By Dr Shane Oliver, Chief Economist and Head of Investment Strategy at AMP.

Investment markets and key developments

Global share markets fell over the last week not helped by concerns about the impact of US tariffs on economic growth, despite various deals being reached. US shares were supported by strong earnings results, but this was offset by ongoing caution from the Fed. Australian shares fell on Friday in response to Trump’s latest tariff announcements leaving them roughly flat for the week with gains in consumer discretionary, financial and industrial shares but tariff driven falls in resources shares. Bond yields generally fell. Oil prices rose on fears that US secondary sanctions (tariffs) on countries buying Russian oil could impact global oil supply. Iron ore prices also rose but gold and metal prices fell. The $A and Bitcoin fell as the $US resumed its bounce from oversold levels.

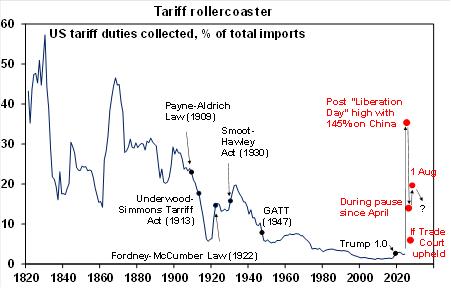

The past week saw Tariff Man Trump again flooding the zone with daily tariff announcements that are next to impossible to keep up with ahead of his (latest) 1st August deadline. It wasn’t all bad news with trade deals with the EU and South Korea (both with 15% tariffs) coming after previously announced deals serving to reduce uncertainty, tariff rates in these deals coming in less than announced on Liberation Day and the baseline tariff of 10% maintained for countries with which the US has a trade surplus, including Australia. However:

· countries without deals have seen tariffs imposed on them ranging from 15% to 50% (Brazil);

· the deals that have been agreed lack detail and look grossly lopsided with countries facing 15% plus tariffs on their goods in the US, but goods from the US seeing around zero tariffs;

· and they come with silly agreements to invest in the US – eg $750bn from the EU – which can likely never be fulfilled;

· US/China trade tensions could flare up again if the current truce is not extended beyond its expiry on 12th August; and

· most importantly the latest set of country and sector tariff rates still imply a rise in the average US import tariff rate to around 20%, from 15% through the pause since April, which is way up from up from 2-3% at the start of the year resulting in higher prices (taxes) for US consumers and businesses and a disruption to the US economy (like Brexit did to the UK) and a hit to non-US exporters posing risks to global growth.

So, while things aren’t as bad as threatened on Liberation Day, the surge in US tariffs still poses a significant threat to the global economy which will likely become more evident in the months ahead. Ultimately, a combination of more trade deals for those countries without deals and Trump being forced to back down in the face of market volatility and or the economic impact are likely to see the tariffs settle around 15%, but this may take a while.

Source: USITC, EvercoreISI, AMP

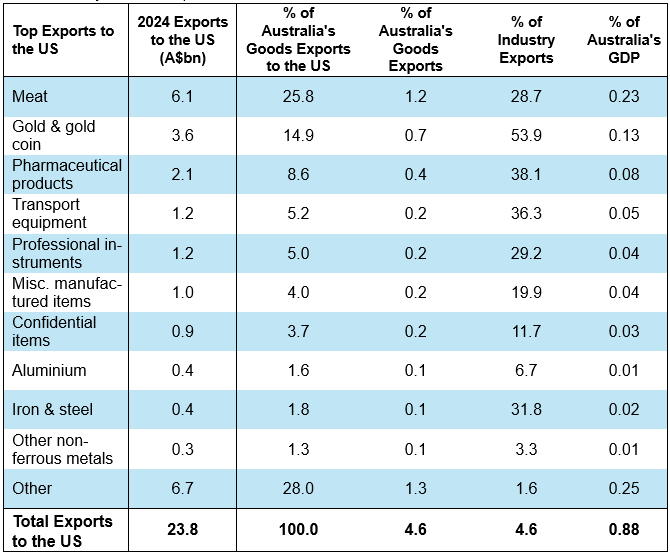

For Australia, confirmation that the general tariff stays at 10% is a relief. But its still up from 2% or less at the start of the year and aluminium, steel and likely pharmaceuticals are still to be tariffed at higher rates. While this remains bad for industries affected, we remain of the view that the overall direct macroeconomic impact will be minor because our exports to the US are a very small share of our total goods exports (less than 5%). Rather the main threat continues to come via the hit to global trade from the tariffs resulting in slower global growth and hence weaker demand for our exports generally. So, while worst case US trade war scenarios have been averted for now the drag from US tariffs still adds to the case for more RBA rate cuts.

