by Jay Sivapalan, CFA – Head of Australian Fixed Interest | Portfolio Manager

Key Takeaways

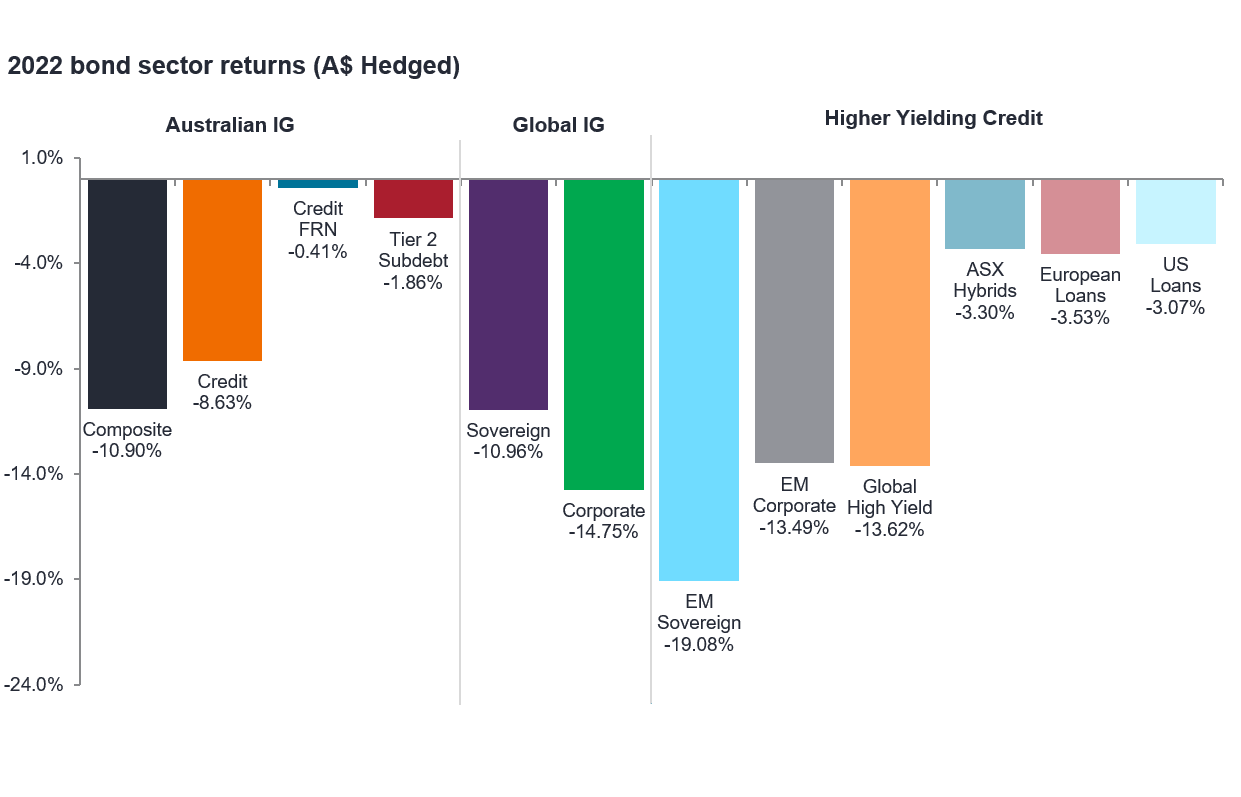

- Bond markets have experienced their largest fall observed in more than 40 years as cash rates and policy begin to normalise.

- Inflation has proven to be much higher than previously expected and has forced central banks to take a globally coordinated ‘talk tough’ messaging program backed by meaningful policy tightening.

- As we enter the more advanced stage of the economic cycle, investors need to consider the implications of tighter policy across the economy.

- The best outcomes for investors are often achieved by looking firmly ahead, taking a patient, measured and focused view of the future in order to navigate the very uncertain path ahead.

