By Dr Shane Oliver, Chief Economist and Head of Investment Strategy at AMP.

Here are our thoughts on the latest RBA decision.

- The RBA left rates on hold 3.85%. This was contrary to the expectations of most economists, including ourselves, and the money market which had priced in around a 90% chance of a cut.

- The RBA judged that it could afford to wait for more information to confirm that inflation is heading sustainably back to target. But it’s commentary overall was dovish suggesting that rates are still set to fall further.

- We continue to see the RBA cutting the cash rate to 2.85%, but it will get there a bit more slowly with the next cut in August, and subsequent cuts likely to be in November, February and May.

- The slower pace of easing could slow the pickup in the economy and risk inflation falling below target but not dramatically so as the next meeting is only five weeks away.

- The more gradual pace of easing could have the effect of moderating the upswing in the property market in the near term.

RBA holds, but still leans dovish

Contrary to widespread, but not unanimous, expectations for another cut the RBA left rates on hold at its July meeting. In doing so it noted that the monthly CPI Indicator has been marginally stronger than expected, financial markets have rebounded, the labour market remains tight, productivity remains poor, there are lags in the impact of the cash rate easing so far and so it concluded that it could wait for more confirmation that inflation is on track to run around 2.5% on a sustainable basis.

However, the overall tone of the RBA’s commentary continues to lean dovish with its assessment that the risk to the inflation outlook – where its forecasting inflation to average around target – has become more balanced along with its caution about the outlook with risks around the impact of US trade policy and a slower pick up in household and business spending. Reflecting this the debate at the Board was about holding (supported by six members) and easing (supported by three members) with Governor Bullock noting that the decision was more about timing rather than the direction for rates which will likely remain down if June quarter inflation comes in on track with RBA forecasts.

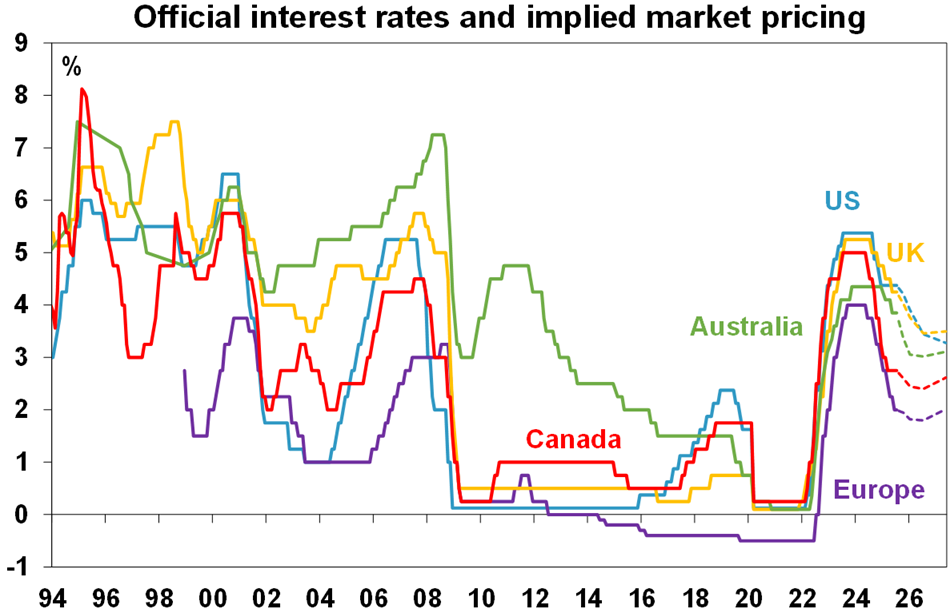

Source: Bloomberg, AMP

We expect the RBA to cut in August, November and February

While we were wrong in our expectations for a cut in July and the RBA is proving to be even more gradual than we had come to expect, we continue to see further rate cuts as we see economic growth picking up more slowly than the RBA is forecasting, underlying inflation is likely to be confirmed around the 2.5% target and monetary policy remains tight.

- The outlook for consumer spending remains subdued relative to RBA forecasts as rate cuts so far have only reversed two of the thirteen rate hikes in 2022 and 2023. Or just $2520 of the $16,800 increase in annual payments on a $660,000 mortgage since May 2022. As a result, evidence from the banks and national accounts suggests that mortgage holders are saving the bulk of their interest rate savings by maintaining their monthly mortgage payments.