Australian exports to the US as a share of GDP

Source: ABS, AMP

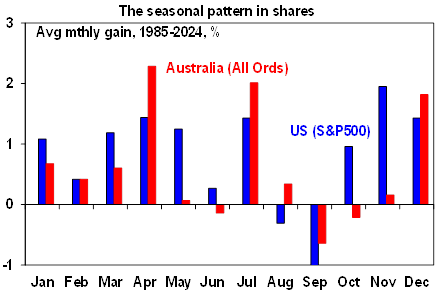

Shares had a strong July with US shares up 2.2%, global shares up 2% and Australian shares up 2.3%. This has left valuations stretched and a lot of good news has been factored in which leaves markets a bit vulnerable over the seasonally weaker months of August and September. And there is a long worry list that could trigger volatility around US tariffs and their impact, the threat to Fed independence, the high risk of a US Government shutdown and rising bond yields with debt worries in the US and Japan. Beyond the messy near-term outlook though, shares should benefit on a 6-12 month view as Trump continues to pivot towards more market friendly policies, the Fed starts cutting rates again and other central banks including the RBA continue to cut.

Source: Bloomberg, AMP

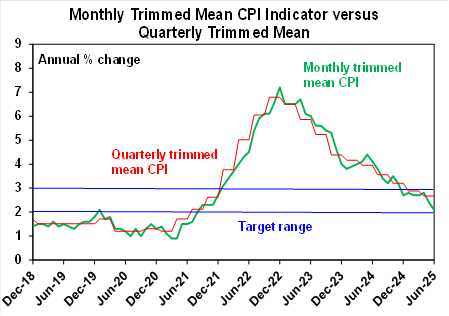

In Australia, the latest inflation data confirms that inflation is continuing to fall. For the June quarter it was good on all fronts: both the headline CPI at 2.1%yoy and the underlying trimmed mean at 2.7%yoy are within the RBA’s target range; both are at their lowest since 2021; annualised trimmed mean inflation was 2.4% in the June quarter and 2.6% over the last six months; services inflation fell to its lowest in three years; more than 50% of CPI basket items now have annualised inflation less than 2%; and the Monthly CPI for June fell to 1.9%yoy with the trimmed mean falling to 2.1%yoy indicating that momentum remains down.

Source: ABS, AMP

The confirmation of the continuing decline in inflation makes an August RBA rate cut almost certain. While trimmed mean inflation was 2.7%yoy compared to the RBA’s forecast for 2.6%, the difference was marginal as before rounding it was 2.67% and, is consistent with the RBA’s forecasts for inflation to fall to the mid-point of their target range. RBA Deputy Governor Hauser effectively confirmed this favourable assessment noting that the June quarter inflation data was “very much as we had expected” implying that its consistent with RBA forecasts. As such along with the signs of softness evident in June jobs data and the threat to growth from Trump’s tariffs we see it as making an August rate cut almost certain. So, we retain our forecast for 0.25% rate cuts in each of August, November, February and May. However, with momentum remaining down the risks are skewed to inflation undershooting the target and unemployment rising more than expected suggesting the risk is towards a faster easing.

