Global clean energy stocks have risen sharply in the past few weeks with Russia’s war against Ukraine transforming into a global energy war as sanctions against Russian energy exports take hold, cutting crucial supplies of oil and gas.

As the US bans imports of Russian oil and natural gas, joining other nations, the dramatic move could further lift oil prices, adding to the considerable push toward renewables as an alternative to fossil fuels.

In the US, even prior to the Russia-Ukraine conflict, gasoline prices were on the rise. They have passed prices not seen since the economic crisis of 2008— and many Americans fear for the future, with some states seeing around US$6 a gallon this past week. It has been estimated that rising oil prices have single-handedly accounted for almost 30 percent of “excess” inflation since the start of the pandemic.

Renewable energy sources, like solar energy and wind as well as increased sales of electric vehicles, could be game changers. Forbes cites the International Energy Agency (IEA), which says stronger policies and the prioritisation of climate goals are the driving forces behind the rise in renewable energy sources.

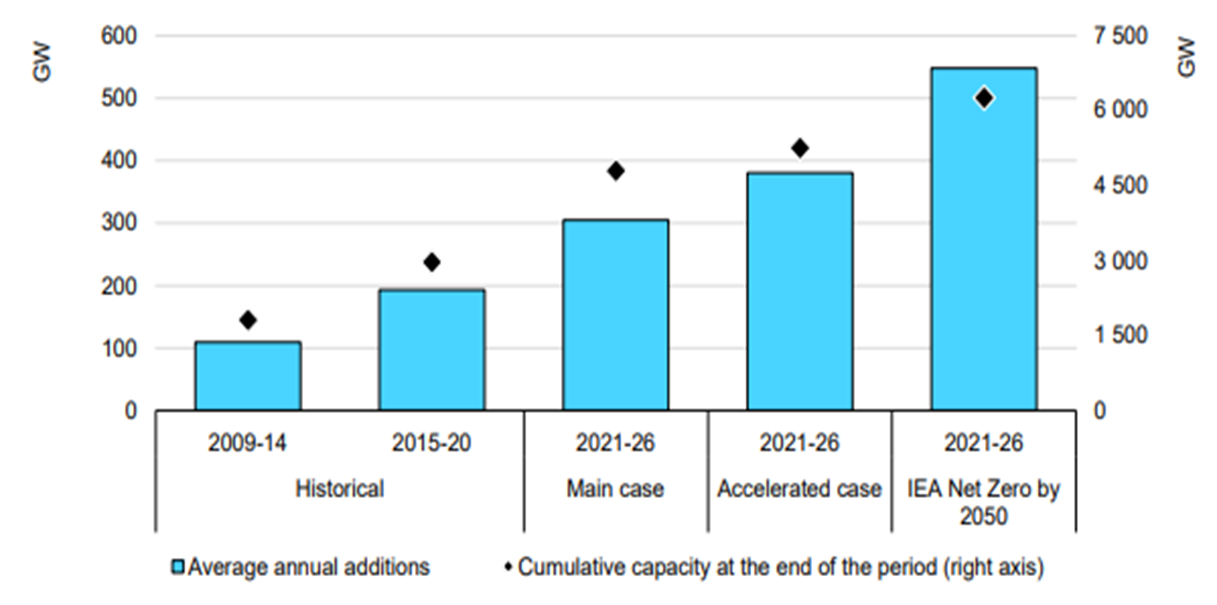

By 2026, the capacity for global renewable electricity is expected to rise more than 60 percent from just pre-pandemic levels in 2020. Meanwhile, the IEA anticipates that renewables will make up almost all (95 percent) of the increase in global power capacity through to 2026.1

Chart 1: Average annual renewable capacity additions and cumulative installed capacity, historical, forecasts and IEA Net Zero Scenario, 2009-2026

Source: IEA, https://www.iea.org/reports/renewables-2021

In Europe, which depends a lot more on Russian oil imports that anywhere else in the world, the change is already well underway. In 2020, renewable energy sources accounted for 37 percent of gross electricity consumption in the EU alone.

