Bond returns in the first three months of 2022 are in line with risky assets, such as equities but with limited potential for capital growth. With a view that interest rates will continue to rise in developed markets, bonds face headwinds. Where in the world do bond investors go? The developed world is not enough.

Jack Bogle who pioneered index investing is also credited for popularising the 60/40 portfolio. The 60/40 portfolio represents the split between growth assets and defensive assets. The importance of diversifying beyond a single asset class has been a cornerstone of investing for as long as there has been stock markets. In the Intelligent Investor, Benjamin Graham, advocated:

- Using a 50/50 stock/bond allocation as a baseline, and

- Shifting as far as 25/75 in either direction, based upon current market conditions.

Graham states, “The sound reason for increasing the percentage in common stocks [beyond 50%] would be the appearance of ‘bargain price’ levels created in a protracted bear market. Conversely, sound procedure would call for reducing the common-stock component below 50% when in the judgment of the investor the market level has become dangerously high.”

Graham is approaching asset allocation as if the stock, or growth component is the variable investors should consider when determining their asset allocation. This may be due to the relative dependability of bonds compared to stocks in 1949 when he wrote the book.

Bonds, remember, are a type of loan set over a fixed period. Investors lend money to a bond issuer and in return, they will receive regular interest payments until the bond matures, when they will receive full repayment of their capital. Therefore, from bonds, investors receive income and the capital is relatively stable because when the bond matures, the bondholder will receive the final income payment and full repayment of the amount loaned.

The table below shows that in the first quarter of 2022, Australian bonds suffered significant falls. This is alarming when you consider Australian equities, as represented by the S&P/ASX 200, rose 2.24%. Global bonds fell 4.98%, faring better than international equities that, as represented by the MSCI World ex Australia Index fell 8.42%.

The table below also shows yield to maturity. This is the rate of return expected on a bond, expressed as an annual rate if you purchased the bond at the current market price and held it until the maturity date. Fund managers use it as a measure of yield. You can see that the yield to maturity of Australian and Global bonds is below 3%. In other words, not much income.

Table 1: Developed market bonds

|

Bond type

|

Index

|

1Q22 index returns

|

Modified Duration (interest rate risk)

|

Yield to Maturity

|

|

Australian Bonds

|

Bloomberg AusBond Composite 0+ Yr Index

|

-5.88%

|

5.39

|

2.91%

|

|

Global Bonds

|

Bloomberg Global-Aggregate Total Return Index Value Hedged AUD

|

-4.98%

|

7.26

|

2.49%

|

Source: VanEck, Bloomberg. Modified duration and yield to maturity as at 28 April 2022. Yield to Maturity (YTM) is the estimated annual rate of return that would be received if the fund’s current securities were all held to their maturity and all coupons and principal were made as contracted. YTM does not account for fees or taxes. YTM is not a forecast, and is not a guarantee of, the future return of the fund that will vary from time to time. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

We wonder how Graham would approach this new world, where bonds are not behaving as a defensive asset class should, nor are they providing much income.

To understand why bond funds are behaving the way they are now, it is worth understanding what determines a bond’s price.