Major global economic events and implications

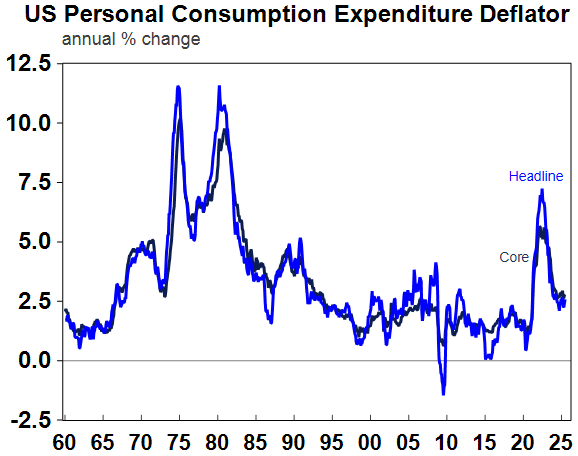

In the US, the Fed left interest rates on hold as expected at 4.25-4.5%, with Trump appointees Governors Waller & Bowman dissenting in favour of a cut. Basically, the Fed remains in wait and learn mode regarding the impact of tariffs. While June core PCE rose an as expected 0.3%mom, upwards revisions saw it rise 2.8%yoy which was a bit higher than expected and highlights the challenge facing the Fed. Our base case is that weaker growth will trigger a cut in September followed by one more by year end.

Source: Macrobond, AMP

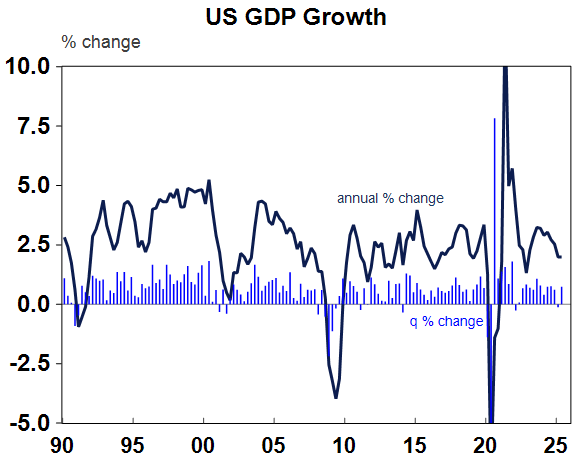

US growth rebounded but is slowing beneath the surface. June quarter GDP growth was 3% annualised after a 0.5% fall in the March quarter as the boost to imports from tariff front running reversed resulting in trade contributing 5 percentage points to growth. Private final demand grew just 1.2% annualised though highlighting an ongoing underlying slowdown in growth.

Source: Macrobond, AMP

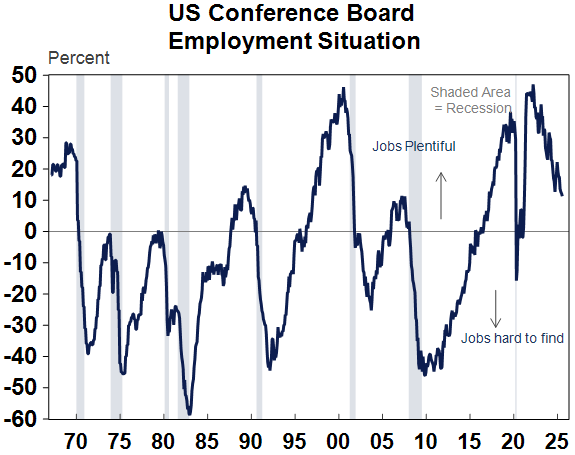

In other US data, consumer confidence rose slightly in July, but consumers’ perceptions of whether jobs are plentiful fell again.

Source: Macrobond, AMP

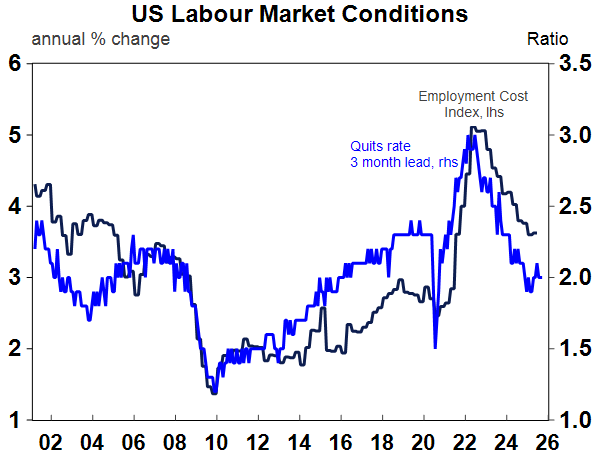

US job openings, quits and hirings all fell with quits pointing to a further cooling in the growth rate in Employment Costs which remained at 3.6%yoy in the June quarter. It was more of the same for initial jobless claims remaining low but continuing claims trending higher. Meanwhile May home price data showed a further slowing to just 2.8%yoy.

