by Paul O’Connor, Head of the UK-based Multi-Asset Team

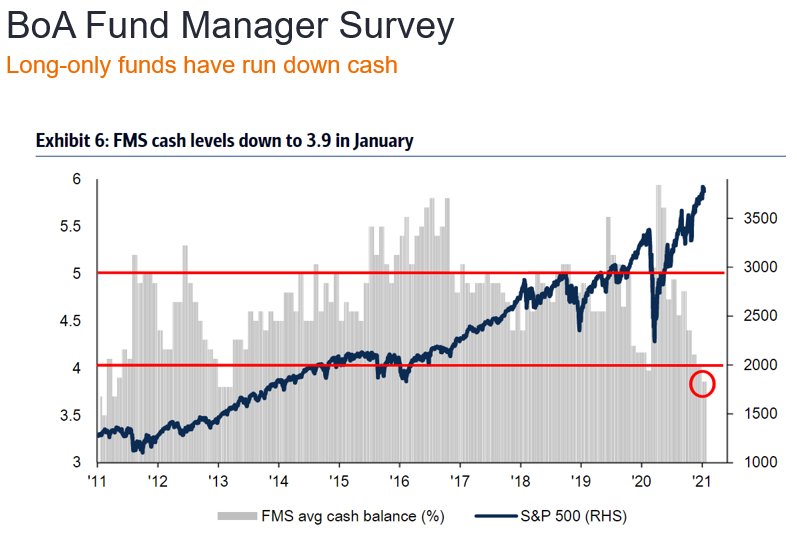

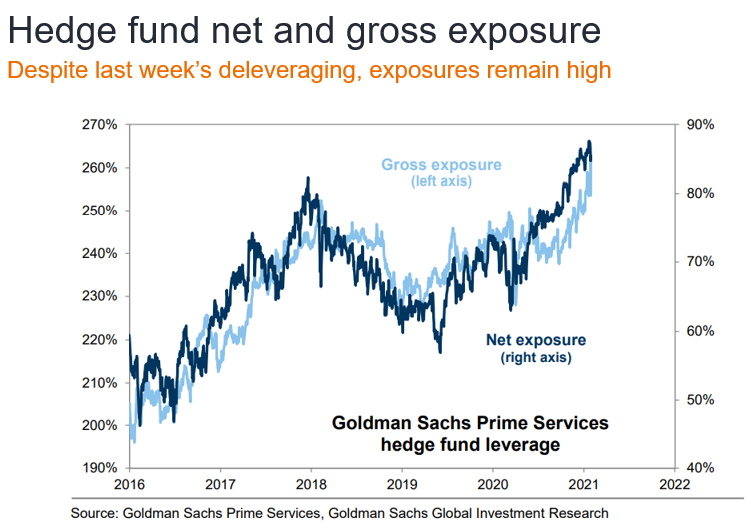

For the third time in four years, we found ourselves taking risk down in our multi-asset portfolios in the early weeks of the year, in response to mounting evidence of overheating investor sentiment and positioning. Historically low cash and high equity weightings among long-only institutions, record high net equity exposures among long-short managers and many indicators paint a general picture of investor exuberance and extended positioning in risk assets. In broad terms, we see the sorts of signals here that typically emerge as equity rallies reach exhaustion point and give way to market consolidations or reversals.

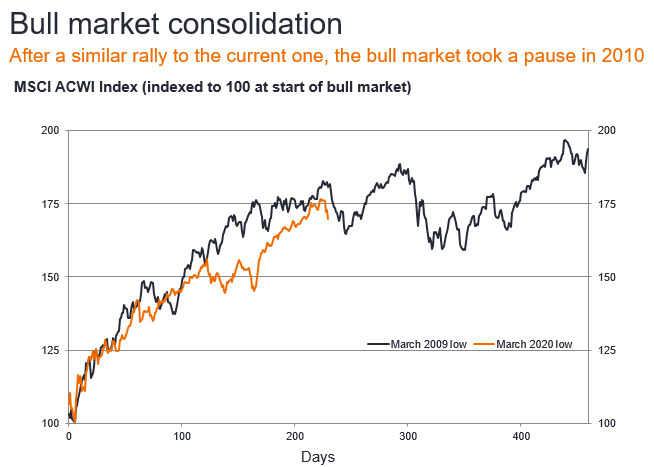

Shift happens – While we share the consensus view of a strong vaccine-driven recovery in global growth and corporate earnings this year, we also feel that a fair bit of this cheery scenario is now priced in to financial markets and we would be wary of expecting the rally in stocks to continue in a straight line. The last big V-shaped recovery in global equities, comparable to the current move, was when markets rebounded from the GFC trough in 2009. That rally began in a year of crisis and contraction, anticipating 2 years of strong growth, very similar to what is now expected for this year and next (real World GDP growth was 5.4% and 4.3% in 2010 and 2011 – consensus expectations for this year and next are 5.5% and 4.2%). That rally peaked after a rebound similar in size and age to the one that we have just experienced and then mutated into a lengthy consolidation phase, which didn’t break new highs until 8 months later.

