Key points

- Digital currencies and blockchain technology may have a lot to offer – but that does not mean Bitcoin will be it.

- Due to extreme volatility, high transaction costs and slow processing, Bitcoin does not cut it as digital cash.

- But it’s not an asset generating cashflows either, which makes it impossible to value.

- Key for investors is not to invest in something if you don’t understand it and to recognise that just because Bitcoin has surged in price does not prove its worth.

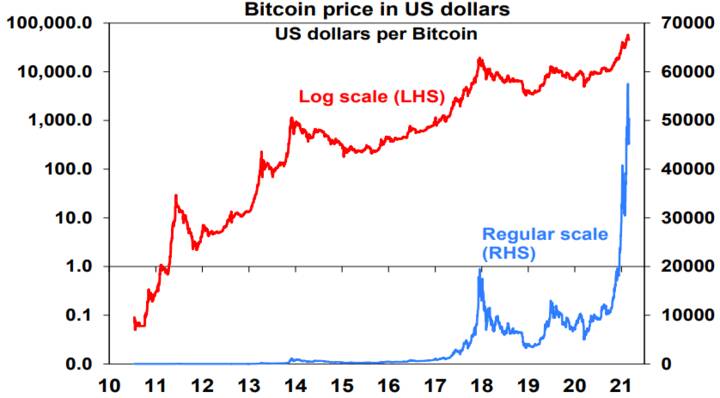

The title may seem a bit harsh, but I reckon it’s a reasonable question given the issues around Bitcoin and the amount of interest it’s once again attracting. This interest is largely being driven by the resurgence in its price – where at its recent high it was up nearly 15 times up from its low last year. The next chart shows Bitcoin’s price relative to the US dollar since 2010, both on a regular scale where it has gone exponential and on a log scale to show some perspective. This note takes another look at Bitcoin and what it means for investors.

Source: Macrobond, AMP Capital

Bitcoin to the moon

Digital or crypto currencies, led by Bitcoin, and their blockchain technology seem to hold much promise. Trying to explain it is also very complicated…but here goes! The blockchain basically means that transactions in Bitcoin are verified and recorded in a public ledger (which is the blockchain) by a network of nodes (or databases) on the internet. New Bitcoins are created as a reward for an intensive computational record keeping process called mining, that groups new transactions into a block which is added to the chain. The supply of Bitcoins is limited to 21 million, and half of the supply was mined in the first four years of Bitcoin but because of a process called bitcoin halving which sees miners compensated by less and less Bitcoins over time the limit will only be reached around 2140 after which transactions fees will be the only reward for record keeping.

This sounds complicated as it is and hopefully, I have explained the gist of it reasonably correctly! Because each node stores its own copy, there is no need for a trusted central authority like a central bank. Bitcoin is also anonymous with funds just tied to Bitcoin addresses which require a private key to access. Bitcoin was invented in 2008 by a person or group named Satoshi Nakamoto and the first genesis block was created in 2009.

Because of Bitcoin’s limited supply and independence from government and central banks, it’s seen as a hedge against a surge in inflation and the debasement of paper currencies that some fear from quantitative easing (or money printing) by major central banks most recently in response to the pandemic. These characteristics have also made it attractive to supporters of the Austrian school of economics (which advocates a free market in the management of money) and libertarians.

As with many things tech, the more that use it, the greater its appeal and so news that: PayPal will let customers buy, hold or sell Bitcoin on its platform; various institutions are looking into it; and that Tesla has put $US1.5 billion into it and will accept it as payment have boosted hopes that it will attain general acceptance as a currency – with the Tesla announcement seeing Bitcoin’s price rocket higher. Its enthusiasts see it as the currency of the future and as a way to instant riches with rapid price gains cited as confirming the validity of this view.

Reason to be sceptical

An alternative view is that it’s just another financial market bubble and should not be taken seriously. There are numerous grounds for caution regarding Bitcoin.

First, is not suitable for everyday transactions as digital cash:

- Bitcoin transactions are not cheap with the average fee for a transaction now running at around $US30;

- Transactions can take 10 minutes or more to complete because of the computational time taken by miners. Bitcoin averages less than four transactions per second whereas Visa processes around 25,000 per second. Attempts to speed this up (via eg, the Lightning Network) don’t seem to have gotten very far. This renders it impractical for retail use. Tap and go would become tap and wait 10 minutes!;

- Bitcoin’s price is very volatile. Over the last ten years, its volatility was 15 times greater than the US share market, 12 times greater than gold, 31 times greater than the US dollar index and 18 times greater than the $A/$US exchange rate. This makes it completely unreliable in fulfilling the store of value purpose of money. Sure, it has gone up sharply in value this year, but it has already had two 20% plus setbacks along the way and it lost more than 80% of its value in 2011, 2013-15 and 2017-18. Imagine you agree to buy a Tesla Model 3 for $66,900 and you have your funds in Bitcoin but at the time of the final payment it has a 20% plunge in value, suddenly boosting your cost by 20% or so. Sure the same could happen if you had your money in shares – but shares are nowhere near as volatile and the comparison should really be to cash in a bank account which is not volatile at all (even after allowing for inflation).

All of these things suggest that Bitcoin has limited value as a currency for regular transactions. Which explains why most Bitcoin transactions take place on cryptocurrency exchanges, ie, by speculators, as opposed to with merchants. And why would anyone use it for everyday transactions? We can now do digital transactions instantaneously and cheaply with the tap of a phone so why bother with all the issues around Bitcoin?

Second, Bitcoin has had issues with theft and hacking whereas use of a bank can provide protection of your savings in the event your account is compromised. There have been several issues of people losing their private keys and being unable to access their Bitcoin, whereas losing your bank account password is a nuisance but hardly ever a disaster. There have also been issues around its integrity, with allegations its price has been manipulated through a cryptocurrency called Tether & some would say it can be debased (to get around the supply constraint) by Bitcoin forks. (You will have Google that one!)

