by Matthew Culley – Research Analyst | Assistant Portfolio Manager and Daniel J. Grana, CFA – Portfolio Manager, Emerging Market Equity

Emerging markets (EM), in our view, remain one of the more compelling themes in equities investing, but perhaps for reasons not fully appreciated by investors. At present, EMs as gauged by leading benchmarks encapsulate 26 countries and more than half the world’s population. We think the size and growth rates of these regions alone should merit investors’ attention.

Despite these countries’ diverse social, economic and political structures, over the years there has been surprising similarity in the underlying themes and opportunities for EM equities investment. Consistent with their “emerging” status, there have historically been two primary reasons for gaining equity exposure to EMs: outsourcing and convergence. With respect to the former, EMs have been a major beneficiary of the drive toward globalization as developed markets look for lower-cost ways to unearth and refine raw materials, manufacture products and provide services. As incomes in EMs rise, so too does the demand for cars, smartphones, life insurance and other middle-class outlays that drive convergence toward developed market penetration rates. These two factors have been the principal forces behind the impressive performance of several EM commodities, manufacturing and outsourced services stocks over the past two decades.

And Now There are Three

While outsourcing and convergence remain core pillars of the EM opportunity set, we have begun to see the emergence of innovation as a third investable EM meta-theme. The last decade has witnessed innovative EM companies such as Alibaba and Tencent growing to become some of the largest companies in the world. We expect other companies to follow suit and believe that we are at the precipice of a broadening of EM-originated innovation that has the potential to reshape the social and economic order for the majority, and perhaps all, of the world’s population.

The global economy is entering an unprecedented time for innovation. The so-called Fourth Industrial Revolution is enabling the homogenization of the physical, digital and biological world. Importantly, these advancements are no longer the exclusive domain of developed markets. Instead, these global forces are coalescing to drive innovation in EMs as well.

The undercurrents that aided the outsourcing and convergence stories of the past decades – combined with consumer technology proliferation and Internet penetration – have set the stage for a profound change in how and where innovation happens. We are not alone in recognizing that demographics strongly favor EMs, given their materially younger populations and a shift in consumption toward the rapidly expanding generation of middle-class, digitally native consumers.

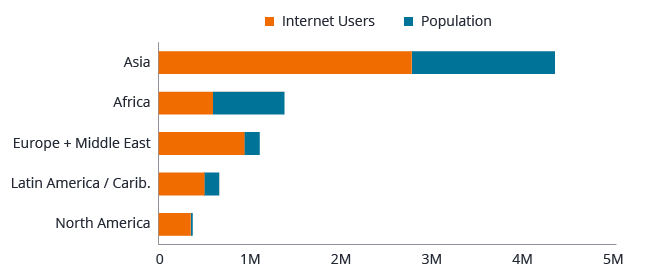

Exhibit 1: Global Internet users by Region

Asia leads the word in Internet users, many of whom are younger, digitally native consumers who rely upon connectivity for many aspects of their professional and social lives.

Source: Internet World Stats as of 31 March 2021.

Emerging countries are educating students in science, technology, engineering and mathematics at a faster pace than any other region. These graduates are entering the workforce with the sum of nearly all information known to mankind at their fingertips. In contrast to years past, they are increasingly looking away from Western markets and toward home, seeing the combination of opportunity and resources available to build viable businesses that tackle local market challenges. This has led to scaled pools of talent, experienced entrepreneurs and abundant venture capital to form the backdrop for sustained innovation for decades to come. Artificial intelligence (AI), Big Data, 5G, blockchain, nanotechnology, biotechnology, the Internet of Things (IoT) and quantum computing represent some of the enabling technologies supporting the transformation of human lives and enterprises that we are beginning to see originate out of the emerging world.

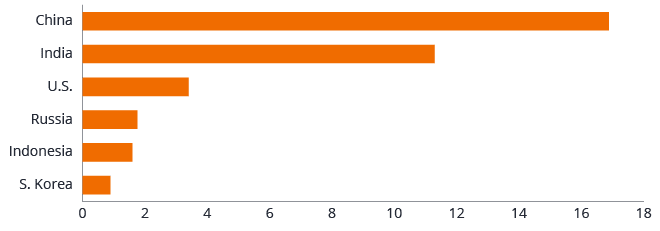

Exhibit 2: University Enrollment in STEM Curricula

Major Asian emerging markets are training students in science, technology, engineering and math curricula at a higher rate than other regions.

Source: Bloomberg.

A Springboard for Productivity

We were struck by a recent conversation with a South Korean entrepreneur who noted that true innovation breaks trade-offs by eliminating the higher friction and stacked economics common of legacy market structures in EMs. Regulatory and business formation constructs over time developed to favor incumbents and stifled the competitiveness of small- and medium-size businesses. Technological advancement has the potential to shatter this unproductive paradigm. What has become so salient in EMs is that these innovations are driving inclusion – one of the most powerful forces in unlocking demand globally and an essential ingredient for economic growth. By broadening access and enabling participation by EM populations that are under- or unserved by existing institutional structures, innovation is adding benefits that are inherently different and complementary to the convergence and outsourcing stories of past decades.

Entrepreneurial fintech businesses are bringing an unbanked population into the financial system with the potential to elevate millions out of poverty. The application of blockchain technology across supply chains is enabling access to credit to an enormous group of underserved small businesses and could help alleviate failure rates that are much higher than in developed markets. Importantly, the shifting landscape for innovation is similarly enabling a positive environmental impact. Rather than balancing the inherent trade-off between economic growth and environmental harm, many innovators have made sustainability a positive input to their business model, rather than a negative output to be managed. This flips traditional environmental, social and governance (ESG) investing on its head.

