You are invited to a Zoom call by the CEO. In between regular interruptions of your 10-year-old requesting you to help print the Storm Boy quiz, it becomes clear the CEO has big changes in mind for the post-COVID world. You are informed that upon returning to the office, the new company policy will be to allow each staff member 1 day per week to work from home (WFH). You have been given the task of negotiating with the landlord the firm’s new office space requirements.

The maths is not as simple as it seems

All staff working from the office 4 instead of 5 days per week implies a 20% reduction in overall office usage. However, in reality the actual reduction in space is far less.

Assuming the WFH days are not rostered and are available on a random basis, there are potentially days when a large number of your 20 staff are in the office at the same time. You may even contemplate the possibility that all 20 are in the office on the same day. If so, the decision will be to either have no reduction in office space, or risk an uncomfortable and cramped office conditions on random days.

To put some science around the problem, you decide to run a Monte Carlo simulation[1] to calculate the maximum number of employees on any given day over 100 days, and the chance (probability) of hitting that number.

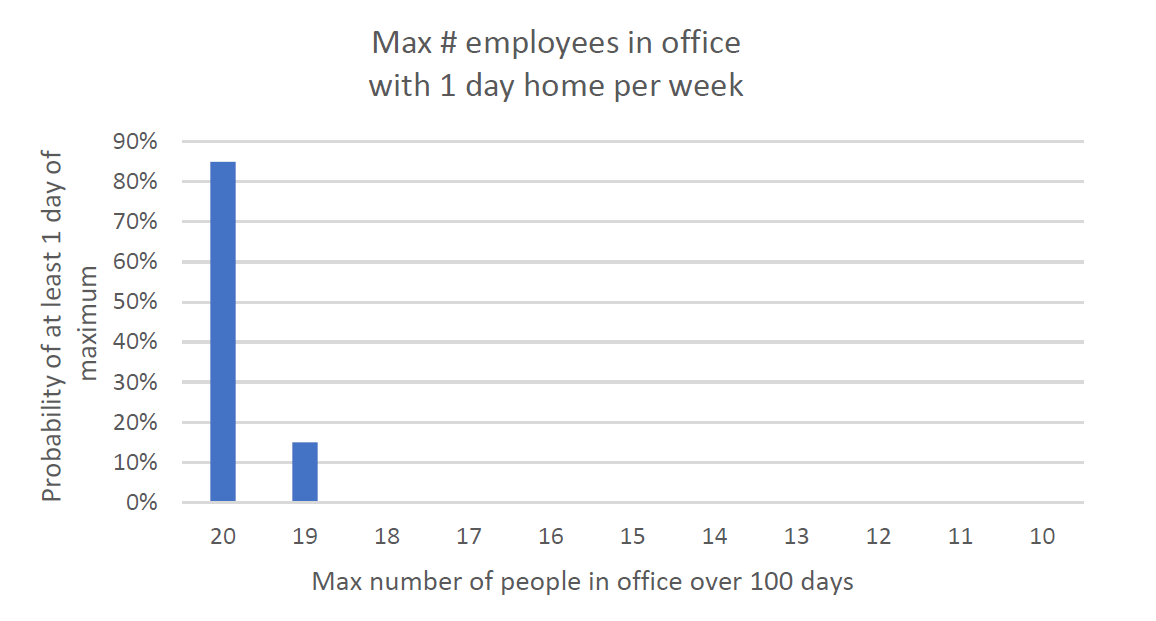

Again, assuming the days working from home are not rostered and generally random (for example, no preference for Friday or Monday), the probability of at least 1 day (from 100) of each ‘number of staff in office’ scenario can be estimated as below.

Source: Quay Global Investors

What the above chart shows is that over 100 work days (approx 4 months), there is an 85% chance that at least 1 work day will have all 20 employees in the office. Conversely, there is a 15% probability that at most 19 employees will be in. To be clear, there will be other days when there are less – but this analysis is calculating the maximum workers in the office on any particular day over 100 days, since this is the basis for the required office accommodation.