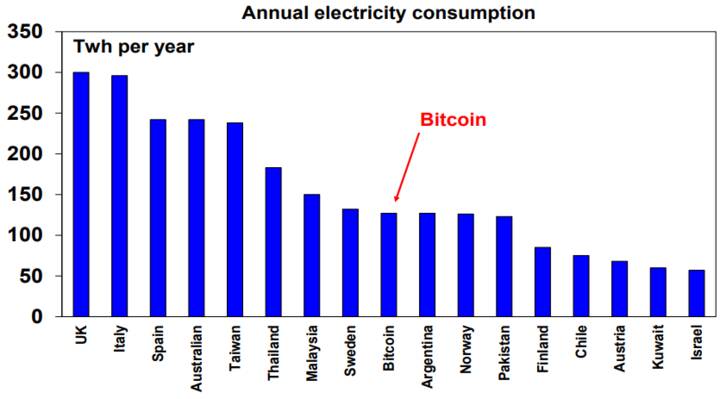

Third, it’s bad for the environment. According to the Cambridge Centre for Alternative Finance, the amount of energy needed by computers to mine Bitcoin is nearly 0.6% of total global electricity consumption and its annual electricity consumption is equal to that of countries like Argentina, Norway and Pakistan – and more than 50% of Australia’s. A single Bitcoin transaction consumes as much energy as 500,000 Visa transactions.

Source: Cambridge Centre for Alternative Finance, AMP Capital

Fourth, while digital money based on blockchain/public ledger technology may be the way of the future, this does not mean it will be with Bitcoin. There are thousands of them popping up.

Fifth, Bitcoin and other crypto currencies face numerous threats from governments. In particular:

- Governments are unlikely to give up their monopoly on currency (because of the “seigniorage” revenue it yields) and ordinary members of the public may not fully embrace crypto currencies unless they have government backing.

- In fact, many governments are already looking at doing their own digital currencies – eg, the RBA is looking into a central bank digital currency for wholesale use based on an Ethereum (not Bitcoin) based distributed ledger platform.

- Government intervention may also escalate if concerns grow that it’s being used for illegal activity. In theory, Bitcoin should be easily traceable in the publicly distributed blockchain but it was estimated a few years ago that 25% of Bitcoin users are associated with illegal activity (and I have only ever come across it in relation to just that).

- Governments will face rising pressure to regulate Bitcoin if it looks like getting too big to fail, posing a threat to financial stability and to protect individual investors. We are not there yet as it’s not used much for transactions so it can’t threaten the financial system and not enough people are exposed to it to see significant wealth effects from a Bitcoin crash – but if it continues to rocket up then we will be.

Finally, it’s impossible to value Bitcoin. Unlike property or shares in a company, it is not a capital asset and so does not generate cash flow in order to be able to value it. Unlike most commodities, it is not used to make things for economic use. And unlike gold (of which around 45% is in jewellery) it does not have an alternative use to resort to. This makes it impossible to put a price on what it’s worth – it could go up to $1,000,000 but it may only be worth $100. And when it’s impossible to fundamentally assess the value of something, it’s easy for people to dream up all sorts of levels as to what it’s worth.

So, what is it and why has it gone up exponentially?

If Bitcoin is not really digital cash (for the reasons noted in the last section) and it’s not a capital asset suitable for investment, it begs the question as to what it really is? The short answer is that it’s something to speculate on. On this front, and putting aside the claims that its price is being manipulated, Bitcoin has all the hallmarks of a classic bubble: a positive fundamental development (or “displacement”) in terms of a claimed high tech replacement for paper currency; self-reinforcing price gains that are being accentuated by social media hype; all convincing enthusiasts they are on to something and the only way is up.

It’s all being helped by ultra-easy global monetary policy making the opportunity cost of holding zero cash flow assets like Bitcoin feasible and at the same time fuelling demand for a hedge against a surge in inflation which some claim Bitcoin is. While Tesla’s and other institutions’ forays into Bitcoin are helping reinforce the optimism, historically institutions have been just as susceptible to speculative manias as individual investors.

It’s basically a vehicle for enthusiasts to hodl (Bitcoin lingo for buy and hold) on the hope that more and more people will buy and hodl to keep Bitcoin going to the moon. Which has led many to voice concerns that Bitcoin is just a big Ponzi scheme. Or maybe as a colleague described it, “more like a cult than a currency” – with a god (the mysterious Satoshi Nakamoto), a belief set & defined behaviours (including to hodl & never sell).

Bitcoin could keep going up for a long way yet as more investors are sucked in on the belief that they are on the way to unlimited riches, with that belief reinforced by prior price gains. But just as the crowd can push something to euphoric extremes – whether it be Dutch tulips, nifty fifty stocks, dot com stocks or Bitcoin – it can also drive it to collapse if people decide it’s not worth much. For example, if it never takes off for transaction use, government regulation of it ramps up and/or economic recovery sees the removal of easy monetary policy destroying demand for Bitcoin as an inflation hedge.

What does this mean for investors?

First, it’s hard to work out where to put Bitcoin in an investment portfolio. It’s far too volatile to be considered a defensive asset like cash. It’s impossible to assess as a growth asset in order to get any reasonable idea as to what it may return. And its high leverage to shares make it a poor diversifier.

Second, one big lesson from the Global Financial Crisis is that if you don’t fully understand something, you shouldn’t invest in it. Bitcoin is anything but easy to understand.

Third, remember what it says in the fine print: past performance is not a reliable guide to future performance. Just because Bitcoin has gone up and may rise a whole lot further does not prove its story. All it tells us is that people have been buying it.