by Denny Fish – Portfolio Manager | Research Analyst

Key takeaways

- Tech sector earnings multiples have compressed largely on the back of expectations of higher interest rates rather than any reassessment of these companies’ business models.

- We believe the sector remains on course to deliver products that increase efficiencies across the economy and, in the process, command a greater share of aggregate corporate profits.

- Companies across sectors, in our view, are likely to leverage back-office technologies to navigate an inflationary environment and labour shortages.

Six weeks in and, thus far, 2022 has been a rough ride for stock investors. Given the outsized sway the technology sector holds over global equity markets, it’s little surprise that tech stocks have been a driver in broader market fortunes. As of 16 February, the MSCI All-Country World Index returned -4.5% year to date, largely weighed down by the tech sector’s 9.4% slide. A cursory assessment of such performance may cause one to think that tech’s time in the sun has passed. We don’t think that’s the case. Instead, we believe tech’s recent volatility has been the result of valuation adjustments as equity markets recalibrate for an era of higher interest rates. In fact, we believe that when analysing company fundamentals – what should drive stock performance over the long term – prospects in much of the sector have improved in recent months.

A nod to the macro

It is no accident that the tech sector has led markets over the past few years. With growth concerns prevalent during the US-China trade war and – later – the COVID-19 pandemic, investors sought growth where they could find it, and in the face of uncertainty, the secular growth themes powered by the products and services of mega-cap tech and Internet companies were a favoured destination. Many of these themes accelerated during the pandemic as businesses and households increasingly relied upon digital solutions to navigate trying times.

More recently, a resumption of economic activity and supply-chain constraints have led to elevated inflation and with it a policy response from central banks. At the end of 2021, futures markets were predicting three interest rate hikes of 25 basis points each by the US Federal Reserve in 2022. In the wake of inflation’s persistence, market expectations have now climbed to six hikes. This matters as interest rates directly influence the discount rates used to value riskier asset classes. And the impact of higher discount rates is most pronounced in long-duration assets, including the secular growth stocks that have a large share of their value derived from cash flows years in the future.

Valuation compression in perspective

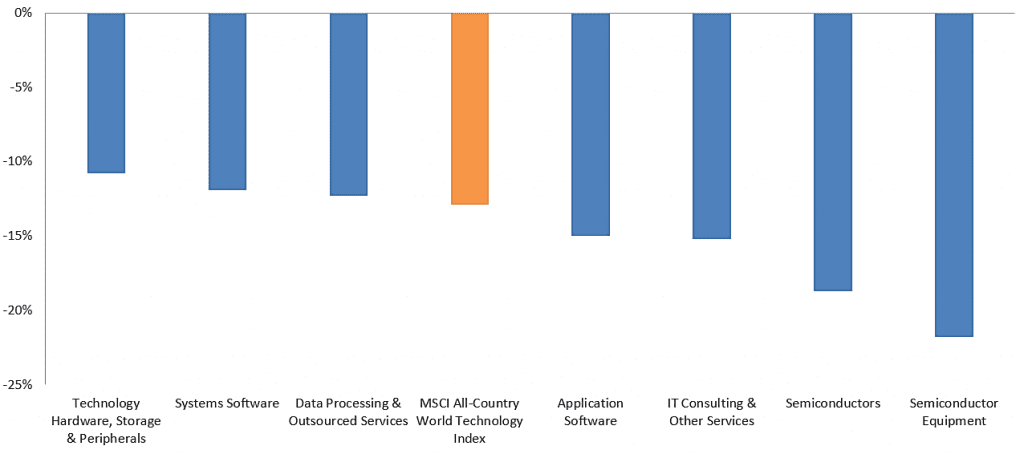

This is exactly what we’ve seen in 2022. In aggregate, the price-earnings (P/E) ratio of the global tech sector has compressed by 13%, year-to-date through 15 February.

Year-to-date change in full-year 2022 P/E ratio

Source: Bloomberg, as of 15 February 2022.

Few would doubt loose monetary policy has been a contributor to lofty valuations across financial markets. Understandably, the multiples that investors are willing to pay for a unit of future earnings would fall upon the removal of that largesse. Valuations of tech stocks are no exception. It’s worth noting, however, that in some instances, the ‘baby has been thrown out with the bath water’. Stocks within the semiconductor complex and the applications software sector – that includes many cloud computing companies – have experienced some of the most pronounced multiple compression. Yet semiconductor chips and cloud computing are fundamental building blocks of the transition to a more digitised global economy. These themes are not going away.