Source: Macrobond, AMP

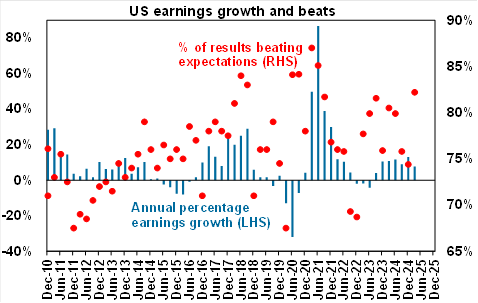

US June quarter earnings are continuing to come in stronger than expected. 63% of S&P 500 companies have so far reported results with 82% beating expectations which is above the norm of 76%. Consensus earnings expectations for the quarter have risen to 7.7%yoy up from 4.1% four weeks ago with strong profit growth in tech and financials but other sectors seeing profits down. Earnings surprises suggest a final outcome around 8.5%yoy.

Source: Bloomberg, AMP

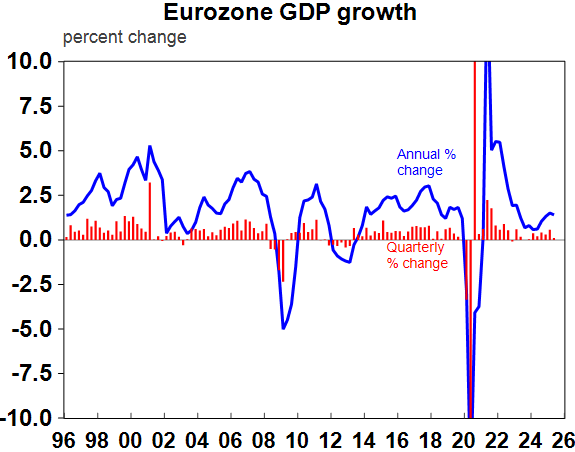

Eurozone June quarter GDP growth slowed to 0.1%qoq and 1.4%yoy after the boost to exports from US tariff front running in the March quarter reversed. France and Spain surprised on the upside, Germany and Italy on the downside. Meanwhile, July economic sentiment rose slightly but remains subdued and unemployment remained at 6.2%.

Source: Macrobond, AMP

The Bank of Canada left rates on hold at 2.75% noting the economy showing some resilience, ongoing inflation pressures and a reduced risk of a severe global trade war but noted that there may still be a need for a further rate cut.

The Bank of Japan also kept interest rates on hold at 0.5%. While it noted that uncertainty remains high, with an upwards revision to its inflation forecasts and worst case scenarios averted by the US/Japan trade deal, another 0.25% rate hike is possible by year end. Growth in retail sales and industrial production picked up in June and unemployment remained low at 2.5%.

