The Blackstone buyout of Hilton is one of the most famous buyouts in history. In December 2013, Bloomberg called Blackstone’s Hilton Deal as “The Best Leveraged Buyout Ever,” while it was not smooth sailing, the deal is a case study in the long-term nature of private equity and the potential rewards for those with the risk tolerance and the patience.

After approaches and rebuffs in 2006, Blackstone eventually announced its purchase of Hilton for US$47.50 a share, in cash, in July 2007. In hindsight, the timing of buying a real estate asset could not have been worse. In September 2007, the US housing bubble began to burst and by March 2008, a partner in the deal, Bear Sterns, collapsed. Over the first three years of the deal, Blackstone’s equity fell 70%. Undeterred and with new management in place, in April 2010, Blackstone corralled all 26 lenders into a new debt agreement and it invested a further US$819 million into Hilton. Fast-forward three years, and Blackstone nets US$8.5 billion from the December 2013 IPO of Hilton Worldwide Holdings (HLT). Over the next five years, Blackstone continues to reduce its stake, checking out of Hilton in May 2018. Over the 11 years of its investment, Blackstone realised a US$14 billion in profit from its Hilton deal.

Blackstone is one of the biggest buyout firms in the world. They have been responsible for transforming a number of businesses over many years. Investors that want to be a part of that success and invest in a Blackstone closed-end private equity fund require:

- A large capital outlay;

- Be prepared for a long lock-up period; and

- Take concentrated, illiquid exposures to a small number of private companies – which are often leveraged.

These funds often close at capacity, despite demand from other investors. As a result, investing in private equity is generally only accessible to large institutions and the very wealthy. The lure for these investors is the associated historical long-term growth, albeit with a significant increase in risk.

Private equity is the ownership or interest in a corporate entity that is not publicly listed. There are different types of private equity investment. It can involve taking control of a company either through outright purchase or through obtaining a controlling equity interest in a company (buyout, like Blackstone). Private equity can also involve taking a stake in a growing business at its early of growth stages and private equity can be involved in making direct loans to business.

Private equity provides capital to nurture expansion, new products or restructuring with the goal of unlocking greater value for investors.

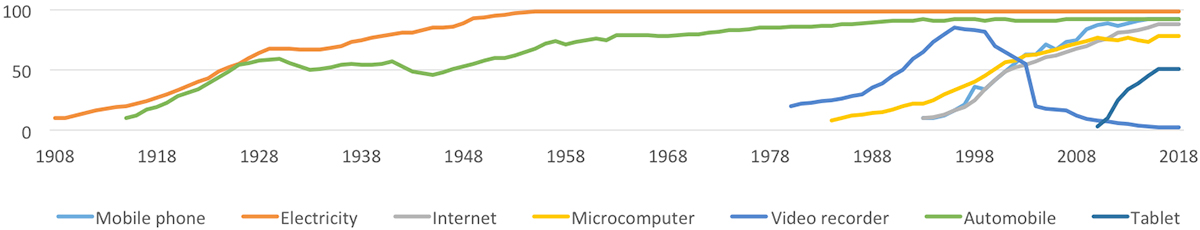

Throughout recent history, private equity has played a vital role in the spread and adoption of new technologies. When introducing a new technology, its adoption steadily increases over time. Think of the automobile, while its penetration is still not 100%, it is one of the most important inventions of the 20thcentury and is essential for the economy, establishing itself as ‘basic’. All of today’s basic technologies were at one-point ‘new’ technologies that has become essential for economic functioning.

Chart 1: Adoption rate of selected technologies in the US over the period from 1908 to 2018

Source: Comin and Hobijn (2004) and others, LPX AG

As you can imagine for investors, it is desirable to be able to invest in these technologies as early as possible. This is because the highest growth rate and hence investment return can be achieved for new and growth technologies especially if they achieve a significant market penetration and adoption rate. The private equity asset class plays a vital role in the financing and in the support of new and growth technologies.

