by Julian Howard, Lead Investment Director of Multi Asset Solutions

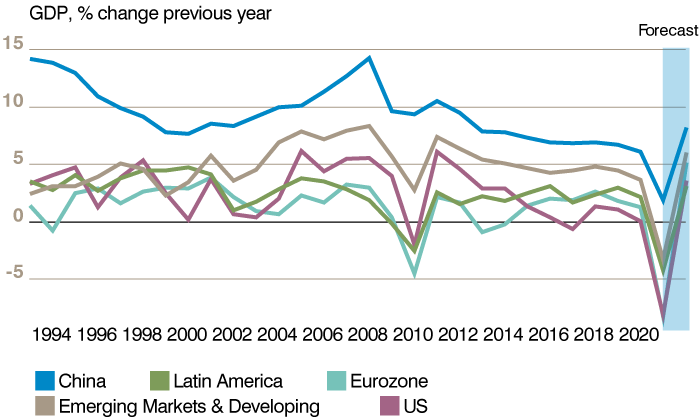

2020 brought untold misery in the form of the Covid-19 pandemic and associated responses, with over 81 million cases and nearly two million deaths worldwide according to Johns Hopkins University. The economic impact was also profound, with growth outlooks collapsing as demand fell and consumer activity was curtailed during lockdowns. According to Bloomberg, economists had predicted a 2020 growth rate of 3.1% at the end of 2019 but by late December this year, it had fallen to a disastrous -3.8%. Unemployment around the world rocketed, with the US rate exceeding 14% at one point in April. And yet, global equities, as measured by the MSCI AC World Index in local currency terms, returned over 14% this year. The latter stages of this rally can probably be explained by November’s clear US election victory for Joe Biden and the announcement of an effective vaccine against the virus. But most of the big moves in markets had already happened by then and are better explained by central bank policy responses, which looked to support the economy by lowering interest rates across all maturities via direct monetary policy easing and outright purchases of government bonds. The effect was to boost the present value of those stocks with business models independent of the economy, in particular technology which was already seeing increased demand as consumers and employees remained at home. Low interest rates also left those investors looking for returns with little choice but to invest in equities or turn to speculation, fuelled by the rise of app-based retail platforms. While the tech sector justifiably fared well, gold and bitcoin also saw tremendous gains. With the vaccine news giving hope of eventual normalisation in 2021, investors sold government bonds (thereby pushing yields up) and turned to the cyclical sectors of the market that had been so roundly rejected back in March. Value stocks in areas of the market like leisure, energy, banks and industrials enjoyed a strong run from the autumn. In parallel, and less well-covered by western commentators, was China’s vanquishing of the virus and its remarkable economic resilience. According to the International Monetary Fund (IMF), China is not just expected to enjoy a positive GDP growth rate in 2020 (see Chart 1) but should also see its lead over many developed economies grow over the next five years. This went some way to explaining the strong performance of China’s domestic stock market, another contributor to positive world equity returns in this otherwise traumatic year.

Chart 1: Barely a dent – China’s pandemic resilience bodes well for coming years:

Source: IMF World Economic Outlook. *Forecast from 2020. Past performance is not an indicator of future performance and current or future trends.