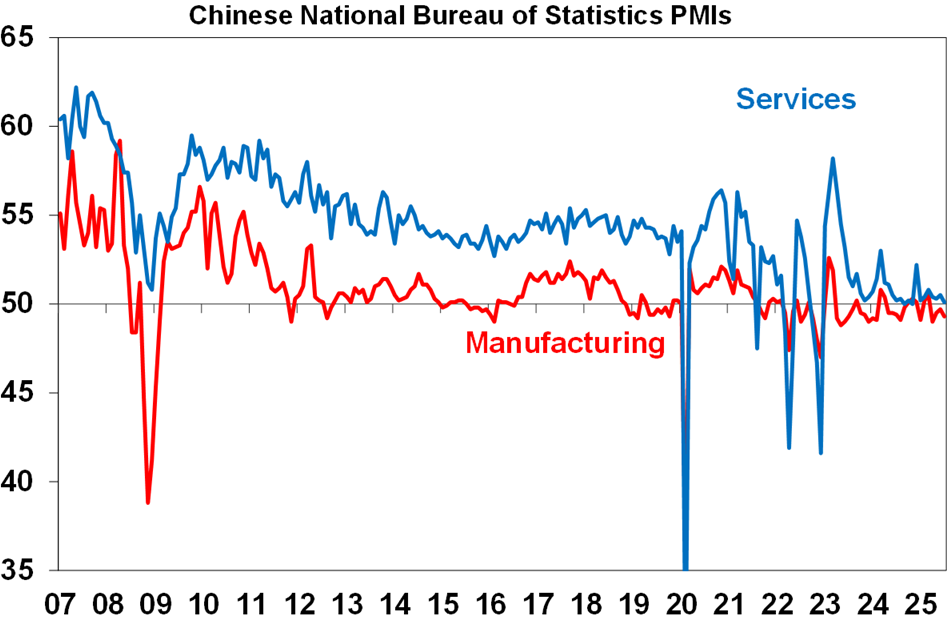

China’s business conditions PMIs fell in July, although they remain in the same range seen over the last two years. Interestingly the July Politburo meeting indicated less urgency for further policy stimulus, possibly reflecting better than feared first half growth and optimism of a trade deal with the US.

Australia economic events and implications

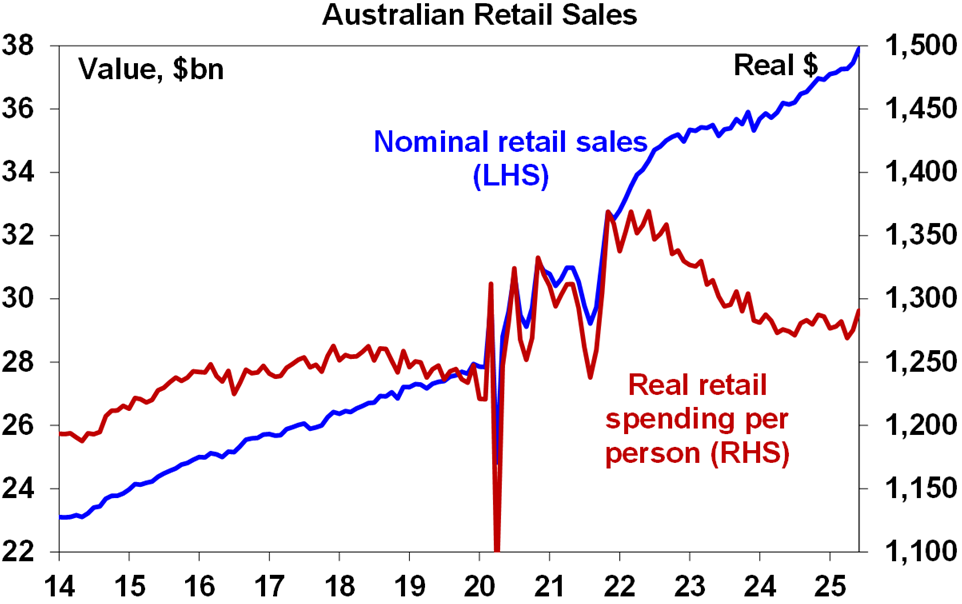

The past week saw a run of stronger economic data. Retail sales rose a stronger than expected 1.2% in June. This along with a rebound in spending in Queensland after bad weather also drove up real retail sales in the June quarter by a stronger than expected 0.3%. However, the June bounce looks to have been boosted by EOFY sales driving spending on furniture, electrical goods and clothing with a high risk that it will soften next month much as occurred after Black Friday and Cyber Monday sales last year.

Source: ABS, AMP

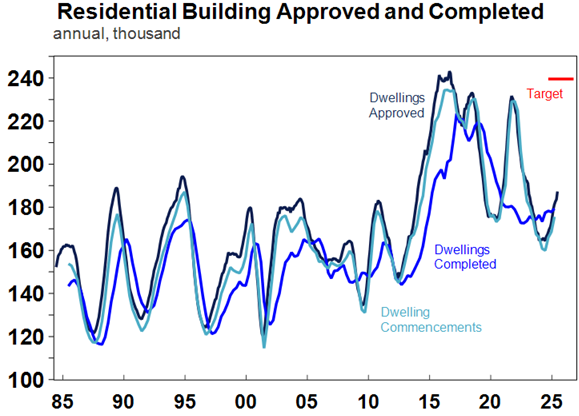

Home building approvals surged nearly 12% in June, restoring a rising trend. The rebound is good news and puts trend approvals running at 192,000 pa which is just above current population driven demand for housing. However, it’s still well below the Housing Accord target for 240,000 homes a year (or 1.2 million over five years) which is what we will need to cut into the accumulated housing shortfall which we estimate to be between 200,000 to 300,000 dwellings! What’s more the surge in June was due to a 33% rise in private unit approvals and they are normally very volatile whereas private house approvals fell.