Local Solutions to Local Challenges

Many business models prevalent in EMs have been imported from developed markets where they were forced to overcome intense competition to create differentiation by solving local market frictions. With the greater ease in which technology is diffused globally, an increasing number of businesses are finding their way into EMs – with varying degrees of success. Emerging markets have a long history of leapfrogging legacy technology generations, such as mobile networking superseding traditional wireline communication. But in many cases, we are presently seeing a complete bypass of traditional development, which is resulting in innovation scaling faster. Food delivery has grown at a dramatically rapid pace in China and penetration now stands far in excess of developed markets. In India, where restaurant penetration remains but a fraction of the Western world, with limited selection, we are seeing a strong adoption of cloud kitchens alongside the expansion of the major food delivery platforms. This has the dual benefits of increasing supply and selection for underserved consumers and also enabling enormous job growth in what has historically been a difficult industry for small business owners.

In Latin America, Brazilian logistics have long been underdeveloped, resulting in elongated and costly supply chains dominated by the state-run postal service and fragmented middlemen. Today, we are seeing the emergence of multiple digitally enabled logistics companies that are providing on-demand, intra-city services. Digital freight matching platforms are also on the rise. These companies pair shippers and truckers to significantly increase the efficiency and speed for the shipper and provide higher wages for drivers, all while circumventing the need to build the traditional multi-modal supply chain conglomerates prevalent in the U.S. and other developed markets.

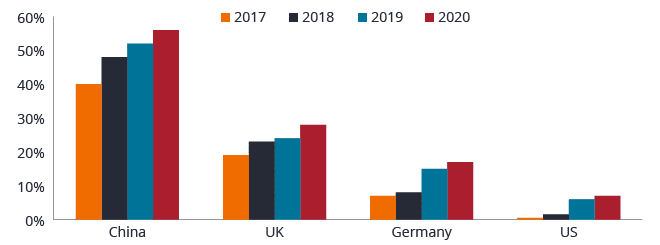

Exhibit 3: Food Delivery Service Users as a Share of Internet users by Region

The proliferation of food delivery in China vis-à-vis developed markets illustrates how seamlessly many of the country’s citizens have adapted to the digital economy.

Source: Company presentations, Bloomberg.

Health Care Joins the Fray

As emerging markets compound their demographic advantages in education, we are seeing an explosion of new and innovative companies across the health care ecosystem. Increasingly, even Western-educated EM citizens are returning home to establish startups. Rather than joining well-known global leaders, or developing outsourced generic drug manufacturing facilities, true innovation is happening domestically. We recently spent time with the founder of a colorectal cancer screening company who has developed a patented technology to provide world-leading accuracy at costs that are a fraction of those currently available in developed markets. While initially providing benefits for an at-risk population of 700 million in its home market, there are enormous opportunities to provide this technology on a global basis. With the lack of sufficient access to health care infrastructure across many countries, we are increasingly seeing unique business models emerging to utilize technology to address these gaps. By integrating telemedicine, e-pharmacy, digital recordkeeping, educational content and AI-assisted decision making for providers, EM innovators are creating scalable solutions that create not only powerful business models, but more importantly, drive inclusion of the underserved into the health care ecosystem.

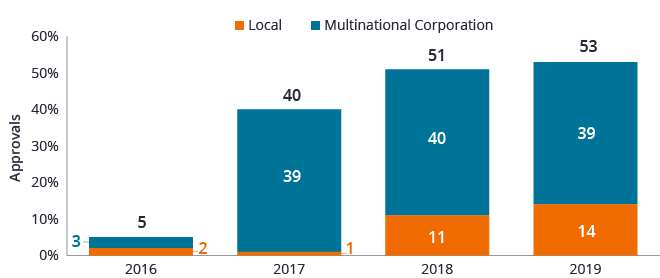

Exhibit 4: Annual New Drug Approvals in China

Chinese regulators have accelerated drug approvals with the objective of improving the health outcomes and quality of life of the country’s citizens, an aim that aligns with government policy.

Source: Jefferies, China NMPA.

Going Global

Perhaps most exciting is the opportunity for many of these businesses to scale beyond local-to-local innovations and into local-to-global solutions providers. Many of the complex issues EM innovators have solved for can be applied back to developed markets to improve existing solutions that didn’t require breaking trade-offs.

We recently met with an emerging market software company that provides solutions to global multinationals seeking to grow their e-commerce operations in EMs. These global enterprises needed a solution that integrates multiple fragmented logistics providers, horizontal e-commerce marketplaces, brick-and-mortar stores, local banks, payment schemes, currencies and many other ecosystem partners in a flexible, cloud-based solution. By providing this service across Latin America, this company has become recognized as a global leader by market intelligence firms and is increasingly expanding along with its customers into developed markets by displacing legacy models. This is just one of many differentiated companies that are beginning to arise across EMs that will have global implications.

We expect EM innovators to reshape the global equities investing landscape. Benefiting from deep local markets, improving scale of engineering and executive talent, we expect many more EM-domiciled companies to break into the ranks of both the largest (and most important) companies in the world over the coming decade. Successful identification and partnership with these companies has the potential to allow for substantial compounding of capital over long time periods. While these preconditions for a wave of EM-oriented innovation are coalescing today, the underlying drivers are durable, suggestive that this dynamic will likely become the new norm, and in the process, likely help many EM countries circumvent the middle-income trap that has previously hampered early waves of development.