by Elfreda Jonker, Client Portfolio Manager

Want 5G… you need silver. Want an electric vehicle… you need lithium, nickel and cobalt. Want a wind farm… you need aluminium and rare earth. Want to recharge anything… you need copper. Want steel… you need iron ore and metallurgical coal up until there is enough scrap available.

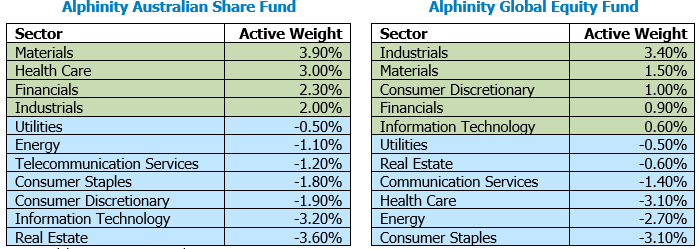

Entering 2021 with active overweight positions in materials

At Alphinity, we invest in quality, undervalued companies entering an earnings upgrade cycle. We specifically look for opportunities where the earnings growth is underappreciated by the market and has valuation support. Following independent bottom up fundamental research on new leadership opportunities by our global and Australian teams, Alphinity enters 2021 with active overweight positions in several commodity companies. Which in turn has resulted in positive active positions in the Materials sector in the Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund and Alphinity Global Equity Funds respectively.

Despite the sector’s strong performance since November 2020, multiple macro tailwinds, new supportive demand dynamics and positive earnings momentum should continue to drive returns higher. Our top sector active positions are BHP in the Alphinity Australian Share Fund and Alphinity Concentrated Australian Share Funds and Teck Resources in the Alphinity Global Equity Fund. Below we expand on the investment case for these top picks and why we have preference for iron ore exposure over the short- to medium term and copper exposure over the medium- to long term.

Source: Alphinity, as at 31 December 2020

Sector outlook

Why commodities have more legs to run: Despite most commodity prices now trading well above the producer cash cost curves, fundamentals remain very supportive of a strong commodity cycle. We are seeing a substantial demand pull, driven by powerful combination of government infrastructure stimulus combined with the expectation of the re-opening of the economy as vaccines are rolled-out. All this coming on the back of supply disappointments as producers battled the COVID impact on their people and operations. Add to this a weakening USD and the cocktail for higher prices is perfectly set.

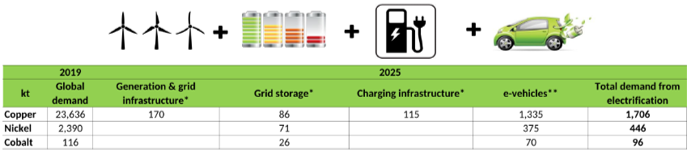

So-called ‘green commodities’, such as copper, nickel and various rare earth metals, are benefiting from a surge of green infrastructure commitments and a rapid rise in Electric Vehicle (EV) penetration across the globe. This is a significant new source of demand which will push some of these commodities into theoretical deficit, forcing prices to adjust to demand destruction and/or new supply incentive levels.

Impact of “electrification” on metal demand

Source: Copper Development Association, Glencore, Morgan Stanley Research

The real demand spike is however expected during the 2025-2030 window. Demand is one thing, but the ability to ramp up supply is the other key aspect, a challenge that is far more important for copper than lithium.

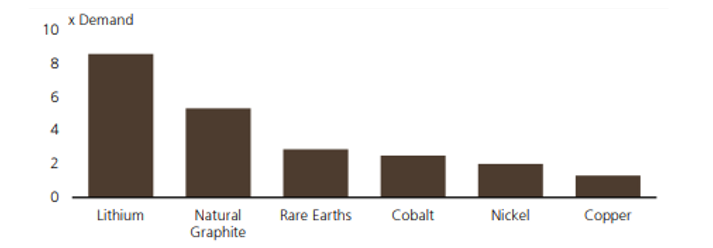

Commodity demand growth to 2030E

Source: UBS

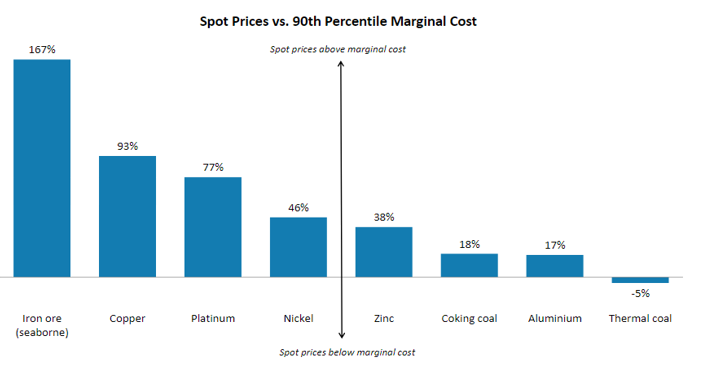

A preference for copper and iron ore:

- Copper is benefiting from a significant demand boost from green infrastructure and EVs. We believe that supply will struggle to meet that demand growth both short and long term, making it one of the most attractive commodities, in our view.

