The current recovery in markets highlights the need for investors to have the necessary tools to manoeuvre portfolios to meet the challenges and idiosyncrasies of these markets. Navigating the world of investment opportunities through Smart Beta ETFs has empowered advisers and investors to build robust portfolios and target outcomes.

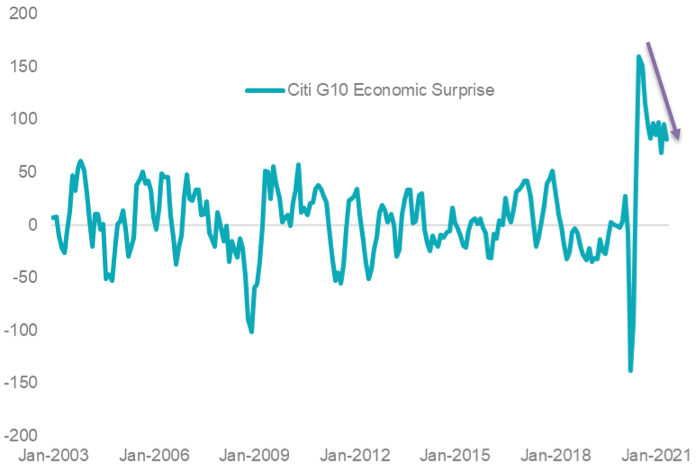

During the first quarter of this year the pace of recovery surged beyond economists’ expectations with Citigroup’s Economic Surprise Index reaching historic highs in Q3 2020 (chart 1). But it has since started to normalise.

Chart 1 – G10 Citigroup Economic Surprise Index

Source: Citigroup, Bloomberg. January 2003 to April 2021.

This chart measures ‘surprise’, but it doesn’t differentiate between an upside surprise and a downside surprise. Therefore, an optimist’s view of this data would be that data releases have been stronger than expected while a pessimist’s would be that data releases have been worse than expected.

The normalisation in results then, may be an indication that the global economy is transitioning from an early-cycle to a mid-cycle recovery, which has historically boded well for quality stocks. Quality stocks, according world leading index provider MSCI, are those with: high return on equity (ROE, stable year-on-year earnings growth and low financial leverage).

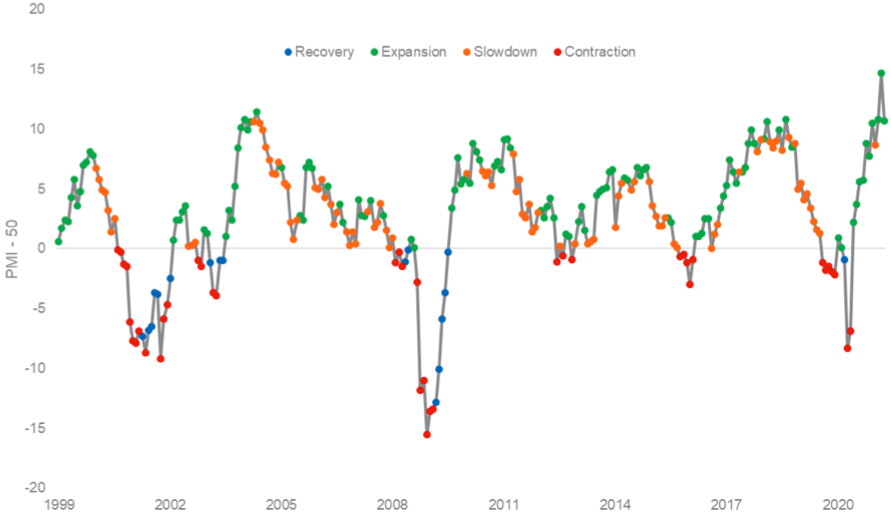

An early-cycle to a mid-cycle recovery is usually characterised by falling PMIs (Purchasing Managers’ Index).

Expansion in economic activity is at the highest level since 1997, represented by the US Institute of Supply Management (ISM) Manufacturing PMI Index (chart 2). ISM Manufacturing PMI measures the change in production levels across the US economy from month-to-month. It is considered to be a key indicator of the state of the US economy.

Chart 2 – US ISM Manufacturing PMI Index

Source: Bloomberg, November 1997 to April 2021. Economic phase is a function on the current value of PMI-50 and the three-month change in PMI. Change>0, Level<0 = Recovery. Change>0, Level>0 = Expansion. Change<0, Level>0 = Slowdown. Change<0,Level<0 = Contraction.

Quality is one of the factors MSCI identify in its factor suite of indices. Others include Momentum, Growth and Enhanced Value. MSCI creates an index for each of these factors. With the performance of these indices we are able to analyse how these factors perform during different phases of the economic cycle noted above.

One useful tool for comparison between different performance series is the information ratio. The information ratio measures returns beyond the performance of a benchmark index compared to the volatility of those returns. A positive value indicates risk-adjusted outperformance relative to the benchmark index.

In this instance we calculate the information ratios of different MSCI World Factors using the MSCI World Index as the benchmark.

Our analysis is presented in Chart 3 below. It shows that those stocks that exhibit the MSCI Quality Factor historically outperform during slowdown “mid-cycle recovery” and contraction “recession” periods.

Chart 3 – Information ratio by MSCI World Factor and economic phase

| Factor Information Ratio | ||||

| Period | Quality | Momentum | Growth | Enhanced Value |

| Recovery | 0.20 | 0.02 | 0.05 | 0.41 |

| Expansion | -0.11 | 0.21 | 0.13 | 0.16 |

| Slowdown | 0.24 | 0.20 | 0.00 | 0.04 |

| Contraction | 0.39 | -0.15 | 0.00 | -0.01 |

Source: Bloomberg, VanEck. MSCI World Factor indices. November 1997 to April 2021.

Should PMIs print lower than their current levels, which would indicate a slowdown or contraction, Quality could shine. On the other hand, should PMIs continue to be stronger indicating an expansion, Enhanced Value could shine.

Smart beta ETFs empower investors to be positioned for both of these outcomes.

| Quality: | VanEck Vectors MSCI World ex Australia Quality ETF (QUAL) VanEck Vectors MSCI World ex Australia Quality (Hedged) ETF (QHAL) |

| Value: | VanEck Vectors MSCI International Value ETF (VLUE) |

And both of these factors, according to MSCI, are able to demonstrate long-term outperformance versus the parent MSCI World Index.