Historic levels of inflation and aggressive rate hikes by central banks are shrinking investor confidence in a soft economic landing. As inflation continues to run hot, investors can look to insulate their portfolios by pursuing opportunities in the healthcare sector as well as by investing in ‘quality’ companies.

Market performance overview

Global equity markets capitulated since the NASDAQ 100 reached an all-time high in November 2021, with the NASDAQ 100 a proxy for US growth stocks performance. The slump in equities, is the result of two main drivers, high inflation, and corresponding higher interest rate expectations. These factors have led to downgraded valuations, particularly, of high growth companies. In recent months, markets have started to increasingly price in a ‘hard landing’ or recession.

Hard landing definition

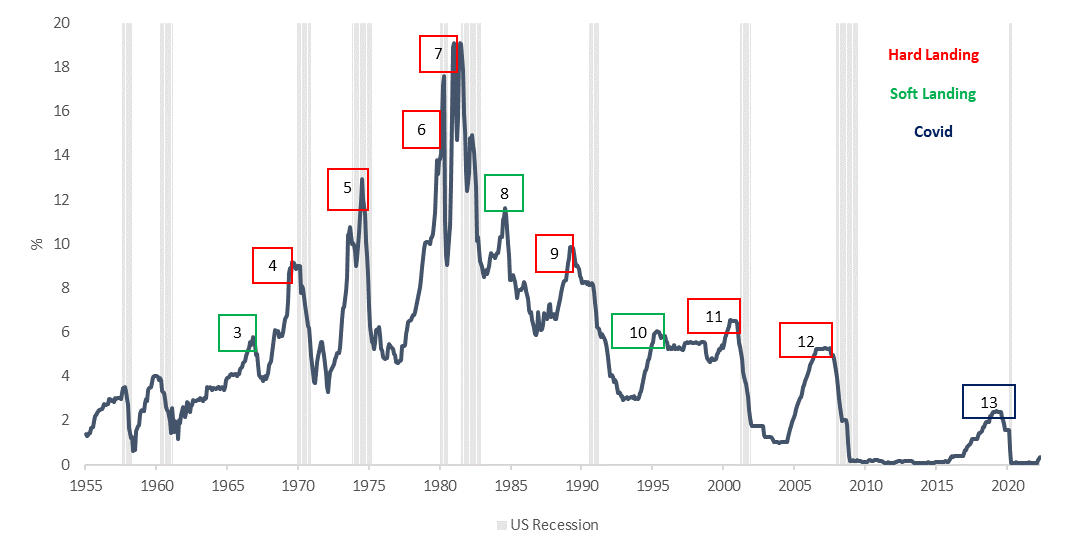

A ‘hard landing’ refers to a period where the economy enters a recession following a series of central bank cash rate increases. Historically, it has been the most common scenario following central bank interest rate increases. In fact, 75 per cent of US monetary policy tightening cycles since 1955 have resulted in a recession. Markets see this as the base case scenario. Of particular note, a recession followed the last five instances when US inflation peaked above 5 percent; 1970, 1974, 1980, 1990 and 2008. US inflation hit a 40 year high of 9.1 per cent in June this year.

According to Bloomberg, there is a 43 per cent chance of a recession by 2024. If this does eventuate, it implies that we are in a late cycle economic environment, the final phase before a recession.

Figure 1 – US Federal Fund effective rate versus recession periods

Source: Board of Governors of the Federal Reserve System (US)

Given the current market uncertainty, investors are looking to defensive investment strategies. Below are two strategies to consider in the lead up to a recession.

1. Healthcare

Healthcare demand is sticky. For example, consumers still need to purchase pharmaceuticals and care for their wellbeing even if the cost of living is on the rise. The healthcare sector typically outperforms in a late cycle environment as these companies are rewarded for their ability to generate sustainable earnings amid a backdrop of stagnate economic growth.

