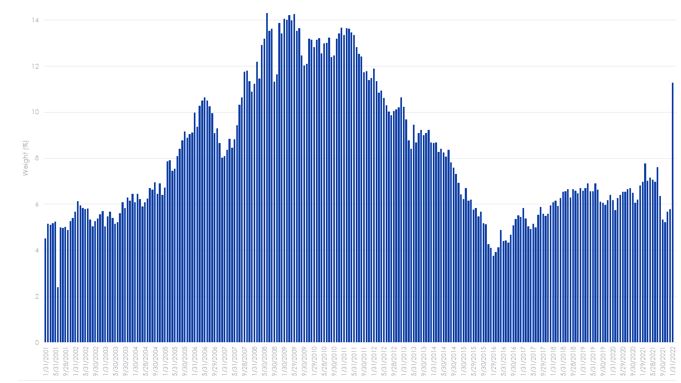

Last week BHP consolidated its corporate structure and stock trading to its primary listing on the ASX. Because of this, BHP’s composition within Australia’s market capitalisation S&P/ASX indices increased. On the day of the unification, there was unprecedented trading on the ASX. This is because passive managers, tracking the S&P/ASX 200 or S&P/ASX 300 have had to buy BHP to increase their holding to consider its new level, while selling others to make room. There is also no doubt that many active benchmark-hugging managers will continue to up-weight their holding in BHP if they have already not done so.

The reason your active manager may be buying BHP is that the way they construct their portfolios is to hold positions similar to the index, usually within a range. Otherwise, they are taking a big risk. If markets go against them and they drastically underperform the index, they will be seen as incompetent. Better to be just above or just below the index.

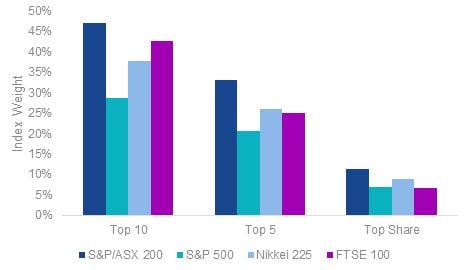

BHP now makes up over 11% of the S&P/ASX 200 increasing from just under 7% at the start of January. This is significant when you consider major global indices around the world. Australia is the most concentrated share market in the world. The top 10 stocks in the ASX 200 now makes up 47% of the index.

Chart 1: Concentration within global indices

Source: Bloomberg, VanEck as at 31 January 2022

When you consider the sector composition of the S&P/ASX’s top 10, five companies are banks and two are materials. Investors buying a diversified Australian equity strategy would think it is unlikely one stock would be 10% of the portfolio, nor would they think two sectors represent over 50% of the portfolio, but that is what you will be getting from a portfolio linked to Australia’s largest 200 companies. This is a risk: Concentration risk.

Chart 2: BHP’s weighting in S&P/ASX 200 index

Source: Bloomberg, VanEck as at 31 January 2022

Managing Australian share market risk with alternative weighting

Rather than constructing an index or a portfolio considering a constituents’ size, like the S&P/ASX 200 or S&P/ASX 300, an alternative method is to equally weight the constituents. The MVIS Australia Equal Weight Index (MVW Index) includes only the largest and most liquid companies on ASX, currently 96 stocks, and equally weights them once a quarter at each rebalance.

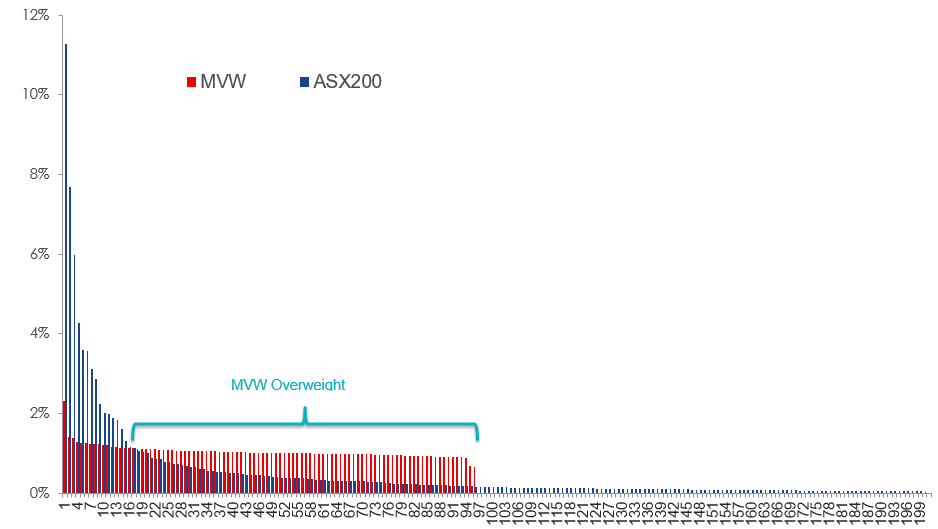

Australian equity market – company weights

Because of the MVW Index’s equal weight construction methodology, at last rebalance no company was more than 1.04%. Therefore, the MVW Index has less stock concentration risk than the S&P/ASX 200. What this means is that if BHP or CBA goes down 2%, its impact on the S&P/ASX 200 is greater than in the MVW Index.