Last week, bond markets extended their meltdown with the magnitude of yield movements resembling something that’s normally witnessed over a one-year time frame, not one week. The peak to current drawdown of the Australian bond market as measured by the Bloomberg AusBond Composite 0+ Yr Index is now around -15% at the time of writing. The largest fall observed in at least 40 years since our records began for the Australian bond market. Last week was also historically significant as we observed the highest inflation rate recorded in over 40 years. While the policy normalisation process was always going to be complex, this cycle has unusually coincided with highly correlated drawdowns in equity, property, credit and government bond markets. This complexity comes not only from a normalisation of cash rates but also an unwinding of unprecedented unconventional policy that had artificially taken bond yields to 100 year lows during the pandemic period.

For investors, there’s been very few places to hide.

Chart 1: Global bond market returns (Calendar year-to-date to 14 June 2022)

Source: Bloomberg (Ausbond Composite Index, AusBond Bank Bill Index, AusBond Credit FRN Index), iBoxx AUD Investment Grade Subordinated Debt Index, JPMorgan (Global Bond Index (GBI Global), JPMorgan Emerging Market Global (EMBI Global), CEMBI Broad Diversified), BofAML (BofAML ICE Global Broad Mkt Corp (G0BC), ICE Global High Yield Constrained (HW0C)), SolActive Hybrids Gross Franking, Credit Suisse (Western European Leveraged Loan Index), S&P LTSA US Loans Index as at 14 June 2022. Past performance is not a guide to future performance.

What’s happened?

Inflation in its various forms has proven to be much higher than central banks had previously expected, exacerbated by the energy and agricultural displacements from the Russia/Ukraine war at a time of strong consumer recovery along with full employment. And in our assessment, this inflation is likely to persist for some time before settling down, but it will in all likelihood moderate once policy transmission grips. Meanwhile, central banks having been criticised for overstimulating economies during the pandemic along with government spending and being slow to normalise have now taken a globally coordinated ‘talk tough’ messaging program backed by near term decisive and meaningful policy tightening action to ensure markets believe their ability to control inflation at all costs. Today, markets do believe this to be the case.

