by Paul O’Connor – Head of Multi-Asset / Portfolio Manager

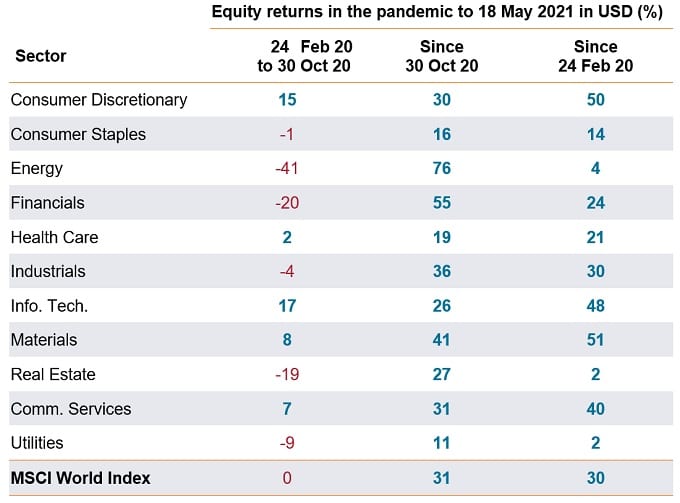

It is a remarkable fact that the coronavirus era, a time of great uncertainty and human suffering, has been a very rewarding period for investors in risk assets. While it is not entirely clear when the pandemic era began, 24 February 2020 seems like a reasonable day to choose, from a financial market perspective. This was the start of the big sell-off, with major stock markets dropping 3-4% that Monday, in response to reports that the coronavirus had spread beyond China to Italy, Iran and South Korea. Since that day, investors have reaped 30% returns from holding global equities (Exhibit 1) and have enjoyed solid gains from owing high yield bonds, commodities and most types of alternative assets.

Exhibit 1: Investors have reaped significant gains since the pandemic began

Source: Janus Henderson Investors, Bloomberg, as at 18 May 2021. Note: Returns based on MSCI Global indices. All returns in US dollars. Past performance is not a guide to future performance.

The ‘V-shaped’ recovery in risk appetite seen over this period reflects the fact that, although the coronavirus caused one of the deepest recessions in history, it was also one of the shortest. The extraordinary policy support provided by global monetary and fiscal authorities played a major part in reviving investor risk appetite after last spring’s market crash, but confidence in the economic consequences of vaccines has been the key driver of sentiment since last November, when the good news on this front first began to emerge. Naturally enough, the rally in stocks since then has seen equity market leadership pivot towards cyclical sectors and regions as consensus conviction in this year’s reopening economic boom has strengthened.

Goldilocks scenario

Although coronavirus-related restrictions continue to hamper economic activity in many parts of the world, the global recovery has gathered momentum in recent months as the European and US economies have begun to reopen, the latter boosted by sizeable fiscal stimulus programmes. The outlook from here is for global growth to surge into a broad-based global boom by the middle of 2021, as the vaccine rollout unlocks pent-up consumer demand in many developed economies. Although inflation is expected to move significantly higher in the months ahead, reflecting base-effects and reopening bottlenecks, economists generally believe that these dynamics will be transitory and inflation will return to below 2% in most major economies in 2022. Accordingly, the major central banks are widely expected to keep interest rates on hold this year and next.

While it is not hard to conclude that this goldilocks backdrop of strong growth and low interest rates is a highly constructive one for asset prices, the challenge now is evaluating just how much of the good news has already been factored into financial markets. The speed and scale of the recent rally in stocks and the elevated level of equity valuations, suggest that plenty has. Global equities have risen by more than 30% since the start of November [1], with small caps, value stocks and cyclicals markets advancing by much more than that. The fact that industrial metal prices have risen by over 40% during the same period and oil prices by over 80%, certainly points in the same direction, as does the observation that corporate bond spreads are close to all-time lows.

Peak sentiment

Most indicators of investor sentiment and positioning confirm that investors are highly optimistic about the outlook for risk assets and well invested. A composite index of equity positioning calculated by Deutsche Bank, based on 14 different indicators of retail, hedge fund and institutional investor behaviour, recently recorded a reading at the 98th highest percentile in its 11-year history [2]. The survey showed cash allocations by households, pension funds and equity mutual funds at or near record lows, equity weightings near levels last seen in early 2000 and short interest near a two-decade low.

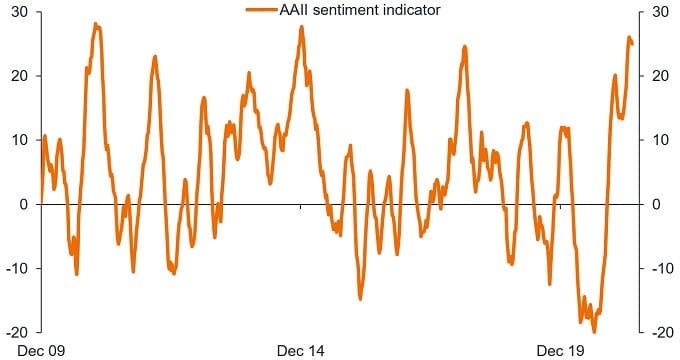

One specific sentiment indicator that is now close to a historic peak is the American Association of Individual Investors equity survey (Exhibit 2). This survey recently showed levels of US retail investor bullishness that have rarely been surpassed.

Exhibit 2: Equity market sentiment – bull/bear spread from AAll equity survey

Source: Janus Henderson Investors, Bloomberg, American Association of Individual Investors, as at 18 May 2021.

