by Julian Howard – Lead Investment Director, Multi-Asset Solutions

In the 2015 espionage thriller ‘Bridge of Spies’, lawyer James Donovan, played by Tom Hanks, asks his client who has been accused of spying: “Do you ever worry?”, to which Mark Rylance’s Rudolf Abel replies: “Would it help?”. Market participants today appear to be sharing some of the same cool headedness in the face of apparent adversity. The VIX gauge of US equity market volatility remains subdued, valuations are relatively stretched even on a cyclically adjusted price / earnings basis and market dips over the last year have become steadily smaller. All this despite the fact that on the surface there appears to be a fair amount to be concerned over. The US economic rebound is showing signs of slowing amid supply chain disruptions in Asia and rising concern over the Delta variant of Covid-19. Beyond the US, an over-reliance on ‘Zero Covid’ policies is resulting in growth-sapping shutdowns and restrictions spontaneously applied across parts of Latin America and Asia. Business groups lament Hong Kong’s strict three-week quarantine requirement upon entry to the territory. Amid uneven vaccine take-up, a meaningful global reopening seems unlikely anytime soon. Geopolitically, the picture is also bleak. Nearly nine months into the new US administration, relations with China have not improved meaningfully, rhetoric remains bellicose and war games on all sides continue with the aim of provocation. Finally, the withdrawal from Afghanistan has been a blow to US prestige, resulting in a widely-held perception that the world is a little less safe as a result.

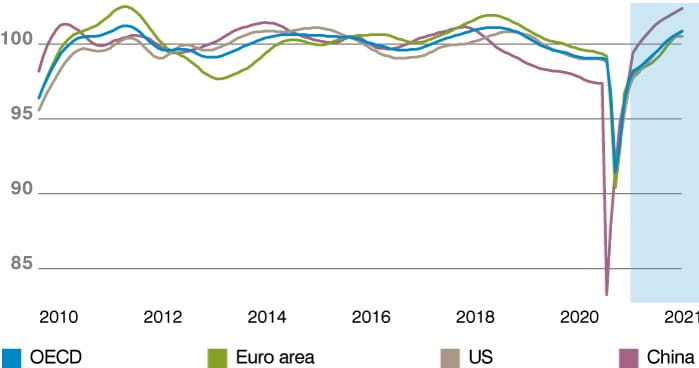

Chart 1: Cooling off – OECD leading indicators chart a slowing of the economic rebound:

The calm seen in equity markets may be put down to a collective psychological effort to avoid reacting to bad news, but given the sheer number and diversity of participants in global capital markets, a more universal – and therefore convincing – explanation lies in the perceived likely course of interest rates. Valuing an asset accurately demands knowledge of that asset’s cashflow (yield) and the prevailing discount rate. Today’s corporate earnings are, in the US at least, proving both sizeable and reliable. Combined with low interest rates (0.125% to be precise) they mathematically justify the low volatility and elevated valuations described above. This framework is key to understanding market behaviour now and how it might evolve in the future. The slowing growth described will likely see the US Fed and other central banks delay actual interest rate rises, while debate for the most part remains firmly stuck at the pre-stage of when to taper bond purchases (quantitative easing). Any perceived delays to raising discount rates will indirectly help the cyclical sectors that make up around 50% of the S&P 500 Index by supporting growth via low borrowing costs, but they will be of far more immediate benefit to the valuations of the other half (and growing) of the S&P 500 Index that is less cyclical in nature and whose earnings reliably stretch out into the future. Such sectors include information technology, communications services and even healthcare.

It seems counter-intuitive – even cold-hearted – to be rooting increasingly for low interest rates given the dismal circumstances that prompt them, but a glimpse into the future will demonstrate how the trend is only likely to become stronger. The ‘good news’ for investors is that long-term headwinds to growth transcend Covid-19 and are likely to persist for decades to come. Demographic trends are set to create acute and permanent worker shortages in the coming years, with Japan often cited as a case study of low economic growth caused by a high old age dependency ratio. Tellingly, there are now nearly four care home job vacancies for every applicant in Japan. In China, famous for its one-child policy, the announcement in May that couples will be allowed to have up to three children was accompanied with the alarming statistic that the birth rate was the lowest since 1960. A more pragmatic solution for challenged demographics around the world would be immigration but the populist politics of outrage have made this an unrealistic option for now.