- Iron ore is continuing to benefit from very tight demand-supply fundamentals as China stimulates its economy, the rest of the world’s steel production recovers and as global competitor Vale struggles to address its Brazilian supply issues. There is no large new supply source coming to the market in the next 1-2 years, which means the market is likely to remain very tight.

Spot commodity prices vs the marginal cost of production

Source: Wood Mackenzie, Bloomberg, Morgan Stanley Research. Note: Marginal cost – year 2020, dataset Q3 2020, for coal, the dataset is as of August 2020, C1 cash costs for zinc, copper and aluminium. Total cash cost for iron ore, coking and thermal coal

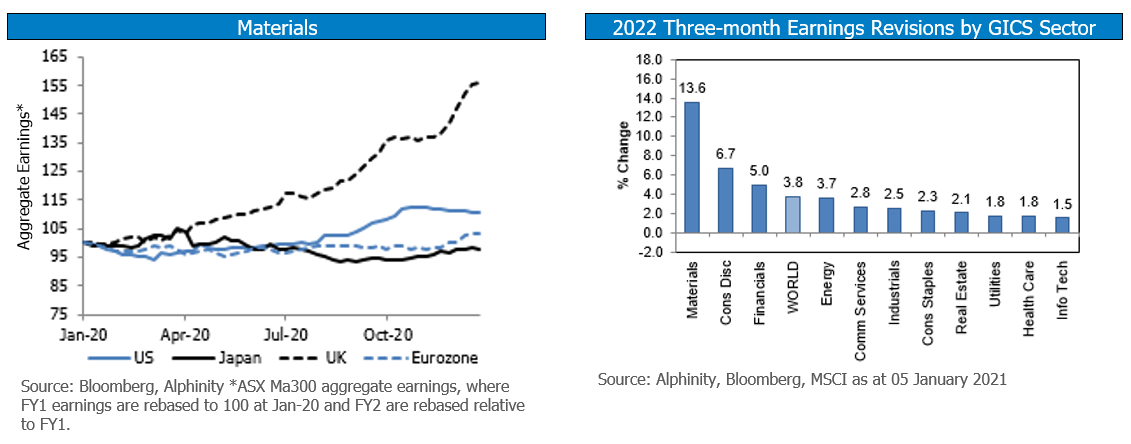

Materials seeing positive earnings revisions and gaining momentum

As the global earnings recovery continues to broaden to the cyclical part of the market, Materials have been one of the major beneficiaries, with the sector seeing positive earnings revisions across all regions and time periods (in particular for 2022).

Global earnings:

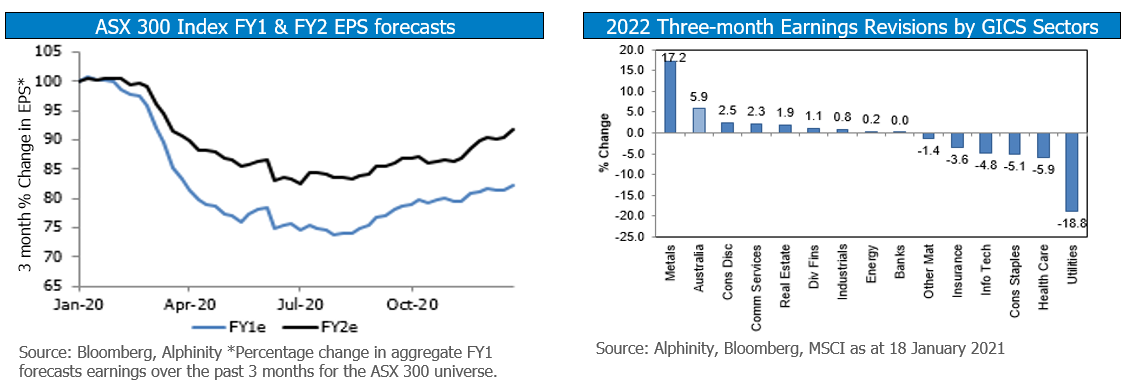

Australian earnings:

Since June 2020, the ASX300 Metals and Mining Index has also seen positive earnings upgrades and is now the only sector with FY21 Earnings per share (EPS) above FY19 levels. Despite the rally, the sector valuation is still below long-term averages, with several stocks offering good valuation support at current levels.

