The fundamental value of a Resource company can be assessed essentially by two things – the commodity price and everything else – like production, costs and discount rates. As company’s production plans and costs position change relatively slowly, it is the more volatile commodity price that generally sets the shorter-term share price movement.

Energy stocks lagging the commodity boom

However, when we look at key ASX-listed energy stocks and Woodside Petroleum (WPL) in particular, its share price has massively underperformed the strong rise in its key commodity – oil which also links to LNG pricing.

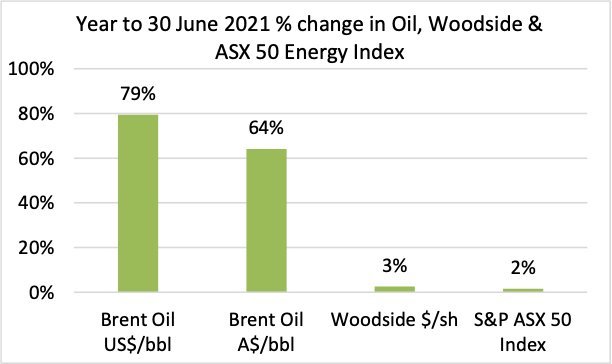

Woodside’s share price closed on the 30th of June 2021 at $21.21/share, a gain of just 3% for the year. The top 50 S&P ASX listed Energy stocks rose just 2% for fiscal year 2021. This compares to the 79% and 64% rise in Brent spot oil price to US$74.7/bbl and AUD$99/bbl respectively. In the same period, when converted to A$, LNG rose 457% and thermal coal prices rose 132%. Energy producers are highly profitable again but share prices have clearly lagged.

Chart-1 Brent Crude Oil price, Woodside & ASX Energy from 30 Jun 2021 and 30 Jun 2020

Source: FactSet

Woodside’s de-rating appears over-done

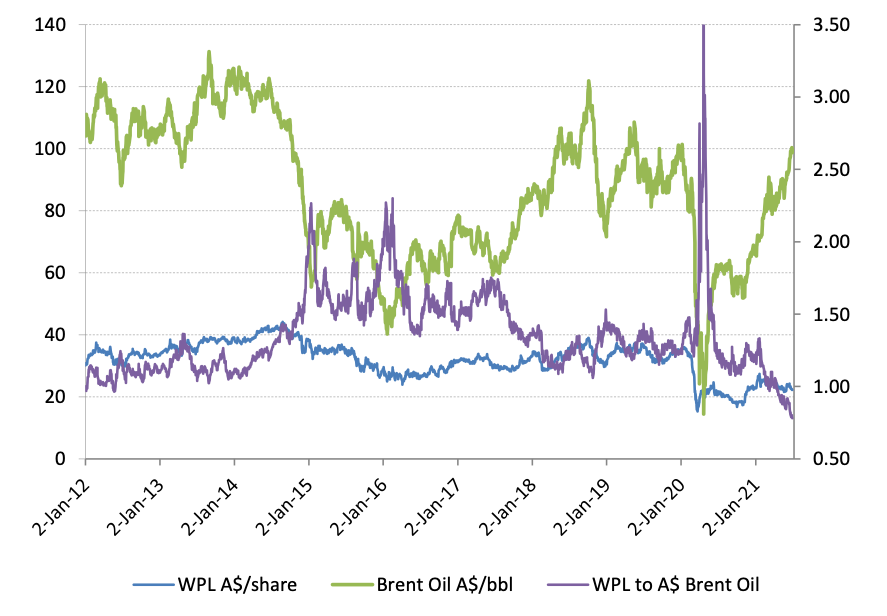

Chart -2 starkly shows Woodside’ underperformance relative to the oil price. At ~A$100/bbl, the Brent Oil Price is 16% above its average A$ price since 2012. WPL’s share price however is languishing at 30% below its average price traded since 2012.

The ratio of Woodside’s share price to A$ Brent Oil price as shown as the purple line in Chart -2. This ratio has de-rated to be 42% below its average level since 2012. We must go back to 2003 to see a similarly low ratio of Woodside’s share price to the oil price. On an oil pricing basis Woodside’s shares are at a two-decade low rating.

Chart-2 Woodside & A$ Brent Oil price (lhs); WPL to A$ Oil Price ratio – purple line (rhs)

Source: FactSet

Woodside appears very cheap relative to oil prices

What could be the drivers of Woodside’s poor relative performance?

Share price to commodity price ratios are only rough proxies for value for long asset life companies like Woodside. Operational items also affect Woodside’s valuation, and we urge investors to consult analysts detailed forecasts for these influences.

A likely recent share price driver is the selling of carbon-emitting energy producing stocks for portfolio mandate reasons, regardless of valuation. We acknowledge future costs for carbon abatement or restrictions upon new developments can crimp long-term earnings. However, the rapidly recovering near-term profitability of Woodside and for some other energy stocks appear to be ignored.