Factors affecting a bond’s price

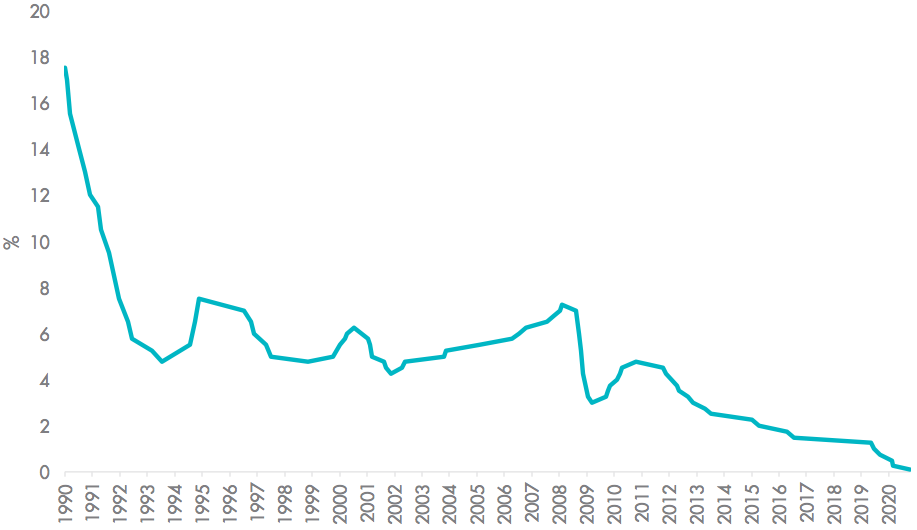

The most important factor affecting a fixed-rate bond’s market price is the level of interest rates. When interest rates fall, as they have consistently since 1990, existing bonds become more valuable as they continue paying out income based on the higher interest rate when they were issued. These existing bonds are worth more than new bonds, which are paying income based on the new, lower interest rate.

Chart 1 – Reserve Bank Of Australia – Interest rate changes

Source: RBA

On the other hand, if interest rates rise, existing fixed rate bonds become less valuable because their income is based on the lower interest rate they were issued and investors can get higher income from newer bonds.

Chart 2: Relationship of fixed rate bond prices to interest rate rises and falls

Source: VanEck

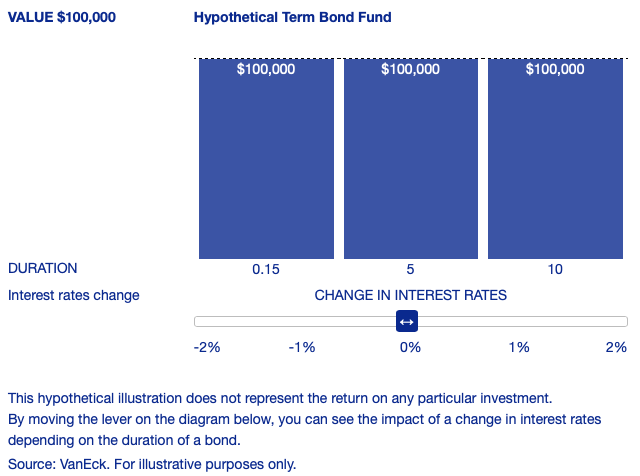

The threat of interest rates rising is affecting bond prices in 2022. Some bonds are impacted more than others. ‘Duration’ measures a bond price’s sensitivity to interest rate changes (this was noted in table 1). The longer the duration of a bond, the more the bond’s price will move when interest rates change. This is ‘interest rate risk’. For example, if the duration of a bond is 5, that means that with a 1% rate rise, the value of the bond would fall ~5%. However, if the duration is 1, then the bond’s value would only fall by ~1% if rates rose 1%.

Factors affecting bond prices in 2022

The US Federal Reserve has already started raising its official interest rates. Other developed markets’ central banks, including our own Reserve Bank have indicated that they will also be raising rates in the near future.

The reason central bankers are raising interest rates is that they use interest rates as a way to curb high inflation. While inflation numbers remain high, the threat of higher interest rate remain. Continuing high inflation numbers, and therefore the expectation that interest rates will rise is affecting bond prices.

Alternatives to developed market fixed rate bonds

The outlook does not look good for fixed rate bonds. Investors though do have bond market options they may not have considered.

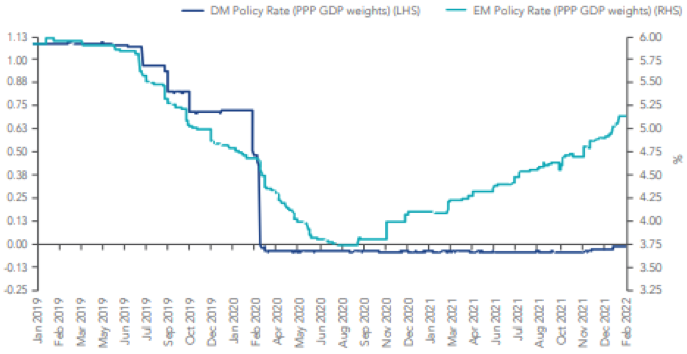

While riskier, emerging market bonds are offering income commensurate with their risk. Emerging markets started their rate hiking cycle earlier than developed markets.

