BNPL has been a fast-developing theme in 2021. In the third quarter, Square acquired Afterpay for USD 29 billion in a deal reflecting the intensifying battleground in the sector. Other developments included Amazon announcing a partnership with Affirm to offer BNPL as a checkout option, PayPal augmenting its own BNPL product with the USD 2.7 billion acquisition of Paidy and Apple revealing it will work with Goldman Sachs to offer its service through Apple Pay. BNPL is a concept that has been around for decades, so what has triggered the recent wave of enthusiasm? A handful of forward-thinking companies have embraced technology to streamline the process into a very simple user-friendly format. For example, Afterpay makes an instant decision to approve a new customer based on six simple inputs and no credit check or proof of income. This has proven particularly popular with millennial and Gen-Z consumers, who view the format as a payment plan, rather than debt.

The BNPL business model relies on a merchant fee of between 2% and 6%, which is higher than the fees levied by credit card companies. Why are retailers happy to pay more to offer this service? The simple answer is BNPL customers have higher conversion rates and significantly higher average order values. Afterpay was also quick to spot the high take up among millennials and leapt on this as a key selling point, given how difficult the cohort has been to reach through traditional marketing methods. It has worked well in Australia, and merchants such as Urban Outfitters have expanded the payment method to the US and UK. The key is that the BNPL companies are enablers of growth for their retail partners, as well as a no-strings convenient finance product for the end consumer; this has created a strong network effect, as more customers attract more retailers, which attracts more customers, and so on.

Retailers with greater e-commerce penetration, catering to younger fashion-conscious consumers, have been enthusiastic early adopters with the payment option featuring prominently on several fast fashion websites. Luxury brands, having been slower to adopt e-commerce at all, have been more reluctant to embrace the concept for fear of being associated with selling products to people that are unable to afford them. Gucci is a rare example of a luxury brand offering BNPL through Affirm, although only in the US – signalling its courting of a younger demographic in this market. Online fashion retailers, such as Farfetch and Net-a-Porter, have started to offer BNPL options but have so far restricted the availability to a narrow range of products and price points.

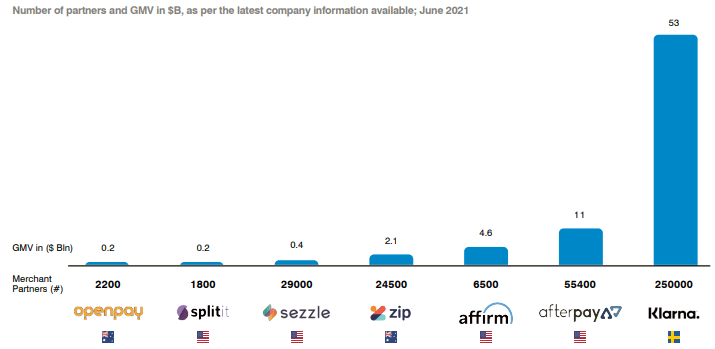

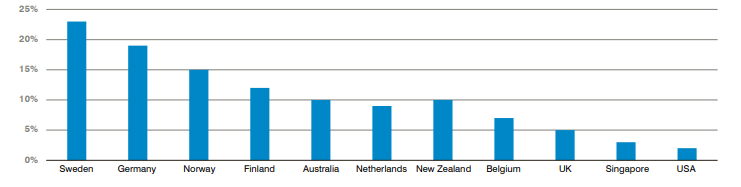

Analysis by Accenture suggests BNPL transactions have more than tripled in the US since January 2020, and the 2021 Worldpay Global Payments Report shows its share of the USD 1.1 trillion US commerce market is still only 2% (or USD 22 billion); there is therefore a long runway of growth ahead as the US converges with more mature markets. As Chart 1 illustrates, Klarna is the clear independent leader and as a result of its Swedish heritage the Swedish market is over 20% penetrated with BNPL as a percentage of e-commerce sales. This is an indicator of the opportunity set globally.

Chart 1: Overview of BNPL providers, ranked by size

Chart 2: BNPL penetration as a percentage of e-commerce sales

The moats of the dominant BNPL platforms are about to be tested as banks and card companies, who have so far been slow to get on board, have now announced plans to offer the service. Mastercard, which has a network of 78 million merchants, has launched a suite of tools to facilitate BNPL in an effort to ensure the transactions stay on its ‘rails’. PayPal offers the services to its merchants for no additional cost and is adding the option onto its new super app. This is likely to trigger a race to the bottom on merchant fees, which we expect to converge towards credit card levels. While the impending initial public offering (IPO) of Klarna will be an interesting data point, we see this development as much more of an opportunity for the card issuers to consolidate their positioning and with the network effect generated by Visa, Mastercard and PayPal, it seems highly likely that they will end up being the leaders by adding the back-end processing of BNPL as an attractive product for their card issuing clients.

Download The Disruptive Strategist Q3 2021 HERE