This trend towards clean energy stocks too will likely gain momentum as energy consumers seek substitutes for fossil fuels and the demand for renewable energy rises to meet climate change carbon emissions targets.

Amid the energy supply shock, VanEck’s Clean Energy ETF (ASX:CLNE) has surged over 16% since the Russian invasion of Ukraine.

Chart 2: CLNE: 2022 year-to-date net asset value (NAV)

Source: VanEck, Bloomberg as at 15 March 2022. Past performance is not a reliable indicator of future performance.

The top mover Renewable Energy Group has returned a stellar 41.49% year to date (contribution to return: 1.06%). The company specialises in biofuels and renewable chemicals and recently agreed to the acquisition from Chevron that has pledged to spend $10 billion on low carbon investments through to 2028.

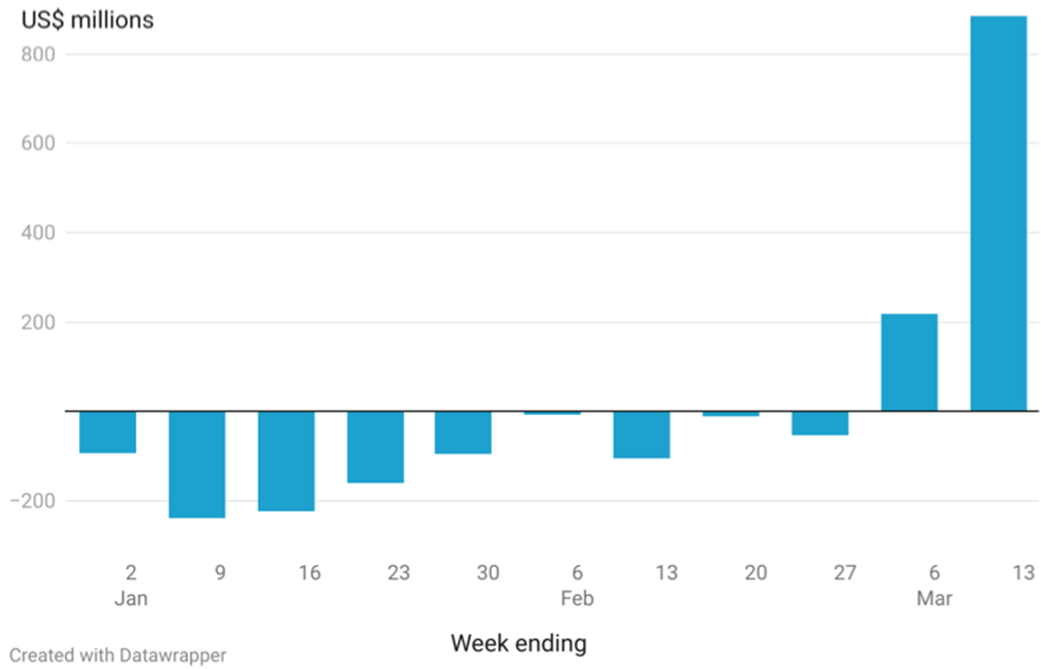

Global ETF flows in the clean energy space has also seen a jump on the back of the war indicating global investors see this as an opportunity.

Chart 3: ETF Flows: Investors bought clean energy ETFs as Russian fuel sanctions were announced

Clean energy assets are typically pro-cyclical and tend to over-perform when the economic cycles expand and capital spending on renewable energy increases. We could therefore see clean energy companies likely to rally in the months ahead as the world seeks cleaner and more reliable supplies of energy.

CLNE launched in March 2021 and was the first clean energy ETF listed on ASX.

1 Forbes, Could The Russian Oil Ban Turn The World Toward Renewable Energy? March 11, Accessed March 15, 2022