by Dinesh Kuhadas (CA, CPA) and Lisa Harrison

Market review

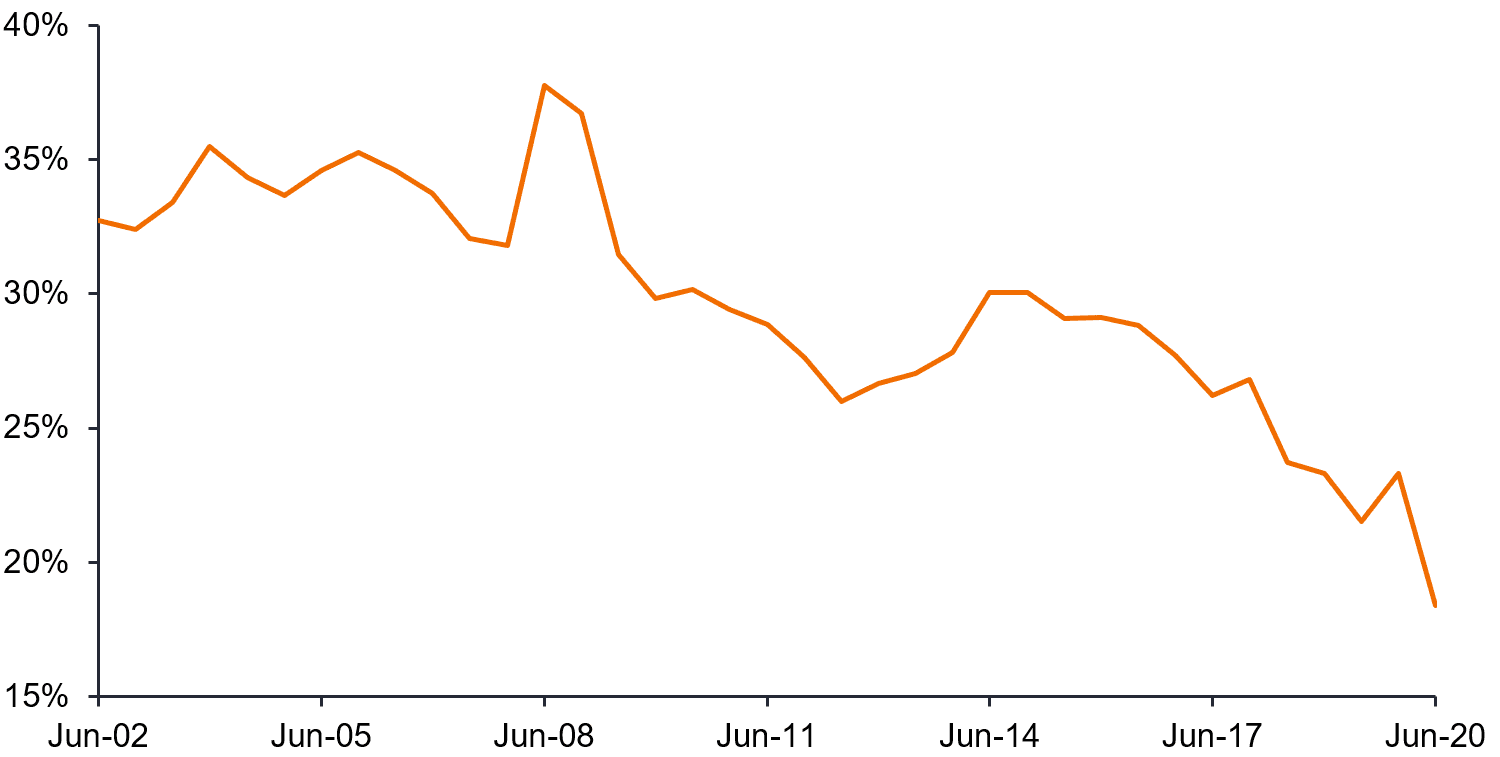

For many investors, REITs have been a polarising asset class over the past 18 months due to the impact of COVID-19. Property owners have had to shoulder a portion of the pandemic’s financial impact, with tenant rental waivers and deferrals. Fortunately, the sector had materially de-risked in the period since the Global Financial Crisis, meaning in contrast to previous recessionary episodes, it entered the pandemic with significantly lower gearing levels and improved financial flexibility.