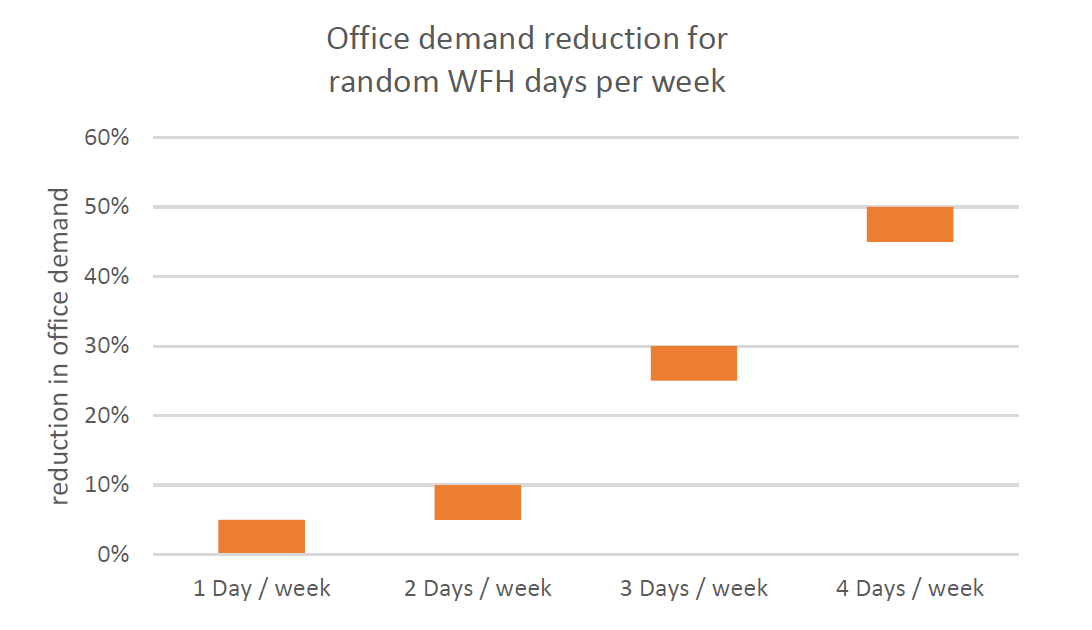

As office manager, depending on how un/comfortable an environment you want for your staff, the overall space reduced will be between 0-5%. Running similar analysis for 2, 3 and 4 days WFH scenarios results in less needed space (obviously), but the relationship is far from linear.

Source: Quay Global Investors

So even under the scenario where employees are allowed 4 (out of 5 days) to randomly work from home, there is at least 1 day in 100 where 50% of staff will be in on the same day. So office usage is only reduced by 50% despite 80% days worked from home.

How realistic are our assumptions?

The above analysis relies on the assumption that days taken to WFH are random. Of course, certain days can be rostered, which will give more certainty about maximum office staff levels (and therefore provide some certainty for lower space requirements). Alternatively, if there is no roster there could be bias toward some WFH days (for example, Friday or Monday), which will almost certainly mean there will be no reduction in office needs between Tuesday and Thursday.

To us, the idea of a rostered WFH day for staff seems unlikely. It seems to fly in the face of ‘flexible work days’, which is the main attraction of WFH. We think it is more likely there will be biases for preferred days, which suggests our analysis above is too bearish on overall long-term office demand.

The above analysis also assumes every employee will want to WFH 1 day per week. As the lockdowns across Australia drag on (6th time in Melbourne), it is reasonable to think this is an unrealistic assumption. This would again mean our analysis above is too pessimistic.

Other considerations?

The idea of reducing office accommodation to save costs needs to be balanced with workplace morale. For example, under the scenario of 2 days WFH, what’s the cost-benefit of reducing office space by 10%? Assuming rent is (say) $1000/sqm/year (CBD), and the average employee accounts for (say) 20sqm, then the savings equate to $2,000 per employee per annum ($1000 x 20 x 10%). Relative to the cost of employment (especially for CBD-based businesses) and the cost of losing and re-hiring staff, is it really worth it? Especially since, as office manager, you will be blamed for those days when all staff are in the office and can’t find a desk (e.g. Sydney office during Melbourne Cup).

Investment considerations

At Quay, we view office property as largely a commodity (with life sciences an obvious exception). Over time, all commodities are priced at their marginal cost of production – or in real estate terms, replacement cost. Buying above replacement cost is a sure way to lose money in real terms as newer stock is delivered to the leasing market at better terms versus your purchase price. Buying below cost is an effective way to preserve capital, as it is more difficult for new stock to compete.

So, when considering office property as an investment we simply ask ourselves two questions:

- Are the underlying office properties priced below replacement cost?

- Are they worth replacing?

The purpose of this article is to consider the second question.

If the answer to both questions is ‘yes’, an attractive investment opportunity may well exist.

What we don’t know is whether office tenants will ‘experiment’ with WFH scenarios, which will temper short-term tenant demand – at least for the foreseeable future. In other words, it could take a long time for values to recover, and the next development cycle to emerge.

But for long-term investors, this shouldn’t matter. Whether the recovery is quick or slow, so long as the entry point is below cost, then the capital appreciation from the purchase will exceed a rise in building costs (which should roughly match inflation). If an adequate return on capital is generated in the meantime, then our investment objective (CPI + 5%) total return is achievable.

Source: Quay Global Investors

Concluding thoughts

The pandemic has forced many of us to re-evaluate our personal and work life priorities. It is tempting in the middle of such a disruptive event to extrapolate our current environment into the future; to assume our behaviour as consumers, as workers, as individuals has changed forever.

Yet, as we have highlighted in previous Investment Perspectives, this is certainly not the case for retail; and we think we have illustrated it is not likely to be the case for office.

Investing is about finding opportunities or investments priced for a pessimistic outcome that may not happen. These types of investments can sometimes offer a skewed bet – not much loss if the market was right, but big gains if wrong. The office sector may harbour such opportunities.

Download a copy of this article HERE