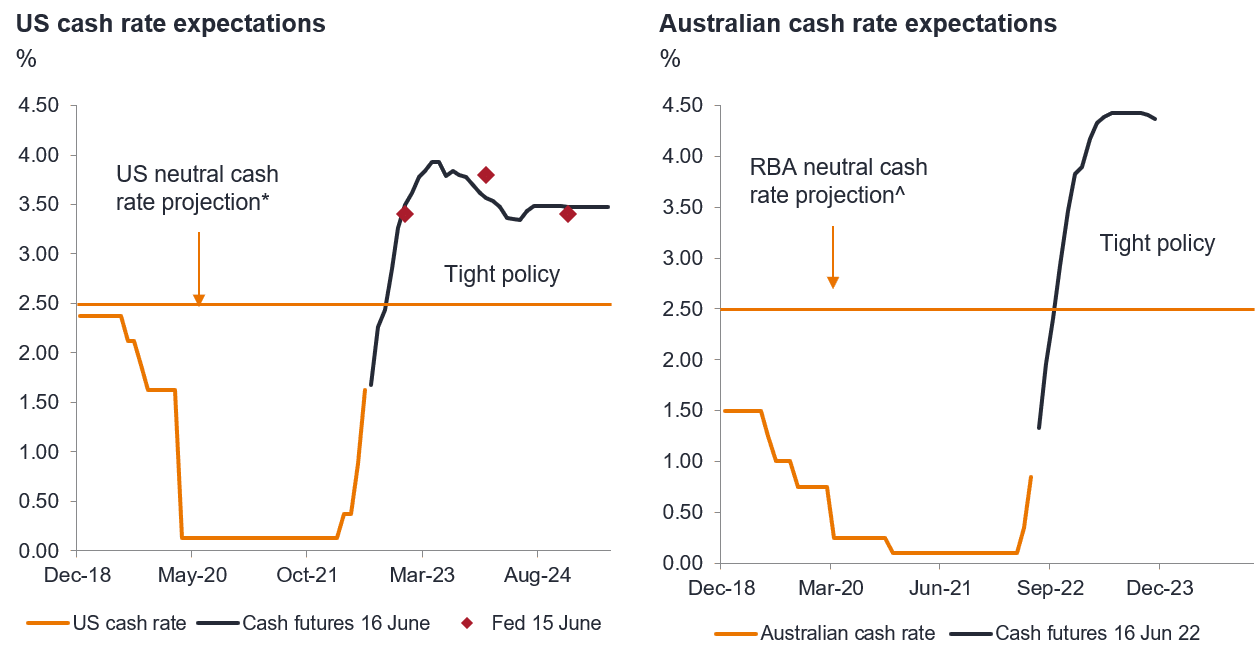

At the time of writing, markets have fully priced in a Reserve Bank of Australia (RBA) cash rate profile of 3.75% by this Christmas, peaking at 4.5% around mid-2023 suggesting an easy to neutral to tight policy path and moderating to a still high 4% thereafter. In contrast, cash rate expectations in the US are similar however peaking at around 4% before some easing back toward their neutral.

Chart 2: Cash rate expectations

Source: Janus Henderson Investors, Bloomberg, as at 16 June 2022. * US Federal Reserve Jun 22 FOMC projections, ^RBA May 3 Media Briefing

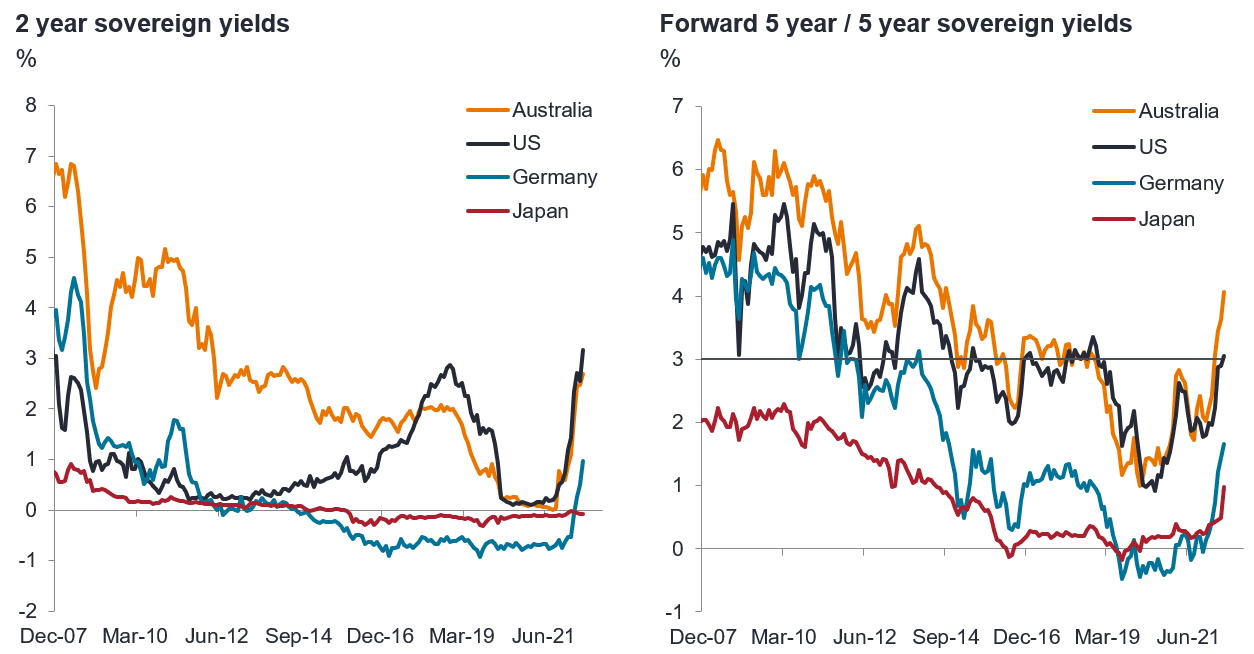

Interestingly, in Australia, markets have priced a higher, longer term cash rate as captured by 5-year 5-year forward inflation swap rates of around 4%, suggesting that policy will move to tight settings and remain there indefinitely, or that the new neutral cash rate is quite a bit higher than the RBA’s estimation.

