Phil Strano, Portfolio Manager of the Yarra Absolute Credit Fund

Happy New Year to all of our readers and clients. We hope you all enjoyed some much needed time to refresh and renew for the year ahead, which we anticipate (fingers crossed!) will be a far less eventful one than 2020.

Looking back briefly at the year just gone, Australian credit performed strongly in the second half, with unprecedented fiscal and monetary stimulus pushing risk-free yields to historic lows. Yarra’s investment grade (IG) portfolios returned in excess of 4% in 2H 2020 (8% annualised), a strong result considering the dearth of income available, with the cash rate sitting at just 0.10% and traditional sources of income (e.g. term deposits) now yielding well below 1% p.a.

Pleasingly, for investors in search of income in 2021, we’re confidently quoting the famed Little River Band classic: “help is on its way”! Overall, we expect Australian credit will remain a happy hunting ground for those in search of income, with credit margins in most segments of the market either at or above long-term averages, observable in yields in our IG portfolios in an attractive 3.5-4.0% p.a. range.

Where are we seeing those opportunities?

1. Australian Corporates

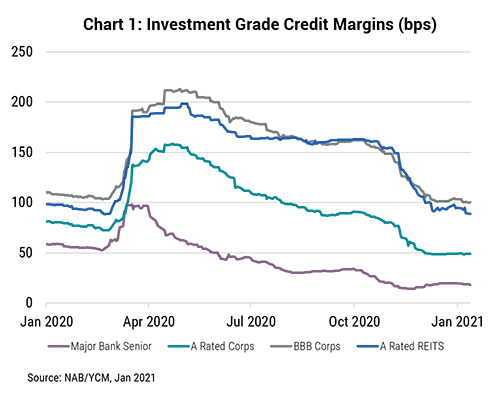

Credit margins on IG corporates, particularly in the low risk single A and BBB rated sectors, and in segments more directly impacted by the COVID-19 pandemic (e.g. REITS and airports) continue to offer attractive sources of income and capital growth (Chart 1).

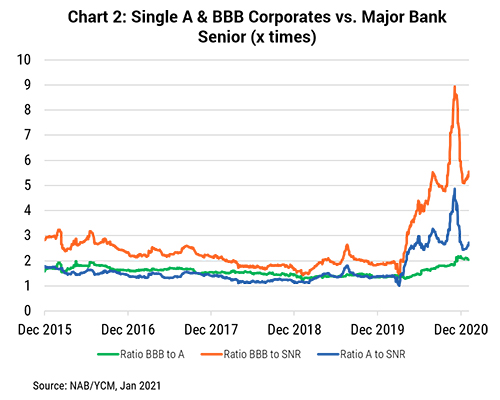

Further, relative to the very low credit margins on senior unsecured major banks, both single A and BBB corporates continue to trade at a disproportionate multiple compared to pre-pandemic levels; evidence of income sustainability from corporate credit in 2021 (Chart 2).

2. Bank Capital Securities – T1 and T2 Securities

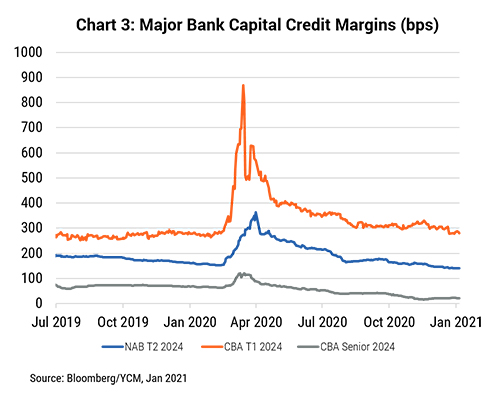

Entering 2021, major bank capital securities (excl. senior unsecured) are also offering attractive returns. As pandemic uncertainties subsided amidst a flood of central bank liquidity, major bank balance sheets are in a very strong position to sustain the credit quality of lower ranking (and higher yielding) T2 and T1 securities. Worst case bad debt scenarios sit comfortably below total loss absorption capital (~12-14%) and the 5.125% mandatory T1 conversion triggers.

That said, to meet APRA’s requirement for T2’s to comprise 5% of risk weighted assets (currently ~2%) by 2024, increased issuance will likely limit capital growth in T2. We maintain a preference for T1 over T2 securities, and expect the margin between the two to narrow (Chart 3).

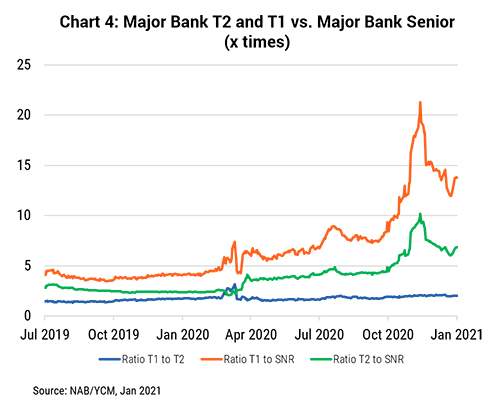

Moreover, as with corporate credit, the expanded multiple to unsecured bank senior is supportive for income sustainability for T2 and T1 securities in 2021 (Chart 4).

3. RMBS and selected corporate hybrids

Beyond corporate senior and bank capital securities housing market stability augurs well for exposure to residential mortgage backed securities (RMBS), with many tranches offering attractive credit margins and strong asset protection. We also expect to see further corporate hybrid issuance following on the strong performance of the Ausnet and Ampol hybrids (issued late 2020).

We are enthused by the positive economic backdrop and the attractive relative value of Australian credit, and remain confident in our ability to generate income of 3.5-4.0% from our low risk, diversified portfolios through 2021.