- Global dividends fell AUD$76.7bn (US$55bn) to AUD$460.1bn (US$329.8bn) in the third quarter, a fall of 11.4% on an underlying basis and a headline decline of 14.3%

- The decline was less severe than in Q2 because seasonal patterns in Q3 favour parts of the world where dividends have been more resilient

- The weakest results came from the UK, Australia, and the Netherlands, but China, Hong Kong and Canada were among the very few major countries to see higher dividends

- Australian dividends were one of the biggest drops in the world, thanks to steep cuts by the banks, transport and leisure sectors

- CBA, NAB and ANZ accounted for three fifths of the AUD$12.3bn (US$8.8bn) fall in Australian dividends in Q3

- Forecast raised for 2020 – best case now -17.5% (up from -19%); worst case -20.2% (up from -25%)

As the pandemic has worn on, so has its impact on the dividend-paying capacity of the world’s companies has become much clearer, according to the latest edition of the Janus Henderson Global Dividend Index.

The third quarter saw total payouts fall by AUD$76.7bn (US$55bn) to AUD$460.1bn (US$329.8bn), the lowest since 2016. The 14.3% headline decline was equivalent to a fall of 11.4% on an underlying basis, far better than Q2’s 18.3%[1] decline. The smaller impact primarily reflects a geographic mix in the third quarter that emphasises parts of the world where dividends have proved more resilient, especially in North America and emerging markets, but it is also an indication that the worst is past. Overall, more than two-thirds of companies increased dividends or held them steady in Q3, compared to a little under one third that cut or cancelled them.

Q3 is China’s big dividend season and payouts there were 3.3% higher year-on-year. Three quarters of Chinese companies raised payouts or held them steady. Canada and Hong Kong were among the few major countries to see dividends rise too. The weakest results came from the UK, Australia, and the Netherlands.

UK payouts were 41.6% lower, while the cancellation of banking and brewing dividends impacted the Netherlands severely.

US companies pay two-fifths of the world’s dividends. The relatively small decline (-3.9% in Q3 and flat in Q2) is helping support the global total this year. Eight in ten US companies held or increased their payouts in Q3, with lower share buy-backs reportedly bearing the brunt of companies’ efforts to preserve cash. Janus Henderson estimates that the US total shareholder yield (which adds dividends and share buybacks) will be in line with the more resilient European nations this year.

Excluding Australia, dividends from Asia-Pacific ex Japan were exactly flat year-on-year, reflecting the milder impact of the pandemic both on the population and on the economy, stronger balance sheets, lower payout ratios and because many of this quarter’s payouts relate to 2019 earnings and were fixed several months ago. Hong Kong enjoyed the fastest dividend growth in the developed world in Q3, with payouts rising 9.9% on an underlying basis to AUD$30.3bn (US$21.7bn), the second highest quarterly total on record from the territory.

The worst declines in Q3 came from consumer discretionary companies, down 43% in underlying terms, with car manufacturers and leisure companies making the deepest cuts. Media, aerospace and banks were also severely impacted. The most resilient sectors were classically defensive pharmaceuticals, food producers and food retailers, which all saw higher payouts on an underlying basis.

In April, in the midst of the greatest pandemic-induced uncertainty, Janus Henderson calculated that global dividends could fall at least 15% this year, but by as much as 35% on an underlying basis. In July the team narrowed this range to -19% to -25%. Janus Henderson is now confident that the final figure will come in towards the top end of our expectations. The best case now sees a fall of -17.5% to AUD$1.67 trillion (US$1.20 trillion) on an underlying basis, equivalent to a headline drop of -15.7%. Our worst case sees underlying dividends declining -20.2% to AUD$1.6 trillion (US$1.16 trillion), a headline drop of -18.5%. The best case would eradicate more than three years of dividend growth, costing investors AUD$312.5bn (US$224bn) in lost income this year.

Australian dividends hardest hit in Q3

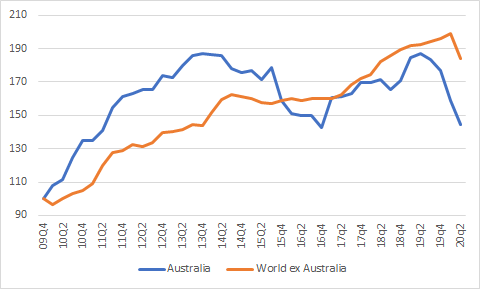

Australian dividends fell 40.3% on an underlying basis, down to just AUD$13.4 bn (US$9.6bn), the lowest third-quarter total in at least 11 years, with cuts from the banks making a particularly large impact. Special dividends were significantly lower compared to last year, so the underlying fall was less severe at 40.3%.

The heavy reliance on banking dividends in Australia has long been a source of major risk. Last year banks accounted for half the dividends in the Australian part of the index. In 2020, under pressure from regulators only to pay up to half their earnings out in dividends, and already with extremely high payout ratios, Australia’s banks had no choice but to make big cuts to meet the mandated target, ranging from -60 to -70% in the third quarter. CBA, NAB and ANZ accounted for three fifths of the AUD$12.3bn (US$8.8bn) fall in Australian dividends in Q3.

Other casualties include Insurance Australia Group, which cancelled its dividend for the first time on record in order to bolster its capital reserves, as well as Sydney Airport and Aristocrat Leisure. Food retailer Coles and gold miner Newcrest are both beneficiaries in the current crisis, however, the former due to the increased grocery demand and the latter thanks to the soaring price of gold. Both Coles and Newcrest were the only two Australian companies in our index to raise their dividends year-on-year.

Jane Shoemake, Investment Director for Global Equity Income at Janus Henderson said: “The loss of AUD$312.5bn or US$224bn in dividend income from around the world in 2020 is nothing to celebrate, but we have been encouraged by how resilient payouts have been in many parts of the world, especially in Asia, the US, Japan and emerging markets. This resilience is partly because companies seek to cushion investors from the disruption to their operations, but it’s also because payout ratios (the portion of profits distributed) have been comfortable in many parts of the world. The UK, Australia and parts of Europe have proved to be more vulnerable in part because payout ratios there were already too high, and a reset was overdue for some key companies. They now have a firmer basis for future growth. What’s more, two fifths of the world’s dividends have historically been paid by defensive sectors that are proving relatively insulated from the crisis, and the big growth sectors like technology are breezing through 2020 almost entirely unscathed.”

Matt Gaden, Head of Australia at Janus Henderson said: “In 2021, Q1 will still be affected by reductions, but then things should pick up. The big question mark is over the decisions the regulators in the UK, Europe and Australia will make around banking payouts. And of course, so much depends on the pandemic and the severity and duration of any further lockdowns. As a rough guide, we estimate a worst case for dividends to be flat next year on an underlying basis, but we believe they could rebound by 12% in our best-case scenario.”

ENDNOTE

[1] Revised upwards from -19.1% – see full report for more details, available at https://www.janushenderson.com/en-au/investor/jh-global-dividend-index/