Chart 3: Sovereign yields

Source: Janus Henderson Investors, Bloomberg, monthly to May 2022, spot 13 June 2022

Meanwhile, both 10-year and 20-year breakeven inflation rates in Australia today remain relatively low at around 2.4% p.a. suggesting markets believe central banks will be able to contain inflation over the longer term and that there is very little prospect of structurally higher inflation.

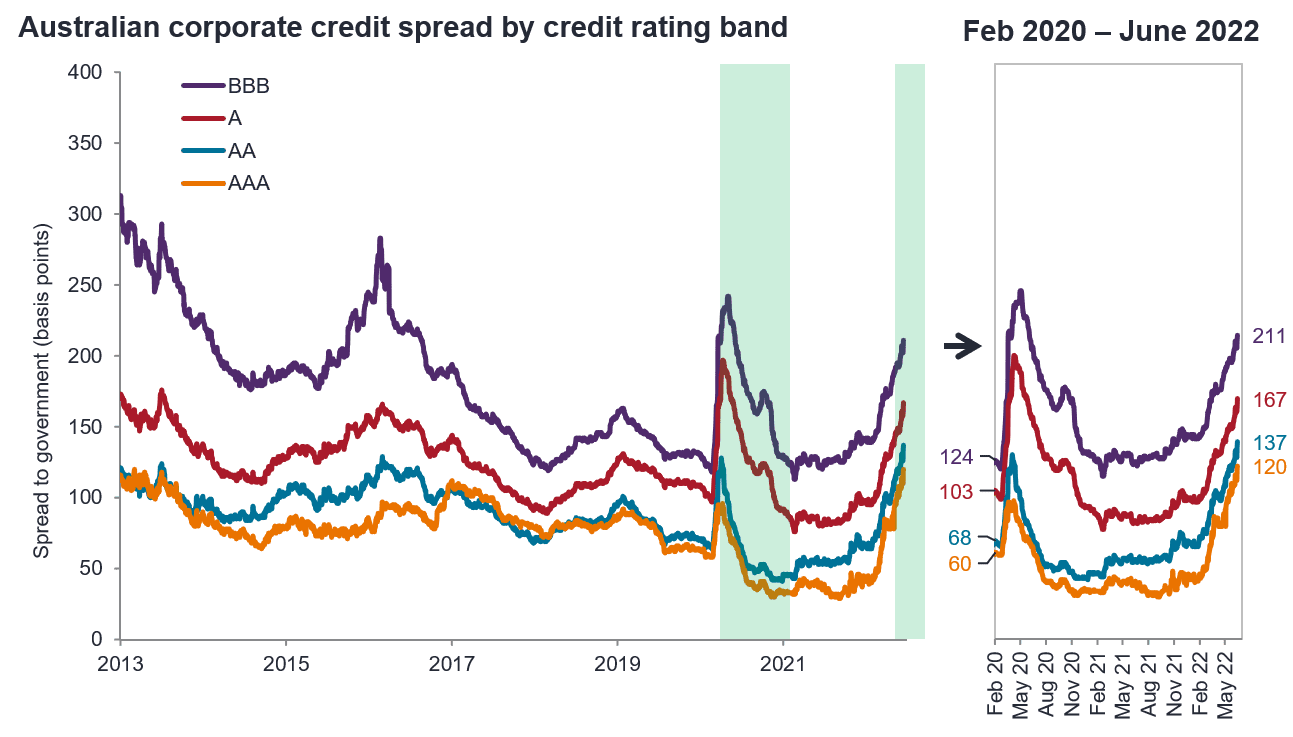

In the interim, risk assets including credit across the spectrum from high quality investment grade to high yield, loans and emerging market debt have all been adversely impacted.

Chart 4: Australian credit spreads

Source: ICE BofAML Indices, Australian Corporate Index (AUC0), as at 15 June 2022

Where to from here?

