NYSE Arca Gold Miners Index is up over 8% so far this year and it could continue to rise as Ukraine tensions simmer, inflation persists and mining companies continue to report strong results.

At the same time the financial system is returning to ‘normal’ and this process is likely to benefit the gold price as risks around a tightening Fed play out and as other inflation drivers continue to mount.

If inflation remains elevated for several years, the financial system will not be able to return to normal for an extended period. This could create a favourable environment for gold and gold stocks to shine.

Gold on a tear so far in 2022

In 2021, the gold price consolidated in a range around US$1,800 per ounce, despite macro conditions favourable to its lustre. The market was all but ignoring inflation, but now that the Fed is no longer using the term, ‘transitory’ gold looks on track to bounce back through US$1,900 for the first time since October 2020.

A beneficiary of the march of the gold price has been its miners.

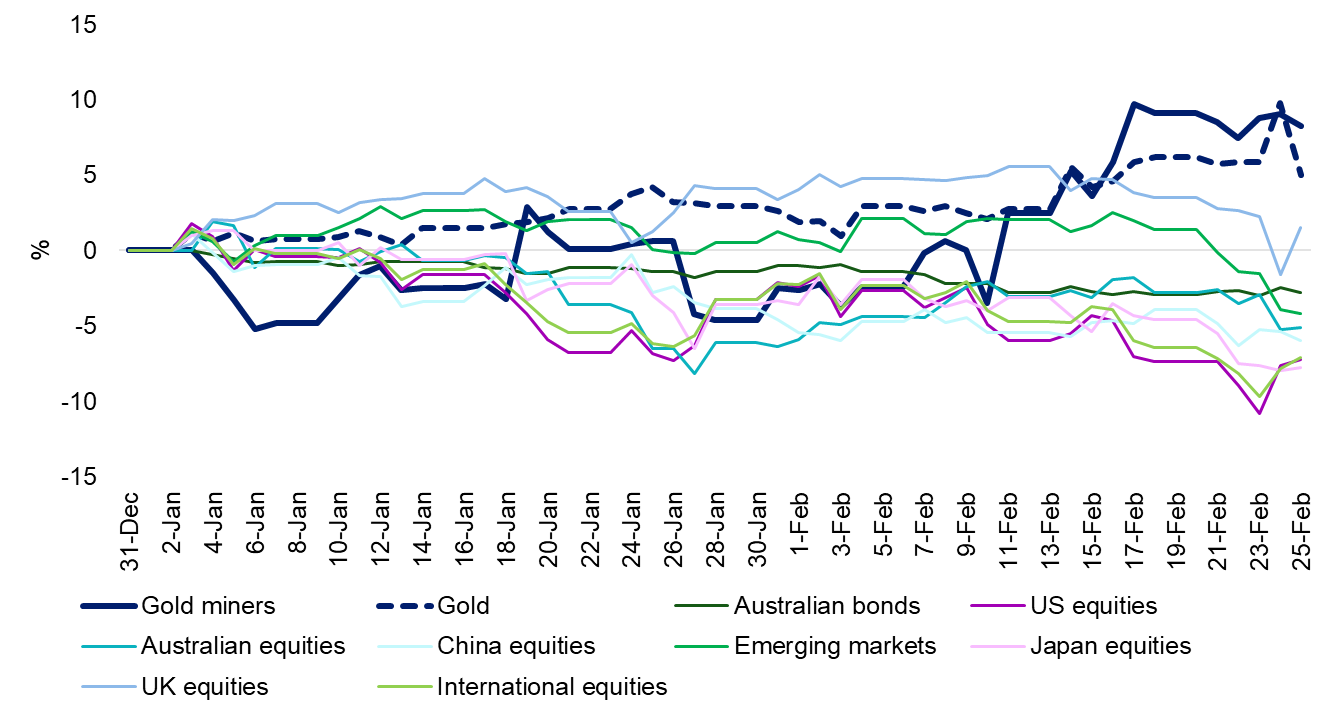

Figure 1: Performance of major indices so far in 2022

Source: Morningstar Direct, 31 December 2021 to 25 February 2022. All performance converted to Australian dollars. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Indices used: Gold miners: NYSE Arca Gold Miners Index; Gold: LBMA Gold Price PM; Australian bonds: Bloomberg AusBond Composite 0+Y; US equities: S&P 500 Index; Australian equities: S&P/ASX 200 Index; China equities: CSI300 Index; Emerging markets: MSCI EM Index; Japan equities: Nikkei 225 Average; UK equities: FTSE 100 Index; International Equities: MSCI World ex Australia Index.

The return to ‘normal’

Soon quantitative easing (QE) will be over and the Fed will begin raising rates. The multi-billion dollar stimulus packages will also be over. Through QE, the Fed has crowded out the private sector, funding over 50% of the entire government borrowing requirements since 2010. The Fed also holds over 30% of all federally insured mortgage-backed securities. This entire stimulus has distorted markets and the pricing signals that follow. For example, the yield curve has flattened during a time of increasing inflation expectations, which is the opposite of past inflationary cycles. The last time real rates were as negative as in 2021 was in 1974, a year when the S&P 500 Index fell 37%. However, in 2021, the same stimulus-fueled index gained 29%.

The reality of an economy without stimulus caused many major stock indices to decline in January.

The volatility since the start of 2022 looks like a precursor to a year of uncertainty, as the financial system attempts to transition back to normal. The transition, if successful, will take years of 25 basis point rate changes and disposal of trillions in treasuries and mortgage-backed securities. We doubt

the system can get back to normal without more market volatility, along with some unintended consequences. On top of that Putin stands at the ready on the Ukrainian border.