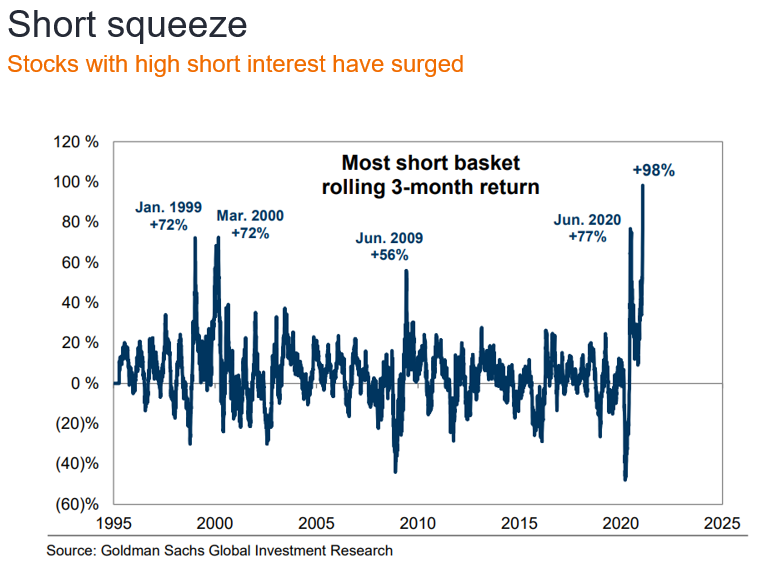

GameStop is no game-changer – Of course, this week’s chaos in GameStop and related areas has blown some of the froth off equity markets as equity long-short hedge funds got hurt by the squeeze in this and other stocks with high short interest. While these brawls between retail speculators and hedge funds have been distracting and at times entertaining, we see them more as being localised tussles over a few highly-contested stocks (with high short interest and options exposures) than something with broader or enduring market significance. The overall impact on long-only investors, quant funds and macro investors has been modest. Spillovers to credit markets, commodities and FX have been inconsequential. Regulators will undoubtedly examine recent developments here and might well take some remedial actions but we see this as being a US story, rather than a global one.

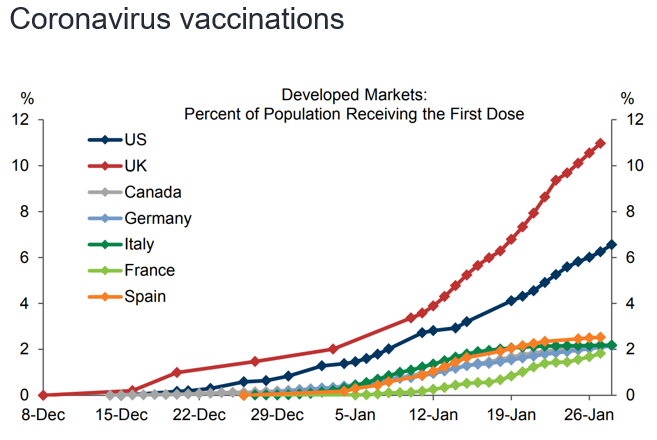

Vaccines v mutants – While the near term outlook for stock markets might well be driven by fluctuations in investor sentiment and positioning, the race between coronavirus vaccines and virus mutations developments is likely to remain the key driver of underlying trends in many asset classes beyond that. Developments on the vaccine front remain broadly encouraging, with the UK looking set to reach herd immunity by mid-year and the rest of Europe and the US by Q3. Most emerging markets are expected to reach this target in late 2021 or in the first half of next year. However, even if these vaccine deadlines are met, uncertainties surrounding the dynamics of the new more contagious variants of the coronavirus continue to raise questions about the speed at which current restrictions can be dismantled.

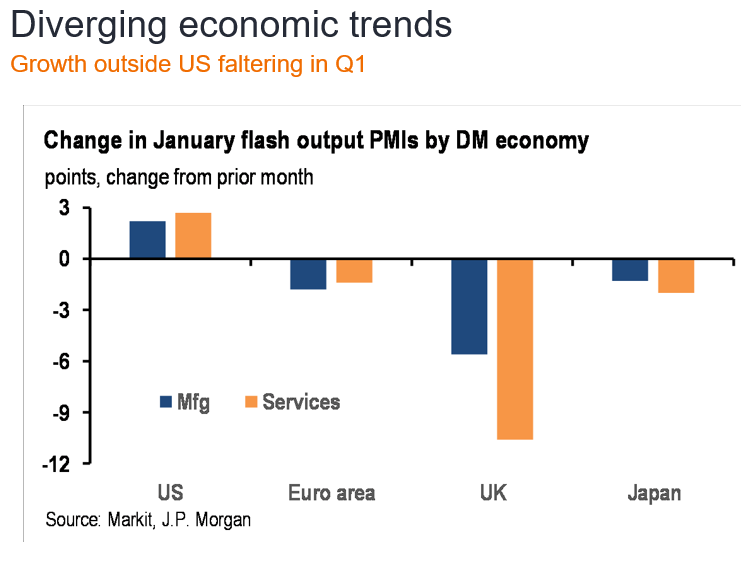

Mixed signals on growth – Where macroeconomic momentum is concerned, the year has begun with fairly mixed signals coming from the key global data. Global manufacturing and services purchasing managers indices (PMIs) showed the year getting off to a good start in the US, but activity weakened in eurozone, Japan and most notably in the UK. Tighter lockdown restrictions are a big part of the story in the eurozone and the UK. Last night’s Chinese data also had a soft tone, with both manufacturing and service sector PMIs coming in light. Weaker employment intentions in both surveys point to further potential weakness in activity in the months ahead. Despite these near-term disappointments, the recently enhanced US fiscal stimulus and fading second-wave drags in many countries, should revive growth by the beginning of next quarter, hopefully paving the way to a more vigorous rebound beyond that as vaccines allow restrictions to be eased more decisively.