- Weak consumer demand will likely in turn constrain business investment relative to expectations.

- While unemployment at 4.1% is historically low there is no sign of a wages breakout with wages growth down from its 2023.

- The cash rate is still above most of the RBA’s estimates of the neutral rate which average around 2.8% as published in the May SOMP. This means that monetary policy remains tight which is probably unnecessary when inflation is now judged to be back around target. But it means there is still plenty of scope for further rate cuts to get monetary policy back to neutral.

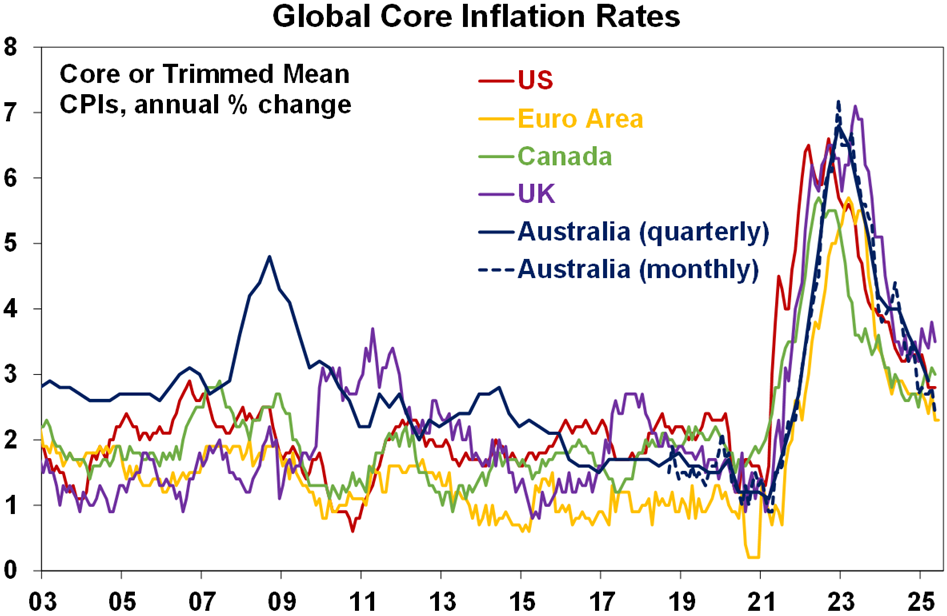

- Underlying inflation in Australia is in line with or below that in the Eurozone and Canada both of which have rates well below the RBA’s cash rate.

Source: Bloomberg, AMP

- While the tariff threat to global and hence Australian growth receded with Trump pausing the tariffs in April, the average tariff on US imports is still five times greater than last year’s level and his trade war is now at high risk of flaring up again as he has started nominating tariff rates mostly well above the 10% baseline rate for various countries to commence on 1st August if deals are not agreed. So, Trump’s trade war is still going to be a drag on global and hence Australian economic growth.

So, despite the surprise decision to leave rates on hold this month we continue to see the RBA taking the cash rate back to around neutral with more cuts to 2.85%. It’s just that its now going to take a bit longer and so we are forecasting 0.25% rate cuts in August, November, February and May.

The August meeting is clearly live for a rate cut with Governor Bullock noting that by then it will have the June quarter CPI inflation data, another round of jobs data, revised economic forecasts and more information on the global growth outlook. The key here is the June quarter inflation data and specifically the trimmed mean inflation rate. Our assessment is that it will come in at the RBA’s 2.6%yoy forecast or just below which in turn should clear the way for another rate cut.

Implications for the Australian economy, shares and property

- Delaying the next rate cut by five weeks won’t have a huge impact on the economic outlook but it does risk seeing growth take longer to pick up to more normal levels with a risk that inflation could slip below target necessitating more aggressive RBA rate cuts down the track. Our assessment remains that Australian economic growth this year will be weaker than RBA forecasts at 1.6%yoy.

- For the share market the impact of the delay in rates cuts will probably be minor as it will continue to focus on rate cuts ahead.

- For the property market the delay in cutting rates could see buyers hold back a bit seeing some cooling in the recent pick up in home price growth and auction clearance rates. We revised our home price growth forecasts to 5 to 6% from around 3% a month or so ago and the risks to this could be back on the downside.