Source: Macrobond, AMP

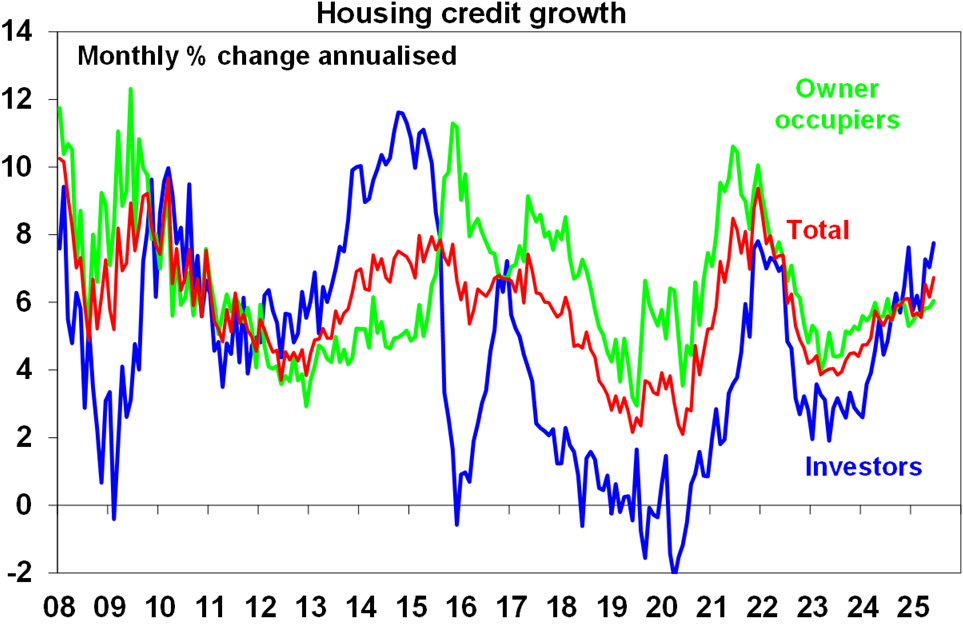

Meanwhile, credit growth remained moderate in June with housing credit growth picking up slightly.