The de-rating process for Woodside’s share price relative to the oil price has been continuing since 2016. However, the current ratio is far below this down-trend and suggests that even a 20%-plus rise in WPL share price would merely restore WPL to its de-rating downtrend, assuming oil prices remain the same.

Oil pricing – fundamentals are improving

Perhaps Woodside is weak because the market is expecting oil prices to fall?

There are persistent threats to oil pricing from mutant virus reducing global oil demand growth or an ill-disciplined production response from OPEC, Russia and/or Iran. However, countering these risks is a remarkable firming of global oil market fundamentals.

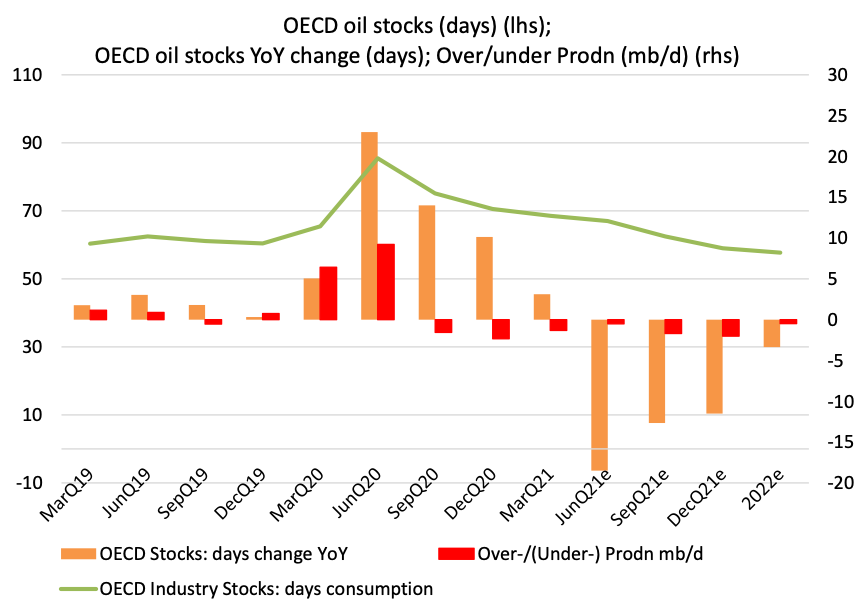

Incredibly, global oil inventories appear headed for normalisation this year, even before widespread travel and economic restrictions are lifted. See in Chart-3 the green line, represents days of OECD oil inventories, based on our interpretation of IEA and OPEC supply and demand forecasts. US weekly data is showing US refining capacity utilisation is back to normal at 93%, but with flat domestic oil production, US crude inventories are now nearly two days below 5-year average level.

Combining tighter inventories with a critical under-investment in depleting producing capacity, sees a rising chance that current oil prices may be sustainable for longer than most expect. It may perhaps escalate prices beyond US$80/bbl to encourage new supply. The oil futures market is currently price Brent crude to be over US$70/bbl until mid-2022. This pricing is a highly profitable for WPL, particularly with the AUDUSD at ~$0.75.

The market appears to need more OPEC & Russian oil, and a disciplined and measured supply increase is consistent with maintenance of current strong oil prices.

Chart-3 OECD Inventories of oil in days of consumption – normalising soon

In conclusion – positive revisions a likely catalyst

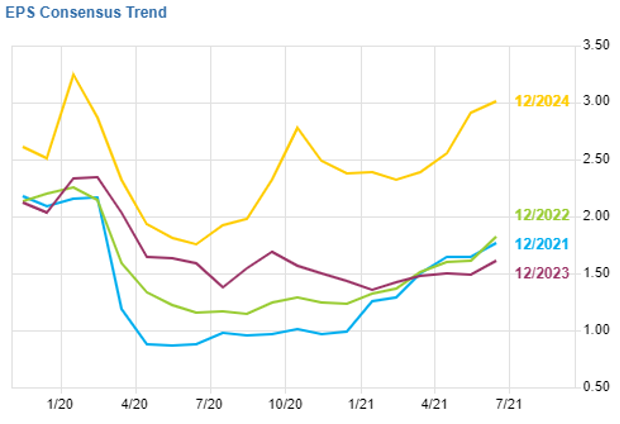

We think that if current oil prices are maintained, this can be a for trigger for further significant positive revisions in analyst earnings and recommendations for oil stocks including Woodside. See Chart – 4 below for Woodside’s positive eps estimate trends.

This may prompt some of the 7 million shorted Woodsides share to cover positions. More importantly, value investors currently have a multi-decade opportunity to reap near-term benefits of rising profitability at a far cheaper than normal relative price.

Chart-4 Analyst’s estimates of Woodside’s EPS – appear trending up

Source: FactSet survey

Please note the author is a holder of Woodside shares. NOTICE: This communication explicitly does not constitute a recommendation to trade any security. Investors should seek appropriate professional advice prior to trading any listed or unlisted security or asset.