by Justin Arzadon

Whilst interest rates are at record lows and are likely to remain there for several years based on Reserve Bank governor Phillip Lowe’s commentary1, should you be taking advantage of the current market environment by investing in property or investing in the sharemarket?

Australia has a well-known love affair with property, and many Australians hold a firm belief that its value never goes down. In terms of investments, it’s relatively straightforward and easy to understand.

However, not everyone has the minimum amount needed to place a deposit on a property and secure a mortgage. In addition, the world is going through a pandemic and, according to the RBA, prices in rental markets have recently adjusted in response to reduced demand and higher supply. Advertised rents have declined sharply since April 2020, particularly for apartments in Sydney and Melbourne2.

Does it make more sense to invest in the sharemarket at this time, or do you take advantage of low interest rates and dive into property? This is an age-old debate.

Today I’ll look at some of the similarities and differences of investing into either asset class, and discuss some of the pros and cons to help in your research. Please remember, it is important you consider your own circumstances and the relevant risks, and seek appropriate advice.

Potential for growth

Both investments offer the potential to grow in value over time.

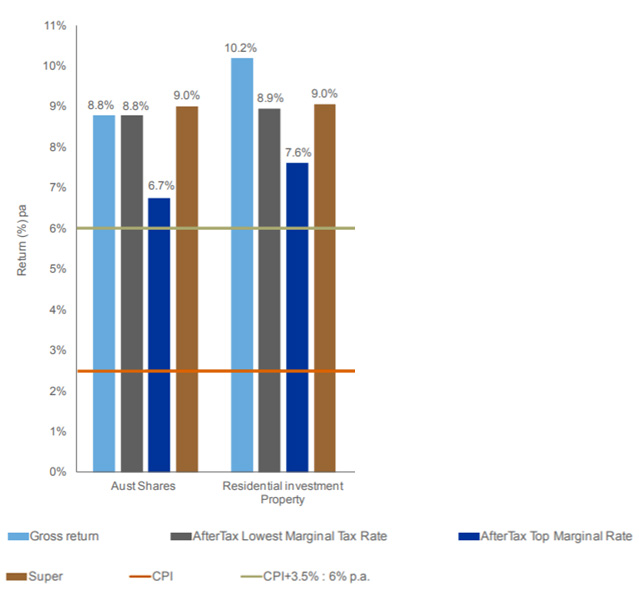

For example, according to the 2018 Russell Investments/ASX Long Term Investing Report, over the 20 years to 31 December 2017, property produced slightly better returns on a gross of fees and tax basis with a 10.2% p.a. return vs. shares at 8.8% p.a.3 As the chart below shows, the difference in after-tax returns was narrower, and varied depending on the investor’s tax bracket.

Property/shares comparison taking into account tax and costs: 20 years to December 2017

Source: 2018 Russell Investments/ASX Long Term Investing Report. Past performance is not a reliable indicator of future performance.

Note that comparisons have their limitations, as returns can of course vary according to the timeframe selected, and if you break property down into different regions, or equities into various sectors. It’s important to keep in mind there have been periods of boom and bust for both asset classes.

Returns change further once gearing is introduced into the equation, as the chart below shows.

Comparison with and without gearing: 20 years to December 2017

Source: 2018 Russell Investments/ASX Long Term Investing Report. Past performance is not a reliable indicator of future performance.

Income

Investing in either property or equities can provide income.

The yield according to Bloomberg, as of 25 Jan. 2021, for the S&P/ASX 200 Index is 2.7% p.a. plus franking credits, and whilst property may also provide a yearly income (assuming it is occupied), the yields for houses in Sydney and Melbourne have more recently come down to around 2.7% p.a. and 2.9% p.a. respectively as of December 2020, down from 3.2% p.a. and 3.3% p.a. 12 months prior4.

Maintenance and transaction costs

With property you must assume there will be yearly maintenance costs associated with repairs, upkeep and upgrades. If you use a property manager, there will be costs associated with that too.

Other costs associated with starting your search, and after initial purchase, include search fees, pest and building reports, legal and conveyancing fees and stamp duty.

With equities, although there are no yearly maintenance costs, depending on how you decide to invest there may be transaction costs when you buy and sell, such as brokerage. In addition, if you are using an adviser or broker, there may be fees or costs to manage the portfolio, which is usually a percentage based on the amount of the entire portfolio. If you use actively managed funds or exchange traded funds (ETFs) to obtain equities exposure, there will be management costs built into the price of those funds.

It is quite easy to keep ongoing costs for equities to a minimum by going self-directed, but for property the maintenance costs can be unpredictable, and can end up being quite high if something unexpected occurs.

Ability to enter the market quickly

Buying a property takes some time.