Source: ABS, AMP

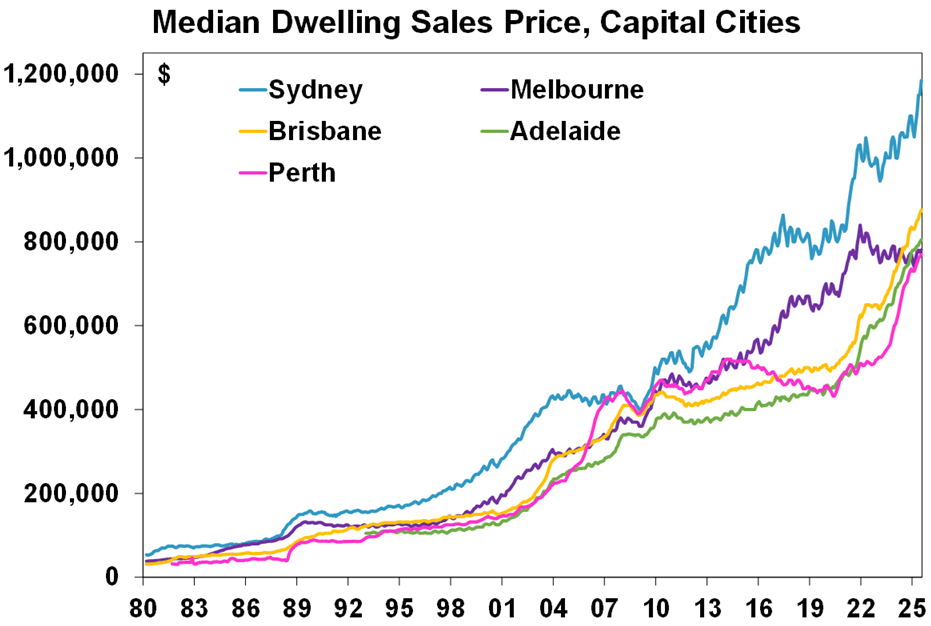

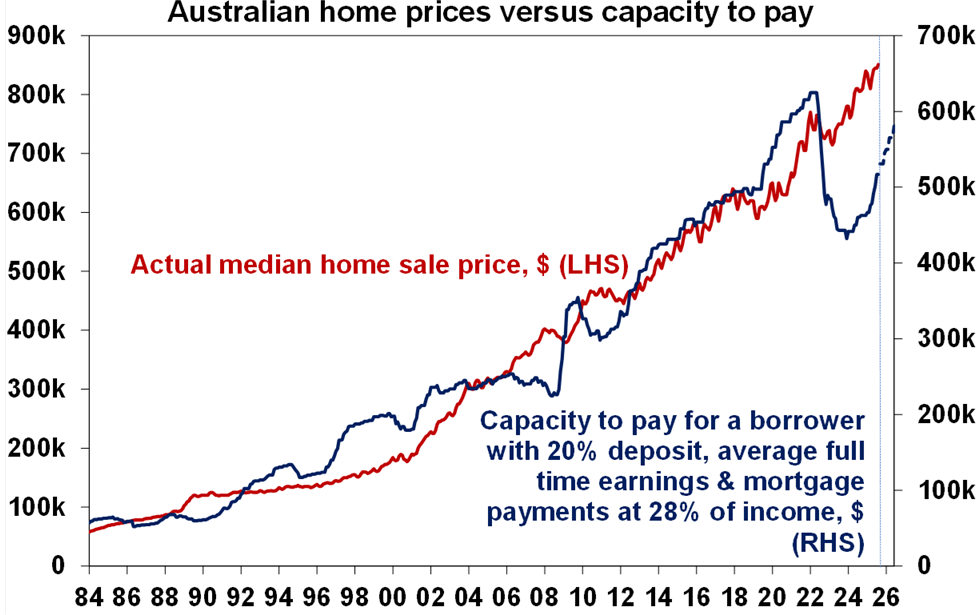

Australian home prices rose for the sixth month in a row in July with another 0.6% gain, as Sydney and Melbourne continue to pick up and the boomtime cities of Brisbane, Adelaide and Perth remain strong. RBA rate cuts with the expectation of more to come are the key driver along with the ongoing housing shortage. Expect further gains ahead, although poor affordability, as illustrated by the still weak capacity to pay for a home compared to when prices soared in 2021, will act as a constraint.

Source: Cotality, AMP

Source: Cotality, AMP

What to watch over the next week?

In the US the July services conditions ISM (Tuesday) is expected to improve slightly to an okay reading of 51.3.

The Bank of England (Thursday) is expected to cut its policy rate by 0.25% taking it to 4% and provide dovish guidance.

Chinese trade data for July (Thursday) is expected to show a slight slowing to 4%yoy with import growth remaining weak around 1%yoy. Inflation data (Saturday) is likely to show consumer prices up just 0.1%yoy.

In Australia, household spending for June (Tuesday) is expected to rise 0.9%mom or 5%yoy and the trade surplus for June (Thursday) is expected to rise to around $2.5bn. The June half profit reporting season will see 10 major companies reporting including AMP (Thursday) and Nick Scali & QBE (Friday). Consensus earnings expectations are for a 1.7% fall in earnings for 2024-25 which will mark the third year in a row of falling profits. Resources earnings are expected to be the main drag (as evident in Rio’s profit slump already reported) along with modest falls consumer sector profits but growth elsewhere. Key to watch will be outlook statements given the boost from lower rates, but the threat posed by US tariffs.

Outlook for investment markets

Share markets are at risk of a correction through the seasonally weak months of August and September given stretched valuations and risks around US tariffs and US debt and likely weaker growth and profits. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains into year end.

Bonds are likely to provide returns around running yield or a bit more, as growth slows, and central banks cut rates.

Unlisted commercial property returns are likely to improve as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have started an upswing on the back of lower interest rates. But it’s likely to be modest initially with poor affordability and only gradual rate cuts constraining buyers. We see home prices rising around 6% this year.

Cash and bank deposits are expected to provide returns of around 3.75%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted in the near term between the negative global impact of US tariffs and the potential positive of a further fall in the overvalued US dollar. Undervaluation should support it on a medium-term view with fair value around $US0.73.

Ends