Alphinity’s highest conviction Materials positions:

BHP is currently our highest active weight position in both the Alphinity Australian Share Fund and the Alphinity Concentrated Australian Share Fund, while Teck Resources is currently our fourth highest active weight in the Alphinity Global Equity Fund.

BHP – Rising prices, strong balance sheet and progressively green

BHP’s earnings are currently benefiting from a powerful tailwind of rising prices for almost all the commodities it extracts. It’s armed with a strong balance sheet that provides growth and capital management options. Its’ progressive Environmental, Social and Governance (ESG) and Climate Change commitments are also gaining support from a growing portion of the investment community.

We expect further significant earnings upgrades for BHP in FY21-22, despite strong upgrades over the last 12 months and significant earnings growth already anticipated by the market. In its’ FY20 result, BHP generated ~75% of its operational earnings from Iron Ore, 15% from Copper, 5% from Metallurgical Coal and 5% from Petroleum. The market currently expects its’ net profit to rise 55% in FY21 to US$12.4bn, but then fall in FY22 to US$10.3bn. At today’s spot prices, FY22 net profit after tax (NPAT) would be close to US$23bn, more than double current expectations. While spot prices may correct from current elevated levels, we believe they are unlikely to fall to the levels assumed by current consensus numbers.

BHP’s balance sheet provides significant capital management optionality. Current earnings expectations suggest a dividend yield around 4.5%. If spot prices held, the yield could lift to 7%. A low gearing of 10-15% provides optionality for dividends and/or acquisitions. Divestures of non-core assets such as thermal coal and mature gas basins will further boost the balance sheet optionality without meaningfully affecting BHP’s earnings profile.

BHP’s ESG and Climate Change commitments are well supported by investors. BHP has announced some of the most ambitious reduction targets in greenhouse gas emissions in the mining industry with practical steps and milestones to achieve these. This is important as such targets combined with good ESG practices and proper handling of matters such as heritage sites demonstrate a level of care now demanded by an increasing portion of the investment community.

Teck Resources – Steel recovery in the short term, but Copper is the big long-term story

Teck is a cyclical, Vancouver-based mining company with main operations in Met Coal, Copper and Zinc in North and South America. It has a diversified and high-quality asset base in relatively low-risk geographies. The company also has a consistently good ESG track record.

Teck’s strategy is to use cashflows from Met Coal and Zinc to finance doubling its’ Copper production from 2023 onwards. This is a significant step-change for the company driven mainly by their Chilean QB2 project becoming fully operational. The main risks are around the global cyclical recovery. Near-term cashflows are also likely to be pressured as QB2 capex peaks in 2021.

Current commodity prices would drive significant upgrades to earnings estimates. At current spot prices:

- Teck’s earnings before interest, taxes, depreciation and amortisation (EBITDA) would almost double by 2023 (+92%), rising to US$4.7bn (partly COVID-recovery, rest is mainly volume growth from ongoing projects).

- Met Coal EBITDA +83% from 2020 to 2023, remaining 35-40% of Group EBITDA. Total met coal production is set to rise 25% and reach 26.5mt.

- Copper EBITDA +165%, rising from 30% to 50% of Group EBITDA. Total production is expected to more than double to nearly 600kt.

- Zinc EBITDA is +8% and drops from 30% to 17% of Group EBITDA.

Comparing the current cycle to the last positive commodity cycle in 2016-18:

- The Teck share price rose to C$36 before the cycle peaked in early 2018 (+51% vs current price of C$23.81).

- EPS peaked at C$4.19 in 2018, compared to the current 2021 consensus of C$2.25 (+86%).

- The Price to Earnings ratio now is 12x compared to 9x back then.

- This time around, the balance sheet and cashflows are more burdened than during the last cycle because of the large QB2 Copper project in Chile.

But this time around, Teck is more of a “Copper story“, with QB2 start-up expected in 2H22 (delayed six months due to COVID). Copper is expected to be >50% of Teck’s revenues in two years’ time (30% now).