by Julian Howard, Lead Investment Director of Multi Asset Solutions

Review

The first quarter of 2021 saw the MSCI AC World Index in local currency terms gain nearly 6%. This good result belied the turmoil within global stocks, as long-term interest rates began to rise in anticipation of a global recovery facilitated by effective vaccinations against Covid-19. Investors moved swiftly to re-price those companies which benefited from lockdowns and which would likely benefit from re-opening. This took the form of a significant rotation within the market from long-dated growth stocks to more near-term cyclical value stocks. Typical of the former is the technology sector, with its ‘stay-at-home’ beneficiaries investors are so familiar with, while typical of the latter are the leisure, energy, manufacturing and financial sectors that have been so universally shunned since March 2020.

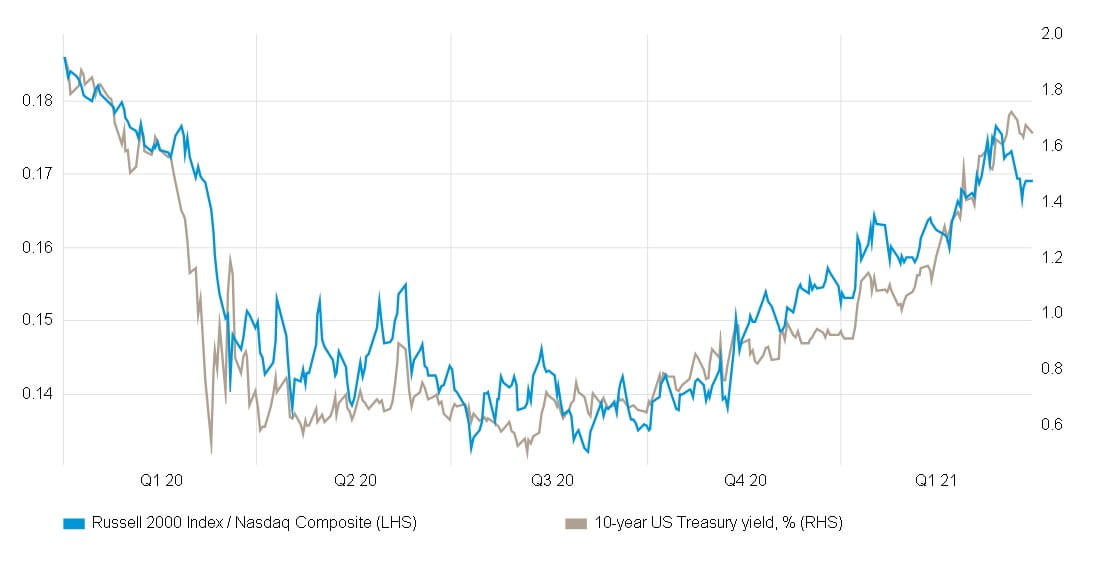

Accompanying the rotation, as mentioned, was the rise in longer-term interest rates. From just over 0.5% in early August 2020, the 10-year US Treasury yield rose to over 1.6% at the end of the review period as bondholders breathlessly priced in higher future inflation. This was in the belief that the battered world economy would not be able to ‘supply’ the surge in demand that would surely ensue from a combination of lockdown easing, unleashed pent-up savings, low near-term interest rates and significant fiscal stimulus. For stocks, the signalling was clear enough: the low interest rates that had been holding up the entire edifice of equity valuations for much of 2020 could no longer be counted on and therefore a re-assessment was due and new style leadership emerged. Value stocks were therefore unsurprisingly ascendant during the quarter, with UK and European, as well as US small caps performing especially well. Technology stocks correspondingly lagged as did emerging market equities which came under pressure as higher US bond yields lifted the US dollar. This presented a familiar headwind in a region subject to the relentless ‘dollarisation’ of both debt and trade receipts over recent years. Chinese stocks in particular stalled, amid government intervention at both the company and market level.

Chart 1: Full circle – Tech / cyclical equity rotations mirror changing bond yields

Positioning

A thematic portfolio pointed to long-term secular trends was always likely to experience a degree of volatility amid a near-term narrative of reflation and recovery. Within equities, exposures to the Nasdaq Technology Index and a new dedicated onshore Chinese equity allocation were buffeted, as investors rotated to those stocks that would most obviously benefit from recovery. However, the recovery theme did not only see market rotation but also a change of market leadership that generated positive momentum at the index level. In other words, markets were still able to make progress under the ‘new regime’. Our strong engagement in equities therefore continued to support portfolios, while additional pragmatic measures had been taken in recent months in anticipation of the changes in sentiment described, without fundamentally compromising the strategic outlook detailed below. At the strategic level these mitigation measures in recent months have included locking in some gains on the aforementioned Nasdaq exposure while also lifting the pan-European equity allocation, since Europe acts as a cyclical play on world growth and should continue to benefit from any continuation of the recovery theme. Tactically, certain positions could also benefit from this theme such as short US Treasury bonds, long pound versus euro, long value stocks over the MSCI World Index and a modest exposure to the Russell 2000 US Midcap Index. Away from equities and tactical asset allocation, government bond allocations predictably suffered during the fixed income selloff described, while allocations to European long / short equities were buffeted by the lack of earnings momentum in the market. Other areas provided encouraging levels of relative stability. Highlights included agency and non-agency mortgage-backed securities, insurance-linked bonds and ultrashort-dated high-quality investment-grade bonds. This combination of equity engagement, pragmatic adjustment and steady downside management ensured portfolios were able to weather the thematic changes in market sentiment described.

