May 2022 and November 2023 which totalled 4.25% have been reversed. For mortgage payments it will reverse another $1260 of the $16,800 increase in annual payments on a $660,000 since May 2022. Or a total saving of $3780, which only reverses 23% of the increase in payments between May 2022 and November 2023.

- Partly reflecting this, the outlook for consumer spending remains subdued. Evidence from the banks, national accounts and various consumer surveys suggest that mortgage holders are saving the bulk of their interest rate savings by maintaining their monthly mortgage payments for now.

- Weak consumer demand will likely in turn constrain business investment.

- While unemployment at 4.3% remains historically low it appears to be resuming its gradual rising trend, forward looking jobs indicators are softening and so the risks are on the upside. What’s more there remains no sign of a wages breakout with wages growth down from its 2023 high.

- The cash rate is still above most of the RBA’s estimates of the neutral rate which averaged around 2.8% as at May when the RBA last published it. While the RBA has stopped publishing estimates of the neutral rate, the comparison to estimates of it still provided a useful albeit imperfect guide as to whether monetary policy is restrictive or not and gith now it remains somewhat restrictive. It means there is still scope for further rate cuts to get monetary policy back to neutral.

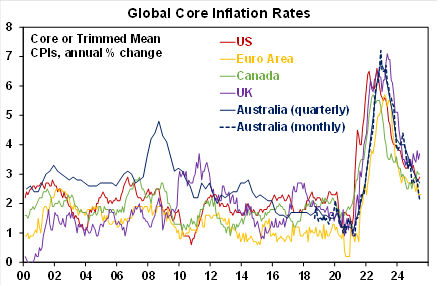

- Underlying inflation in Australia is in line with or below that in the Eurozone and Canada both of which have rates well below the RBA’s cash rate.

Source: Bloomberg, AMP

7. While the tariff threat to global and hence Australian growth receded with Trump pausing the tariffs in April, the average tariff on US imports following latest US announcements is still 6 or 7 times greater than last year’s level. So, Trump’s trade war is still going to be a drag on global and hence Australian economic growth.

So, while low unemployment and poor productivity growth mean that the RBA will remain cautious and gradual in cutting rates, and they will assess the situation from meeting to meeting, we continue to see the RBA cutting rates again in August, November, February and May taking the cash rate down to 2.85%. Indeed as noted earlier the RBA’s own forecasts are predicated on something like this indicating that if rates are not cut further unemployment is likely to rise above levels consistent with the RBA’s own assessment of “full employment” and inflation will likely fall below the midpoint of the target range.

Implications for the Australian economy, shares and property

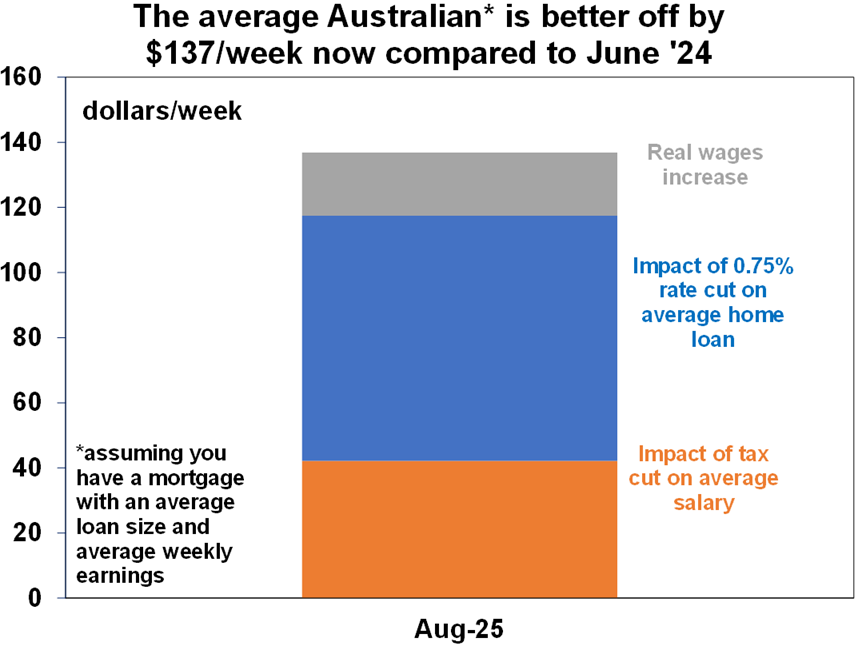

- Growth to rise to 1.8%yoy. The continuation of the RBA rate cutting cycle is likely to support a modest uptick in Australian economic growth this year to around 1.8%yoy, which is around RBA forecasts. The further 0.25% rate reduction (which the banks seem to be passing on) will cut roughly another $105 off monthly mortgage payments on a $660,000 mortgage freeing up some more spending power. The combination of the three mortgage rate cuts, last year’s July tax cuts, and wages growth running above inflation is providing roughly a $136 a week boost to someone on average earnings with a mortgage compared to a year ago. Consumer confidence is also likely to see a further modest improvement. However, the impact on spending is likely to be modest initially as: it takes a while for interest rate moves to start impacting spending as we saw in 2022; rate cuts into early next year are expected to reverse only 6 of the 13 hikes; and rate cuts will likely still be gradual particularly compared to the rapid fire rate hikes back in 2022 which may dampen expectations.

Source: ABS, AMP

- Positive for shares, but expect a rough constrained a more ride this financial year. Providing recession is avoided, RBA rate cuts are positive for Australian shares because they help boost future profit growth and make shares relatively more attractive relative to cash. The experience since 1982 suggests no boost to shares after 3 months on average from the first rate cut but a 2.6% median boost after 6 months and a 5.3% median boost after 12 months. However, this masks a huge range, with shares having a rougher ride at least initially if there is a recession. Fortunately, a recession is unlikely. But shares have seen continuing strong gains to record highs after a correction into April, valuations are stretched and Trump’s trade war and various other risks will no doubt make for a volatile ride. However, the continuation of rate cuts in the absence of recession still point to reasonable gains on a 12-month view.

Positive for property too, but expect only modest gains this year given the starting point of poor affordability. Lower rates are positive for home prices because they take pressure off existing homeowners who may have been struggling with their mortgages and as they increase the amount a borrower can borrow from a bank and hence pay for a property which supports demand. Consistent with this we have seen auction clearance rates move up since late last year. Roughly speaking the latest 0.25% rate cut when fully passed on to variable mortgage rates will add nearly $11,000 to how much a buyer on average earnings can borrow, bringing the total for the three rate cuts since February to around $33,000. This along with a few more rate cuts into early next year will drive a significant increase in the capacity of buyers to pay for a property. However, with housing affordability remaining poor, the capacity to pay set to remain well below the 2021-22 high as mortgage rates remain well above the 2 to 3% lows seen in 2021 and rate cuts likely to remain gradual, we are forecasting a 6% rise in average home prices this year.

Ends