OPEC & its allies manipulate the oil supply side of oil markets. However, it is the massive US oil production, refining, exports and consumption sector that helps set the level from which the oil market can discover pricing equilibrium.

Strong demand recovery from a low base

The US’s hi-frequency petroleum data is showing considerable strength, though coming from a low base impacted by the Covid-19 pandemic. The blue line in Chart -1 charts US refining runs which cratered in 2020.

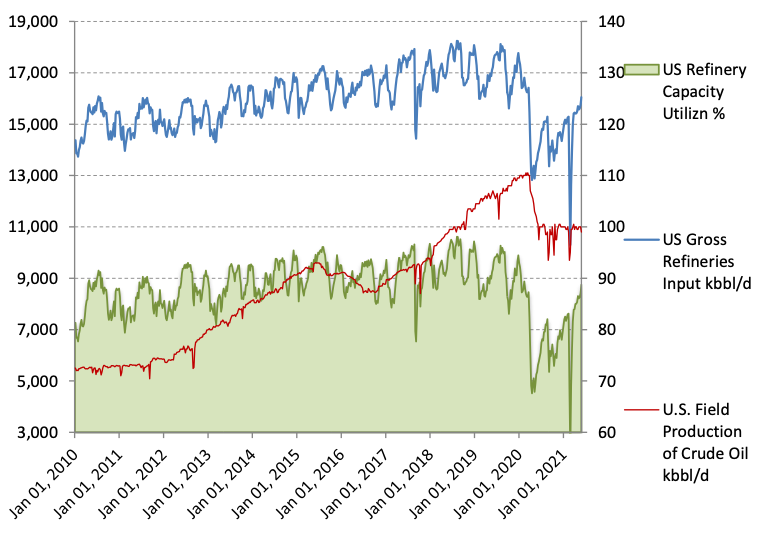

Chart – 1 US weekly data Oil Production, Refining Runs on left hand scale; and US Refinery Capacity Utilisation in % on right scale.

Source: US EIA

Slump passed, now racing to close the 10% capacity gap

In Chart – 1 we see that US oil refining fell from 17+ million barrels per day (mm b/d) to as low as 13 mm b/d in JunQ2020 as Covid-19 lockdowns interrupted all manner of oil products consumption. The refining sectors’ capacity utilisation fell below 70%. Consumption and refining runs have been rebuilding for a year and have gradually risen to 88.7% and 16.0 mm b/d respectively. This is a remarkable upturn given that the US is still disrupted by the pandemic. Despite the rise in products demand, US refiners have been disciplined to limit refining output rise to enable their excess inventories to be sold.

US crude oil production bounce is lagging

US oil industry entered 2020 as the biggest producer in the world. However, output fell heavily during the June Half 2020 from 13 mm b/d to just over 10 mm b/d. US producers are quick to stop drilling, completing new shale wells and shut-in marginal producers – see red line in Chart-1.

While oil drilling rigs operating in the US fell from 675 in early 2020 to a low of 174 rigs turning by mid-2020, they have recovered to 359 rigs last week. This level of drilling appears only sufficient to offset shale wells’ high rate of output decline and keep US crude oil production rate at around 11 mm b/d.

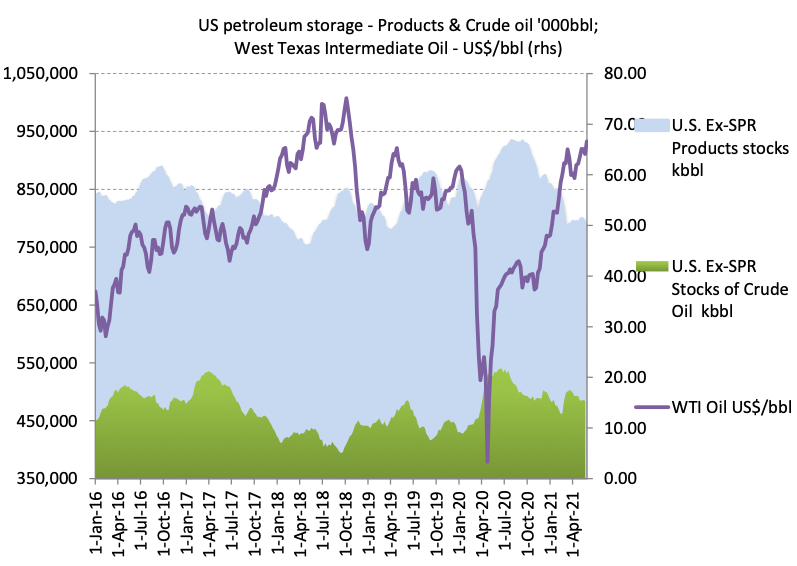

Chart- 2 shows the result that high products demand combined with refiner’s careful management has reduced products inventories more quickly than crude oil inventories. US refining also exports around a net 2.4 mm b/d that assist inventory management.

