by Thong Nguyen

It pays to be diversified – and 2020 has been no exception. The Australian small cap market offers breadth and opportunity for those investors willing to accept the risk that comes with an investment in a basket of small companies.

How have small caps typically performed following market disruptions?

It should not be a surprise to anyone that the Australian small cap market [1] has significantly outperformed the large cap market [2] post the COVID-19 lows of March 2020.

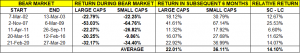

Looking back over the last two decades, there have been five bear markets (defined as a market drop of over 20%). On each of those occasions, small caps outperformed large caps by an average of 14% over the six months following the end of the bear market. The average return in that 6-month period for large caps has been 22%, compared to 36% for small caps, with the returns over the 6-month period following the most recent bear market in March 2020 being bang on average.

Why have small caps outperformed large caps post COVID-19 lows?

Part of it has to do with smaller companies being more leveraged to a cyclical domestic recovery, with huge fiscal stimulus spent to support the economy, further measures potentially in the works, and interest rates expected to stay low for longer. This is clearly supportive of stock prices.

Australia has, to date, managed to contain the virus better than its global peers. The market looks forward, and with expectations of a recovery and ultimately earnings coming through, some investors may be looking to take on more risk, higher beta, higher leverage to the domestic recovery, and higher growth opportunities – qualities which can often be found in smaller companies.

This is evident when we look at recent equity capital raisings on the ASX, as companies look to shore up their balance sheets as a direct result of COVID-19, with many simply looking to survive. There has been over $20 billion raised on the ASX post the March 2020 lows, which already surpasses the total raised in 2019 [3]. Over 80% of these raisings by number, and the majority by dollar value, have come from the small cap market.

The other element contributing to outperformance is the composition of the small cap market relative to the large cap market, with the small cap market being generally more diversified across sectors and individual stocks which have benefited the most in the period following the March 2020 lows.

For example, as at the end of March 2020, the technology sector had 4 times the representation in the small cap market (10%), 3 times the exposure of gold stocks (10%) and twice the exposure of consumer discretionary (11%) [4], with consumer discretionary expected to be one of the sectors to rebound the most from the re-opening of the economy and a return to normality. On the flip side, the large cap market is highly concentrated to financials (28%), including banks and insurers – which have significantly underperformed so far during the recent recovery period compared to the broader market [5].

How can investors gain exposure to Australian small cap stocks?

A big part of small cap investing is avoiding the losers, given the market is under-researched, and hence tends to be less efficient.

The Betashares Australian Small Companies Select Fund (managed fund) (SMLL) employs screens which aim to identify companies with positive earnings and a strong ability to service debt. Relative valuation metrics, price momentum and liquidity are also evaluated as part of the stock selection process.

SMLL aims to outperform the S&P/ASX Small Ordinaries Accumulation Index over the medium to long term (after fees and expenses), and returned 47.0% (after fees and expenses) over the six months from the market low of 27 March 2020 to 28 September 2020. This is an excess return above the S&P/ASX Small Ordinaries Index of approximately 9%.

During this period, SMLL benefited from the small cap market’s overweight to technology and consumer discretionary, and underweight to financials, along with strong stock selection within the materials and healthcare sectors relative to the small cap market itself.

Since its inception in April 2017, the fund has returned 6.7% p.a. Of course, it’s important to remember past performance is not indicative of future performance and note that SMLL’s returns are subject to higher volatility than a broader sharemarket exposure.

ENDNOTES

1. Represented by the S&P/ASX Small Ordinaries Price Index.

2. Represented by the S&P/ASX 200 Price Index.

3. Source: Bloomberg. Based on equity share offerings plus rights issues from companies within the S&P/ASX 300 universe.

4. Source: Bloomberg.

5. As represented by the S&P/ASX 200.