Positioning

During the year, our asset allocation stance was guided in large part by the sizeable gap between equity earnings yields and ever-lower risk-free rates offered by government bonds. This so-called equity risk premium (ERP) has been a fair prognostic indicator of future equity returns over the years and 2020 proved no different. Positive engagement in equities within portfolios ensured meaningful participation in the recovery and subsequent rally in markets that began in late March. Tactically, further value was added by increasing equity exposure amid the waterfall moves in March before gradually paring back again as the market recovered in subsequent months. Within equities, we were already focused on technology going into the pandemic given we foresaw the sector’s ability to grow in the low-growth world. This, along with the emphasis on emerging markets and environmental, social and governance (ESG) aware stocks, contributed to the year’s performance. Later in the year, we locked in gains on US technology stocks and lifted our exposure to European equities in anticipation of positive vaccine news. Beyond equities, the focus was on simplicity and reliability over complexity and unrealistic return expectations. ‘Alt-bonds’ in the form of agency mortgage-backed securities (MBS), insurance-linked bonds and ultrashort-dated investment grade paper performed the bulk of the heavy lifting in terms of diversifying portfolios when equity markets fell. Longer-dated credit recovered somewhat during the year but was pared back when spreads over risk-free rates fell towards unlikely pre-2020 levels. Meanwhile, ‘pure’ alternatives were represented by merger arbitrage and market-neutral equity long / short strategies. Both recovered in part from initial volatility in March: the former should fare well as travel is restored and M&A activity can pick up again, while effective equity long / short strategies retain the potential to pick up on the continued dispersion of fortunes across business models that the pandemic response and eventual normalisation brings.

Outlook

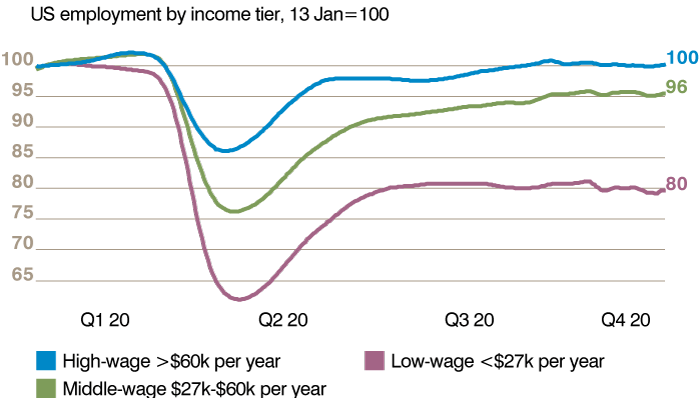

Investment outlooks often fail to survive first contact with reality but it remains useful to have a starting framework which can be adapted over time. As such, we see 2021 likely to be marked by three distinct phases. The first phase will see a continuation, perhaps even a deterioration, of tough economic conditions as the virus mutates and spreads exponentially. Blunt lockdowns will continue to be used by way of mitigation but may well prove both ineffective and poorly observed. The second phase, starting around springtime, will see vaccinations gain traction in developed economy populations, with hospitalisations beginning to fall meaningfully. This will see an unleashing of repressed demand for leisure and hospitality, as well as consumer goods. Some analysts see this as the start of a ‘Roaring 20s’ era similar to a century prior. However, we view it more as the final stages of the outperformance of cyclical equity sectors that began in October, when the rumour of recovery starts to become a solid fact. The third phase of 2021 will be more circumspect. The economic rebound could start to fade by the final quarter of the year and equity investors will be looking ahead to what’s next. The cyclical rally will be nearly a year old by then and could cede ground to stocks with high levels of intangible goodwill and intellectual property that can grow in the era of stagnation and perpetually low discount rates that likely awaits. If the above sequencing sounds too choreographed, underpinning it all is the firm belief that none of the major challenges of the post-global financial crisis era have been addressed in 2020, and may even have been made worse by the pandemic. Inequality, low productivity, debt overhangs and shrinking workforces show no sign of being fixed anytime soon and their shadows will loom large over the fleeting euphoria of 2021.

Chart 2: Lower for longer – pandemic inequality will feed into stagnation, low rates:

Source: tracktherecovery.org

Ultimately, we believe continued low interest rates should underpin equity progress, justifying continued and possibly higher allocations than in 2020. Significant additional value in the coming year could be unleashed via the right thematic approach within equities and, beyond them, an emphasis on reliable rather than high-yielding diversifiers. The coming year is set to bring great joy for many at a personal level as freedoms are gradually restored. It will, however, remain important to maintain a cool-headed approach as markets present several twists and turns along the road to normalisation and beyond.