Outlook

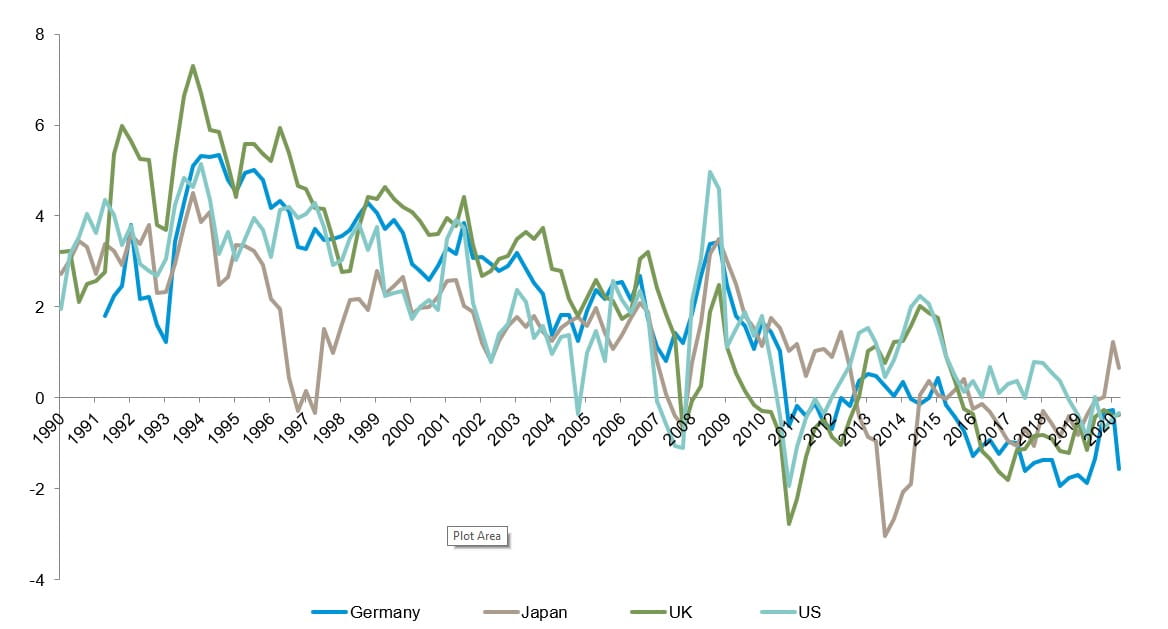

Chart 2: Stagnation not reflation – low growth entrenched in bond market outlook

Amid the euphoria of lockdown easing – at least in the UK and the US – and the personal freedoms that will be regained, it is important to persist with a cool assessment of what the future is most likely to bring. In our view, ‘Roaring 20s’ scenarios excitedly outlined by commentators reflect in part the triumph of optimism over actual reality after months of dismal headlines. The fact remains that the last three decades have seen a steady deterioration in real long-term interest rates reflecting ever-lower growth and inflation forecasts by the bond market. This long history is by itself no guarantee of the continuation of the trend but today many of 2019’s challenges remain outstanding and, in some cases, have become more pressing. These include inequality, ageing populations in the UK, Europe, Japan and to a lesser extent the US and China, unprecedented fiscal overhangs and growing climate change costs, among other things. All of these will ultimately outlast current stimulus measures, forcing back down economic growth and long-term interest rates. Such a worldview suggests continued engagement in long-duration assets whose valuations benefit from low discount rates. These include government bonds to some extent but primarily growth-style equities that can generate long-run revenue streams over time. Getting ‘in the way’ of this scenario is a rebound of economic activity after months of government-mandated suppression. This interregnum period could last anything from three to 12 months, depending on how quickly countries can vaccinate their populations and normalise daily life. Navigating these shifts will demand some tactical pragmatism for sure, but more profoundly an awareness that reflation and stagnation cannot simultaneously be invested for. As such, it makes sense to remain strategically focused on those investment themes that will likely reassert themselves when the initial excitement of re-opening has settled down.