It’s not easy coming up with the deposit needed to secure a mortgage. Unless you put down at least 20% of the purchase cost, there will be likely be the additional expense of mortgage insurance. It can take years to save up for these costs – and then you may not want the additional burden of a mortgage payment that has to be made every month.

By contrast, if you are ready to invest in equities, you can get started with as little as $500, or even less (depending on your broker’s trading limits) – all you need to do is open an account with a trading platform. It really can’t be any easier.

One of the easiest and cheapest ways to access equities is through an ETF. ETFs are funds that can be bought and sold on an exchange such as the ASX. Instead of buying shares in one company, ETFs allow you to get exposure to a basket of shares or assets with a single trade.

Hands-on involvement

With equities, you are able to invest in companies run by some of the most influential people of our generation – Elon Musk, Jeff Bezos and Mark Zuckerberg come to mind when thinking of founders of companies that dominate the globe and continue to grow and improve their business. As a shareholder, you can own part of these businesses without having to be involved in their day-to-day operations.

When investing directly in property there is greater hands-on involvement. You can take on becoming a landlord yourself – or you will need to hire a property manager, which can reduce your workload but comes at a cost.

Two biggest pros for investing in property

1. Leverage – This is the big winner for investing in property. The most important figure for an investor is your return on investment (ROI). When you purchase a property, you usually borrow a substantial portion of the cost. Assuming you put down 20% of the value of the property, you are 80% leveraged, therefore your returns are a much larger percentage of the value you initially put down, than if you had paid the full purchase cost outright. Of course there is no reason you can’t gear your share portfolio to the same extent as a mortgage, but far fewer share investors than property investors gear into their investment. This is partly because of the potential for margin calls, which you don’t get with property as your home isn’t marked to market on a daily basis, and partly because share investment loans are typically at a higher rate than property loans.

2. Add value – You’ve no doubt heard the saying “buy the worst house on the best street” – the reason being that with a bit of TLC and hard work, through renovations, upgrades and additions you generally should be able to add value to your property.

Two biggest pros for investing in the sharemarket

1. Diversification – whereas property investors typically invest in a very small number of assets, share investors can easily spread their money across a range of investments. ETFs make this even easier. By purchasing ETFs that are traded on the ASX, you can easily diversify your portfolio without having to buy multiple companies across multiple sectors and asset classes. ETFs give you the opportunity to buy a number of companies in one sector or across a broad market. By using ETFs, you can also obtain exposure to other asset classes such as commodities, currencies – and even commercial and industrial property.

For example, the BetaShares Australia 200 ETF (ASX: A200) provides exposure to the 200 largest companies on the ASX in one trade, at an ultra-low management fee of just 0.07% p.a.5

Example: Initial investment of $1000 into A200 units over the last 10 years

Source: Morningstar. Chart shows the performance the Solactive Australia 200 Index (the index A200 aims to track) adjusted for A200’s management costs for the period prior to A200’s inception date (7 May 2018) and the performance of A200 for the period from that date. Past performance is not an indicator of future performance.

The BetaShares Nasdaq 100 ETF (ASX: NDQ) offers exposure to many of the world’s most innovative companies that are revolutionising our everyday lives – including Apple, Amazon, Google and more.

The BetaShares Diversified All Growth ETF (ASX: DHHF) is an all-in-one investment solution that provides low-cost exposure to a diversified portfolio comprising Australian, global developed and emerging markets equities, in a single ASX trade.

As always, investors should consider their tolerance for risk when making investment decisions.

2. Liquidity – If you stick with ETFs or shares, you are holding investments which generally have a high level of liquidity. Shares and ETFs settle T+2 (trade date +2) – when you sell your shares/ETFs, the proceeds will be in your account two business days later. This is a significant benefit if something unexpected comes up and you need to access some or all of your cash. Compare this to the time it takes from deciding to sell an investment property to when you receive the proceeds of the sale. Plus, if you don’t need all of your funds, you can’t just sell off a bedroom!

Conclusion

Investing doesn’t just come down to which asset class offers the best returns. You need to consider the risks associated with the asset, your personal situation such as your goals, financial situation, risk appetite, and age.

Diversification across different asset classes is key. A healthy investment portfolio should contain an element of both shares and property. There is no reason why you can’t seek to benefit from both asset classes.

ENDPOINTS

1. https://www.smh.com.au/politics/federal/low-rates-for-years-as-economy-meanders-lowe-20200622-p554w6.html

2. https://www.rba.gov.au/publications/bulletin/2020/sep/the-rental-market-and-covid-19.html

3. https://russellinvestments.com/au/insights/asx-long-term-investing-report

4. https://propertyupdate.com.au/property-investment-melbourne/ and https://propertyupdate.com.au/property-investment-sydney/

5. Additional costs, such as transactional costs, may apply. Refer to the PDS for more detail.