Gold stocks, along with gold bullion have underperformed other asset classes since the start of the year, weighed down by elevated US Treasury yields and a stronger dollar. The rollout of coronavirus vaccines and optimism of a global economic rebound have also dulled its lustre.

There are a number of catalysts that could propel a recovery in the yellow metal and its price in the latter half of the year and in turn, its miners’ stock prices.

One of these is inflationary pressures, which appear to have returned to pre-pandemic norms. Other risks – including radical monetary policies, negative real rates and unsustainable debt levels – remain persistent and pervasive and may remain supportive of higher gold prices.

Gold equities appear cheap compared to the gold price and other equities. We believe they are therefore well placed to benefit as they typically rise more than the gold price in an upswing. And, gold miners have been keeping their balance sheets in order, though they are not yet getting rewarded for it.

Risks ahead provide supportive backdrop for gold

While a potential rise in interest rates may impede the performance of gold in the near term, we expect a catalyst to emerge in the latter half of the year that could drive the yellow metal higher. The most likely catalyst would be inflation expectations, which have returned to pre-pandemic levels (see Figure 1). As the US$1.9trn stimulus that US President Joe Biden signed into law recently makes its way through the economy, there are concerns that the economy may overheat and push inflation higher. Historically, the gold spot price has performed well in a high inflationary environment.

Figure 1: US market inflation expectations (5 years ahead)

Source: Bloomberg, VanEck. Data as of January 2021.

Meanwhile, economic growth is unlikely to be as rosy as some people would expect. The pandemic is far from over, with new variants surfacing and parts of Europe recording a third wave of infections, while vaccine distribution has been patchy.

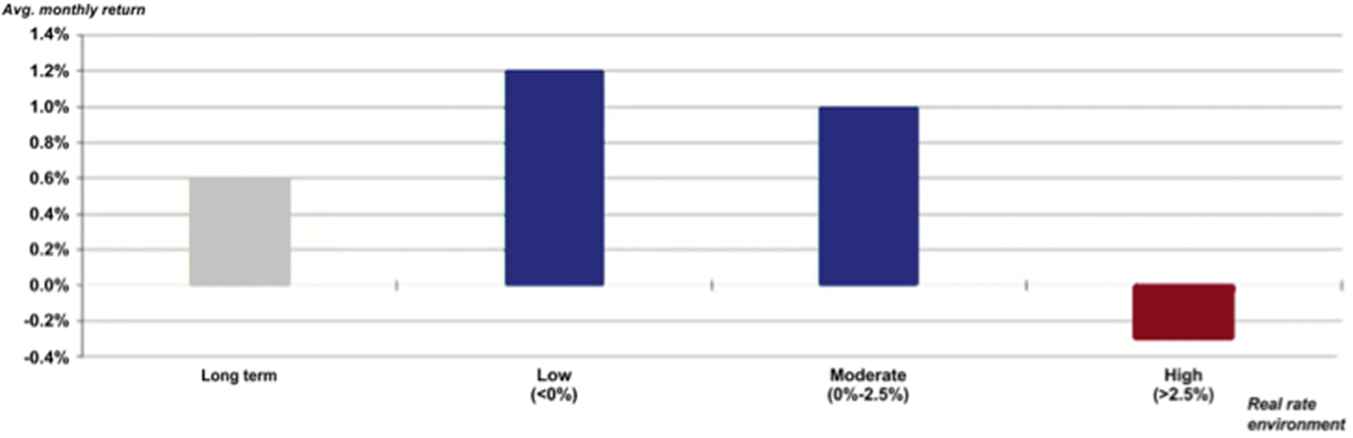

Investors’ preoccupation with rising nominal and real yields – considered a negative for gold – also appears overdone. Although gold performs well when real yields are negative, it also generates returns when real yields are moderately positive, according to a World Gold Council study of 50 years of data (see Figure 2). With the inflation-adjusted yield on 5-year Treasuries at -1.80% and 10-year Treasuries at -0.57%1, we believe that there is ample buffer before real yields become an impediment to gold.

Figure 2: Gold performance in various real rates environments

Source: World Gold Council, as of September 2020 (latest data available).

Over the longer term other systemic risks that could provide a catalyst for the asset classes growth include the extremely high global debt levels which we think are unsustainable, zero rate policies, asset bubbles that seem to be popping up everywhere these days, and a possible weakness in the dollar.