Chart – 2 US Products and Crude Oil Inventories in ‘000bbl on left scale; and the West Texas Oil Price in US$/bbl on right scale

Source: US EIA

Gasoline stocks are already tight

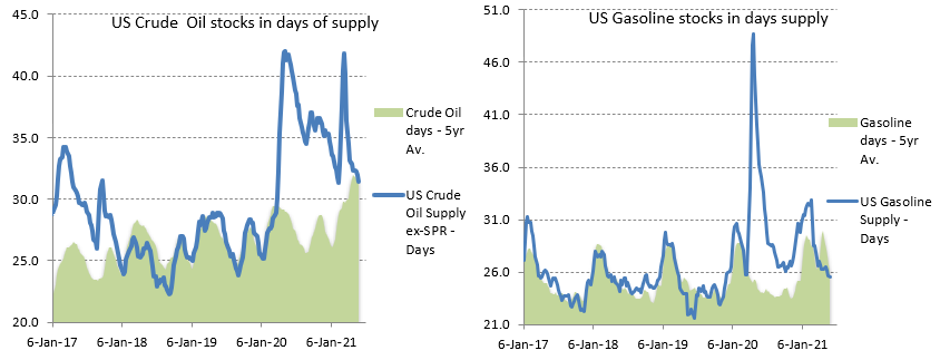

Chart – 3 US weekly petroleum inventories – measured in days of use

Source: US EIA

The key driver to strength in US petroleum markets has been the recovery of petroleum demand for gasoline – mainly for car transport; also, diesel and propane use – mainly for industry and heavy transport. These product inventories are tight as they are at levels well within their 5-year average levels, for this time of the year. Predictably, aviation kerosene, while improved from 69-days of cover to just 32-days of supply – are still above normal levels of around 27-days.

Privately held crude oil inventories have reduced from over 40-days to 32 days. While the momentum of falling crude inventory is positive for oil pricing, the inventory is still above the ~28-day level, when this market is perceived to be uncomfortably tight.

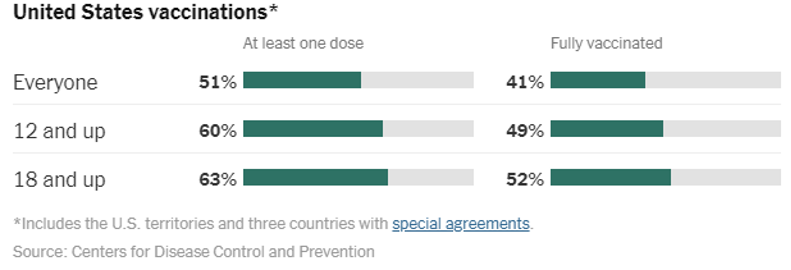

Chart – 4 – US vaccinations to 3rd June 2021* – economic normalisation closer as herd immunity goal in sight

*Source: Covid-19 Vaccinations – New York Times tracker

Strong outlook for products – a positive price signal for crude oil

The US vaccination program has reached 63% of adults*, 52% fully vaccinated and with millions more per week obtaining prophylactic cover. As more US sectors resume normal operation, plus the huge fiscal stimulus and pent-up demand for products we see US petroleum products demand reaching pre-pandemic levels during next year.

Refiners’ reaction would likely be to cease de-stocking and match or exceed the rising final products demand. We forecast an increase capacity utilisation to over 90% and a demand boost of around 1.5 mm b/d of extra crude supply in coming quarters. This will include imports of heavy oils that shale does not yield. These crudes come from Canada and OPEC.

US crude producers need two things to respond. Firstly, stepped-up oil field activity that takes some time; and secondly, a strong price signal to both incentivise and to cashflow fund the drilling activity. A West Texas price of US$70/bbl and tightening inventory cover signals should prompt this oilfield activity.

US strength gives OPEC some room to expand quotas

The gathering strength of the US petroleum market plus a widening global recovery provides firming of oil market fundamentals. There are risks like a resurgent mutant virus or an abrupt lifting of the Iranian export boycott. However, the rising global demand trend has increased the chances that OPEC & its allies can gradually increase its production quotas over the next few months, without de-railing the oil price rally.