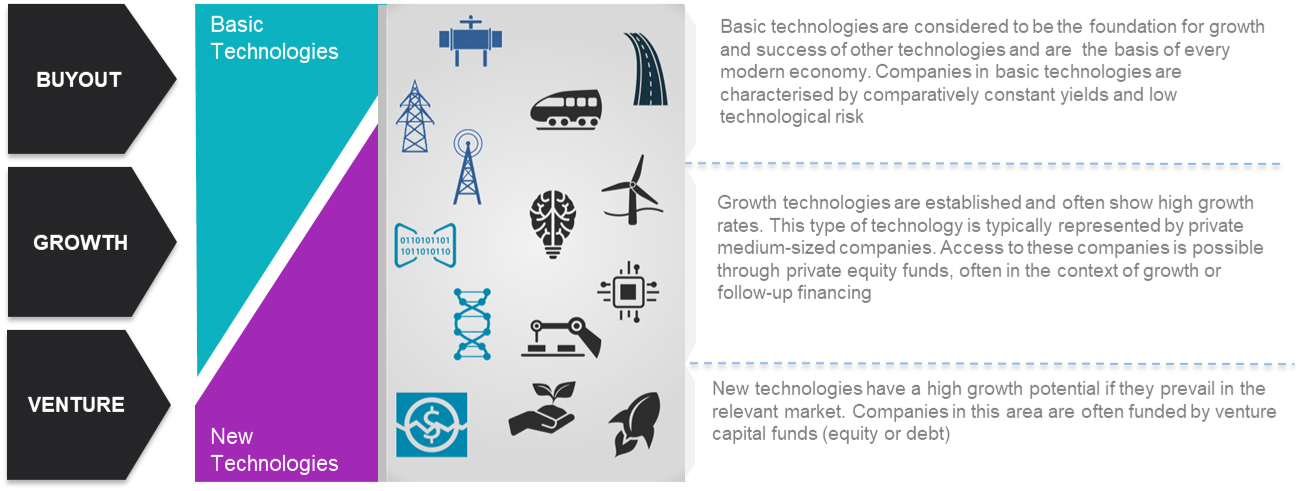

Since future technologies are by nature unknown, an investor should diversify. Private equity allows investors to invest across different technology categories. Technologies categories can be classified depending on the adoption rate into new, growth and basic technologies. An investor can access a diversified technology portfolio by investing in the private equity asset class.

Chart 2: Private equity strategies and technology categories

Source: LPX

As mentioned above, to date, closed end funds that offer private equity investments are typically available only to very large investors who have the financial resources to make long-term commitments. From this background, the private equity asset class can be difficult to access for non-institutional investors.

That is changing. Later this week the VanEck Listed Private Equity ETF (GPEQ) will list on ASX.

GPEQ will track the LPX50 Index that includes the largest and most liquid 50 listed private equity companies with exposure to venture, growth and buy-out opportunities. The companies will gain their exposure to private equity either:

- directly, that is the company invests directly in private equity from its own balance sheet;

- indirectly, by investing into private equity funds; or

- they are the private equity managers themselves.

GPEQ will provide immediate access to a highly diversified private equity portfolio of more than 3,300 private equity direct investments and 350 private funds.

GPEQ aims to provide investors with private equity returns, but with share market liquidity.

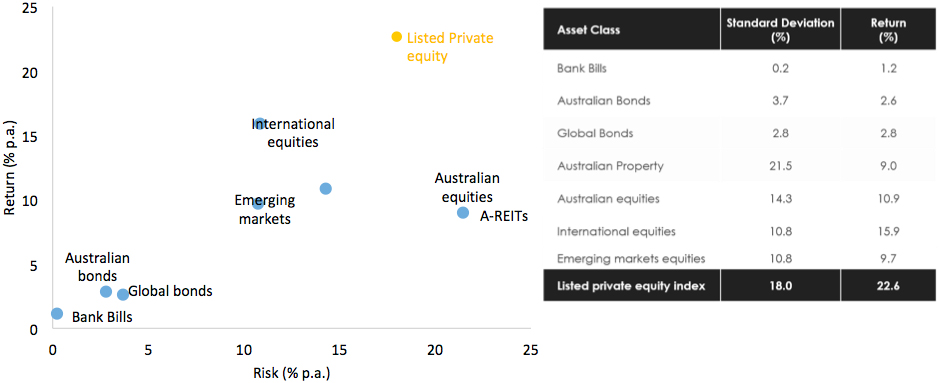

You can see in the chart below, compared to other indices the LPX50 Index is higher risk, as measured by standard deviation of returns, but it has provided the highest return.

Chart 3: Illustrative risk and return of major asset classes.

1 October 2011 to 30 September 2021

Source: Morningstar Direct, Ten year risk-reward. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Indices used Bank Bills – Bloomberg AusBond Bank Bill Index, Global Bonds – Barclays Global Aggregate Bond Index A$ Hedged, Australian Bonds – Bloomberg AusBond Composite 0+ years, Australian Property – S&P/ASX 200 A-REITs Index, International Equities – MSCI World ex Australia Index, Australian Equities – S&P/ASX 200 Accumulation Index, Emerging markets equities – MSCI Emerging Markets Index, Listed private equity – LPX50 Index.

Accessing private equity will soon be easier for Australian investors with the launch of the first listed private equity ETF on the ASX. GPEQ will track the LPX50 Index which includes the 50 largest and most liquid private equity companies with exposure to venture, growth and buy-out opportunities.