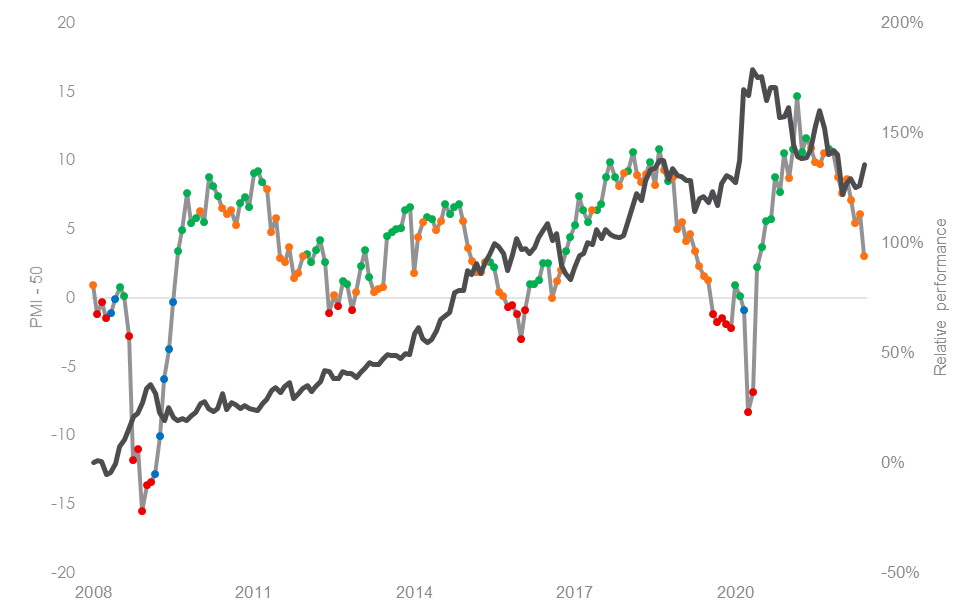

Figure 2 highlights that healthcare companies historically outperform when manufacturing activity (proxy for economic activity) slows or contracts (orange or red).

Figure 2 – US ISM Manufacturing PMI Index and Healthcare versus MSCI World performance

![]()

Source: ISM, Bloomberg, January 2008 to June 2022. Economic phase is a function on the current value of PMI-50 and the three-month change in PMI. Healthcare as MarketGrader Developed Markets (ex-Australia) Health Care Index.

VanEck Global Healthcare Leaders ETF (ASX: HLTH) invests in 50 fundamentally sound companies with the best growth at a reasonable price (GARP) attributes in the healthcare sector from developed markets excluding Australia.

2. Quality

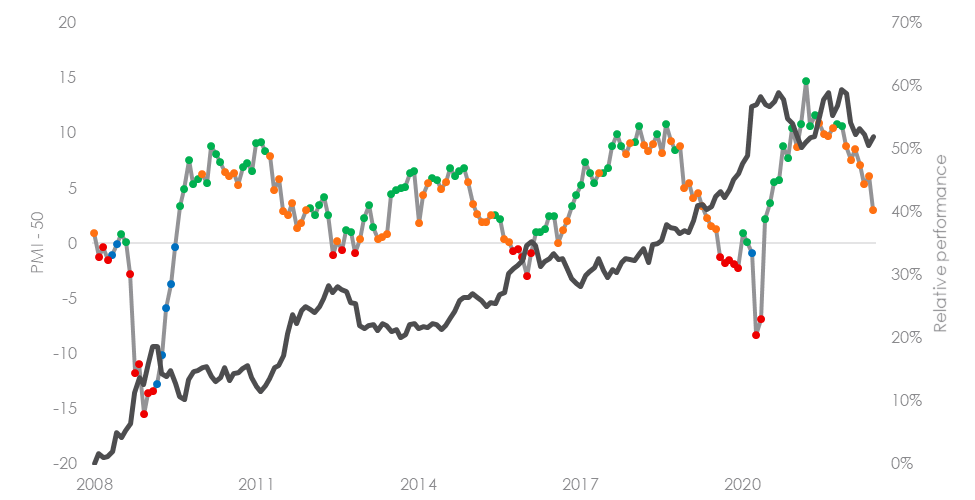

A broad based investment strategy that historically outperforms in a late cycle environment is the quality factor. Quality companies, according to world leader in index construction MSCI are those with: high return on equity (ROE), stable year-on-year earnings growth and low financial leverage. Revisiting chart 2, the chart below highlights that quality companies also historically outperform when manufacturing activity slows or contracts.

Figure 3 – US ISM Manufacturing PMI Index and quality versus MSCI World performance

![]()

Source: ISM, Bloomberg, January 2008 to June 2022. Economic phase is a function on the current value of PMI-50 and the three-month change in PMI.

VanEck offers three ETFs that invest in quality companies which track MSCI Quality indices: The VanEck MSCI International Quality ETF (ASX: QUAL), an Australian dollar hedged version of QUAL which has ASX code: QHAL, and the VanEck MSCI International Small Companies Quality ETF (ASX:QSML).

Key risks

An investment in the ETFs carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, currency hedging (QHAL), country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.