Business models first

Interest rates are a consideration – not a determinant – in tech investing, and while acknowledging that the math underpinning valuations has changed, what hasn’t are these companies’ business models. Prospects for the tech sector rest upon its ability to wring out efficiencies across the economy and in the process compound earnings growth, and command an ever-greater share of aggregate corporate profits. As illustrated in recent earnings results, many sector leaders are still on track.

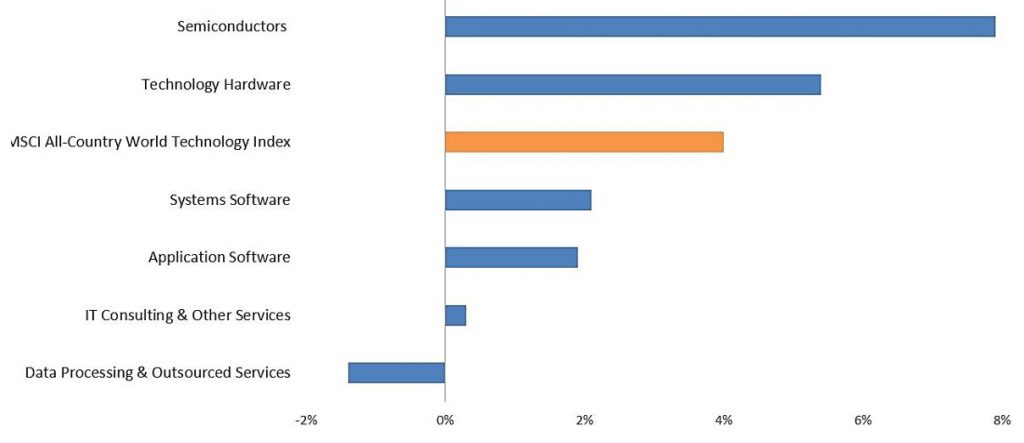

Three-month change in full-year 2022 earnings per share estimates

Source: Bloomberg, consensus estimates as of 16 February 2022. Past performance does not predict future returns.

Over the past three months, full-year 2022 consensus earnings expectations for the global tech sector have been revised upward by 4%. Notably, semiconductor stocks, which have returned -7.3% year-to-date, have seen the most aggressive upward revisions. Meanwhile, applications software, which can serve as a proxy for cloud computing stocks, have returned roughly -15% despite full-year earnings prospects nudging upward by 1.9%. The incongruence between flagging stock prices and bullish earnings estimates indicates that something other than fundamentals is at play in the sector’s recent trajectory. Yes, valuation compression at the hands of higher rates may be painful in the near term, but investors should keep in mind that it’s these business models’ ability to execute their strategies over the longer term that matters most in generating attractive returns.

A convergence of the secular and the cyclical

We believe the resilience of the sector’s earnings is owed to a favourable cyclical backdrop. With inflation threatening to eat into margins or hamper customers’ purchasing power, companies across the economy are looking to improve operational efficiencies. Whereas technology was deployed during the height of the pandemic to maintain front-office operations, we are now seeing companies focus on streamlining back-office functions to maintain profitability. Reflecting this are increasingly optimistic outlooks from an array of software companies.

The prospects of semiconductor producers have improved for different reasons. Progress is being made in fulfilling order books by working through lingering supply-chain disruptions, and pricing remains strong given robust demand for both analogue and more complex digital chips. Driving this hunger is the growing recognition by corporate leaders that the data collection, analysis, machine learning and automation made possible by a proliferation of chips has the potential to continuously improve a company’s operational economics over a mid- to long-term time horizon.

Welcoming the re-rating

Investors seldom welcome elevated volatility. But the accompanying re-rating of stocks across the tech sector can be viewed in a positive light. Much capital has flowed into the space, pushing up valuations – sometimes indiscriminately. The shift toward monetary tightening has removed support from many unworthy names and, more importantly for disciplined investors, has created attractive entry points for stocks with sound business models that had also seen valuations stretched beyond what fundamentals would merit.

Tech investors should still be mindful of risks. More rate hikes than what are already priced into the market could result in additional volatility. They could also tilt the economy toward recession. While that would likely crash the party for cyclical growth tech stocks, secular growers may once again find themselves being one of the few pockets of the market in which longer-term investors can have confidence.

NOTES

Multiple compression is the reduction of a P/E ratio, which infers that investors place less value on an equity security.

Monetary policy is the set of actions typically undertaken by a central bank to control the level of money in circulation in order to achieve certain economic objectives.