Introduction

The past week has seen share markets wobble – with US shares and global shares down 4% from their recent high and Australian shares falling about 5% – amidst concern about global growth, central banks starting to reduce monetary stimulus and problems at a major Chinese property developer. Some are even talking about a “Lehman moment” in relation to the latter – a reference to the collapse of Lehman Brothers in September 2008 that contributed to the worst of the GFC. Markets have stabilised a bit in the last day or so but its too early to say that we have seen the bottom. This note looks at the key issues for investors and puts the falls into context.

A long worry list is behind the weakness

The wobbles in shares reflects a long worry list that has been building for a few months now.

- Recent economic data globally has been softer than expected, leading to concerns peak growth is behind us.

- Uncertainty remains over the impact of the Delta variant.

- Supply side constraints globally appear to be constraining growth and threatening to continue boosting inflation.

- Central banks are starting to slow monetary stimulus with a focus this week on when the Fed will announce a “tapering”, or slowing, of its bond buying.

- The US Congress needs to pass a continuing resolution to fund Federal spending by the end of the month (to avoid another Government shutdown) and will need to increase or suspend the debt ceiling sometime between mid-October and mid-November (to avoid the US Government defaulting on its debt servicing and social security commitments).

- Congress is looking at tax hikes (on corporates which could knock 5% off US earnings, capital gains and dividends) to help fund Biden’s $US3.5trillion remaining stimulus plans.

- The Chinese economy has been slowing in response to earlier policy tightening and recent coronavirus restrictions, adding to concerns about global growth.

- Debt servicing problems at China Evergrande Group – China’s second largest property developer has gotten into trouble as a result of high debt levels and property tightening measures. If Evergrande ends in a full-scale default and liquidation of its assets, some worry that this may lead to another “Lehman moment” in terms of a flow on the Chinese financial system and property market, posing a big threat to the Chinese economy, global growth and commodity prices (like iron ore).

- And share markets having had huge gains since their March lows last year – with US shares doubling having risen 14 of the last 17 months and Australian shares up 68% having risen 16 of the last 17 months – are arguably vulnerable to a bit of a pull back.

Considerations for investors

Sharp market falls with talk of “Lehman moments” are stressful for investors as no one likes to see their investments fall in value. However, several things are worth bearing in mind:

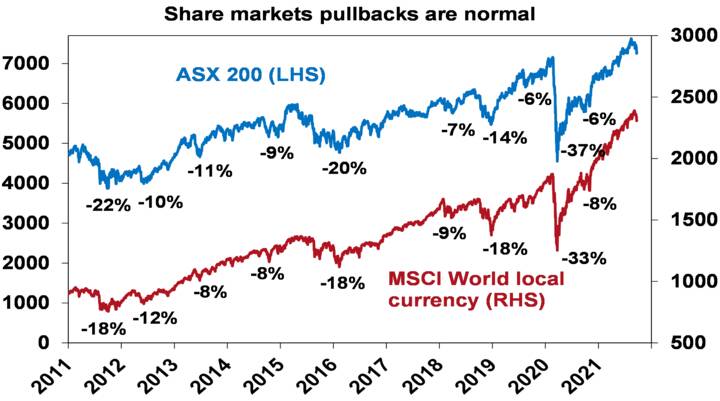

First, while they all have different triggers and unfold differently, periodic corrections in share markets of the order of 5%, 15% and even 20% are healthy and normal. For example, during the tech/dot-com boom from 1995 to early 2000, the US share market had seven pull backs ranging from 6% to 19% with an average decline of 10%. During the same period, Australian shares had eight pullbacks ranging from 5% to 16% with an average fall of 8%. All against a backdrop of strong returns every year. During the 2003 to 2007 bull market, the Australian share market had five 5% plus corrections ranging from 7% to 12%, again with strong positive returns every year. And the last decade regularly saw major pullbacks. See the next chart.

Source: Bloomberg, AMP Capital

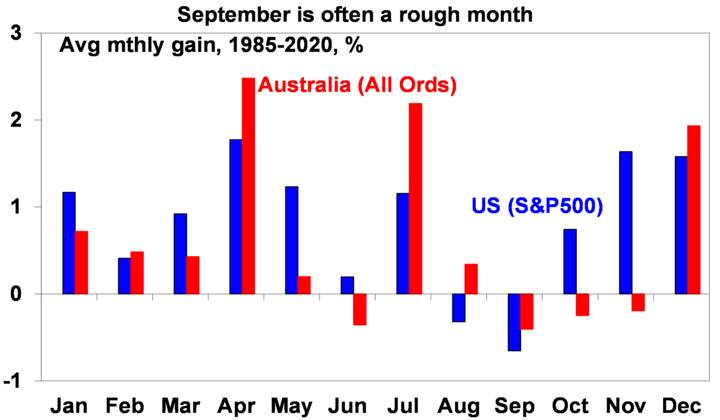

And right now, we are in the time of year often associated with share market pullbacks. Over the last 35 years, September has been the weakest month of the year for both US and Australian shares. See the next chart. US shares have fallen in five of the last 10 Septembers and the Australian share market has fallen in seven of the last 10, with both falling in September last year.