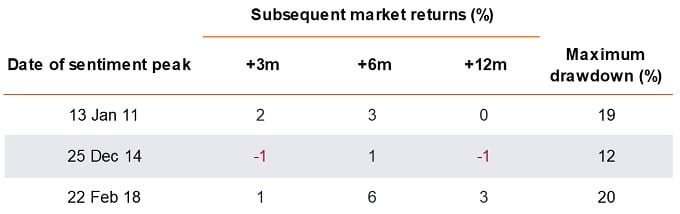

On the three other occasions that investors were broadly as optimistic as now, according to the survey, US equity rallies became fatigued shortly afterwards, morphing into prolonged periods of sideways range-trading over the following year or so (Exhibit 3). In two of these cases, stocks saw 20% drawdowns within the next year. In the other case, they experienced a 12% pullback.

Exhibit 3: Equity market returns following peaks in investor sentiment

Source: Janus Henderson Investors, Bloomberg, American Association of Individual Investors, as at 18 May 2021. Past performance is not a guide to future performance. Note: Sentiment peak refers to 10-week moving average of the spread between bullish and bearish responses. Returns and maximum drawdown based on the S&P 500 Index in the year following a sentiment peak.

Peak growth

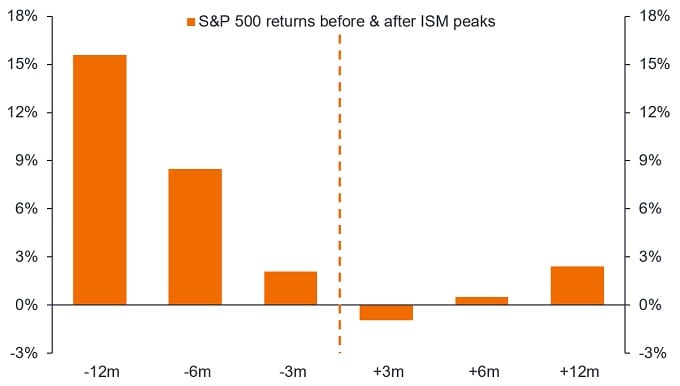

Of course, it is hardly surprising to see investors being optimistic now, given that a global economic boom is widely anticipated. In previous cycles, risk appetite has tended to be highly correlated with the rate of change of economic activity and investors have typically become increasingly bullish as economic recoveries passed through this acceleration phase. However, while this rationalises the recent surge in investor optimism, it also raises questions about its durability. Although the global economic expansion seems likely to remain strong well into 2022, growth rates look set to peak sometime soon. The US ISM Manufacturing Index, a good proxy for global growth expectations, has already peaked. Equity market returns are usually strong up to the peak in the ISM and weaker than usual after that (Exhibit 4). Cyclical frameworks like this reinforce the message from sentiment and positioning indicators, which is that equity returns over the next few quarters are unlikely to be as rewarding as those enjoyed in recent months.

Exhibit 4: Equity returns around peaks in the US ISM Manufacturing index

Source: Janus Henderson Investors, American Association of Individual Investors, as at 18 May 2021. Past performance is not a guide to future performance.

These analyses highlight one seemingly paradoxical feature of financial markets, which is that the outlook for investment returns usually dims as optimism about the economic cycle reaches its cyclical peak. In contrast, the most rewarding time to buy equities is typically when sentiment is gloomy and macro fundamentals are crumbling. Investors who bought risk assets under these conditions in March 2020 were handsomely rewarded for their valour. With investor sentiment and cyclical economic conditions today being the polar opposite to back then, it should not be surprising to expect future investment returns from here to be significantly different to the rich gains of the past year.

While the slowing of growth is one factor that typically depresses equity returns as the economic cycle matures, this is usually reinforced by the downward pressure on stock valuations from rising interest rates and bond yields. This has not been a major phenomenon recently, thanks largely to the dovish stance taken by the central banks in major developed economies. Despite the surge in growth expectations over the past six months, US 10-year Treasury yields are less than 20 basis points higher than pre-pandemic levels. While bond markets have priced in a significant uplift in inflation expectations, the US Federal Reserve’s dovish signalling about the path of future interest rates has kept the lid on real yields, delivering a highly accommodative monetary stance.

Peak policy

Still, we do expect government bond yields to keep grinding higher as the global recovery strengthens and bond issuance associated with sizeable fiscal spending programmes lifts real yields. In broad terms, it seems reasonable to conclude that the pacifying impact of central bank policies on yields is likely to fade from here. For one thing, bond markets have already priced in very dovish expectations for short rates in all the major economies, expecting the next round of rate hikes to be later, more gradual and more modest than in previous cycles. Furthermore, central bank asset purchase programmes have peaked already. Global QE is expected to fall from around US$8.5tn in 2020, to US$3.4tn this year and US$0.4tn in 2022.

So monetary policy joins the list of constructive market catalysts that now seem to be peaking. While the strong global recovery should provide tailwinds for risk assets well into 2022, the potential impact on stocks from future changes in investor sentiment or expectations for growth or monetary policy now look symmetric at best, having all been very equity-friendly during the sharp market rally from November 2020. The labour and materials shortages and other bottlenecks seen in the US recently might well intensify in the months ahead, both there and elsewhere, raising some questions about current bullish consensus expectations for growth, profitability or central bank policies. While we retain a broadly constructive view on the macro outlook from here, we feel that a lot of good news is priced in. The evidence leans in favour of equities moving into a more choppy consolidation phase in the months ahead, rather than continuing the strong uptrend of the past six months or so.

[1] Source: Bloomberg, 30 October 2020 to 17 May 2021.

[2] Source: Deutsche Bank, 16 April 2021.