Chart 1: A-REIT Sector Gearing (weighted average)

Source: Credit Suisse Research – A-REITs – June 2021

Rather than being a homogenous asset class, REITs comprise several sub-classes which continue to be impacted to varying degrees, with some suffering, while others experienced strong tailwinds. Looking ahead, the sector is facing structural themes, including the acceleration of e-commerce and online adoption, hybrid work practices, and a new focus on the resilience of supply chains. REITs are often labelled as “bond proxies”, and in this context, rising inflation expectations are weighing on investors’ minds. Additionally, the recent recurrent impact of further lock-downs in a bid to curtail the spread of the Delta strain of COVID-19 are detrimental to investor sentiment. These factors are being reflected in credit spreads, with REITs as a whole trading wide relative to the investment grade corporate credit universe.

Key themes in the sector

E-commerce and online shopping

E-commerce and online shopping trends, which had been firmly in place pre-pandemic, have been given a “shot in the arm”, to the detriment of retail property owners globally. This is especially being experienced in “over-retailed” markets such as the US. Domestically, this theme presents itself with a more mixed picture.

While high street retail and lower quality mall assets continue to be pressured, premium, well-located, well-serviced destination malls, have rapidly recovered foot-traffic once lock-down orders have been lifted. Such high-quality assets benefit from rigorous yet flexible town planning laws which both serve to limit competition, and at the same time allow centres to evolve and adapt to changes in societal demands. Importantly, fears around a shift towards turn-over based rental models have not eventuated to date. Lastly, suburban malls anchored by non-discretionary retail (e.g. grocers, pharmacies), and certain large format retailers (e.g. hardware / home-improvement) have benefited from “shop-local” and “work-from-home” trends.

Hybrid work practices

Hybrid work practices are one of the great debates emerging from the on-going pandemic. This was another trend which was previously in place, but has been accelerated and enabled by advances in technology.

Office property is also being affected by traditional cyclical factors, including large tenants seeking to reduce footprints as part of cost-saving measures, and supply technicals. Our sense is that “the Office” and more broadly, the Central Business District, will continue to have an important place in society as we look beyond the pandemic. This should especially be true for high quality, prime grade assets in the major capital cities, and is supported by evidence of continued strong valuations being achieved in secondary office market transactions. That said, we acknowledge the likelihood that the nature of office use, demands of tenants, and tenant mix, will evolve, requiring asset owners to “work harder” than they perhaps might have previously.

Owners of quality industrial assets are benefiting significantly, as their business tenants seek to move from “just-in-time”, to “just-in-case” supply chain management. To say that such assets are in high demand would be an understatement. REITs with residential exposure focused on space and affordability away from CBDs, have also benefited.

REITs as a bond proxy

Inflation expectations have risen and their impact on REIT investments is a live and complex discussion. On the one hand, REITs as bond proxies could be expected to fair poorly as rates rise due to rising costs of debt crimping cashflows. Capitalisation rates could rise as discount rates rise, impacting valuations. More attractive returns available on risk-free / lower risk fixed income assets could reduce demand for REITs. These factors in combination would be credit negatives from the perspective of debt investors in the sector.

In our view, the potential for “recovery-threatening” aggressive interest rates rises going un-checked by the Reserve Bank of Australia (RBA) appears unlikely in the near-term. In a more gradually increasing interest rate environment, “real” assets, including property with contracted annual rent escalators, have long been regarded as decent hedges against inflation, particularly should the underlying driver of inflation and rising rates be broad-based economic recovery. This should bode well for tenant fundamentals, which in turn should translate into rising rents, an inflection in vacancy rates, and strengthening demand for REITs. These factors would support REIT cashflows, capitalisation rates and valuations, which would be credit positive.

Investment View

Our top-down investment view calls for an economic recovery supported by accommodative fiscal and monetary policy, along with successful vaccination rollouts. In such an environment, our base-case is that owners of high-quality property assets should benefit from the cyclical uplift. On the topic of bond proxies, we suspect an emerging bargain to be struck between fiscal and monetary policy, which may help limit the upside on longer-dated yields from cyclical pressures. This may occur as central banks utilise forward guidance and quantitative easing measures to keep term structures low to provide Governments with fiscal space. As such, we remain comfortable that negative impacts from rising inflation / rates will be manageable, albeit we acknowledge rate volatility may impact REITs in the short term.

