by Annabelle Miller – Investment Analyst

In December 2020, PM Capital wrote about the risks appearing in the most coveted companies in the NASDAQ-100 Index – the so-called “FAANG” stocks.

We argued then that tech valuations did not reflect emerging signs of slowing growth and that terminal company values were anchored to low bond yields.

Today, these risks have exposed weaknesses in several tech companies that many investors deemed invincible. Falling tech valuations coincided with a break-out in bond yields.

Investors turn off Netflix

Netflix was one of the first large-cap tech stocks to capitulate, losing US$223 billion in market value since its peak in November 2021. Netflix shares are back to December 2017 levels.

Increasing competition in streaming and the ability of Netflix to increase prices without increasing customer churn are key factors that have led investors to reassess its earnings power.

Meta loses favour

Meta Platforms (formerly Facebook) was the next seemingly invincible tech stock to capitulate. Meta lost US$230 billion in value in in a single trading day (in February 2022).

Meta is facing several challenges as it navigates privacy changes made by Apple and increased competition from TikTok. Mark Zuckerberg, founder and CEO of Meta, acknowledged the rise of TikTok as “one of the most effective competitors we have ever faced”.

Historically, Meta chose to acquire nascent competitors, including Instagram and WhatsApp. However, greater anti-trust scrutiny has enabled the rise of TikTok as a viable competitor for advertising dollars in short-form video. In turn, the market has re-evaluated the risks to Meta’s future earnings.

In our December 2020 article, PM Capital also highlighted Nvidia’s bid to acquire Arm Holdings from Softbank for US$40 billion in September 2020. The deal was terminated in February this year due to “significant regulatory challenges.”1 Nvidia has fallen nearly 50% from its peak in November 2021.

Tesla revs too hard

Another main point in our December 2020 article was Tesla CEO Elon Musk’s net worth (US$132 billion) being greater than Tesla’s cumulative sales since 2008.

Tesla’s stock briefly peaked in November 2021, coinciding with the Musk conducting a Twitter poll to sell 10% of his Tesla stock. This red flag has been followed by Elon Musk’s proposed acquisition this year of Twitter for US$44 billion.2

Musk’s bid for Twitter followed Microsoft’s US$69 billion bid for Activision3 in January 2022. These two deals would be in the top five internet deals in history.4 Tesla and Microsoft have since declined 40% and 23% year-to-date.

Time to buy tech?

As tech stocks tumble, should investors buy the dip?

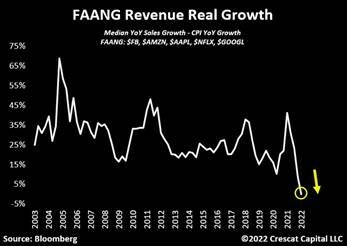

As a group, the FAANG stocks (Meta, Amazon, Apple, Netflix and Alphabet) have delivered 0% real revenue growth for the first time in 20 years, as the chart below shows.

For some FAANG companies, falling valuations reflect lower earnings growth expectations. For others, valuations have not fully adjusted to reflect downside risks to their earnings profile, in PM Capital’s view.

To that end, Peter Lynch, the famed US investor and author, summarises the most important factor in allocating capital to this group of businesses.

“… the single most important thing to me in the stock market, for anyone, is to know what you own. I’m amazed at how many people own stocks, they would not be able to tell you why they own it. They couldn’t say in a minute or less why they own it. Actually, if you really press them down, they’d say, ‘The reason I own this is the sucker is going up’.”