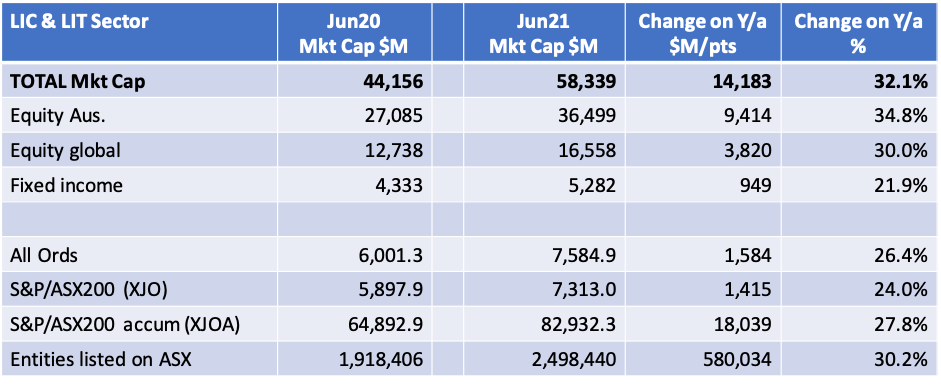

At the end of June, the Listed Investment Companies (LICs) and Listed Investment Trusts (LITs) sector had seen its market capitalisation rise 32% from a year ago.

Commenting on the sector’s increase over the past year, Ian Irvine, CEO of the Listed Investment Companies and Trusts Association (LICAT) noted that the sector had benefited from two IPO capital raisings in June (ASX: WAR) and (ASX: SB2), amounting to some $300 million in new capital.

In addition, the sector performed strongly at an underlying level, up 31.4% excluding IPO capital. “This was driven by both the increasing value of investment portfolios and the share price of the LICs and LITs themselves,” said Mr Irvine.

“There is continuing interest from investors who understand the benefits of the LIC and LIT closed-end fund structure, including its cost efficiency, management stability and focus on the long term.”

LIC & LIT market capitalisation over 2020-21

In the case of LICs, Mr Irvine said the ability for profits from previous periods to be returned to investors in future periods, had assisted in the delivery of income stability to investors.

”Investors who bought LICs/LITs when they were trading cheaply relative to asset backing in 2020 have been able to generate particularly high returns. Not only have they benefited from the upswing in the market value of shares generally, but they have also received a supplementary return as the LIC/LIT shares themselves returned to a more normal trading level relative to asset backing,” he said.

Mr Irvine said LICAT was also pleased to see the income/yield segment of the LIC/LIT sector performing well, with fixed income LITs continuing to pay unitholders regular monthly income.

“In an economic environment where income and yield are hard to find, these LITs have continued to generate returns and income for their underlying investors,” he said.

LICs and LITs have been assisting investors in growing their wealth and in meeting their income needs for nearly 100 years. Today, over 700,000 Australians invest in the LIC/LIT sector, according to LICAT.