Drilling down into the sub-classes, we invest in the senior debt of high-quality REITs in the industrial, office, retail, diversified, specialist and residential sub-sectors. Common characteristics shared across these REITs include:

- Market-leading, reputable and well-regarded businesses;

- Mostly listed on the ASX, with ready access to capital markets;

- Managed by highly experienced and skilled Management teams with solid track records;

- Owners of premium grade assets in diversified portfolios with medium/long-term leases to quality tenants;

- Possessing conservative financial profiles and gearing levels and with ready access to liquidity; and,

- Rated investment grade, with low default risk.

While quality of Management is a mainstay of our credit investment process, in the current environment we believe this to be more important than ever. We would back experienced Management teams to actively “work” their portfolios and businesses for the benefit of debt and equity investors. Examples of “active” management being undertaken currently include remodelling / refitting assets and providing flexible offerings to retain/attract tenants, pursuing high returning development opportunities, actively engaging in accretive asset management / M&A, developing ancillary revenue streams including from funds management activities, and seeking out relationships with capital partners to pursue targeted growth strategies. Crucially, these earnings enhancing initiatives can only be undertaken by businesses with significant financial flexibility.

Digging further into the weeds, certain REIT debt are among the remaining few pockets of investment grade credit which benefit from financial maintenance covenants, including around gearing and interest coverage. These provide strong protections for debt investors. We favour REIT investments at the top of the capital structure, and where we have direct recourse to the underlying property assets, which further mitigates downside in tail risk scenarios.

Environment, social and governance (ESG) considerations

The Property Trust sector is among the more progressive sectors in the Australian market as it relates to sustainability. Australian property companies have emerged with top rankings in the well-regarded GRESB Real Estate Assessment (a global ESG benchmark for real assets), for a decade through to 2020. ESG considerations tend to focus on the ‘green’ credentials of buildings and Australian REITs have been early adopters, focusing on energy efficiency, water conservation, and renewable energy generation such as solar panels. While initially such initiatives were undertaken as cost-saving measures, more recently, green credentials have become a key differentiator to attract sustainability conscious tenants, thereby enabling the tenant to meet their own broader sustainability commitments.

ESG considerations in action

In 2019, QIC Shopping Centre Fund, a high-quality shopping centre REIT managed by the Queensland Investment Corporation, issued an inaugural Climate Bonds Initiative certified Green Bond. A first for the retail real estate industry globally, the proceeds of the Bond have been applied to improve energy efficiency and reduce emissions at three of the REIT’s major shopping centres in Australia. We were happy to invest in a transaction which directly linked debt obligations to environmentally friendly use of proceeds.

While the sector is well placed to address climate change and lowering its environmental impact, shifts to societal preferences have created other headwinds for certain REITs. We have already discussed the pandemic accelerating a shift to online/hybrid work impacting retail and office REITs. Away from this, a recent example where ESG considerations played a significant role in our investment decision making, was with respect to the ALE Direct Property Trust’s (“ALE”) recent new debt issuance.

ALE is the landlord and owner of 86 pubs around the nation which are their sole assets. When undertaking due diligence, we considered society’s changing attitudes towards poker machines, the negative consequences arising from problem gambling, and the potential for responsible gaming regulation to be significantly enhanced. We also considered the impact this could have on tenant profitability going forward. ALE’s portfolio is unique in that the properties are all leased to a single tenant, Endeavour Group, until recently a division of solid investment grade rated company Woolworths Group. ESG concerns around exposure to alcohol and gambling from its own investor-base, triggered Woolworths to pursue a demerger of the Endeavour Group. Whilst ALE’s leases are long-term, these socially driven changes indicated to us the potential for a reduction in tenant quality, together with a more challenging environment for re-leasing, capital expenditure and asset valuations in the future. The continued impact of COVID-19 on the hospitality and leisure industry were also considered. Ultimately, we determined not to participate in the primary issuance due to ESG concerns.

Final thoughts on REITs from a bond investor

We believe our REIT investments should stand to benefit from a recovering economy and continue to provide attractive risk-adjusted returns for our investors.

In a downside scenario, (including pro-longed lockdowns), solid issuer fundamentals, quality assets and contractual protections for senior debt investors should support the value of our investments.