By Emma Fisher – Portfolio Manager

I know, I know. Bullish thought pieces on lithium are as dime a dozen today as Warren Buffett quotes in a fund manager investor letter. However, we think there is a standout sleeping giant in lithium that is incredibly cheap right now and worth discussing.

The precipitous fall in the iron ore price since August has wiped more than 35% off the value of Mineral Resources (ASX:MIN), which now has a market cap of roughly $7.3 billion. We are astounded at the valuations the market is willing to ascribe to ’pure-play’ lithium companies and consider Mineral Resources the cheapest lithium stock in the market. Let’s compare it to one such pure-play peer, Pilbara Minerals (ASX:PLS), which has an asset right next door to Mineral Resources’ Wodgina mine. Pilbara Minerals has a market cap of roughly $7 billion, so basically the pair are neck and neck in valuation.

Comparing Mineral Resources with Pilbara Minerals

Pilbara Minerals’ assets add up to 536 kt p.a. of spodumene capacity, consisting of two mines:

1. Pilgan Plant: Currently in production. Operating at nameplate capacity of 330 kt p.a.

2. Ngungaju Plant: In care and maintenance. Restart to commence at the end CY21, targeting 180 to 200 kt p.a. by mid-CY22.

This is equal to Mineral Resources’ current spodumene operations, which equal 535 kt p.a. capacity:

1. Mt Marion: 475 kt production; Mineral Resources owns 50% so the equivalent of 235 kt p.a.

2. Wodgina Plant: In care and maintenance. Restart commencing, targeting 250 kt p.a. by 3Q22, ramping up to 750 kt p.a. when market conditions allow (i.e. when Albemarle have secured enough downstream hydroxide capacity). We estimate Wodgina will be fully operational by FY24. Mineral Resources owns 40% so this is the equivalent of 300 kt p.a.

What about future expansion plans?

Pilbara Minerals is aiming to expand production to 1 million tonnes p.a. of spodumene (so roughly double what it produces today). The company has given no firm dates on these expansion plans so we consider them longer-dated (five-plus years).

The company also recently finalised a South Korean joint venture with POSCO to construct and operate a 43 kt p.a. lithium hydroxide facility. Pilbara Minerals will own an initial 18% of this venture, with a call option to go to 30%. Assuming it takes up this option, its share would be 13 kt of lithium hydroxide within three years.

Mineral Resources owns 40% of a lithium hydroxide plant under construction at Kemerton which will eventually produce 50 kt of lithium hydroxide, so its share is 20 kt p.a. The company intends to acquire or construct lithium hydroxide plants in China via its venture with Albemarle, adding another 50 to 60 kt p.a. hydroxide capacity, of which Mineral Resources’ share would be 20 to 25 kt p.a. Hence, we assume Mineral Resources will have 40 to 45 kt p.a. lithium hydroxide production within three years.

Pulling it all together, within three years Mineral Resources and Pilbara Minerals will have similar spodumene production and Mineral Resources will be producing three times more lithium hydroxide.

Assuming prices well below spot for spodumene (US$1,250 long-term forecast versus spot US$1,700/t) and hydroxide (US$17,000 forecast versus spot US$28,000/t), we believe Mineral Resources will be generating about $1 billion in EBITDA from its lithium assets. This compares with FY24 EBITDA consensus for Pilbara Minerals of $569 million. Although our above analysis ignores differences in grades and other mine-level nuances, we believe the overarching conclusion is that Mineral Resources will likely make more money out of lithium than Pilbara Minerals in 3 years’ time.

What is $1 billion in lithium earnings worth?

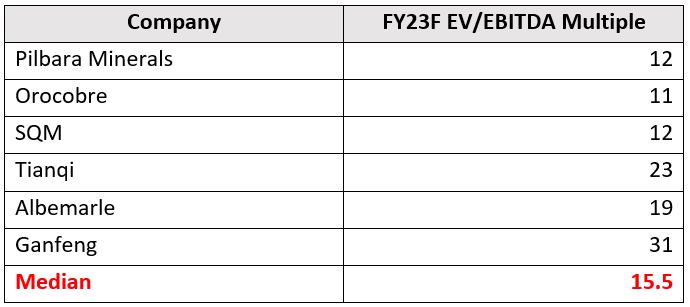

Lithium producers are trading on elevated multiples. If we look at FY23F EV/EBITDA for major lithium producers globally, multiples range from 11 times to a whopping 31 times for Ganfeng, with a median EV/EBITDA of 15.5 times.

Source: Factset

If we ascribed all of Mineral Resources’ current enterprise value to its future lithium EBITDA potential of $1 billion, it equates to 7 times. Valuing the lithium assets in line with the low end of peer multiples, at 11x EBITDA, gives $58 per share value versus the current share price of $38.

However, lithium isn’t the whole business. You also get a mining services business that generated about $420 million EBITDA last year, with guidance for 20% to 25% growth in FY22 (i.e., more than $500 million from mining services EBITDA). And yes, you get a high cost, low-grade iron ore producer at a time when iron ore prices are falling. However, given the iron ore assets generated EBITDA of $1.5 billion last year, and have generated cumulative EBITDA of $2.6 billion in the past seven years, clearly the value of this business is not zero.

In short, the fear around a falling iron ore price has created a unique opportunity to buy the cheapest lithium stock in the world, Mineral Resources. A quick Google Translate from English into Buffett yields: “be greedy when others are fearful”.

The Airlie Australian Share Fund offers investors the opportunity to invest in a specialised and focused Australian equities fund whose primary objective of the Fund is to provide long-term capital growth and regular income. This fund also comes in a listed version with the ASX ticker AASF.