It’s been a good year for the ‘Big Four’ banks as they have returned to pre-pandemic profit levels, their outlook has improved, and AFIC (ASX: AFI) has benefited from a higher level of dividends reflective of the better outlook.

Whilst AFIC has reduced its exposure to the major banks over recent years they remain the largest area of investment and our holdings in the big four – Commonwealth Bank, Westpac, NAB and ANZ – comprised a little over 19 per cent of the total portfolio at the end of October 2021. We don’t have holdings in smaller banks and our next largest area of investment after the big four banks is industrials, at nearly 15 per cent of the portfolio.

The recent reporting of results by three of the major four banks reinforced our view about how they sit within a diversified portfolio, like AFIC’s. We were particularly pleased to see an increase in bank dividends which are an important input into the AFIC dividend.

Why we continue to hold a position in the banks

AFC has been a long-term investor in the major banks as they provide good and steady income returns to investors through fully franked dividends. They currently have dividend yields of 4 to 5 per cent or 5.7 to 7.1 per cent on a grossed-up basis, including franking credits.

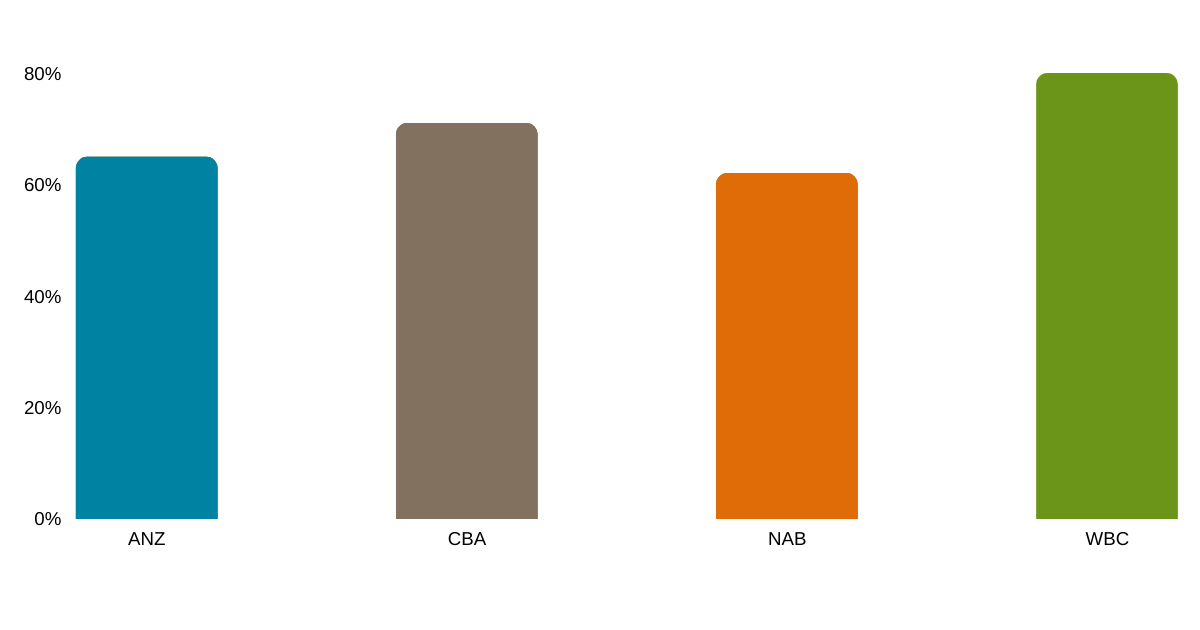

Pleasingly, dividend payout ratios have now moved to more sustainable levels, on average at around 70 per cent of profit. The big banks are now paying out an appropriate level of their profits whilst retaining funds to maintain their strong balance sheets and reinvest in their businesses at a time when competition is coming from several areas, including newly developed fintech companies.

Major bank dividend payout ratios

The share prices of the major banks have enjoyed a strong run upwards since late 2020, reflecting an environment where the impact of the COVID pandemic was less severe than initially anticipated, with expectations the economy is likely to recover more quickly. However, given the very strong return bank share prices have produced over the past 12 months, we expect share price growth to moderate. Whilst the large banks have strong industry positions, they remain mature businesses, and they continue to face growing competition and disruption from small and large fintech companies.

This being the case, other holdings in our portfolio that can generate superior income and/or share price growth are likely to continue to be more attractive over time.

Nevertheless, the major banks remain attractive to AFIC as part of a diversified portfolio given they have become simpler operations, divesting businesses such as wealth management and insurance to concentrate on their core banking activities. This reduces risk, and with good management teams in place, it should produce better returns than these activities.

Presently, we rate Commonwealth Bank as the best quality bank, so we have our biggest holding there, with smaller holdings in Westpac, NAB and ANZ. Westpac share price has under performed more recently and consequently it looks to us to be the best relative value at this point, noting it needs to continue to improve its operations and risk and compliance measures, and reduce costs. However, we believe Westpac still has a good franchise and sound competitive positioning in the sector.

Bank performance has bounced back

The returns from the major banks in the last financial year have been spectacular, reflecting the incredible bounce-back from a big hit to the banks as the COVID pandemic took hold from early 2020.

The banks made significant provisions for bad and doubtful debts in the early stage of the pandemic. But the macro-economic environment has been very supportive, with interest rates remaining very low and government fiscal policy helping businesses and consumers. Revenue growth has rebounded faster than market expectations out of the COVID lows of early 2020. The economy is in pretty good shape considering the extent of the pandemic lockdowns.

Another feature of the big banks’ recent financial results was that they’ve been writing back some of their bad and doubtful debt provisions, which has benefited net profit and, by extension, dividends. We expect this trend to continue until at least to the next results, although the banks will be carefully assessing the health of their borrowers as government support starts to decline and eventually ceases.

Most of the growth for the major banks will come from both mortgage and business lending, which is consistent with the recovering economy. The housing market is very strong now but likely to moderate. On the other hand, business credit is likely to pick up. If credit growth is four to five per cent and costs are contained, the big banks should be able to generate earnings and dividends growth of three to four per cent. That would be a good result.

The impact of increased inflation is an interesting one for the banks. A moderate increase in inflation leading to a gradual increase in interest rates is generally good for banks. Assuming there is a healthy demand for credit, and all else being equal, the banks’ net interest margins would expand as the cost of funding generally lags increase in loan rates. On the other hand, if inflation is very high, attendant increases in interest rates are likely to produce a slowdown in the housing market, and you may see an increase in bad debts across their customer base producing reduced profitability. On balance, whilst the prospect of high interest rates is low, it is something we watch out for when assessing our holdings.

The outlook for the banks remains positive

Given that many key economic indicators are positive and that the banks have strong bad debt provision cover and strong balance sheets, the outlook for the banks is sound as the economy transitions from lockdowns into living with COVID. The current share prices of the banks probably reflect that.

From an income perspective, we expect the major banks will increase their dividends in the 2022 financial year and continue to provide a good level of income to the AFIC’s diversified portfolio.

AFI invests in a diversified portfolio primarily of ASX-listed Australian equities and aims to provide shareholders with attractive investment returns through access to a growing stream of fully franked dividends and enhancement of capital invested over the medium to long term.