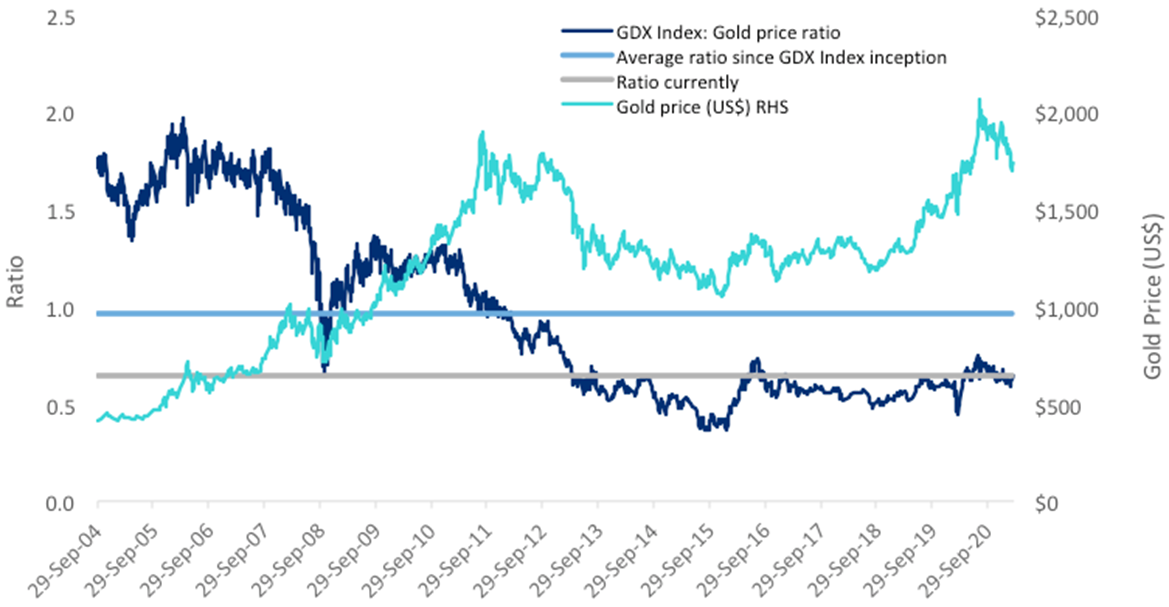

Compelling valuations

Gold miner stocks are trading well below historical averages, having pulled back along with the gold price since the start of this year. You can see this in Figure 3, which shows that the value of gold mining equity, when measured using the NYSE Arca Gold Miners Index, relative to the gold price. This is despite the fact that gold mining companies are generating significant free cash flow; many are fundamentally sound and have robust balance sheets. Most companies are holding their costs below US$1,000 an ounce, and are returning the cash to shareholders via increased dividends and share buybacks.

Figure 3: Gold equity valuations remain at attractive levels

Source: Bloomberg, as of 19 March 2021. GDX Index Inception is 29 September 2004. GDX Index is the NYSE Arca Gold Miners Index. You cannot invest directly in an index.

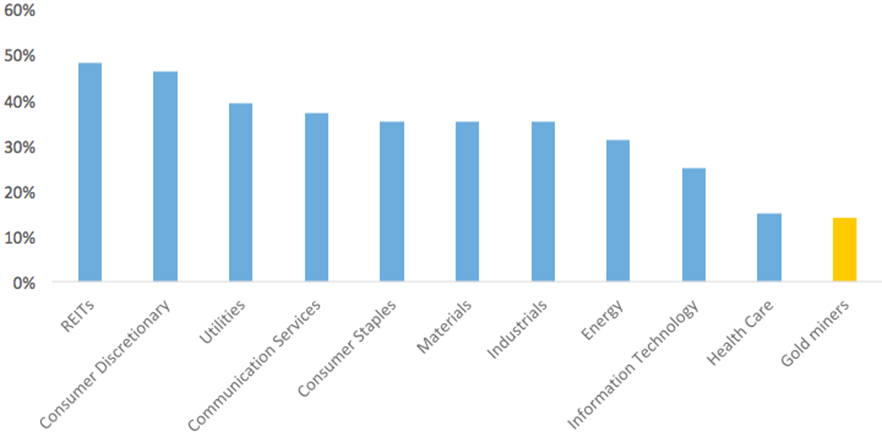

And gold miner’s balance sheets are as strong as ever relative to other equity sectors as shown in Figure 4.

Figure 4: Median total debt to asset ratio (US equities, S&P 500)

Source: Bloomberg: VanEck, 31 December 2020.

Gold stocks provide leverage to bullion

Gold equities tend to outperform gold bullion when the gold price rises, and underperform if the gold price falls. Although this expected relative performance may not hold during certain periods, gold equities have consistently demonstrated their effectiveness as leverage plays over the years. As investors become more confident that the current low multiples are not merely ‘value traps’, given their improved earnings and fundamentals, gold miners could benefit from an upward re-rating as capital flows towards value shares such as commodity-related stocks.

Investors can gain exposure to global gold miners via the VanEck Vectors Gold Miners ETF (GDX), the world’s largest gold equities.

ENDPOINTS

1 Federal Reserve Bank of St Louis (FRED), as of 19 March 2021.

2 FactSet, as of 19 March 2021.