Source: Bloomberg, AMP Capital

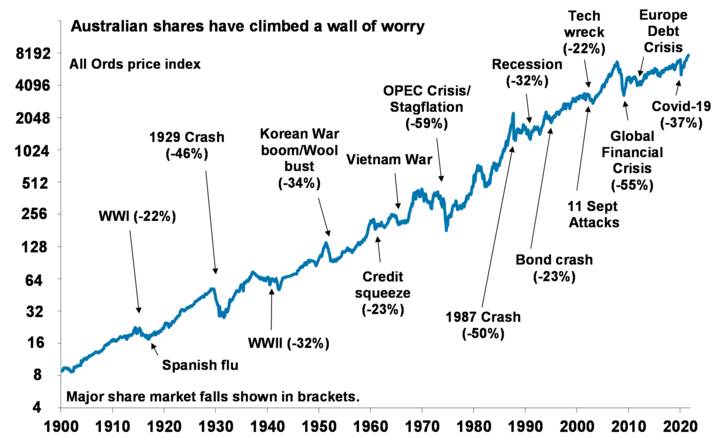

But while share market pullbacks can be painful, they are healthy as they help limit complacency and excessive risk taking. Related to this, shares climb a wall of worry over many years with numerous events dragging them down periodically, but with the long-term trend ultimately up & providing higher returns than other more stable assets. Bouts of volatility are the price we pay for the higher longer-term returns from shares.

Source: ASX, AMP Capital

Second, historically the main driver of whether we see a correction (a fall of say 5% to 15%) or even a mild bear market (with say a 20% decline that turns around relatively quickly like we saw in 2015-2016) as opposed to a major bear market (like that seen in the global financial crisis (GFC) or the 35% or so falls seen in February/March last year going into the coronavirus pandemic) is whether we see a recession or not – notably in the US as the US share market tends to lead most major global markets. Right now it’s doubtful that the worry list referred to above, while extensive, will be enough to drive a US, global or Australian recession:

- While global growth is likely to slow in 2022 business surveys remain strong and global growth is still likely to be strong at around 4%.

- The exit from the coronavirus pandemic is proving longer and messier than expected – but vaccines are helping protect against serious illness with little support for a return to lockdowns in developed countries. In Australia, the delayed but now rapid vaccination program looks on track to allow a gradual reopening as we learn to live with higher levels of coronavirus though next quarter, avoiding recession ahead of much stronger growth next year.

- Supply side constraints and hence the near-term inflation threat is likely to recede as recovery continues and spending rotates back towards services from goods.

- While central banks are heading towards the exits from ultra-easy money, it’s likely to be gradual with low interest rates for some time and the sort of tight monetary policy that brings an end to cyclical bull markets looks a long way off.

- The path to pass a funding resolution and resolve the debt ceiling in the US looks likely to be a white-knuckle ride with lots of brinkmanship, but neither side wants to be blamed for shutting the government or causing a default so a last minute deal remains likely.

- Confirmation of rising taxes in the US will be a negative for shares – but tax hikes are likely to be watered down from already watered-down plans such that it’s only a partial reversal of the Trump tax cuts and the direct drag on US profits will only be about 5%.

- While there is much uncertainty about how Evergrande will be resolved – which could cause more short-term weakness in share markets and the iron ore price – it’s not as systemically important to the Chinese/global financial system as Lehman Brothers was. While the Chinese authorities want to teach property developers and investors a lesson about the dangers of too much debt, it’s unlikely to allow Evergrande’s failure to mushroom into a full-on credit squeeze or a “Lehman moment” that collapses the property sector (via forced property sales) and the economy. So ultimately, some sort of debt restructuring rather than full bankruptcy is likely, with reports of a deal with bond holders regarding a payment due on 23rd September and the relative calm in China’s own debt markets possibly being a sign of that. And more broadly China is likely to provide policy stimulus to support growth into year end.

Third, selling shares or switching to a more conservative investment strategy whenever shares suffer a setback just turns a paper loss into a real loss with no hope of recovering. And trying to time a market recovery is very hard. The best way to guard against deciding to sell on the basis of emotion after weakness in markets is to adopt a well thought out, long-term strategy and stick to it.

Fourth, when shares and growth assets fall, they’re cheaper and offer higher long-term return prospects. So, the key is to look for opportunities’ pullbacks provide. It’s impossible to time the bottom but one way to do it is to average in over time.

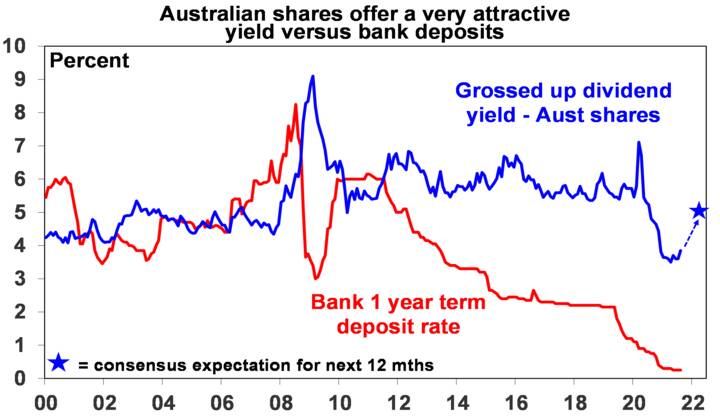

Fifth, Australian shares are offering a very attractive dividend yield compared to banks deposits. While resource stocks dividend payments may have peaked for a while following the plunge in iron ore prices, they’re unlikely to fall back much as they didn’t go up as much as earnings and high prices for gas, coal and metals are providing some offset. So, the income flow you are receiving from a well-diversified portfolio of shares is likely to remain attractive, particularly against bank deposits.

Source: RBA, Bloomberg, AMP Capital

Sixth, shares and other related assets often bottom at the point of maximum bearishness, ie, just when you and everyone else feel most negative towards them. So, the trick is to buck the crowd. “Be fearful when others are greedy. Be greedy when others are fearful,” as Warren Buffett has said.

Finally, turn down the noise. In times of uncertainty, negative news can reach fever pitch. But it often provides no perspective and only adds to the sense of panic. All of this makes it harder to stick to an appropriate long-term strategy let alone see the opportunities that are thrown up. So as always, it’s best to turn down the noise.