So far, gold has sidestepped the market’s volatility. Gold was among the best performing assets in January. However, we expect there is more room to grow for gold in 2022 due to the ongoing geopolitical uncertainty. We also expect it to outperform, as the risks around a tightening Fed play out and as other inflation drivers continue to mount.

You can see above, while gold miner’s lagged the performance of the yellow metal in January, they have come bouncing back in February.

Gold stocks provide leverage to bullion

Gold equities tend to outperform gold bullion when the price rises, and underperform if the gold price falls. Although this expected relative performance may not hold during certain periods, gold equities have consistently demonstrated their effectiveness as leverage plays over the years. As investors become more confident that the current low multiples are not merely ‘value traps’, given their improved earnings and fundamentals, gold miners could benefit from an upward re-rating as capital flows towards value shares such as commodity-related stocks.

Compelling valuations

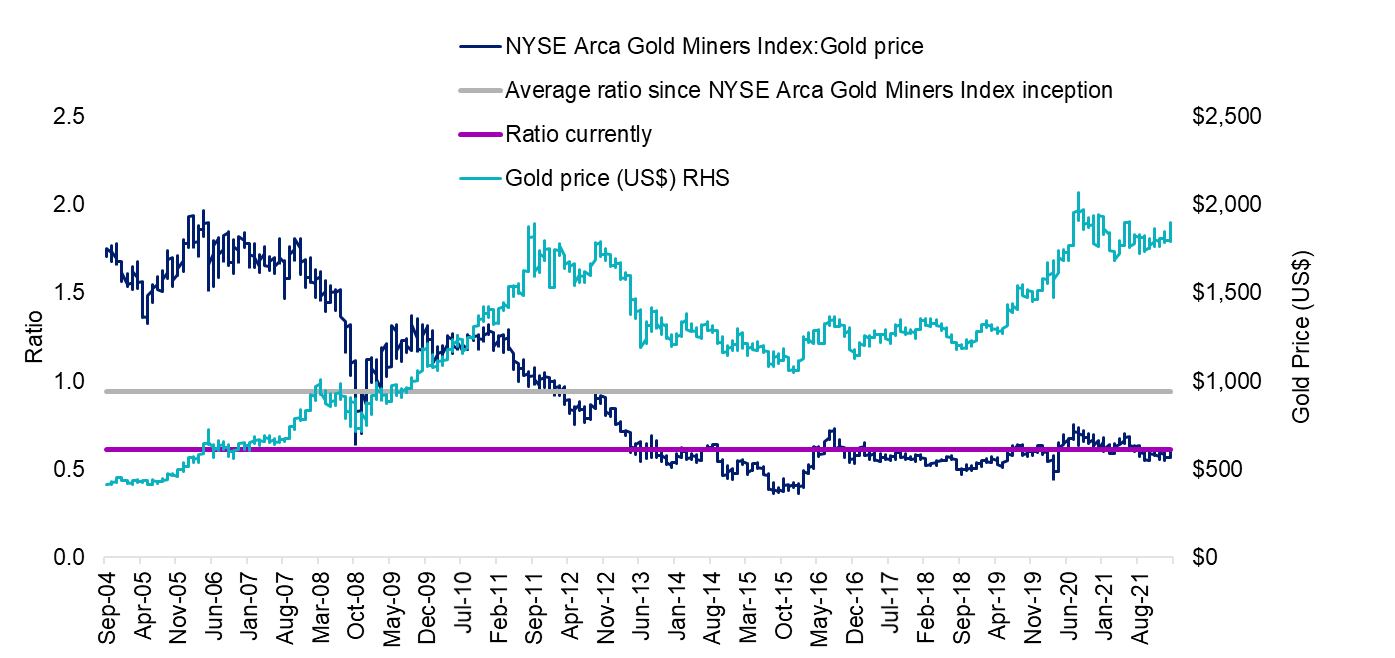

Gold miners are trading at well below historical averages. You can see this in figure 2 below, which shows the value of gold mining equity, measured using the NYSE Arca Gold Miners Index relative to the gold price. Despite the recent rally miners have not yet matched the ratio reached by recent rallies in 2016 and 2020.

Figure 2: Gold companies relatively cheap at current levels

Source: Bloomberg, VanEck, as of 23 February 2022. All figures in US dollars. NYSE Arca Gold Miners Index inception is 29 September 2004. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

Most gold mining companies are holding their costs below US$1,000 an ounce, and companies such as Barrick are beating on earnings and revenue, returning cash to shareholders via increased dividends and share buybacks. Other gold miners reporting strong results were Royal Gold and Kinross.

Looking ahead

Gold miners are well placed to benefit from any prices rises of the yellow metal that may continue as uncertainty reigns over markets and the geopolitical environment of 2022. In addition to the uncertainty around Russia’s intentions with the Crimea, investors also have to navigate an economic environment recovering from a pandemic unlike any other it can compare.

The last pandemic that was comparable in terms of lethality broke out over a century ago and was accompanied by World War I. The spending on the war can be equated to the spending to fight the coronavirus pandemic. Inflation surged to 18% in 1918, 14.6% in 1919, and 15.6% in 1920. While we do not expect double digit inflation in this post-pandemic cycle, if inflation remains elevated for several years, the financial system will not be able to return to normal for an extended period. This could also create a favourable environment for gold and gold stocks to shine.

Investors can access to the NYSE Arca Gold Miners Index can do so via the VanEck Gold Miners ETF (ASX: GDX).