by Julian Howard – Lead Investment Director, Multi Asset Solutions

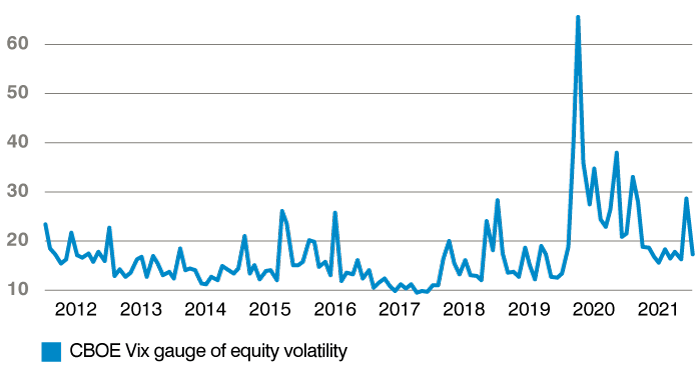

Global equities as measured by the MSCI AC World Index in local currency terms rose 7.1% in the final quarter of 2021, bringing the whole year’s return to a very strong 21.4% gain. This performance came despite a slew of potential headwinds. The world continued to grapple with the Covid-19 pandemic, with most economies relying on blunt lockdowns and blanket travel restrictions as primary public health responses. These of course weighed heavily on economic growth, with one UK lawmaker remarking in exasperation recently that the travel, leisure and hospitality sectors had become “uninvestable” as a result. This was despite the early promise of mass vaccinations which were rolled out successfully across most developed economies over the course of the year. Related to the pandemic response, inflation was more stubborn that originally supposed, with the US headline CPI close to 7% by the end of November 2022. How then to explain the success of the major equity markets? Interest rates remained the key factor. Despite the higher inflation, most central banks were reluctant to tighten near-term monetary policy in the face of the on-going disruption caused by the pandemic response. And long-term US Treasury yields, while rising from 1.0% to 1.5% over the course of 2021, did not represent an excessive tightening of financial conditions to unsettle equity investors. The muted rise in yields indicated that long-term inflation and growth expectations remained anchored and this accordingly supported equities in two ways. First, the circa 5% forward earnings yield offered by global stocks made them highly attractive on a relative basis. Second, those equities which displayed consistent long-term earnings potential saw their net present valuations disproportionately elevated. Such stocks were to be found primarily in the US, and particularly in the technology and communications sectors. With the US representing over 60% of the MSCI AC World Index and over a third of those US stocks in turn allocated to the sectors described, the strong upward surge in global equities was perhaps unsurprising even as more cyclical sectors and emerging markets lagged behind.

Chart 1: Near-term rates rising faster than longer-term in recent months

Positioning

The premium of earnings yield over long-term bond yields has historically tended to show the way in terms of future prospects for equities. 2021 was no exception in this regard and with a healthy equity risk premium (ERP) in evidence, we remained constructively engaged in equities throughout the year. Within equities, we favour a blend of longer-duration stocks to take advantage of the monetary policy accommodation and low long-term rates described. These are mainly to be found in the US, particularly in the Nasdaq Index, and to a lesser extent from quality growth stocks in Japan. Complementing this core exposure to growth-style stocks was our long-term strategic allocation to China and emerging markets. In our view, these markets carry a compelling secular opportunity – China represents 20% of the world economy but just 5% of the MSCI AC World Index – but they faced headwinds in 2021 amid a strong US dollar, disruptive Covid-zero policies and regulatory intervention by the Chinese authorities. More broadly, we consider a variety of underlying equity vehicles with an Environmental, Social and Governance (ESG) tilt across every region. Tactically, we believe it makes sense to maintain elevated cash levels amid the strong-market run-up with a view to deploying some of this back into markets when the opportunity arises. Away from equities, we favour ‘alt-bonds’ in the form of Mortgage-Backed Securities (MBS), both agency and non-agency backed, as well as insurance-linked securities (ILS) and Ultrashort investment grade paper. An allocation to ‘standard’ government bonds remains a viable diversifier in the event of a major equity market sell-off, in our view. In alternatives, we are focused on conservative merger arbitrage as well as a tightly risk-controlled convertible bond strategy.

Outlook

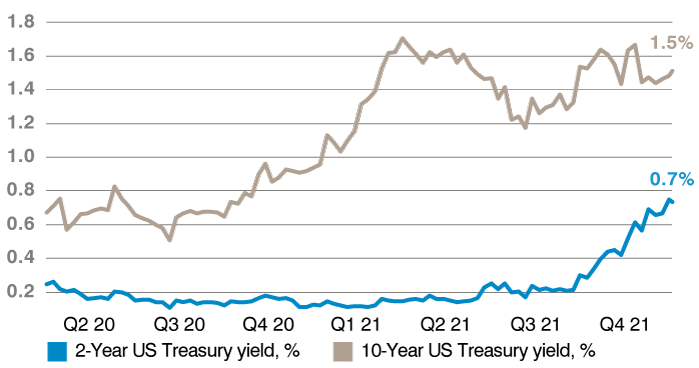

By far the main risk facing most asset classes, but equities and long-dated bonds in particular, is the prospect of higher interest rates. Central bankers are starting to err on the side of action, with the Bank of England having already raised rates once late in 2021 and futures markets now pricing in fully three hikes by the US Federal Reserve for 2022. In our view, such moves amount to a policy error given how economies are struggling with the stop-start pandemic response. However, strategic investors will be more concerned with longer-dated bond yields when assessing the prospects for equities. While stable in 2021 as described, the new year has seen upward moves in the 10-year US Treasury yield and the risk is that higher long-term inflation and growth are increasingly priced in. The prospects for both, however, remain distant. High inflation should eventually ease off as the pandemic transitions to a more endemic phase, with recent US supply data suggesting that it should start abating soon. Economic growth meanwhile, even after a post-pandemic surge, is unlikely to consistently outstrip the mediocre trend rates of the decade to 2019 as the world grapples with the longstanding challenges of climate change, inequality and ageing populations. But even if both short- and long-dated rates rise by a full one or even two per cent in 2022, they are still likely to be bested by higher equity earnings yields. Certain equity sectors like technology and consumer discretionary could offer robust pricing power which have historically acted as an effective hedge against inflation. Nonetheless, investors at the index level are likely to be nervous of the mere threat of higher inflation and rates given the significant progress posted by equities in 2021 and indeed since the global financial crisis. Strategically, while long duration equities remain compelling, the market as a whole could therefore be vulnerable to higher spikes of volatility in 2022. Early 2020 aside, investors have become perhaps too used to extended periods of calm, suggesting that reliable capital preservation and flexible tactical asset allocation strategies could likely be at a premium in the coming months.

Chart 2: Early 2020 aside, investors are unused to volatility after years of calm