Economic growth within Australia in the very near term is likely to remain strong with labour markets strengthening further driven by pent-up economic activity from the pandemic period and deferred consumption. Meanwhile, central banks will ‘talk tough’ on their fight against inflation and initially follow through with swift tangible action. This policy tightening rightly will be front-loaded. Even though various sentiment indices will be particularly soft in the face of central bank rhetoric and action, it will take some time for policy to grip and economic activity decline. Although, the principle amongst our belief is that policy will inevitably grip. To this end, we share three scenarios:

- The RBA tightens policy briskly, getting the cash rate towards neutral by year-end and evidence forms that economic growth, labour markets and inflation has peaked, rendering further tightening unnecessary.

- Inflation and wages further spiral out of control and the RBA has no choice but to tighten from easy to tight policy bypassing neutral pushing the economy into a recession by 2023.

- Policy tightening to date coupled with front-loaded but a moderate amount of further tightening towards neutral in 2022 and a continuation of gradual tightening in 2023.

As we enter the more advanced stage of the economic cycle, albeit the impacts may not be felt until well into 2023, it is appropriate to consider the implications of tighter policy across the economy. Especially in the face of persistent inflation and falling real incomes. Typically, this phase of the cycle includes declining corporate revenues, softer employment and weaker aggregate household income growth. Asset prices including house prices and wealth effects are also adversely impacted. Under each of the scenarios, there are implications for bond yields, credit spreads and defaults. Given the predicament the economy and central banks find themselves in, the best-case scenario is a soft landing with normal growth resuming. At the opposite end of the spectrum is a full-blown recession with central banks assessing that the cost of such is the preferred price to be paid for controlling a generational spike in inflation. The desire to anchor inflation expectations shouldn’t be underestimated as the alternative could be more damaging over the medium term.

Under the range of scenarios depicted above, current pricing of bond yields in our assessment provides investors with not just ample protection for the future path of cash rates and term premia, but also a very real prospect of capital gains should:

- The RBA not be able to / not need to tighten policy anywhere near what is priced in by markets with the economy responding with a lag

- The RBA tighten policy aggressively beyond the first few bold moves and push the economy into a recession then ease policy back towards or lower than neutral

Whilst bonds in the recent past have been unusually highly correlated with growth assets, they are likely to regain their uncorrelated diversification benefits as markets look forward to the other side of the current cycle coupled with much higher starting yields.

Meanwhile, non-performance, delinquencies and defaults of non-government assets are almost certain to lift from their historically low levels absent of policy support enjoyed over the past few years. At the very least, the pricing of credit must adjust for these dynamics and to date we have observed this in the highest quality assets that benefitted most from various forms of direct policy support (quantitative easing, Term Funding Facility, Committed Liquidity Facility, etc). However, lower quality credit in our view have only weakened in a ‘one-for-one’ manner and the usual fanning out of credit spreads (i.e., lower quality widens by more than higher quality) still hasn’t occurred within the lower quality spectrum. The adjustment process remains underway, especially in high yield, loans, emerging market and private debt. The latter in particular is where the near-term vulnerability resides due to refinancing risks and concentrated exposures to rising rates. Residential development, construction, second-lien loans and mezzanine mortgage warehousing asset-backed securities are all prime examples, and we believe should be avoided at this point.

What are we doing?

Whilst it has been a challenging environment for all of us to navigate the current malaise in bond markets despite coming into 2022 with a policy normalisation expectation and defensive duration and credit positioning including hedges in place, it is fair to say there’s nothing like a 1-in-40-year event to test portfolios. As they say, ‘shaken but not stirred’. In our experience, it is a healthy attribute to reflect on these events and learn with the full benefit of hindsight. Equally, the best outcomes for investors are often achieved by looking firmly ahead, taking a patient, measured and focused view of the future in order to navigate the very uncertain path ahead.

With this in mind, we are:

- Adding more duration, now open to moving further along the yield curve

- ‘Locking in’ elevated yields (focusing on 2-3 years to look through the current cycle)

- Avoiding temptation to buy lower quality credit as there will be defaults and delinquencies

- Taking bigger positions in AAA, AA rated high quality credit assets (e.g. major bank senior)

- Focusing on liquidity, we don’t want to underestimate this

- Boosting the yield opportunities of portfolios above and beyond the market

The above are the Portfolio Managers’ views as of 17 June 2022 and are subject to change and should not be construed as advice.