The other major long-term headwind to future growth is inequality. The clarion calls to ‘build back better’ serve to reflect the rapidly worsening distribution of wealth between capital and labour during the pandemic. As many will be acutely aware, knowledge workers tended to keep their jobs as technology facilitated rapid adaptation to remote working, while many of those in lower-paid hospitality and high contact sectors were much less fortunate. While government redistribution in the form of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in the US and similar furlough schemes in the UK were relatively generous in their scope, rapidly accumulated fiscal deficits mean that they cannot go on forever and indeed both the US and UK schemes are in the process of winding down over the month of September. This leaves governments in a post-pandemic world low on cash for repairing healthcare systems or investing in education, while applying higher taxation after the last 18 months of economic disruption and is an extremely unpopular measure, as the raging debate over UK social care funding is demonstrating.

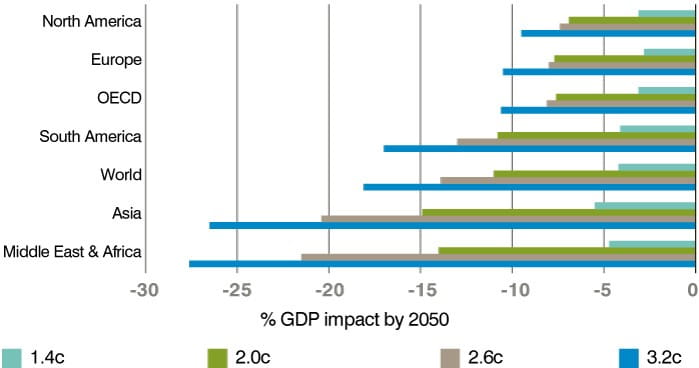

Looming large over both of these growth – and therefore interest rate – challenges is climate change. According to a comprehensive study published by the Swiss Re Institute this year, a global temperature increase of 3.2c by 2050 would see nearly a tenth of US GDP wiped out. By way of context US GDP fell ‘just’ -2.8% in 2008 amid the global financial crisis and -3.4% in 2020 amid the Covid-19 pandemic response. Positive, radical intervention might alter these outcomes somewhat, but even if concerted action limits temperature increases to under 2c, as per the Paris Agreement, a US GDP impact of -3.1% can still be reasonably expected. This will feel something like halfway between the global financial crisis and the pandemic. And the US should consider itself lucky – under a worst-case temperature rise of 3.2c by 2050, Asia’s predicted GDP hit might be in excess of 25%.

Chart 2: Growth killer – climate change GDP impact across four temperature rise scenarios (% GDP impact by 2050):

Faced with a combination of a near-term slowing in the US and global economy, the on-going Covid-19 pandemic and associated policy response, and then a series of highly challenging secular growth headwinds, it is extremely hard to see how central bankers might ever return to what might be deemed a normal interest rate environment. Indeed, most economists under 50 would be hard pushed to define what that is for lack of reference points in living memory. For an entire generation, the 20% US interest rates of the early 1980s now feel like a phenomenon from another world. Today’s price pressures stemming from supply chain issues and labour shortages – themselves related to the pandemic response – are not going to be fixed by raising interest rates and policymakers well know it. Not for nothing has the Fed governor Jerome Powell repeated the ‘transitory’ mantra when discussing his view on inflation’s longevity.

The rolling growth shock described is a stressful concept that challenges the notion of continuous human improvement since the Enlightenment. Investors certainly have a major role to play in addressing these concerns via carefully applied environmental, social and governance (ESG) approaches, but they should not be so naive as to ignore even the most optimistic academic projections which concede profound growth impacts from deteriorating demographics, persistent inequality and global temperature increases. The primary responsibility of the investment manager remains fiduciary and as such long duration assets benefiting from low discount rates should figure prominently in any strategic portfolio, in our view. ‘Acyclical’ equity sectors such as those mentioned, along with longer-dated government bonds – even at today’s relatively low yields – make sense when constructing a long-term investment portfolio in a low or falling interest rate environment. Unlike the serene Rudolf Abel, some concern is probably warranted by anyone with a stake in the future, but equally a cool head is needed to help separate the emotion of what is causing low interest rates with investing pragmatically for them.