Australian investors are often attracted to Australian small companies because of their historical long term outperformance above large companies. A similar history of long-term outperformance also applies for international small-cap stocks.

Some benefits of investing in international small-caps

1. Underrepresentation in portfolios

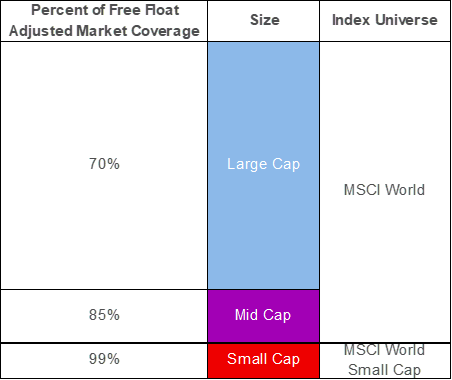

International investments in Australian investors’ portfolios are often dominated by large and mid-sized companies from developed markets. This means they are effectively benchmarked to the MSCI World ex Australia Index, which aims to capture the performance of large- and mid-cap companies. This index captures the largest 85% by free float-adjusted market capitalisation coverage of each developed country.

Investors may be missing opportunities in the remaining 15% made up of small-cap companies.

Table 1 – MSCI market coverage reference

2. Historical outperformance of international small-caps relative to global large- and mid-caps

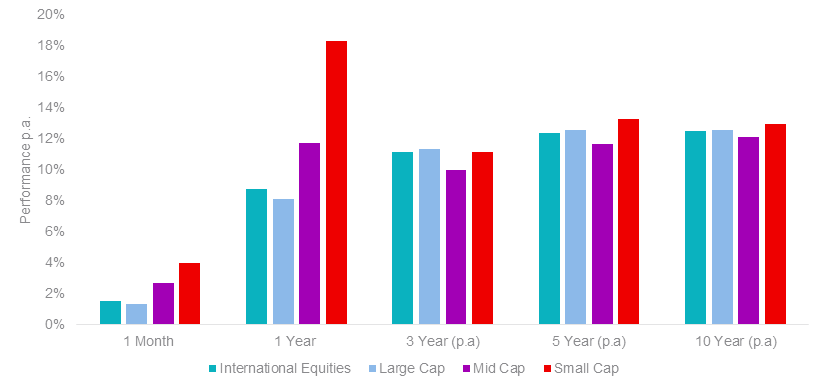

International small-caps have outperformed international large- and mid-caps, and the broader benchmark MSCI World Index in AUD terms over almost all time periods below.

Chart 1 – Performance comparison of international large-, mid- and small-caps, and international equities as at 28 February 2021

3. International small-caps have better risk return characteristics compared to Australian small-caps

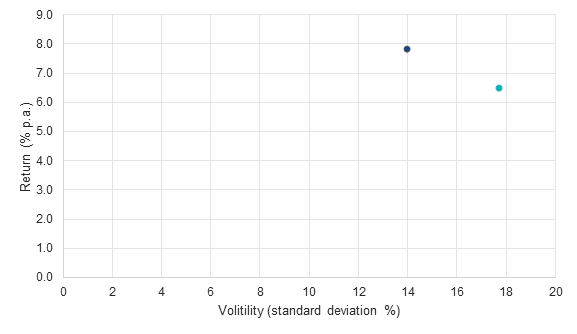

The risk return characteristics for international small-caps are better than Australian small-caps over the long term. As you can see from the chart below, international small-caps have returned almost 8% p.a. on a risk adjusted basis since 2001, which is more than Australian small-caps and with less volatility.

Chart 2: Risk return from 1 January 2001 to 31 January 2021

International Small Caps

International Small Caps

Australian Small Caps

Australian Small Caps

Source: Morningstar Direct; Indices used: International Small Caps is MSCI World ex Australia Small Cap Index; Australian Small Caps is S&P/ASX Small Ordinaries Index. You cannot invest in an index. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude fees and costs associated with investing in QSML. Past performance of the indices is not a reliable indicator of future performance of the indices or QSML.

In addition, the risk-adjusted performance of international small-caps is attractive when compared to international mid- and large-caps, as well as Australian small-, mid- and large-caps. The table below shows the Sharpe ratio over different periods for the various market segments. The Sharpe ratio is a measure which takes into account both performance and volatility. The greater the value of the Sharpe ratio, the more attractive the risk-adjusted return.

Table 2: Small companies versus mid- and large- companies

Source: Morningstar Direct; All data to 28 February 2021. Results are calculated monthly and assume immediate reinvestment of all dividends and exclude fees and costs associated with investing in QSML. You cannot invest in an index. Past performance is not a reliable indicator of future performance of the indices or QSML. Indices used: International Small Caps is MSCI World Ex Australia Small Cap Index; Australian Large and Mid Caps is S&P/ASX 100 Index; Australian Small Caps is S&P/ASX Small Ordinaries Index; International Large and Mid Caps is MSCI World Ex Australia Index.

Building your international small-caps portfolio

Historically, investing directly in international small-caps has proved difficult due to accessibility and cost. To date, the only options for Australian investors have been actively managed funds which typically charge much higher fees than passive funds, or ETFs, that follow a market cap approach. A market cap approach is selecting companies simply based on their size. However, when it comes to selecting the small companies that are most likely to deliver growth, there are other factors that should be considered beyond size.

VanEck will soon be offering an international quality small companies ETF (ASX: QSML) that will take a “smarter” approach to selecting holdings. QSML will track the MSCI World ex Australia Small Cap Quality 150 Index which selects 150 of the world’s highest quality small companies based on three key fundamentals: high return on equity; earnings stability; and low financial leverage.

QSML will be launching on ASX this week.