by Kevin J. Schmitz – Portfolio Manager

During a market dislocation or crisis, short-term asset prices can separate from long-term fundamentals. At MFS, our investment team believe that the best time to prepare for a crisis is before it arrives. After having lived through the global pandemic, the financial crisis and the bursting of the dot-com bubble, we have a game plan for navigating these types of dislocations.

Developing a durable framework

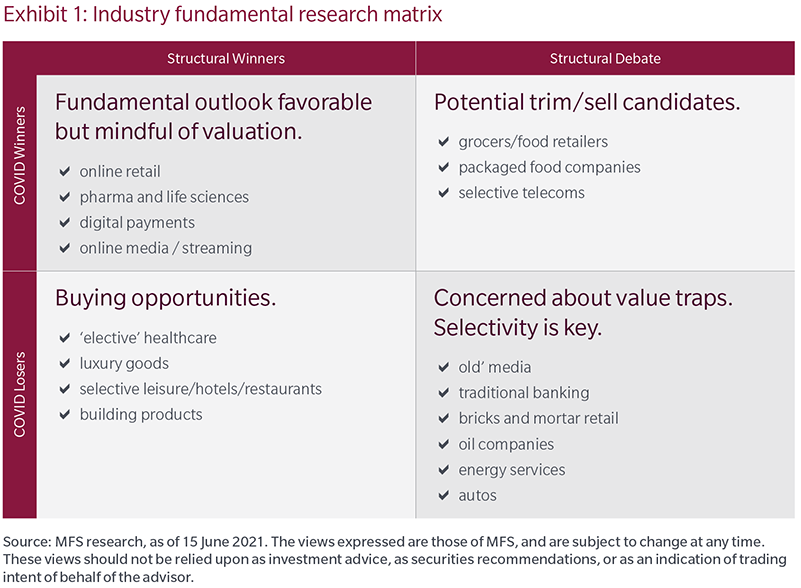

In the depths of a market downturn, we don’t start our analysis from scratch. Instead, we roll out the crisis playbook that we have developed over the years and adjust for whatever nuances there are in the crisis at hand. With this in mind, we thought deeply about how the COVID-19 pandemic has impacted the world. This led us to categorize companies in terms of COVID winners and COVID losers. As always, we also characterized companies in terms of long-term structural winners and losers. The result of this analysis is a two-by-two matrix that includes four buckets: COVID winners and losers and structural winners and losers (Exhibit 1).

Let’s take a closer look. The upper left-hand quadrant contains stocks that are both COVID winners and structural winners. Despite elevated valuations, we have resisted the urge to trim these winners given strong long-term fundamentals. The opposite of this is the lower right-hand quadrant, which contain stocks that are both structural losers and COVID losers. These companies have generally struggled throughout the pandemic, and we remain concerned about their long-term viability. Despite attractive valuations, we are being selective when adding to stocks in this quadrant. The top right-hand quadrant contains stocks that are structural losers but COVID winners. These are companies in industries that have gotten a nice lift because of COVID but whose prospects are uncertain. In this bucket, we are using the COVID tailwind to exit positions. The lower left-hand quadrant includes stocks that have not fared well during the pandemic but could be attractive based on their long-term fundamentals. This area has been the source of many new ideas.

Focusing On Long-Term Fundamentals

Our active investing foundation is built on the belief that fundamentals drive stock prices over long periods, so the key to surviving an environment like a pandemic is to have that long-term time horizon. We strive to ensure that our teams focus on the long term, separating signal from noise. This matrix is one example of how we accomplished that during the pandemic. It is also a primary example of how we collaborate globally across sector teams and investment platforms. The matrix started in the domestic equity group but found applications throughout the MFS Global Research Department.

Offering A View Of Market Dislocations

There were sizable market dislocations when the COVID-19 crisis hit. For long-term investors, these types of dislocations have the potential to create opportunities. So that’s what our teams are focused on — identifying where the market may be too optimistic or pessimistic relative to long-term fundamentals. We remain focused on fundamentals instead of technical factors or the hype and noise that are in the daily headlines. We believe this emphasis on essential fundamental factors helps create long-term value for clients through the responsible allocation of capital.