On the other side of the coin, there are 80 companies within the MVW Index which have a higher weighting compared to the S&P/ASX 200 and therefore have greater influence on it. As Chart 3 below shows MVW has a larger exposure than that of the market capitalisation weighted benchmark index for around 80% of its portfolio. The companies in which MVW is overweight may be former small and mid-caps that have grown large, or they may be large or mega caps that have fallen in size. Importantly these companies have much greater potential for growth or are more likely to be taken over than the largest handful of stocks on ASX.

Chart 3: S&P/ASX 200 and MVW Index company weightings

Source: Factset, 31 January 2022

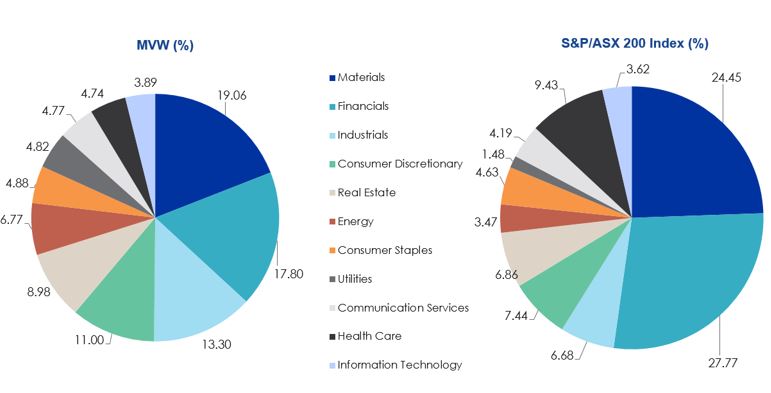

Australian equity market – sector weights

Another consequence of MVW Index’s construction methodology, it will be underweight, relative to the S&P/ASX 200, sectors that contain larger than average companies. For example, the MVW Index is currently underweight the financials’ sector by 9.97% compared to the S&P/ASX 200. Conversely it will be overweight sectors that contain smaller than average companies. The MVW Index is currently overweight industrials by 6.62% and consumer discretionary by 3.56%. Therefore, the MVW Index has less sector concentration risk than the S&P/ASX 200.

Chart 4: S&P/ASX 200 and MVW Index company weightings

Source: Factset, 31 January 2022

What this means is that if there is another systematic banking issue, or commodities fall the impact on the S&P/ASX 200 is greater than in the MVW Index.

A mathematical investigation of diversification

Diversification is a cornerstone of modern portfolio theory. The principle being that when you diversify you improve your risk return trade off. There are two mathematical proofs that provide evidence that the MVW Index is better diversified than the S&P/ASX 200: the Herfindahl Index and some very complex calculus.

Economist Orris Clemens Herfindahl developed the Herfindahl Index and he first used his calculation to determine the concentration within the US steel industry. The concentration calculation has been used in fields beyond economics into fields such as engineering, aeronautics and biochemistry. As a measure, the higher the Herfindahl, the more concentrated. Therefore, a lower Herfindahl index signifies less concentration and greater diversification. The Herfindahl for S&P/ASX 200 is 264. For MVW it is 105. By this measure, the MVW Index is over 2 times more diversified than the S&P/ASX 200.

Further, in 2014 Hamich and Brown provided mathematical proof “that equal weight is the portfolio construction approach that gives the best diversification for the long term. Not just better than market capitalisation, but the best possible diversification among any portfolio construction strategy.” The maths involved is complex and included in Appendix 2 – here. Alternatively, the Australian Financial Review summarised these findings without the jargon – here.

The recent changes in the Australian equities market further strengthens the case for equal weight with the Australian equity market. The VanEck Australian Equal Weight ETF (MVW) tracks the MVW Index and is underweight mega-caps, financials and materials relative to portfolios that track or are benchmarked to the S&P/ASX 200 or S&P/ASX 300.

The VanEck Australian Equal Weight ETF (ASX: MVW) gives investors exposure to a diversified portfolio of ASX-listed securities. MVW aims to provide investment returns (before fees and other costs) which track the performance of the benchmark MVIS Australia Equal Weight Index.