by Jonathan W. Hubbard, Managing Director – Investment Solutions Group

It’s human nature to be fearful of missing out as you watch other people experience short-term financial success. Behavioral biases such as confirmation bias and recency bias creep in and can stoke the flames of market exuberance. However, history is littered with periods when market prices have become irrational and overvalued, and asset purchases turn from research-based investments to momentum-based speculation without sustainable evidence.

With this in mind, we break down the five primary signs of current market exuberance that we feel investors should consider.

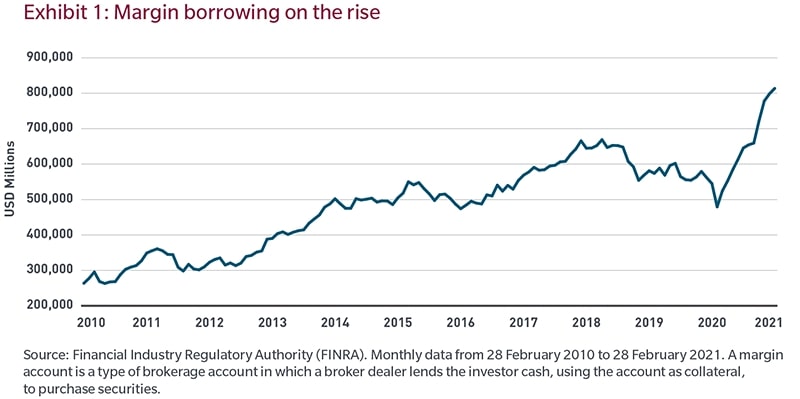

The rise of retail investing and leverage

Intensifying speculative behavior among retail investors is causing concern through new forums of trading, including a greater variety of trading instruments and the gamification of trading. There has been a dramatic increase in retail trading, and margin debt, which are loans in a brokerage account, has been rising at an alarming rate (as shown in Exhibit 1). We believe that borrowing to invest can backfire even during modest downturns. Options trading has also sharply increased, as technology, time and the tediousness of lockdowns have fueled the one-way trade.

Attack of the SPACs

The SPAC (Special Purpose Acquisition Company) structure has provided startup companies with an easier path to go public with less regulatory scrutiny than the traditional initial public offering (IPO) route. SPACs are listed shell companies, which are companies without business operations, that raise funds through public markets first and hunt for acquisition targets second, allowing such targets to sidestep a traditional IPO. SPACs have surged globally to a record $170 billion this year, outstripping last year’s total of $157 billion, according to Refinitiv data. However, the frenzy has started to be met with greater investor skepticism and has caught the eye of regulators.

Increasing Interest in bitcoin and cryptocurrencies

The cryptocurrency Bitcoin hit an all-time high in 2021, prompting many investors and investment professionals to consider whether it is appropriate for their portfolios. However, we are skeptical about the potential for cryptocurrencies to operate outside the traditional financial system. Policymakers may seek to tighten regulatory frameworks and centralize oversight of cryptocurrencies, and we believe these and other potential risks should be considered before making any investment decision.

Index concentration and equity valuation

US equity market concentration has been rising since January 2013, with the top five companies of the S&P 500 Index comprising more than 20% of the index by weight as of 3/31/21. The list of top holdings is predominantly technology related, which suggests to us that any downturn in tech sentiment could be detrimental to the broad market. Investors’ appetite for risk has pushed valuations beyond the two standard deviation level, which could lead to significant price volatility and the potential for greater risk.

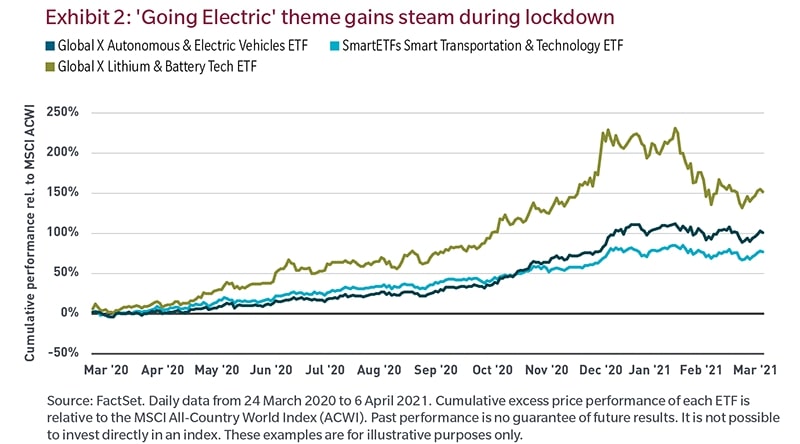

Thematic investing goes electric

We believe the COVID-19 pandemic as well as Biden administration policies are primary catalysts for a greener, more sustainable-oriented economy leading to a greater focus on thematic investing. More mature industries such as automotive have tapped into electric technology (as shown in Exhibit 2) in an attempt to spark sales and enhance their ESG profile. Other staid industries such as healthcare have highlighted the intersection between public health, migration and climate change. We believe that investing in individual themes or a cluster of high-conviction themes is increasing in popularity and the current exuberant environment is likely to continue to accelerate this trend.

How we view market exuberance

During market environments like the current one, we believe it is important for investors to recognize the difference between active management, which is similar to analyzing inclement weather forecasts and responsibly anticipating what is to come, and speculating, which is similar to ignoring weather data and walking an elevated tight rope in a hurricane with no margin of safety. In our view, focusing on fundamental factors such as unit growth, pricing power, sustainable competitive advantages, free cash flow, debt levels, financial materiality and management strength lead to the responsible allocation of capital and the potential of creating long-term value. Market exuberance does not always suggest a reversal is near, but it does present an opportunity to reassess risk and rebalance portfolios based on goals and objectives.

MSCI All-Country World Index measures developed and emerging market stock markets.

The S&P 500 Index measures the broad US stock market.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

“Standard & Poor’s®” and S&P “S&P®” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P“) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones“) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500®is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS’s Products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affiliates make any representation regarding the advisability of investing in such products.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice from the Advisor. No forecasts can be guaranteed.