by Stephen Hayes – Head of Global Property Securities

Now that more than 18 months have passed since COVID-19 started sweeping the world, we have a good understanding of how the pandemic has affected real estate investments. In some ways, it has changed the game. In other ways, it has simply underlined a number of trends that were already shaping the sector.

These ‘megatrends’ will likely cross decades and decades, and have big implications for real estate – boosting some sectors and disrupting others. Below is a snapshot of the trends that have shaped 2020/21, and how we see them for the coming decade.

1. The fall of the high-rise office

While we don’t predict the death of the office tower, we do expect them to decline in tenant popularity. Global lockdowns have proved the viability of remote work and even as the world normalises, many companies are adopting a hybrid working model going forward.

The average occupancy cost for a service based business located in a CDB area is approx. 8%1. Flexible working practices can lead to a reduction in work space requirements and lead to attractive corporate cost savings, which will likely have a material impact on tenant demand over the longer term. We are expecting market rents to fall and higher natural levels of vacancy within the buildings, leading to falling cash flows and valuations. While there will still be a place for such buildings, we believe that the economic returns will be higher in other real estate types.

2. Shopping Malls go out of fashion

It’s not just last year’s trend pieces that have fallen out of favour – so have the once-loved malls who sell them. Why traipse around a huge shopping centre to find the best price, when you can do it online instantly? Online shopping has led to a somewhat redundant customer offering, and malls no longer serve the purpose in society they once did. We expect foot traffic, retail sales and tenant demand to continue falling over time, and for shopping malls to experience higher natural levels of vacancy, lower market rents, cash flows and valuations.

3. Decarbonisation is driving change

Given that the global real estate sector creates one-third of global greenhouse gas emissions2, asset owners and investors can take a proactive approach to reducing the carbon footprint of the properties we live, work and invest in. We see five key areas that can deliver significant reductions in carbon emissions:

- Reducing operational carbon (from the heating, cooling and running of buildings)

- Reducing embodied carbon (from the construction and demolition lifecycle of buildings)

- Installing on-site energy generation technology

- Procuring renewable energy

- Purchasing carbon offsets

Through rigorous bottom-up analysis, our team identifies which asset owners are focused on these factors, so that we can allocate our capital to these asset owners accordingly.