Chart 3: Policy rates in emerging markets and developed market

Source: VanEck, Bloomberg

You can see in the table below that emerging market bonds have not been immune to falls, but the difference is, these bonds are not yielding less than 3%, rather the yield to maturity is much higher. Broadly, there are two types of emerging markets bonds, those that are issued in local currency and those that are issued in a hard currency, such as the US dollar. The index is a 50/50 blend of these. Hard currency emerging markets bonds tend to be the ‘safer’ of the two as they are immune from the movements of the emerging market currency, which is often more volatile.

Table 2: Emerging markets bonds

|

Bond type

|

Index

|

1Q22 index returns

|

Modified Duration (interest rate risk)

|

Yield to Maturity

|

|

Emerging markets bonds

|

J.P. Morgan 50% EMBI GD Hedged AUD + 50% GBI-EM GD Unhedged AUD

|

-6.91%

|

7.16

|

7.21%

|

Source: VanEck, Bloomberg. Source: VanEck, Bloomberg. Modified duration and yield to maturity as at 28 April 2022. Yield to Maturity (YTM) is the estimated annual rate of return that would be received if the fund’s current securities were all held to their maturity and all coupons and principal were made as contracted. YTM does not account for fees or taxes. YTM is not a forecast, and is not a guarantee of, the future return of the fund that will vary from time to time. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

There is no doubt that the higher yields on emerging market bonds are the result of the higher risk investors are taking lending to these countries. In many cases, these higher rates are justified. This is where active management in emerging markets bonds can come to the fore.

Active management allows the manager to avoid those countries with weaker fundamentals and prefer those better managed emerging market economies. Better-managed emerging market economies are able to navigate shocks like the COVID crisis or Russia invading Ukraine. Active managers can position a portfolio to avoid heavily sanctioned countries like Russia or those with economies affected by the war such as Egypt.

As we noted in our last ViewPoints, “Emerging markets started raising rates way before it became cool. Key is that emerging market central banks are super vigilant in keeping inflation expectations from spiralling. And they tend to preserve strong external accounts, improving the ability of emerging markets to repay dollar-denominated debt, this has been a key emerging market strength over recent decades.” In other words, emerging market central banks have been implementing ‘orthodox’ monetary policy to manage their economies. The same cannot be said of many developed market central banks that have resorted to ‘unorthodox’ policy such as quantitative easing and asset buying. Emerging markets bonds may be an opportunity for investors seeking income.

Another bond market option investors may not have considered to navigate a rising bond market is floating rate notes (FRNs), which are types of bonds.

With FRNs, the coupon interest rate is variable, or ‘floating’ which means it tracks short-term interest rates.

This has the effect of preserving the capital value of the bond in a rising interest rate environment. FRN coupon interest rates are commonly set by reference to the 90-day bank bill swap rate (BBSW). For example, a FRN may be issued with a face value of $100 for 3 years with a coupon of ‘3-month BBSW + 1%’.

This means coupon payments will increase if the benchmark 3-month BBSW interest rate rises or decrease as the 3-month BBSW interest rate falls. The coupon interest rate of a FRN is usually reset each quarter to capture any changes in the benchmark BBSW.

The modified duration of the Bloomberg AusBond Credit FRN 0+ Yr Index is 0.13.

Bond funds continue to have an important role to play in investors’ portfolios. Innovations such as ETFs allow investors to access a variety of different types on bond markets. Around the world, different bonds pay different rates of income. Sometimes, this is reflective of the risk that investors are taking, other times the interest rate may be too low relative to the risk and there are cases when the rate is too high considering the risk and so worthy of investment. Active management can help in many bond markets including emerging markets.

In addition, where there is a prospect of rising interest rates, an investment in a bond fund with a short duration may be more appealing than an investment in a longer dated fund.

Investors should speak to their financial adviser or stockbroker and read the relevant product disclosure statement before investing in any fund.