4. Technology drives real estate demand

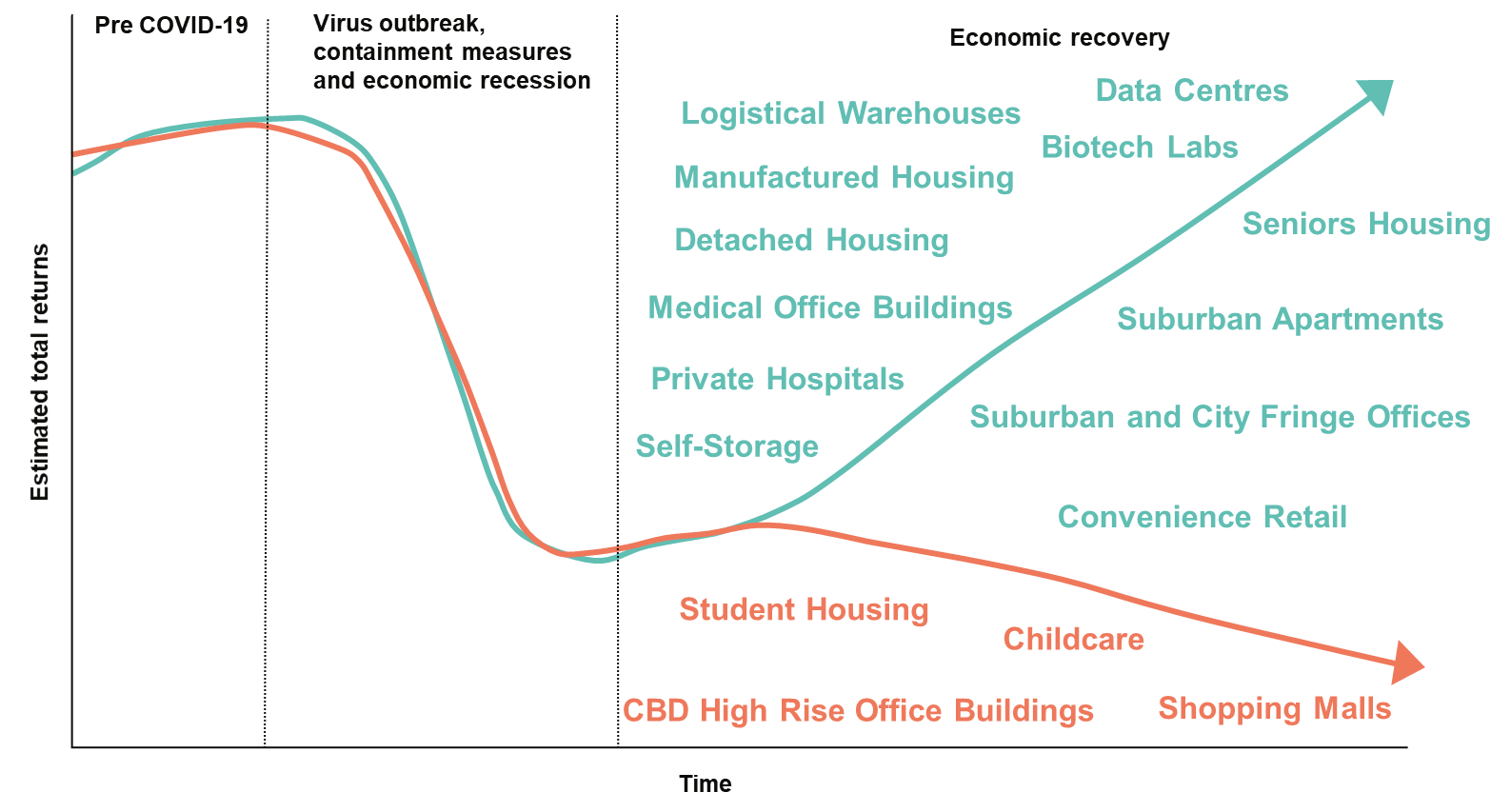

The old world traditional real estate assets such as high rise office buildings and shopping malls make up a very small component of the Real Estate Investment Trust (REIT) universe, which we invest in. Most of the real estate sectors that are set to boom have technology driven societal change at their core. Logistics warehousing, manufactured housing, detached housing, medical office buildings, private hospitals, self-storage facilities, data centres, and biotech laboratories are among the sectors predicting strong growth, as shown in green below.

Source: First Sentier Investors as at 30 April 2021. Chart represents the views of the team and is for illustrative purposes only.

5. Rental housing will continue to grow

Housing is a basic social need and right throughout COVID, the rental housing in our portfolio remained structurally full at over 95% occupied with rent collections above 95%. Falling home ownership rates with societal change, are leading to a greater propensity to rent rather than own, with rental housing being a major beneficiary. We have 30% of our portfolio invested in residential assets across manufactured housing, detached housing and apartments, located in the US, Germany and the UK.

6. Logistics warehouses will deliver the future

With the continued global adoption of the internet, just about every good and service can be researched and procured with near perfect pricing. Price must at least meet the competition, which erodes operating margins, so the other competitive advantage is availability. Wholesalers, omni-channel retailers and e-tailers are therefore investing heavily into their supply chains, and the total capital inflow is immense.

It’s all about fast moving goods: who can get items from the manufacturer or wholesaler to the customer door the fastest? This involves very modern logistical warehousing – for example, our logistics investments in countries such as Hong Kong and Japan are built up to five levels high, usually with external circular ramps up the buildings for large trucks to efficiently load goods.

These modern logistical centres are also becoming very valuable, with end values of some assets exceeding $1 billion. Profit margins for long term ownership are compelling: in high barrier-to-entry markets, margins are more than 30%. As per observed by the REIT’s, market rents are growing 3-5% p.a. in most markets and 5%-15% in top markets, leading to solid cash flow growth for our logistics investments3. Logistics investments in our portfolio are located across the US, UK, Belgium, The Netherlands, Romania, Japan and Australia.

Conclusion

We have shaped our Global Property Securities portfolio to make the most of these societal megatrends. Our residential and logistics investments reflect 55% of the portfolio4 and the remainder of the portfolio is well-diversified predominantly across hotels and resorts, self-storage facilities and data centres.

Given the strong underlying fundamentals, we believe the portfolio is very well placed to deliver very good risk adjusted returns for investors, well into the future.

ENDNOTES